More than half (53%) of senior financial professionals say they have greater difficulty anticipating risks to their companies’ earnings than they did before the financial crisis since many of the variables they consider when making strategic decisions have become more unpredictable. Most (86%) believe these challenging circumstances are here to stay. This second edition of the report examines how companies can develop a sustainable competitive advantage in an increasingly uncertain environment.

The Wall Street Journal's CFO Journal recently reported on the survey. Download the article to find out more about Oliver Wyman’s views on how executives should respond to increasing earnings uncertainty.

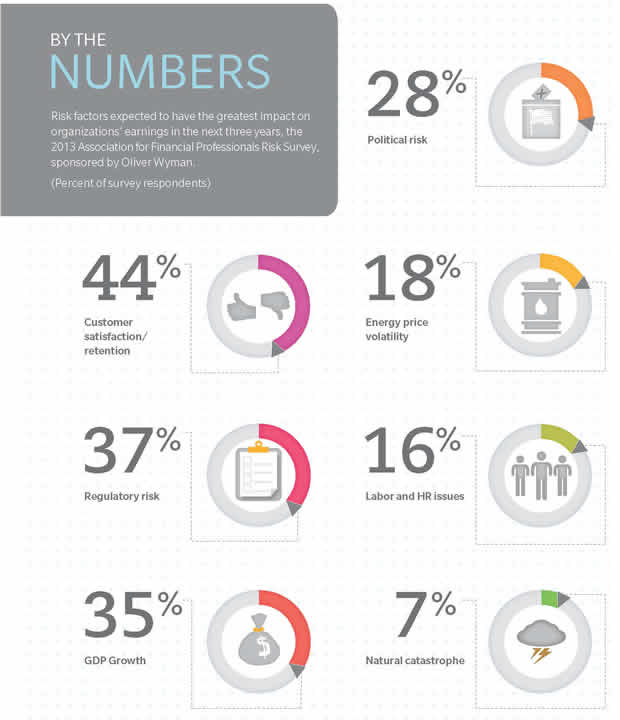

By the Numbers

For the 2013 AFP Risk Survey (published by the Association for Financial Professionals in collaboration with Oliver Wyman) more than 500 chief financial officers and treasurers were asked to identify what they perceive to be the biggest risks to their earnings over the next three years. The table below summarizes the results.