Access to freshwater sits at the intersection of human survival and economic prosperity. While demand for it climbs as a burgeoning global population pushes cities, agricultural production, and industrial activity to expand, mounting climate pressures increasingly threaten the supply through worsening droughts, rising sea levels, and destructive flooding. Currently, close to one-quarter of the global population lives under conditions of extremely high water stress, with one billlion more people are projected to face such conditions by 2050.

Thus, choices the world makes today regarding economic development and climate will shape whether societies can rely on safe, affordable water in the decades ahead. Drawing on our “Water Horizons” report — developed with the Saudi Water Authority — this article sets out eight structural shifts redefining how water is sourced, moved, managed, and reused that could make the difference between whether many millions of people will have access to freshwater or not. With a focus on the Middle East North Africa (MENA) region, because of its particular vulnerability on freshwater, the article details how many of these trends are affecting water security across the globe.

These shifts align under three interconnected categories: expanding infrastructure through such techniques as desalination, advanced water transmission, and upgraded networks; incorporating digital and artificial intelligence innovations aimed at digitizing operations and services and enhancing cybersecurity; and adopting circularity and sustainability priorities by introducing more renewable energy, mining desalination brine, and valorizing wastewater.

Expanding desalination secures reliable water supply

Desalination has moved from niche solution to essential supply, especially in arid regions. The technology story matters here: In recent years, reverse osmosis — a membrane-based process — has overtaken older thermal methods because it uses less energy and costs less to run. Global operating capacity for seawater and brackish desalination is projected to grow by about 5.6% a year between 2024 and 2030 according to DesalData, reaching roughly 82 million cubic meters per day by 2030, with seawater sources accounting for about 89% of the total. The MENA region leads this expansion, representing more than half of new capacity: Saudi Arabia, the United Arab Emirates, Egypt, and Morocco together account for nearly three-quarters of new MENA capacity.

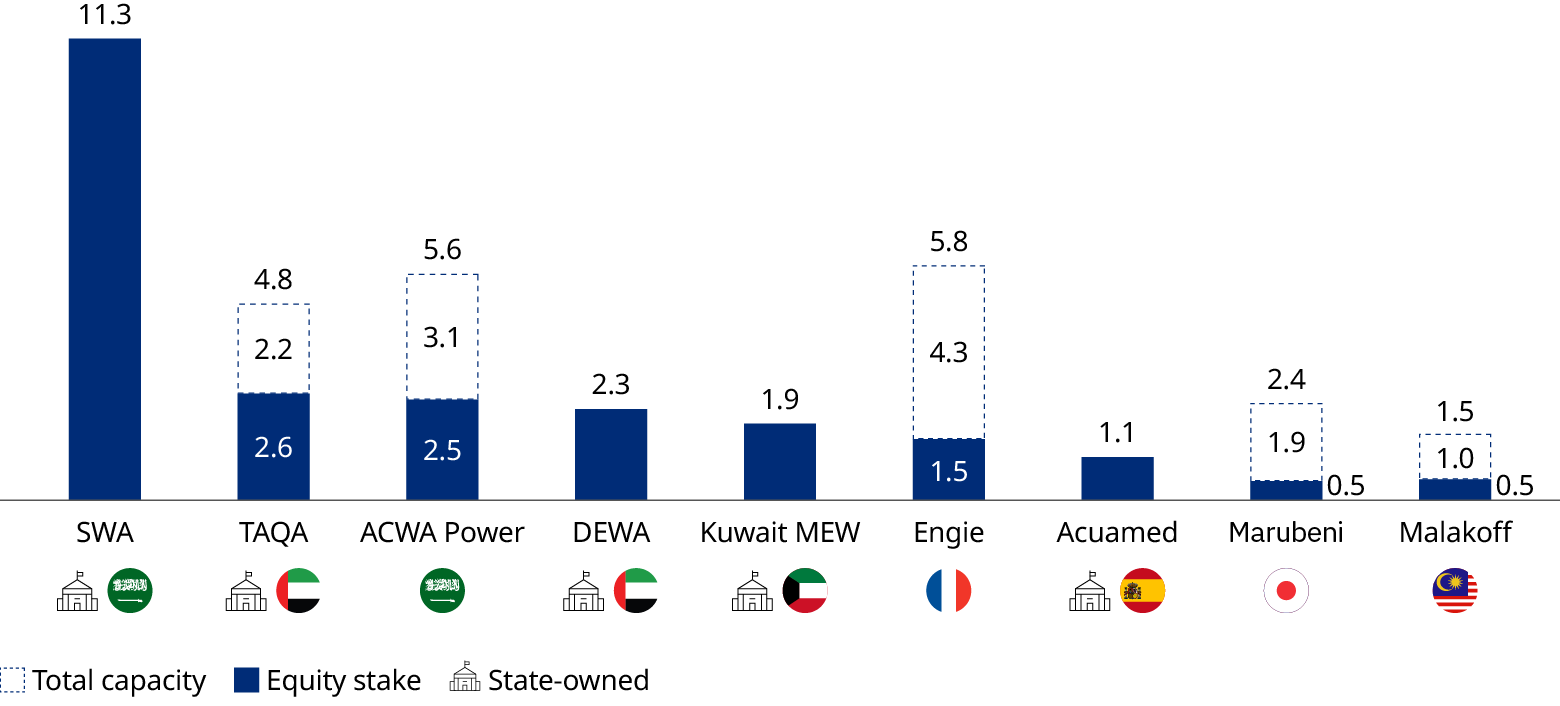

Costs have fallen sharply over the past 15 years thanks to better membranes, energy recovery systems, and smarter plant design. Saudi Arabia already operates the world’s largest desalination capacity — over 11 million cubic meters per day — and recent projects in Saudi Arabia and the UAE have achieved some of the world’s lowest reverse osmosis water prices, below US$0.50 per cubic meter.

