To meet growing demands for their time and advice, treasurers have to ensure highly effective and efficient treasury operations in order to fulfill their traditional roles while also meeting the requirements of the “new” treasurer. We believe the companies that embrace this transition into a broader role for treasury and take advantage of treasury’s analytical and risk management capabilities will have an opportunity to make better strategic decisions in an increasingly uncertain business environment.

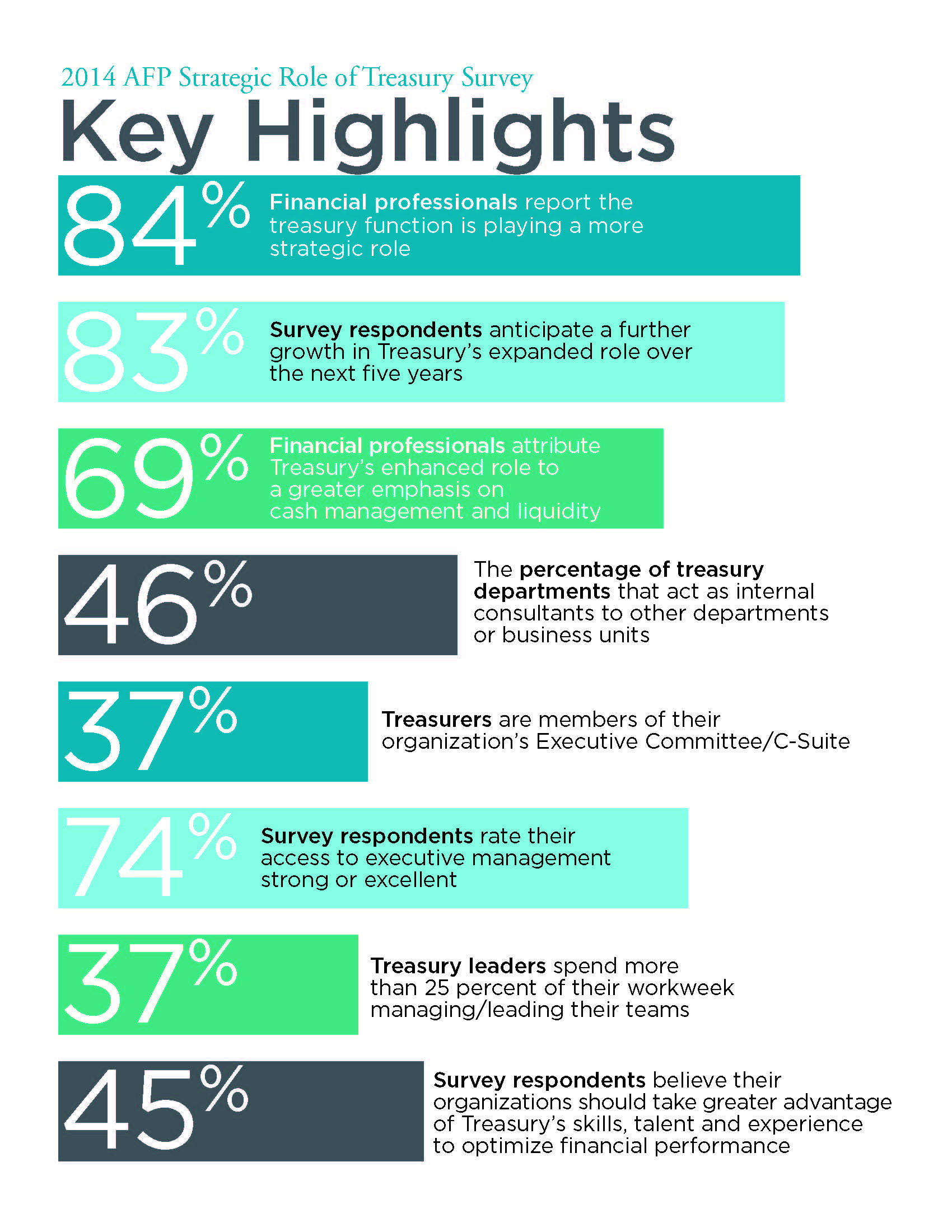

Key Highlights from Survey

The 2014 Strategic Role of Treasury Survey (published by the Association for Financial Professionals in collaboration with Oliver Wyman) captured the views of senior treasury professionals in March 2014 on their changing role and Treasury’ s current and future focus. Key findings are highlighted below.