In the ever-evolving landscape of finance, artificial intelligence (AI) has emerged as a transformative force, reshaping the way financial institutions (FIs) operate, innovate, and compete on a global scale. As the adoption of AI becomes increasingly pervasive, cities worldwide are vying to establish themselves as eminent AI in finance hubs, so as to harness the full potential of this technological revolution.

In collaboration with the Monetary Authority of Singapore (MAS), we embarked on an extensive study which included in-depth interviews and surveys involving industry leaders and key players in the financial ecosystem. Central to this study was examining the challenges associated with two essential drivers — talent and investment, as well as exploring the potential strategies required for cities to establish themselves as leading AI in finance hubs. These insights are complemented by the outcomes of the Elevandi Insights Forum roundtable conducted as part of the Singapore FinTech Festival 2023.

Tapping on the limited but competitive global AI talent pool

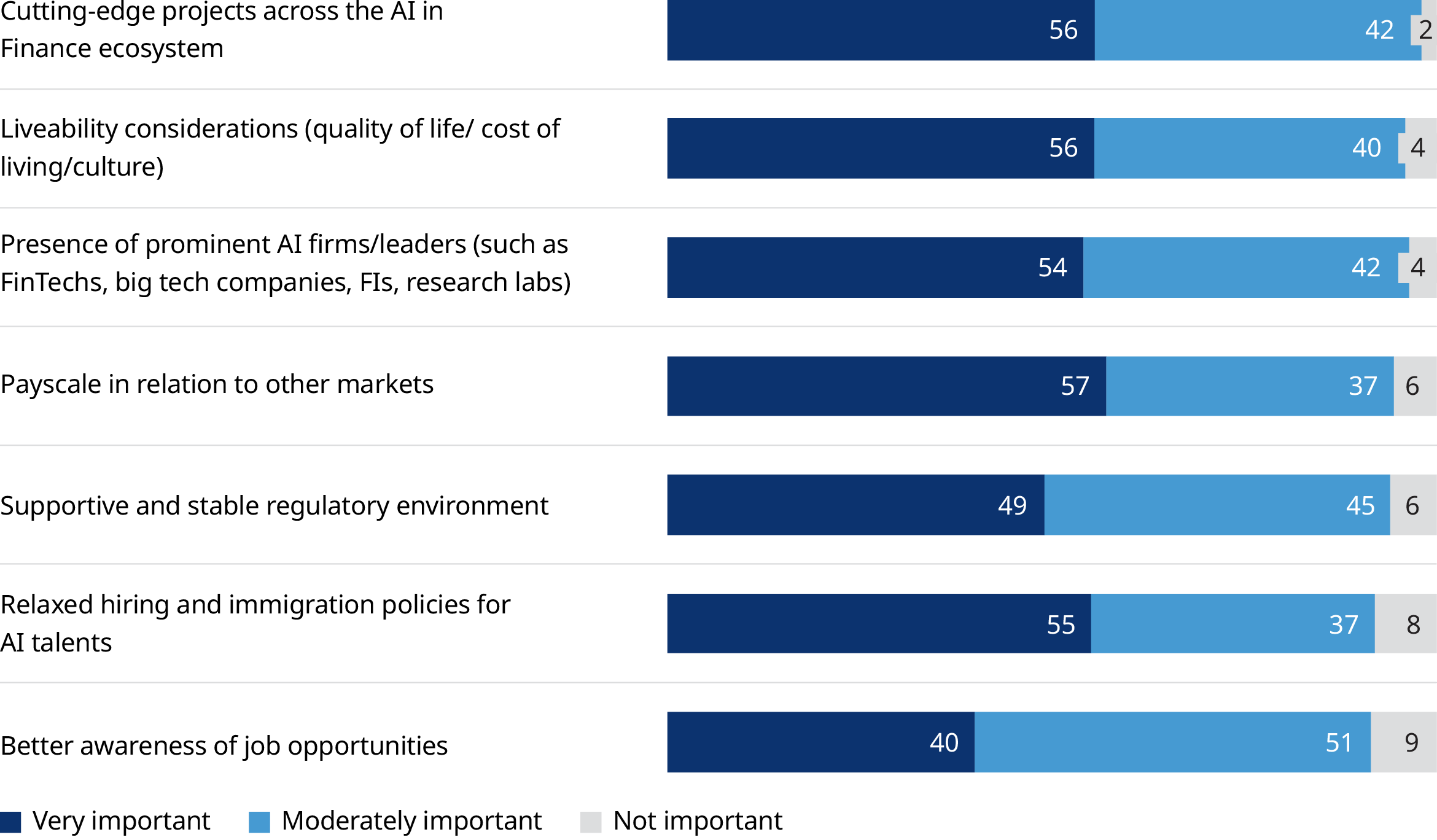

The rapid advancement of AI technology has precipitated a paradigm shift for organizations in terms of the roles and volume of AI talents required to excel in today’s environment. Our study reveals challenges in sourcing strong AI talents, particularly individuals with five to 10 years of industry experience. This scarcity extends across various AI-related positions, including principal data engineers, data analysts, lead AI scientists, and more. In the face of intense global competition for a limited talent pool, organizations must strategize on how to attract the right individuals with the requisite skillsets to fully harness AI.

