Register to View The Recording

Listen to the replay of our experts speaking about the impact of COVID-19 on the commercial aviation industry and its aftermarket.

Password: 7L@0&r5e

https://owg.zoom.us/rec/share/opN8Eo_g6EJJTZ3C9h3kSIgAHY_dX6a8gSRL8qUOn0a0o0HQzPdhFUV0Gf1oFS0q

Overview

On April 28, Oliver Wyman organized a webinar around our latest forecasts on the impact of COVID-19 on aviation’s commercial production and maintenance, repair, and overhaul (MRO) sectors. Part of our firm’s ongoing effort to keep the industry informed during the unfolding crisis, the webinar attracted attendees from aerospace manufacturing, airlines, aftermarket services providers, and lessors and the capital markets.

Moderated by Tom Cooper, the webinar presented perspectives on how COVID-19 will alter short and long-term outlooks for demand and traffic, fleet growth and aerospace production, and aftermarket activity. Oliver Wyman’s Khalid Usman, Ken Aso, and Brian Prentice each led one of the three sections, respectively.

Please find a link to a recording of the webinar, as well as a link to our interactive Forecast Dashboard that lets users analyze various cuts on anticipated MRO spending between now and 2022.

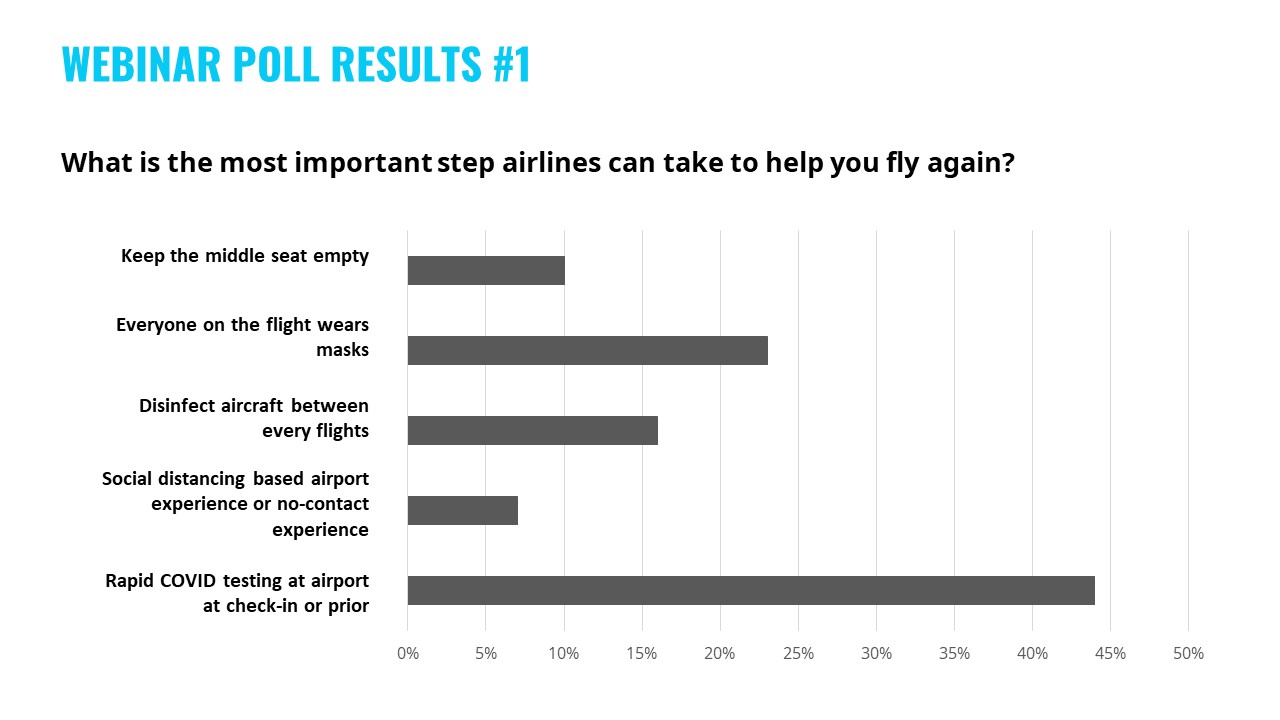

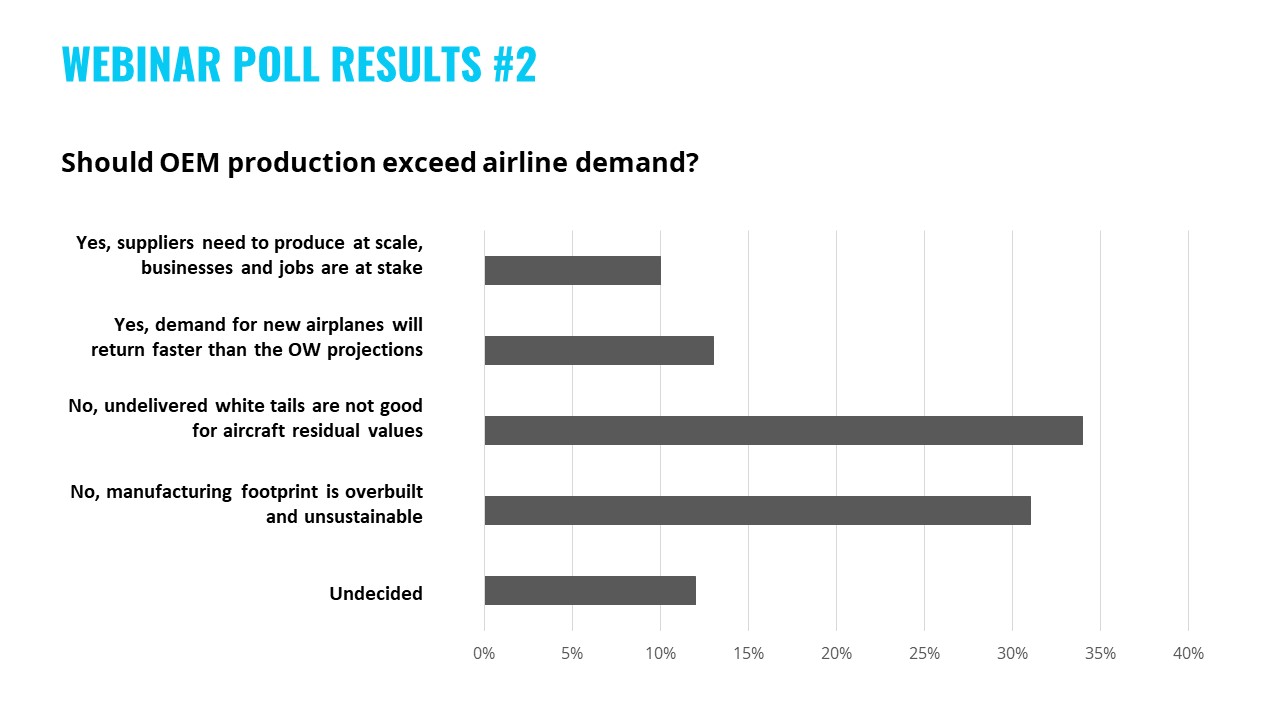

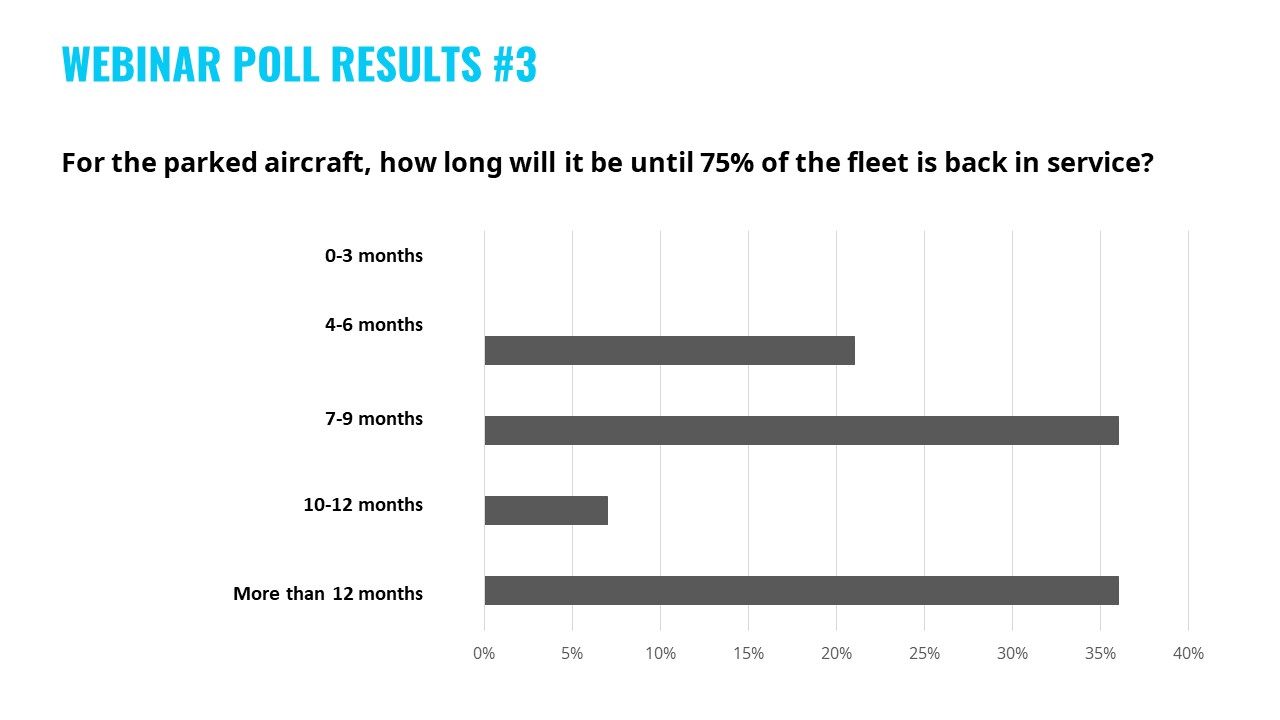

The webinar engaged participants who submitted more than 100 questions during the hour-long event. They also responded to three instant poll questions, which provided insights into executive expectations for the next 24 months.

Going forward Oliver Wyman will continue to update its forecasts and estimates and provide new analyses of the rapidly changing conditions, which will include some upcoming commentary on used serviceable material and the green-time engine market.

