By Christian Edelmann

This article first appeared on Bancaria, issue 12, 2018.

At first sight, asset managers had a good year in 2017. Aggregate revenues increased by 9%. Look beneath this number, however, and the picture is not so pretty. Assets under management (AuM) increased by 13% and costs grew by 8%. In other words, despite a large market-driven increase in AuM, profits at the industry level hardly increased at all. An underlying deterioration in economic performance was disguised by a bull market in equities.

The reasons for this declining profit-per-AuM are familiar. Revenue growth is being subdued by declining fees and by a shift of AuM from high-margin active funds to low-margin passive funds. And costs are being pushed up by regulation and investments in new technology.

But some firms are proving to increase profit margins in the face of these pressures. These are the firms that can use new technology to automate and improve not only investment but distribution. The fixed cost of investing in this technology would seem to advantage large firms. But the increasing availability of outsourcing options allow small firms to benefit from scale without building it in-house. Nevertheless, scale advantages persist in asset management – especially in covering the growing and largely fixed cost of regulatory compliance and in building distribution channels or getting access to third-party channels. The ability to spread the cost of buying proprietary data is also likely to benefit larger players.

As a result of these trends, we see five business models emerging within the flux of in the asset management industry – product providers, solutions providers, platform providers, infrastructure/data providers and capital providers – differing in the expertise they require and in the importance of scale.

1. Pressures continue to build

Equity market performance accounted for 70% of the 13% growth of aggregate AuM in 2017, the rest coming from net inflows – the result of increased global incomes and reforms to pensions policies. The end of “quantitative easing” improved market conditions for active managers and, at an industry level, outflows from active strategies ceased in 2017.

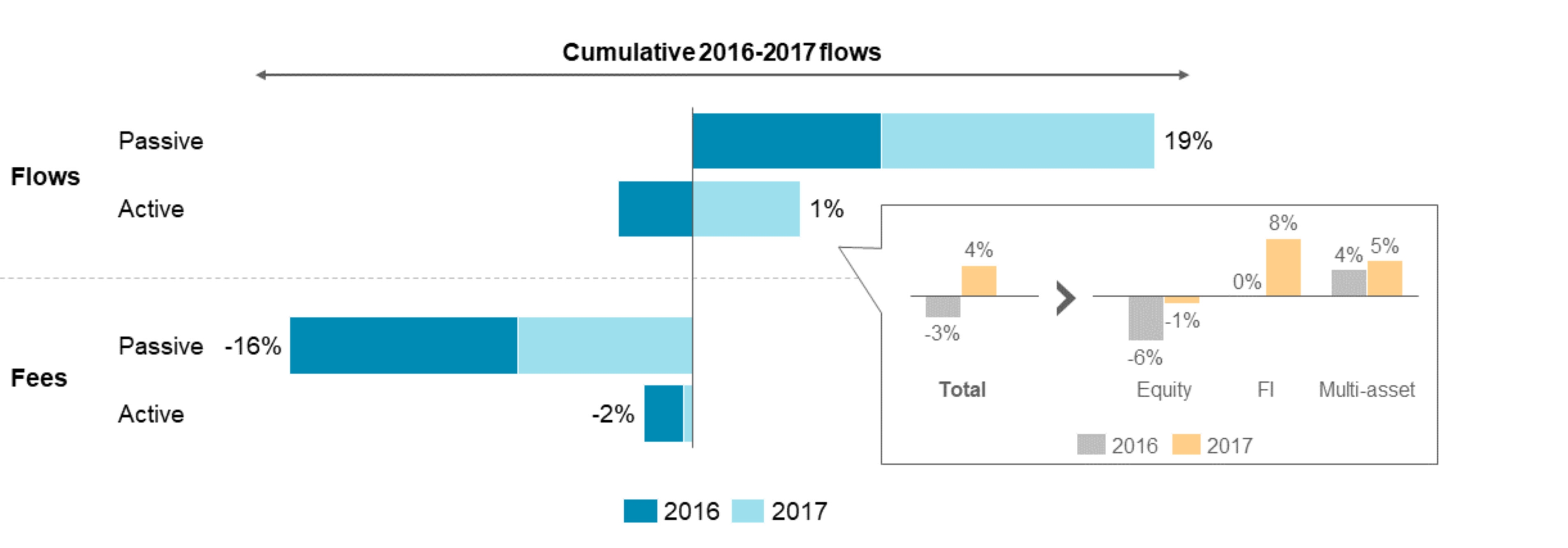

Yet structural pressures did not abate. The gap between AuM growth and revenue growth continued to expand, taking four percentage points off revenue-per-AUM. And flows into low-fee passive funds reached an all-time high, growing by almost 20% over the two years to the end of 2017.

