Many have swung from operating with surplus cash, to making due with shortfalls. Balance sheets that once served as shock absorbers have been wiped out, risking the ability of many companies to perform for years to come.

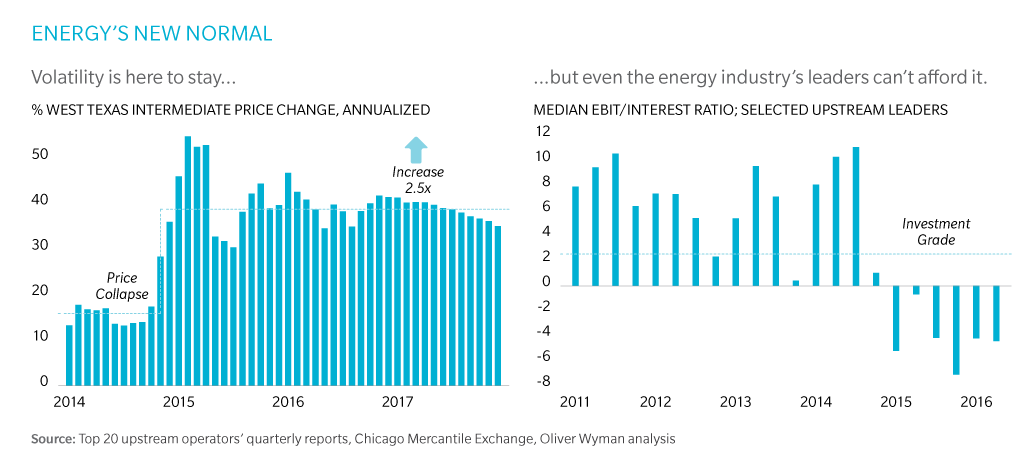

Energy companies have emerged on top of volatile boom and bust commodity cycles before by raising new capital, tearing up and renegotiating supplier contracts, reducing permanent headcounts, and temporarily cutting capital budgets and dividend programs. But this rout is different. It’s been more than 24 months since West Texas Intermediate oil prices tumbled from a high of $106 to a low of $27 in the first quarter of 2016. And it’s unlikely that prices will bounce back any time soon, even if OPEC pulls back on production.

Energy Recalibrated

Mark Pellerin on the present state of the energy industry

About the Authors

Alexander Franke is a Zurich-based partner, Mark Pellerin is New York-based partner, and Tim Thompson is a Calgary-based principal in Oliver Wyman’s Energy practice.

This article first appeared in BRINK.