SELECT WEBINAR HIGHLIGHTS FROM THE DATA-RICH SESSION

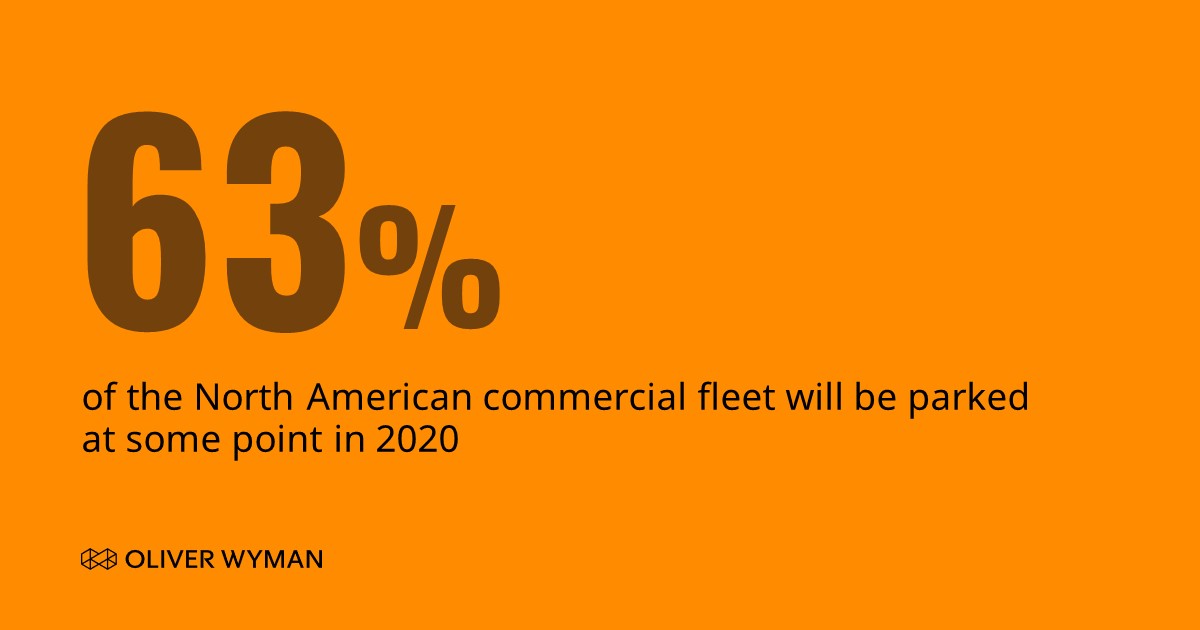

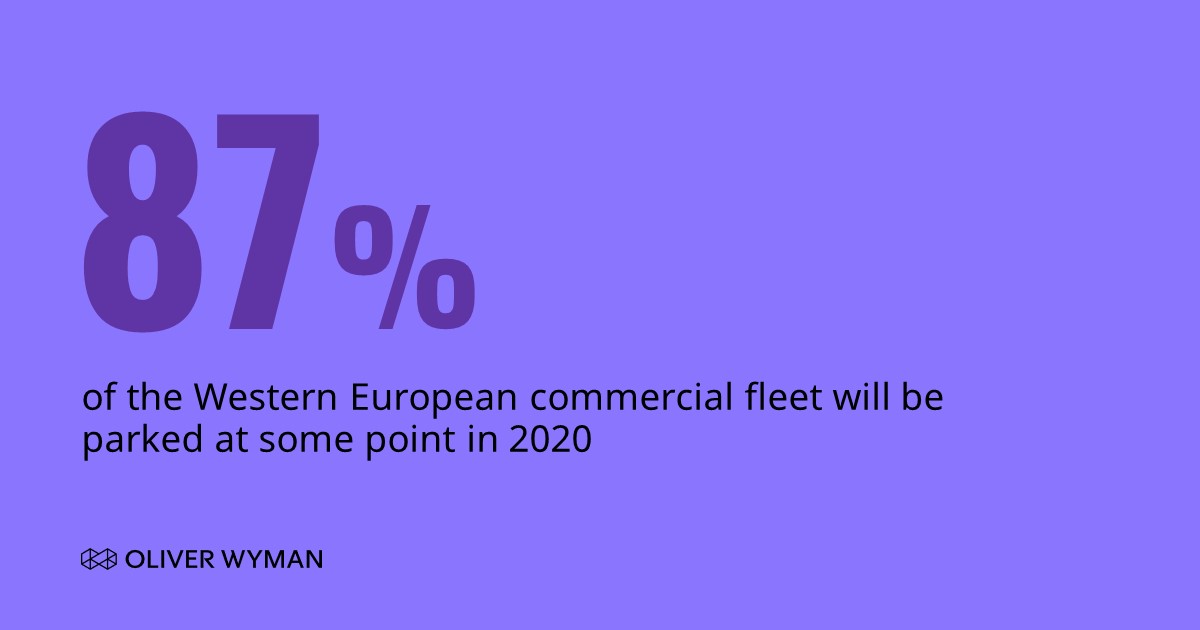

- Seventy percent of the global fleet is currently not flying.

- A u-shaped baseline scenario is most likely, with near full recovery occurring during the early months of 2022.