Active equities saw net outflows through 2016 and 2017 despite the bull market. AuM in active fixed income products grew, though at less than half the rate of their passive siblings. Nevertheless, passive still accounts for only 19% of fixed income AuM, compared to 39% in equities.

Alternatives currently account for roughly 10% of industry AuM and 30% of industry revenues. We expect its share of revenue to grow to 40% by 2025, making the ability to compete effectively in this space ever more important. From 2012 to 2017, diversified asset managers enjoyed stronger flows than their stand-alone alternatives peers. Larger firms originally missed the alternatives trend but have recently gained ground, often through M&A.

Exhibit 1: Net Flows and Fee Changes by Product Class (2016-2017)

Source: Oliver Wyman Analysis

The industry made little progress on its cost-cutting agenda in 2017. Increased compensation, new investments and regulatory compliance costs more than offset any efficiencies, pushing absolute costs up by 8%. The demands of MiFID II are also expected to further increase costs.

Our base case scenario for 2020 anticipates a further 13% structural drag on industry revenues. Combined with continued AuM growth of 10%, this implies a small reduction of industrywide revenues. Our bull case would see a continued equity bull market, buying the industry time. Our bear scenario factors in a sharp asset price correction, which, when combined with greater fee pressure, could see industry revenues fall by nearly 30%.

As with so many industries today, asset managers are increasingly looking to technology and data science to alleviate the mounting pressure on their profit margins.

1. The role of technology and data

We expect technology to transform the asset management industry in three ways. It will significantly reduce costs, while (temporarily) enhancing alpha creation and reshaping the workforce.

A. Costs

Data management typically accounts for 10-20% of an asset manager’s costs. Many have tried to cut this cost by way of major multi-year “re-platforming” or rationalization programmes. However, mediocre savings, the difficulty of future-proofing, and negative effects on front-end agility have forced a change in mind-set. Data aggregation software presents a more immediate solution, while rationalization (internally and of vendors) continues behind the scenes. We expect vendors, rather than asset managers, to drive advances in distributed ledger technology.

Many asset managers still rely on infrastructure and technology dating back decades, creating a strong case for “greenfield” builds. On this approach, technology firms work in partnership with asset managers to launch a platform-based offering with a core data integration and orchestration layer, combined with a strong analytics environment and an open application programming interface (API) front-end.

More radical outsourcing can offer significant savings. About 40% of processing and administration costs are personnel, despite the high potential for automation. The battle is on among provider companies (trust banks, infrastructure firms, and some asset managers looking to bring scale on their proprietary platforms) to develop the winning proposition. Hosting these functions on vendor platforms can strip out further IT infrastructure costs. Together, these moves can deliver cost savings of up to 10% in the middle and back office for the average asset manager.

The maturing vendor landscape will increase not only the potential savings in currently outsourced functions, but also increase the scope for outsourcing, spreading into front office activities, such as execution and order management in liquid asset classes. Mid-sized and smaller firms will increasingly be able to access the advantages of scale from the firms to which they outsource functions, eroding the traditional scale advantage of larger peers in middle and back office activities.

B. Alpha Generation

Although alternative data has been utilized by some asset managers for years, the fear of falling behind has recently prompted most firms to act. Specialist alternative data teams are being created and data scientists are being hired. But, in our experience, many analysts and portfolio managers are unclear about the role data scientists should play in the investment process. Few firms have managed to build the required bridges.

Proliferation may already threaten the opportunity. Over 100 alternative data vendors have emerged, and the kinds of alternative data available continue to multiply. Some hedge funds are now looking for exclusive access, but the half-life of proprietary data is likely to shorten as the creation and provision of data accelerates. A growing number of data libraries of machine learning algorithms are also becoming publicly available. Leaders in this space are working with a hybrid approach, developing proprietary capabilities in conjunction with vendor-provided or publicly available components. However, when proliferated broadly, inherent alpha will decay.

Success in this space will depend on four main factors:

- Cultural integration: the ability to define upfront how new data driven insights are embedded in the investment process and what KPIs are used to measure success.

- Technical expertise: the ability to perform sophistication of data analysis and develop rapid feedback loops

- Financial firepower: the ability to hire the best talent and acquire or generate proprietary data.

- Risk management: the ability to understand new risks, such as data protection failures or infringement of patent rights.

Large firms are advantage when it comes to financial firepower and technical expertise. But scale is irrelevant to success in cultural integration and risk management.

