For commercial aviation, we anticipate a strong global maintenance, repair, and overhaul (MRO) market in 2023, reaching $93.9 billion, up 21% from 2022. The MRO market will return to 2019 pre-pandemic levels this year, with the global fleet 98% recovered and passenger traffic back to 90% as of the beginning of 2023. And we expect spend to grow by 2.9% through 2033 in nominal terms, reaching $125.3 billion.

Outlook for top MRO industry disruptors

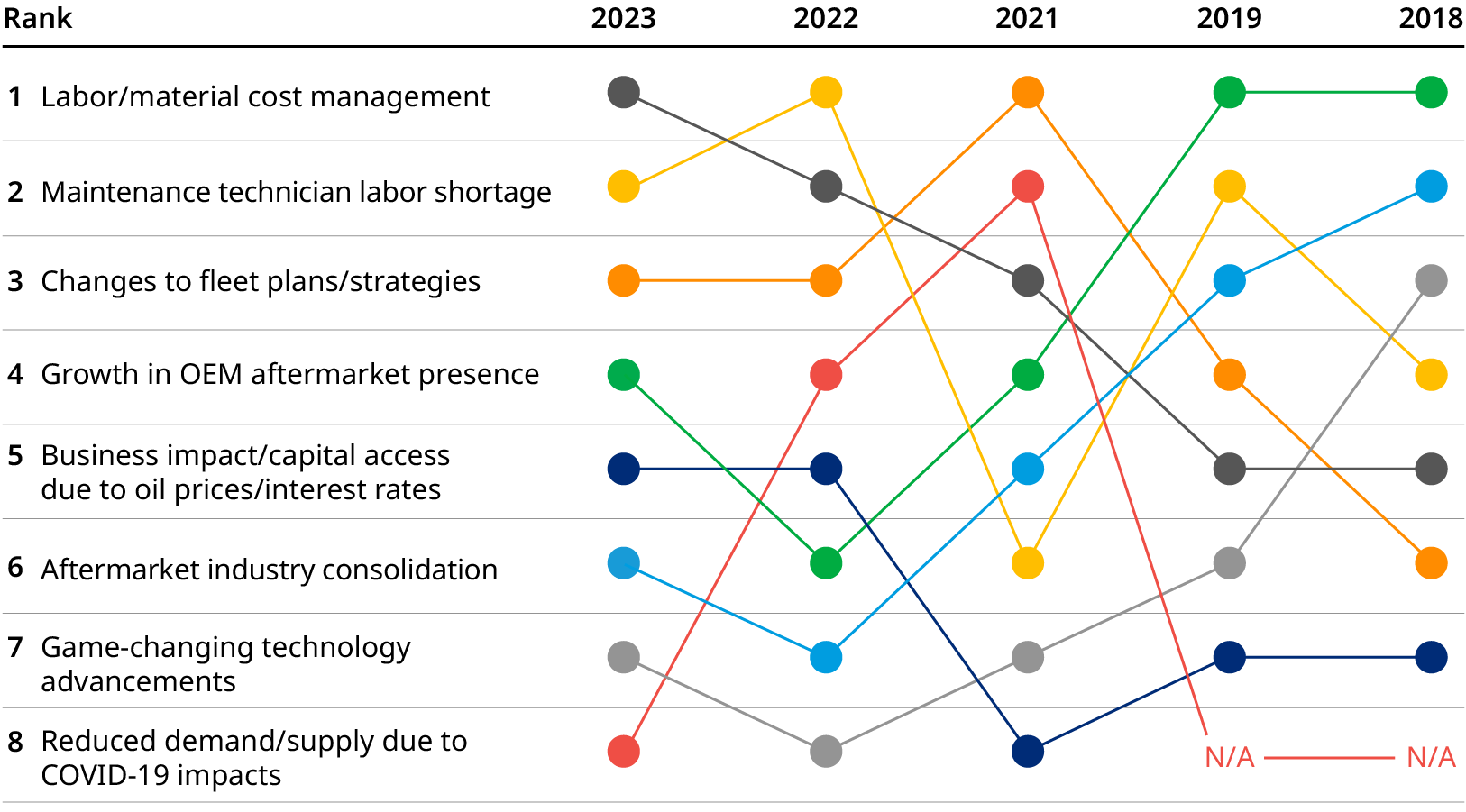

When asked what they expect to be the top disruptors for the MRO industry over the next five years, respondents to our 2023 MRO survey cited labor/material cost management, followed by a shortage of maintenance technicians. This shortage had been predicted for some time, but likely was both delayed and exacerbated by the pandemic. Concerns about disruption from greater original equipment manufacturer (OEM) presence in the aftermarket as well as aftermarket consolidation have dropped since 2019 – as OEMs have refocused on solidifying their supply chains and ramping up production.

Labor and material supply chain challenges

As demand has roared back, the MRO industry has had to rapidly ramp back up production and maintenance to historic levels, while dealing with fewer employees and struggling suppliers – especially at lower tiers. Three-quarters of survey respondents expect current supply chain challenges to last another one to three years.

Respondents also expect materials cost inflation to continue, with prices increasing by about 6.7% a year over the next 1-2 years. To reduce costs, MROs are especially bullish on increasing USM usage. With current gen fleets beginning to retire in larger numbers over the next few years, there should be plenty of opportunity to harvest this material, while strong commonality between current and next gen fleets should help drive adoption.

On the labor side of the equation, market labor rates are expected to increase by about 5.6% a year, compared to the 2-3% annual cost inflation the market saw prior to the pandemic. MROs hope to drive more efficiency via traditional operational improvement and enhanced IT, while operators plan to focus on optimizing maintenance programs. But the most critical input to labor cost is supply. To secure the talent pipeline, operators are looking to do more educational outreach, subsidize technical training, and increase minority hiring. MROs, on the other hand, plan to lean hard on improving the work environment, recruit talent from other industries, and use more internet-based recruiting.

