What do health insurance brokers and agents predict for healthcare? We asked them in the 2013 edition of the annual survey conducted by Oliver Wyman in conjunction with Benefits Selling magazine. The 2012 edition found brokers skeptical about whether the Affordable Care Act would ever be implemented.

This year, the doubts have fled, and brokers are assessing the risks posed by ACA and making plans for how they’ll deal with what more than half of them expect: falling commissions. The big question for brokers: Can they find a new role for themselves as consultants, facilitators, and value-added integrators?

Benefits Selling/Oliver Wyman 2013 Health Care Survey

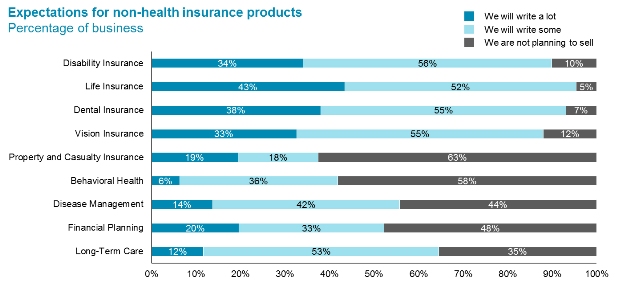

Almost half of brokers say they expect to focus less on health insurance post-reform. We asked them what ancillary products they expect to be selling. Leading the list were the traditional products — disability, life, dental, and vision — with some further diversification into products like disease management, financial planning, and long-term care.

Broker Survey 2013

Source: Benefits Selling/Oliver Wyman