While the long-term battle may be in investment management, using data effectively can yield greater short-term gains in distribution. In the institutional space, few firms mine customer relationship management (CRM) and other internal information and combine it with third-party information on clients’ or prospects’ asset allocation and mandate performance. Client cohort analysis with behaviour flags and predictive analytics for assets-at-risk are other areas where we see leaders building capabilities quickly. In wholesale distribution, managers with access to data collected from distributors can derive differentiated insights on product needs and usage.

C. Workforce

The long-term impact of technology will be a fundamental shift in the workforce. Headcount will decline due to automation and externalization. And we estimate that up to 40% of the remaining workforce will require re-training. This will be most significant in portfolio management and asset administration, where the use of data and analytics will transform roles.

As a result, compensation structures will change. Investment management will continue to take the lion’s share of compensation spend, but we expect technology and data management’s share of compensation to grow fourfold while spend on back office functions will decrease. Distribution’s share of compensation will remain largely flat. However, we expect this role to change most fundamentally, as data and technology become increasingly important at the customer interface.

The depth and speed of the coming transformation of the workforce far exceeds the traditional change management process handled by HR departments. It is a job for the CEO, requiring strong top-down guidance and a clear understanding of how the organization will have to change.

2. Emerging business models and the changing significance of scale

Given that a material percentage of asset managers’ costs are fixed, large firms benefit from lower average unit costs. The cost-per-AuM of asset managers with more than $0.5 trillion in AuM is, on average, half that of smaller peers. As mentioned, this advantage may be reduced by small firms’ increased access to large scale outsourcing providers. However, the growing costs of regulation are largely fixed, and this is restoring some of the advantages of scale.

Large asset managers are also proving more resilient to outflows from active management. Over the last three years, despite comparable investment performance, firms with less than $100 billion in AuM experienced outflows from their active funds of 6% per annum, compared to 2% for their larger counterparts. We believe this reflects growing economies of scale in distribution.

As regulators look to bring down total costs for investors, the end state is unclear. The full impact of MiFID II, in particular, remains uncertain. In contrast to expectations of more openness, integrated models are gaining traction and third-party funds are being cut off from distribution platforms. Large firms can diversify their bets by launching direct distribution in test markets or by acquiring IFA/RIA advisor platforms that can ultimately be turned into direct-to-customer propositions. Smaller firms will also find it harder to bring research in-house or bear the increased cost of buying it from external suppliers.

Asset management is not merely a scale game, however. The importance of scale differs significantly across the value chain. We see five business models emerging, in which scale plays differing roles:

Exhibit 2: Emerging Business Models in Asset Management

Source: Oliver Wyman Analysis

Asset managers traditionally occupy the role of “product providers”. Many have aimed to expand their offering by also providing solutions, such as the outsourced chief investment officer (OCIO). Yet the required skills are very different, and few have figured out how to perform both roles effectively. Clarity about where and how to compete will also be critical for strengthening brand propositions, which remain weak for most asset managers.

Many firms, especially in Europe, also manage in-house distribution and fund administration platforms, typically run out of their back office. With the recent growth of independent platforms and the associated interest of private equity firms in this business, managers will be forced to make strategic choices: potentially opening up to third parties or selling to private equity firms or to a competitor acting as a consolidator.

Similarly, a growing number of firms are looking to replicate the success of those that offer in-house infrastructure to third parties. Again, however, the skill set to succeed is markedly different from managers’ traditional core competencies.

Finally, we see a growing role for capital providers to bridge customers’ cash flow needs. Guaranteed outcomes, even if they come at the expense of capping upside, are in demand, particularly in the affluent and mass market. This creates a role for capital providers beyond the traditional offering of life insurance products.

We expect a significant shift of value over the next five years. Today, value is concentrated in the product provider models. In the medium-term we expect material shifts both across and within these models:

- As outsourcing accelerates, infrastructure and data providers will accrue value, while reducing the costs of product providers

- Proprietary data providers will take a larger share of the available pie, for example, by demanding a share of the alpha achieved

- As distribution polarizes towards high-touch solutions and low-frills platform approaches, providers in these models will benefit to the detriment of traditional distribution channels and product providers who will need to concede on fees to get access

- The biggest shift is likely to occur within the product providers, where those with cheap beta or capacity-constrained alpha products will win to the detriment of those lacking scale or capabilities.

* * *

Various trends in the asset management industry have been evident for several years – the shift to passives and alternatives, increasing market concentration and margin erosion. But no major reconfiguration of the basic asset management business model has yet occurred. This stability is unlikely to persist, however, as innovative players use new technology to respond to the mounting commercial pressures.

As business models reconfigure, asset managers will need to make strategic decisions about where they want to play.