In 2024, wholesale banks in the Asia-Pacific (APAC) region need to continue monitoring the macroeconomic environment globally and how it may affect them regionally. Shifting interest rates in different countries and the United States proposal to implement the Basel 3 endgame for bank capital requirements will affect both global liquidity and the investment decisions and participation choices of banks in Asia. With local macroeconomic paths and geopolitical dynamics as core revenue drivers, we have detailed three scenarios and four management actions for APAC wholesale banks to consider.

Three scenarios for APAC wholesale banks in 2024-2025

Global soft-landing scenario

We believe a global soft-landing is the base case for 2024-25. In this scenario, APAC wholesale banks would have to deal with an economic climate of slow growth and lower global liquidity injection into Asia compared with the previous decade.

In Japan, we would expect the Bank of Japan (BoJ) to raise interest rates gradually to help negate the selling pressure on the Japanese yen, and there would be sustained improvement in Japanese corporate profitability. In contrast, China’s interest rates would remain subdued due to continued macroeconomic weakness in 2024, but this could bolster the internationalization of the Chinese yuan due to attractive borrowing rates. While there could still be default events, real estate and local government debts would remain relatively contained due to the early signs of policy support emerging. Most Asian currencies would rebound from 10-year lows against the US dollar and create trade tailwinds, as US dollar interest rate reductions would begin to take place.

A global soft-landing would also see no major escalation of geopolitical conflict. However, we would expect supply chain evolutions to continue amid moderate sanctions, for example, soaring exports of component parts to “China+1” countries, such as Vietnam. Supply chain restructuring would, in turn, drive corporate footprint evolution. For example, global multinational corporations would reprioritize, and Asian and Chinese corporates would push for increased internationalization.