An emerging MRO leadership gap

Our survey also looked at another emerging talent gap – in the area of leadership. Pandemic-era reductions and retirements led to an exodus of middle managers just one step below the executive level, which appears to have depleted the executive leadership pipeline. The majority of C-suite/executive-level survey respondents believe that less than a quarter of their company’s leadership bench is prepared to move up. With most companies reporting difficulty in external hiring for executive management, they will need to focus hard on internal development of the next generation of leaders over the next few years to head off this incipient trend.

Investor aftermarket interest ticks up

Our final survey topic was the near-term investment outlook for the MRO industry, which appears to be positive: 90% of respondents expect the same or higher levels of deal activity over the next three years. Suppliers’ capital needs are rising as they attempt to meet renewed demand for aircraft and parts, and they are turning to private equity investors, flush with cash, in the wake of higher interest rates and banking headwinds.

Investor sentiment about the MRO industry is being driven mostly by the strength of the recovery, valuation expectations, cash flows that are transparent and strong versus other industries, and the opportunity to continue consolidation as a value lever. Engine overhaul, airframe, and heavy component repair are seen as the top three segments likely to attract the most investment attention.

About the survey

In its second decade, the annual Oliver Wyman maintenance, repair, and overhaul (MRO) survey is an industry standard that samples the attitudes and strategies of executives from across the aviation industry, as they address key trends and emerging issues in the MRO sector. We leveraged the latest Oliver Wyman Global Fleet and MRO Forecast to provide additional insights.

More than 120 global aviation professionals responded to this year’s survey. We also conducted hour-long interviews with more than 30 senior MRO leaders worldwide to provide additional insights. Survey and interview participants were drawn from a cross section of airline operators, airline and independent MROs, OEMs, and others. More than half of respondents were senior executives (C-suite or vice presidents) and 80% were director level or above. More than 70% of respondents’ companies are headquartered outside of North America.