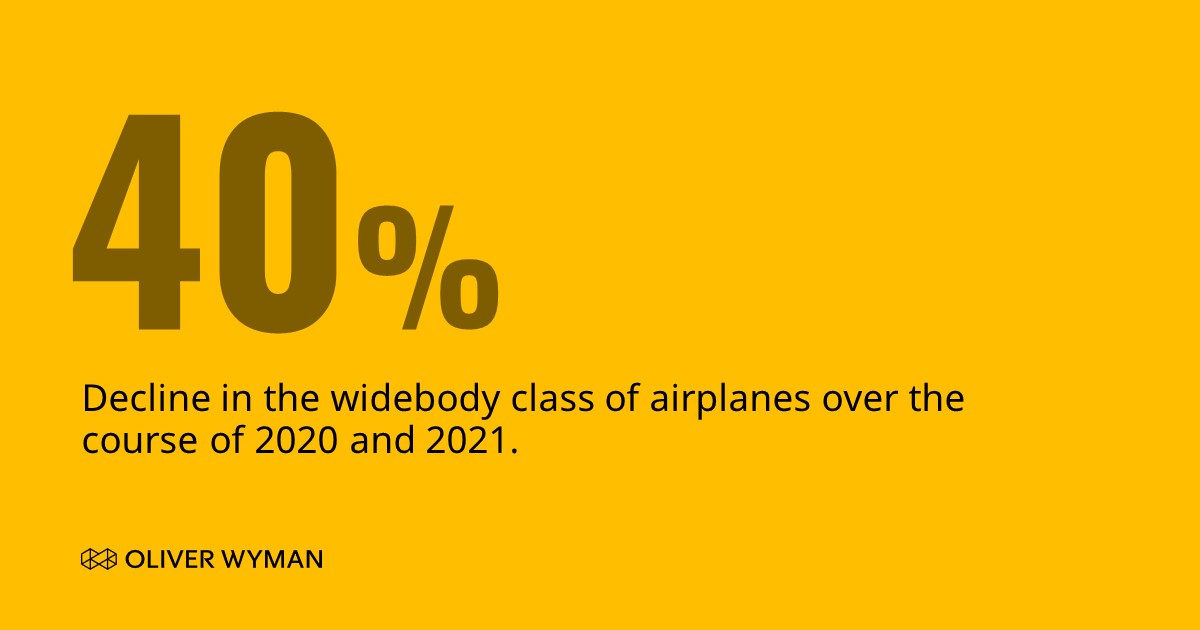

- A 45 percent decline in 2020 narrowbody and widebody aircraft production from 2019 is now expected with the number of units down by 560. The production is also 53 percent lower than our pre-COVID estimates. That represents 762 units fewer aircraft.

- Narrow and widebody aircraft deliveries are expected to be down by 491 units, or 42 percent, in 2020 versus 2019 — a year already reduced by the grounding of the 737 MAX aircraft.

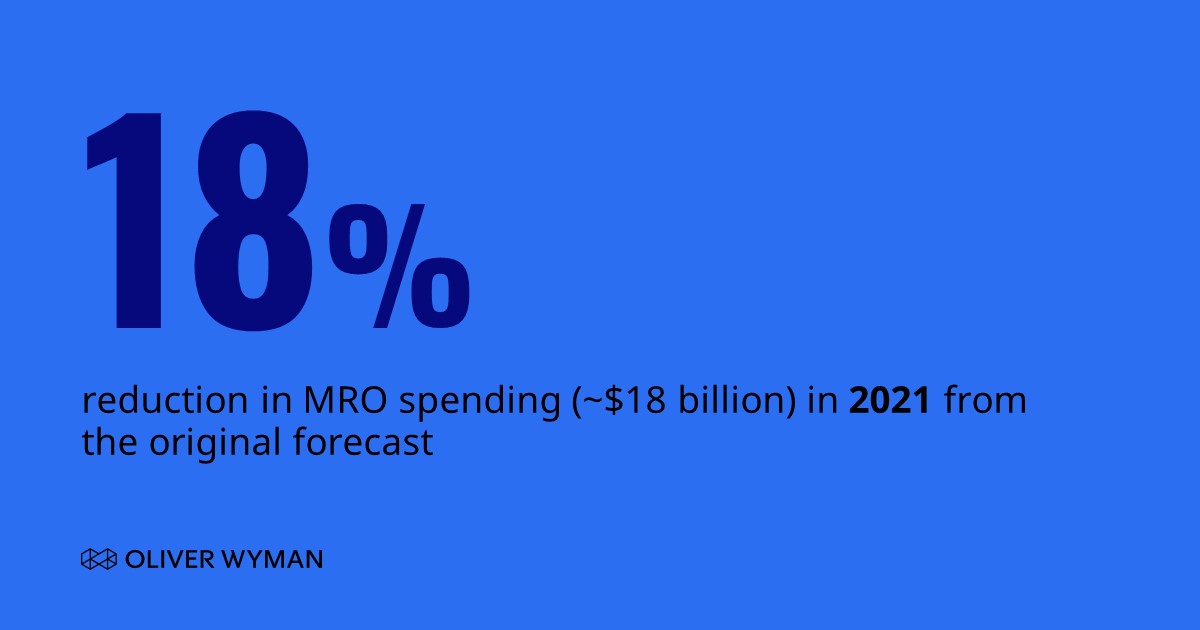

- The revised 2020 MRO spend is expected to come in at around $43 billion, a little less than half of the estimated 2019 demand and 53 percent lower than the $91 billion originally anticipated this year. Over the next 10 years, we expect spending to be $173 billion lower than originally forecast.

Agenda

Topics in the full webinar replay include:

1. Future demand and traffic:

With global capacity down over 70 percent year-over-year, and no immediate end to the pandemic, hear more about current passenger demand trends and how the next 12-18 months could play out.

2. Fleet and production implications:

Learn more about the challenges facing the aerospace supply chain due to an unprecedented mismatch of production and deliveries. Our experts will discuss where the current fleet stands and how retirements and storage could change the overall make-up of the global fleet in 2020 and beyond.

3. MRO and aftermarket shifts:

Overall MRO demand has plummeted. The team will discuss changes across MRO categories and platforms as well as which regions will be most impacted.

4. Q&A

Speakers