Advancing water transmission connects coastal sources to inland cities

Getting water to where it’s needed is just as critical as producing it. As countries add new sources — especially coastal desalination — transmission networks are becoming the quiet heroes of water security. Pipes, pumps, and control systems now move vast volumes from plants at the shore to inland cities.

Saudi Arabia shows what scale can look like: By 2030, more than 10,000 kilometers of new water transmission pipelines are planned according to MEED Projects, with investments nearing $30 billion and public-private partnerships expected to account for roughly 90% of the region’s transmission spending.

Upgrading networks improves water system reliability

Across the world, water and wastewater networks are aging. Leaks, bursts, and outdated equipment waste both water and money. The best performing systems keep non-revenue water between 5% and 15%, while some countries lose more than 40% of treated water before it reaches end users.

Investment is rising to replace old pipes, valves, and pumps and to expand coverage where it is still patchy. Globally, water network spending is expected to grow about 2%-3% a year through 2030, but wastewater network spending will grow around 3%-4% a year, according to Global Water Intelligence.

Digitizing operations with sensors, smart meters, and AI boosts efficiency

A wave of digitization is changing how utilities operate. Sensors, smart meters, and data platforms give managers a real-time view of flow, pressure, and quality across sprawling networks. Artificial intelligence helps spot leaks faster, schedule maintenance before equipment fails, and tailor services to reduce waste and improve customer satisfaction.

The economics are compelling. Worldwide spending on digital water technologies is forecast to reach about US$74.6 billion by 2030, according to DesalData, growing at nearly 7% a year. Data management and analytics are expected to account for roughly 35% of spending and grow at about 10% a year, while smart meters should make up about 30% of the market and grow around 5% a year.

Enhancing cybersecurity protects critical systems and safeguards water quality

As water systems get smarter, they also become more exposed. Recent incidents have shown that a single compromised workstation or remote access tool can put water quality at risk. Utilities are responding by strengthening both their operational technology and information technology — from stricter access controls and intrusion detection to better training and incident response.

Globally, cybercrime costs are projected to reach about US$10.5 trillion this year. Water-sector data breaches average roughly US$4.9 million per incident. In the United States, close to 80% of utilities plan to increase cybersecurity investment. Human error remains a key vulnerability, contributing to around 90% of breaches in reported UK data.

Adopting renewable energy lowers costs and emissions in water infrastructure

Desalination and wastewater treatment consume a lot of electricity. Integrating renewables can cut running costs and carbon emissions, especially in locations where solar and wind are abundant. The practical reality today is hybrid: Most plants still need grid power to guarantee reliability, but onsite renewables account for a growing share of the load.

Global targets are tightening. For new desalination plants, the aim is for about 60% of energy to come from clean power by 2035. Energy often accounts for roughly 30% of desalination operating costs, and renewable integration can reduce greenhouse gas emissions by up to around 80%.

New concepts are emerging too: subsea desalination, installed at about 500 meters below sea level, requires roughly 95% less land, uses about 40% less energy by eliminating high-pressure pumps, and does not discharge toxic brine.

Mining desalination brine recovers valuable minerals and advances circularity

Desalination produces brine — a concentrated salty stream that must be carefully managed. That challenge is turning into an opportunity. With the right technology, utilities can recover valuable minerals from brine, such as sodium, magnesium, potassium, bromine, and even lithium. Doing so reduces environmental impact and creates potential new revenue

Pilot projects in the MENA region are demonstrating what this looks like at plant scale, recovering table salt and industrial minerals while improving overall water recovery rates. Global demand for lithium is forecast to exceed 2.3 million metric tons (lithium carbonate equivalent) by 2030, growing at roughly 14% a year — a market worth over US$13 billion at around US$10 per kilogram. Potassium demand is expected to surpass 83 million metric tons by 2030, growing about 3.5% a year — with current prices near US$340 per metric ton, implying a market of roughly US$28 billion.

Valorizing wastewater expands reuse, energy recovery, and nutrient recovery

Wastewater is no longer just something to dispose of — it’s now a resource. With proper treatment it can be reused for agriculture, industry, and even drinking water, and sludge can yield energy, nutrients, and materials.

Meeting the United Nation's Sustainable Development Goal 6.3 by 2030 will require adding around 160 billion cubic meters of annual treatment capacity. Investment is expected to reach about US$115 billion in capital expenditure and roughly US$190 billion in operating expenditure by 2030. Global treated water reuse capacity is projected to grow about 25% by 2028 — with Asia Pacific accounting for nearly half (China around 40%) and MENA contributing more than 15% — while potable reuse is the fastest growing segment.

Ambition in MENA is high: Dubai targets 100% reuse by 2030; Saudi Arabia aims for 70–100% by 2030; Morocco plans a tenfold increase by 2050. On the energy side, the global sludge management market is projected at about US$45 billion by 2030 according to WaterData, with roughly US$4 billion directed to anaerobic digestion growing at over 5% a year. The United States accounts for around 30% of spend.

An integrated approach will accelerate a resilient, lower-carbon water future

Put together, these eight shifts outline a practical, integrated way forward: expand supply with modern desalination, move water reliably through strong transmission networks, tighten up performance by upgrading grids and digitizing operations, protect systems against cyber threats, and close the loop with renewables, brine mining, and wastewater reuse.

The challenge now is to accelerate: invest wisely, share data, collaborate across borders, and build the governance needed to make water systems both resilient and fair.

Written in partnership with the Saudi Water Authority