Realizing this goal, however, won’t be easy. Compliance functions must contend with waves of new regulation and with increasingly sophisticated techniques being deployed by those actors intent on breaking the rules. And they must do so under tight budgetary constraints.

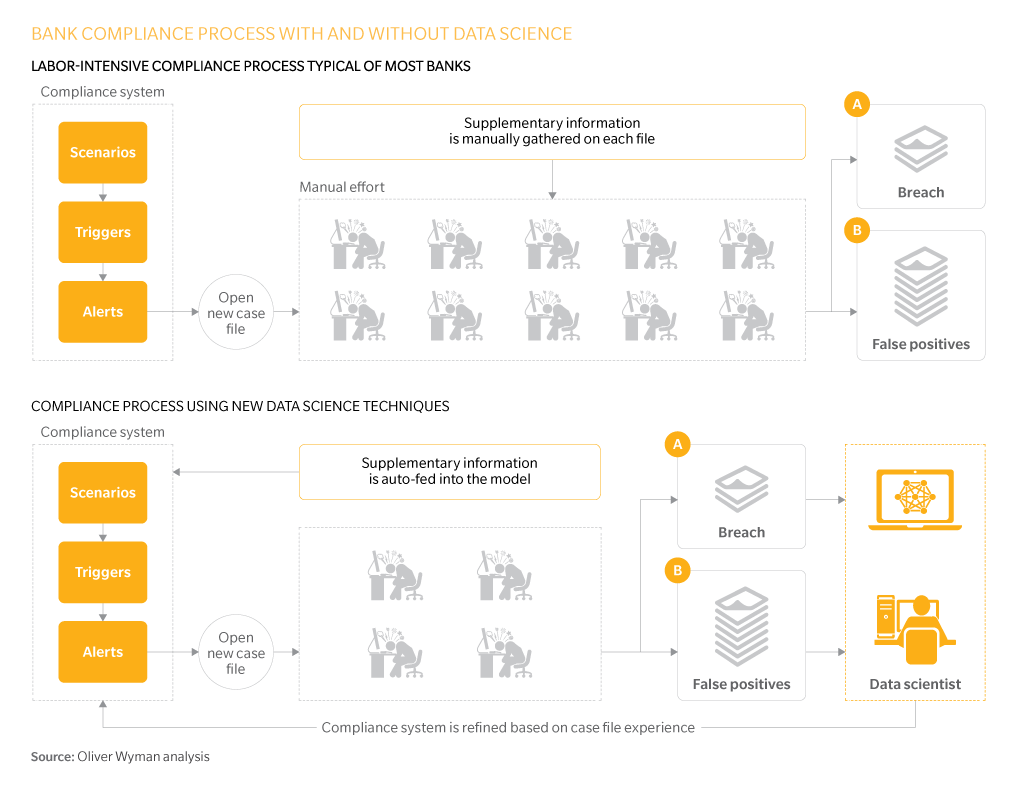

But help is on the way. New data science techniques are able to improve the ability of banks to identify breaches, while reducing the “manual” work required. Banks that have already invested in such technology can achieve further gains in efficiency and effectiveness by optimizing these tools based on their ongoing experience of breaches and by analyzing the outcomes of recent file reviews.

Compliance Science

Barrie Wilkinson explains why new data science techniques are important for improving compliance.

30%: How much a bank reduced its false positives using compliance science

About Authors

Barrie Wilkinson is a London-based partner and co-head of Oliver Wyman’s Finance and Risk practice in Europe, Middle East, and Africa. Hanjo Seibert is a Dusseldorf-based principal in Oliver Wyman’s Finance and Risk and Public Policy practices. Tristan Hands is an Amsterdambased senior consultant in Oliver Wyman’s Finance and Risk practice.

This article appeared in Financial News.