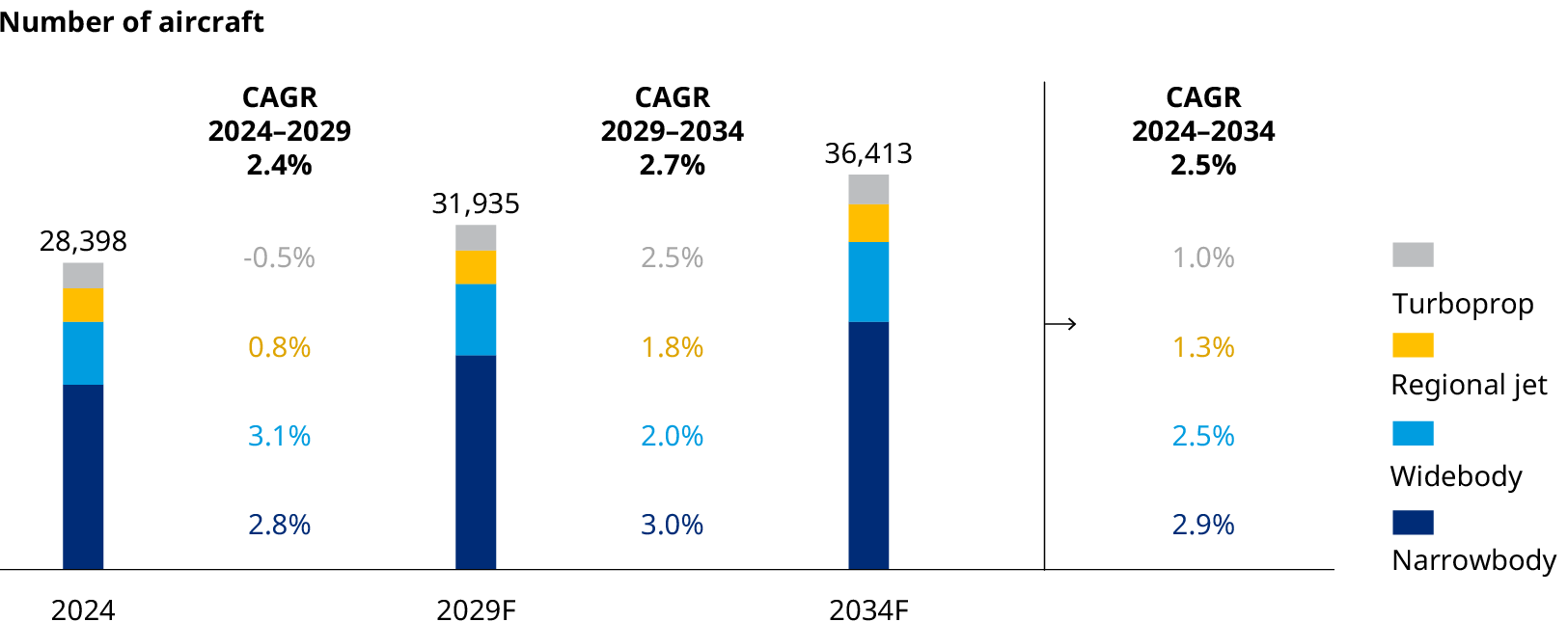

2024 will be the first year of real growth since the peak reached just before the onset of the COVID-19 pandemic. According to the latest edition of the Global Fleet and MRO Market Forecast 2024-2034, the size of the global fleet will increase 28% over the next 10 years, expanding from today’s 28,400 aircraft to 36,400 by 2034. The former peak was 27,800.

But COVID has left indelible impressions on the aviation fleet, which will now add aircraft on a slower trajectory than previously predicted. The fleet’s compound annual growth rate (CAGR) over the forecast period will be 2.5% versus the 2.9% projected in last year’s 2023-2033 forecast. The CAGR has been tempered by modest global economic growth — the product of high interest rates worldwide — and lower than anticipated aircraft production.

Where pre-COVID the forecast expected a fleet of more than 39,000 aircraft by 2030, we now do not anticipate reaching that size until 2036 — essentially six years of lost growth for the industry.