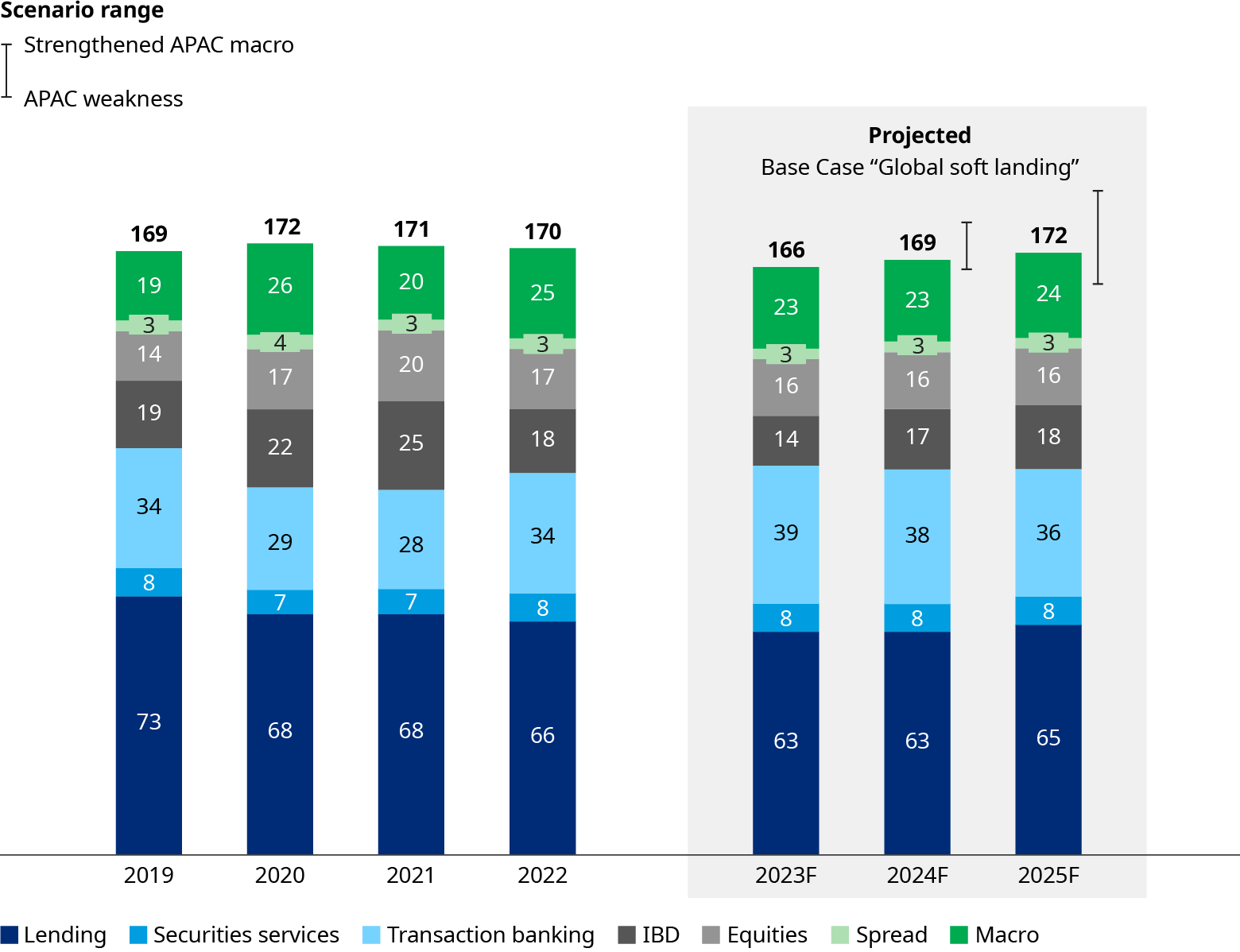

The outcome of this base case would be revenue stabilization for the APAC wholesale banking industry, with corporate and transaction banking benefiting in particular. APAC revenue pools in 2024 would be projected to expand by 1% year-on-year, with markets and investment banking increasing by 4% and 17% respectively, transaction banking and securities services declining by 3%, and lending remaining steady. Net interest margin (NIM) growth in APAC would also likely be buoyed by the growth in volume offset by a slower rise in the interest rates of local currencies. Japan would continue to see improvements in equity markets and macro businesses. China-focused investment banking and equities would remain muted with slight improvement due to bottomed valuations attracting capital.

APAC macro recovery scenario

In this scenario, the recovery of China’s macroeconomic environment would be stronger than expected, resulting in the country drawing global liquidity quickly. We would expect more government and regulatory intervention, with a sharp focus on restoring confidence, to help accelerate the recovery. Sustained improvement in Japan’s economic climate would pave the way for the BoJ to increase the interest rates faster. There would be accelerated intra-regional collaboration, especially between APAC and the Gulf countries, to boost investment in APAC. Yet early economic data in the year does not seem to support a recovery scenario.

For APAC wholesale banks, the outcome of this scenario would be robust growth in industry revenues supported by extended NIM expansion. Banks would enjoy the return of equity and origination-based revenues.

Worse-than-expected APAC macro SCENARIO

This scenario would see sustained weakness persist in the APAC macroeconomic environment. We would expect various shockwaves. There would be major defaults in China debt, coupled with a weaker-than-expected ability of the Chinese banking sector to absorb losses, creating more credit risk than expected. The return of heightened geopolitical tensions would lead to further price pressure. Japan would see a potential setback to corporate profitability, resulting in the interest rate remaining low or negative. Inflation imported to APAC would cause weakness to persist in both local macro businesses and APAC currencies. We believe that the increasing policy intervention means it is likely to avoid the worse scenario.

The outcome of this scenario would be credit losses to both investor and regional banks. Origination would be further suppressed, and volatility-led trading might remain weak due to lower inventory.

The shifting competitive landscape between global and regional banks

Regardless of the scenario, we expect a shifting competitive landscape between global and regional players. Global players, including US banks, will have to make difficult decisions — whether to prioritize home or APAC, or whether to deploy resources within APAC outside China to achieve growth.

Asia-focused universals will be well-positioned to compete for the reshuffling opportunities, with expected interest rate dynamics providing good near- to medium-term support. Japanese mega banks will be looking to take advantage of domestic business opportunities, with domestic rate hikes on the horizon. Chinese banks and brokers will likely gain more investment banking market share and aim to further expand into regional capital markets. Other regional players will likely expand selectively within Asia as they try to deepen their transaction banking offerings rather than having pure lending relationships only.

Four management actions for banks to best navigate 2024 and beyond

In our view, the best management actions for APAC wholesale banks will include local nuances in areas such as wealth management, new growth sectors, and financial resource management.

Building resilience into the revenue model

Banks can achieve geopolitical diversification by building the right balance within their geographical portfolio. They can also ride the current corporate and transaction banking tailwind by actively aiming to reinvest returns into growth areas for the benefit of future cycles. Furthermore, banks can look beyond their core corporate and investment banking business towards wealth and asset management opportunities and synergies, such as entrepreneurial banking and opportunistic acquisitions.

Deepening and defending the client franchise

Banks can upgrade their financial resource management infrastructure to facilitate reprioritization of clients and focus on true partnerships. They can also increase the focus on new growth sectors, such as electric vehicles and biotechnology. They can advance employee know-how in areas such as climate to provide suitable advisory capabilities to their clients. Additionally, banks can develop and enforce better cross-selling discipline and pricing methodologies, such as subscription pricing.

Adapting their business models for balance sheet velocity

This involves moving from “originate to hold” to “originate to distribute”. Banks can also explore partnerships and white-labeling models where existing businesses are sub-scale or undifferentiated. Furthermore, they can explore opportunities to collaborate with real economy industries and build around disruptive, emerging infrastructure within the region, such as payment infrastructure.

Making the right moves to optimize costs

Exploring the use of technology, including generative artificial intelligence, in all operational areas can reduce human-related costs to support growth in new markets. Banks need to emphasize “change-the-bank” over “run-the-bank” technology costs, especially to overcome incompatible legacy systems. They can also design their organization and governance carefully amid regional expansion to avoid complexities and inefficiencies. Moreover, they can revamp their performance management frameworks and tighten systems for key performance indicators (KPIs) to improve productivity.