Exciting young biotech companies, breakthrough academic and research organizations, medical device companies, and other innovators encounter significant barriers to raising capital while staying in control of how their discoveries are nurtured and how their companies are governed. To unlock the value held back by control-taking or burdensome financing solutions, Oliver Wyman has joined forces with Duke Royalty.

The What and the Why of Royalty Financing

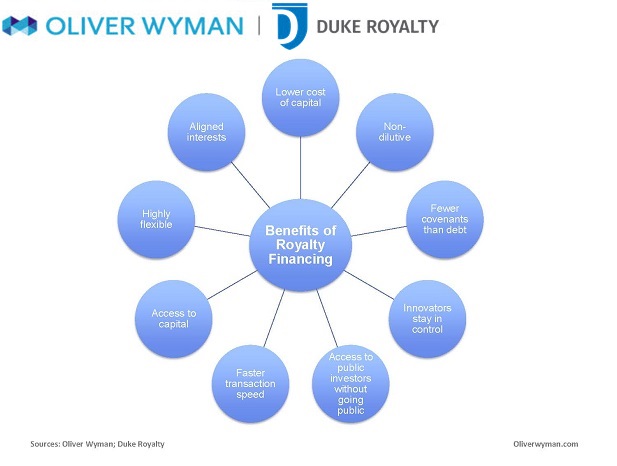

Royalty financing is a means of raising capital with significant differences from regular debt financing (such as loans and trade credit) and equity financing (typically private equity, IPO, or secondary issues). Royalty capital can fund the recipient’s most critical needs, such as product launches, acquisitions, and further R&D, or can re-capitalize balance sheets. In exchange for the capital, the royalty company receives a small percentage of the company's future revenues or cash flow. As payments fluctuate with revenue, royalty investors are better aligned with equity holders than debt providers, a key differentiator of royalty companies. Essentially the innovators have access to capital markets without the risks and distractions of going public.

The roots of royalty financing are found in industries that also have discovery and development at their core, such as mining. In that industry, revenues from a producing mine can be used as the basis to finance testing, development, and commercialization of a new site. In the case of a recently discovered drug or device, the owner might commit a portion of future revenues in exchange for capital, but current operations and processes are not impacted.