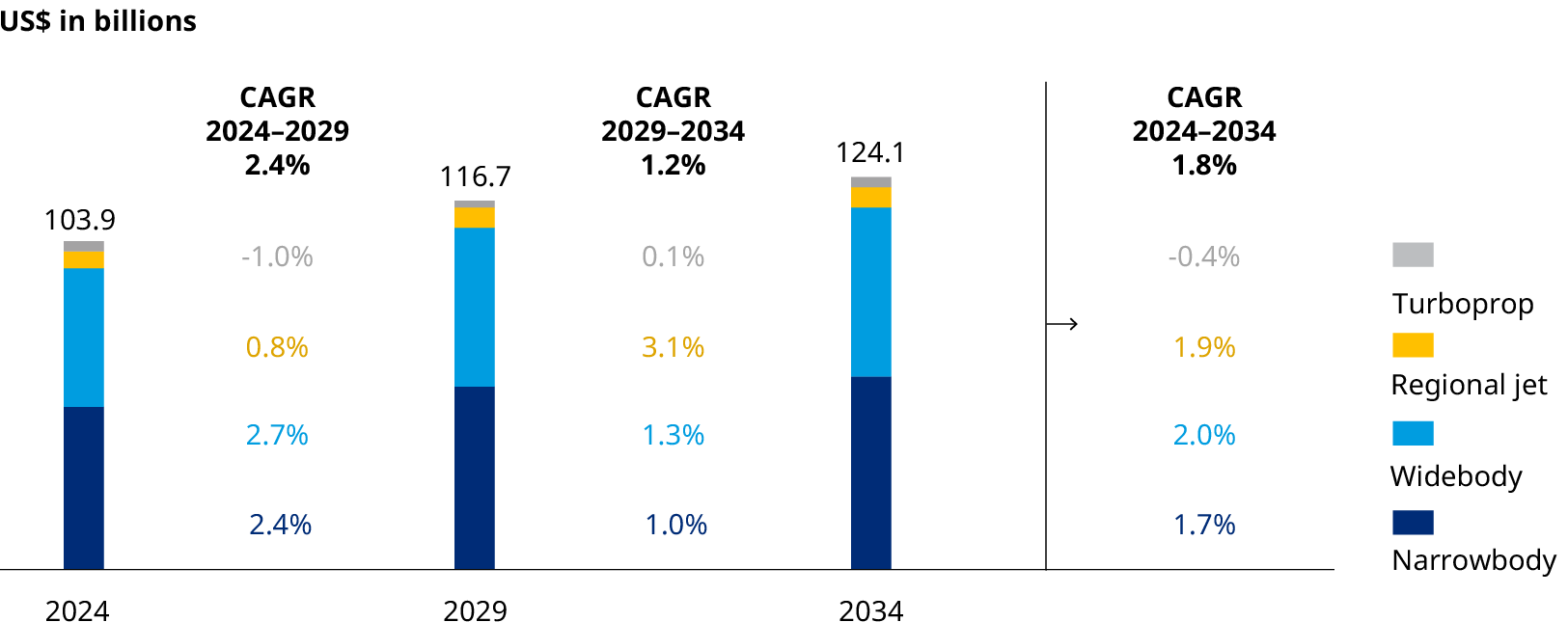

Meanwhile, reflecting that slower expansion, demand in the maintenance, repair, and overhaul (MRO) sector will grow 1.8% annually on average through 2034, when revenue will reach $124 billion. Our 2023-2033 forecast had the sector expanding at a 2.9% CAGR. In 2024, MRO revenue will rise almost 3% to $104 billion from $101 billion last year.

India set to grow the most

Asia will once again serve as an economic engine for the industry. But over the next decade, India will lead the expansion, not China. Currently at just over 600 planes, India’s fleet will add aircraft at a rate of almost 13% over the first five years and nearly 10% for the 10-year forecast period. By 2034, it will be 2.5 times the size it is today.

To give a sense of how fast it is expanding, India has over 1,800 aircraft on order, more than triple the current size of its fleet. India has become the world’s most populated nation, with 1.4 billion people — only 3% of which fly regularly.

China, on the other hand, faces slowing economic growth, in part a result of collapsing real estate values, an aging population, and unemployment among its younger workers. Still, by 2034, China will become the second-largest fleet — displacing Western Europe which slips to No. 3. Over the 10 years, the Chinese fleet will grow 56%.

Biggest-fleet honors throughout the decade will remain with North America, where the fleet today tallies around 8,200 and will grow to 9,850. By comparison, the Western European fleet has a little over 5,300 aircraft today and is expected to grow to almost 5,900 by 2034. China has around 4,100 and will grow to just over 6,400. That means China’s fleet will be 65% as big as North America’s in 2034, versus 50% in 2024.

The other rapidly expanding fleet is in Eastern Europe — expanding 9.2% annually in the first five years and 7% over the 10 years. This is despite Russia’s inclusion in the regional numbers. Russia's fleet, the only major fleet to contract between 2024 and 2034, will shrink 8%, and because of the sanctions imposed after it invaded Ukraine, its narrowbody fleet will decrease by a stunning 44%.

Pressure on production and MRO

But the industry does face risks, even with this more modest growth. The two global airframe manufacturers — Airbus and Boeing — are pushing their production capacity to the limit, hoping to reach new heights in monthly output over the next decade. Yet it appears unlikely at this point that either will reach their targets on time without significantly more investment in their own production facilities and those of their chief suppliers.

After three years of COVID, inflation, and raw material and labor shortages, the aerospace industry faces a pressing need to modernize and optimize production at all points along the supply chain.

Putting a particular strain on both production and MRO is the raft of new engines in next-generation aircraft. One of the more publicized situations involved Pratt & Whitney’s geared turbofan (GTF) platform, which led to the grounding and inspection of Airbus 320 fleets. But all the new entrants — from CFM International’s LEAP to Rolls-Royce’s Trent XWB — have experienced delays and problems. The additional engine work is pushing the CAGR for MRO to 2.3% and has prompted aircraft manufacturers and MRO providers to increase engine MRO capacity.

Fleet and MRO forecast dashboard