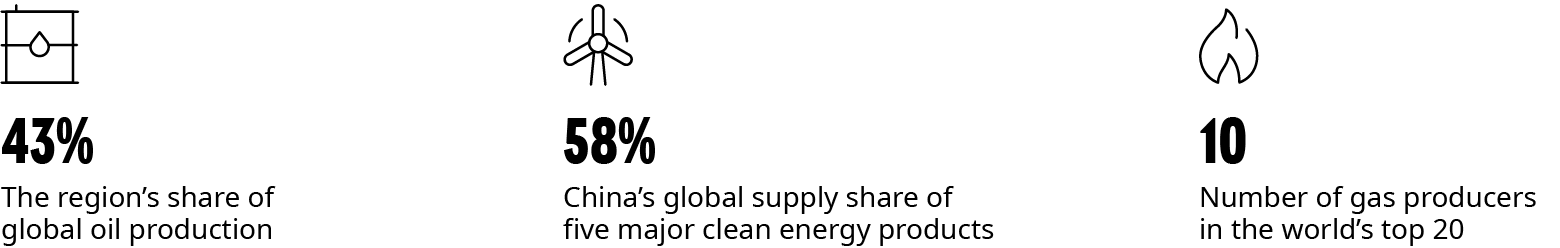

Energy is fundamental to the New Silk Road’s future, as the region is the world’s largest energy producer and consumer. Energy ties between Asia and the Middle East are already extraordinarily tight, and they are likely to strengthen further due to the region’s supply and demand growth outpacing the global average.

The region’s energy demand, in particular, is growing much faster than in Europe or North America, especially in energy-hungry Asian economies. Striking a balance between economic development and energy transition will take time. While the region’s investment in renewables is strong, it cannot fully keep pace with the surge in demand.

Nevertheless, the New Silk Road’s ability to innovate at scale should not be overlooked. China is already one of the major exporters of clean technology. Japan and South Korea are exploring new technologies, from batteries to nuclear power. The Gulf Cooperation Council (GCC) also has ambitious clean technology investment plans and is happy to welcome Asian capital and technologies. As the region strikes a balance between its current needs and its endeavors for energy transition, we see exciting opportunities in the following areas.

Four energy transition opportunities in Asia and the Middle East

China’s Clean Technology Sector

It is hard to overlook China’s clean technology sector, given its innovative technologies and manufacturing scale. If the New Silk Road is going to navigate energy transition properly, access to affordable clean energy products designed for emerging markets will be key. Low prices are often a result of overcapacity, but the effects are nevertheless felt globally, from cheap solar panels to electric vehicles (EVs). Other clean energy products of interest include heat pumps, solar lighting, wind generators, and renewable energy storage devices.

However, Chinese clean technology companies need strong local partners to expand into New Silk Road markets. It is not enough for products to be cheap. Other factors critical for success include strong government relations to help win public bids, quality after-sales services to ensure long-term customer adoption, and sound marketing strategies to convince households to make upgrades. Partnership opportunities will range from joint ventures to strategic investments.

The GCC’s Localization Ambitions

Asia will be a major partner for the GCC, as the latter seeks to successfully localize its renewables infrastructure and take a clean energy lead.

Asian companies will play a key role in helping the GCC countries build their renewables capacity. Chinese and Japanese companies have already built solar panel fields in the UAE and Saudi Arabia, for example. However, the GCC is increasingly seeking to localize production, meaning Asian companies will need to invest in local manufacturing capabilities or supply raw inputs, especially critical minerals and metals, rather than just seek to win engineering, procurement, and construction projects.

This is a different opportunity, but it can still be profitable with the right partners. China’s battery manufacturers are already exploring opportunities to build factories in the GCC countries. Manufacturing in Saudi Arabia for export to Europe, for example, would also strengthen the resilience of Chinese manufacturers in the face of worsening global trade tensions. Other Asian companies may see opportunities to use the GCC countries as a platform for selling into sub-Saharan Africa.

Energy Transition Platforms

The New Silk Road is almost unique in its ability to bring together capital, technology, and talent to tackle energy transition.

Funding the New Silk Road’s energy transition will not be cheap. Public-private sector structures will play a key role, especially for large-scale projects requiring new infrastructure, such as hydrogen. Platforms that bring together a range of actors, from sovereign wealth funds to leading industrial companies, will ensure the right mix of technologies, funding, and government support is brought together to tackle specific decarbonization challenges.

In our report on the region’s financial services, we have explored regional financing platforms. Energy transition platforms are an important part of this opportunity. The UAE’s US$30 billion contribution to a new climate fund, alongside financial sector giants, such as BlackRock and TPG, is just one recent example. A large share of the fund’s investments are likely to not only be made in the New Silk Road, but also include products from the region.

Building Ties between the gcc and asia

The GCC will invest in Asia, whether to guarantee the supply of key inputs, or to strengthen links into Asia’s final energy demands.

The region has plenty of motivation to invest in Asia, in part to secure the supply of minerals and metals critical for the GCC’s energy transition and localization. Indonesia is a prime target, given the country’s domestic reserves of nickel. Its neighbor Malaysia has smaller reserves of rare-earth elements. China is the region’s critical minerals giant and, while it may be less open to direct investment in the sector, it might welcome partnerships with the GCC countries.

The GCC will also invest in Asia to secure demand from its major oil and gas consumers. Saudi Aramco has only recently invested US$3.6 billion on a stake in a refinery and chemical facility in northeastern China, in addition to its existing stake in a Fujian refinery that was completed over 15 years ago. The company has similarly taken a US$2.2 billion stake in Chinese refiner Rongsheng Petrochemical. South Korea has also attracted similar GCC investments.

This article is part of our New Silk Road series