Tackling challenges to foster global AI investments in the finance sector

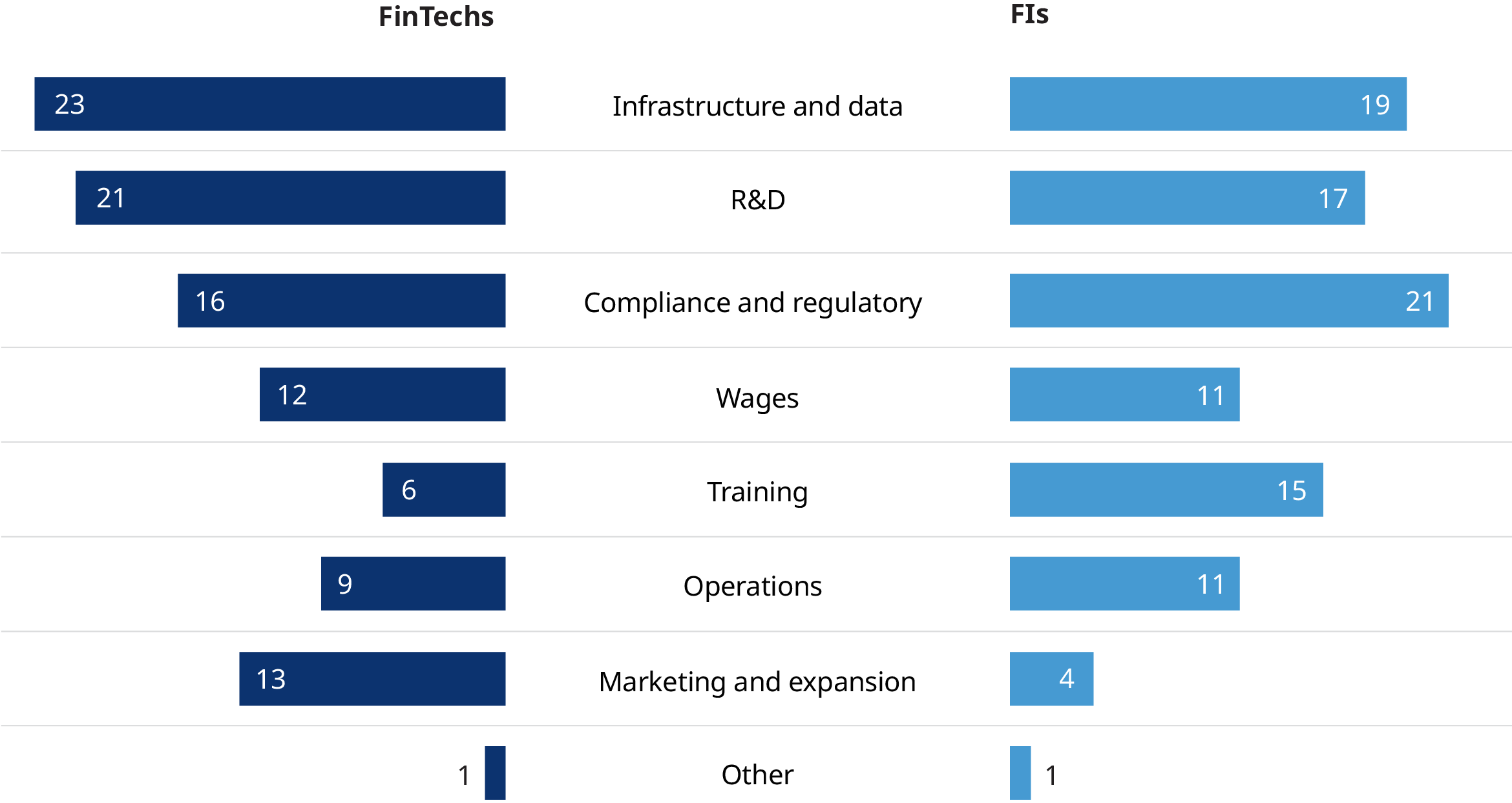

As many AI fintechs offer business-to-business solutions that depend on FIs as their main clients, close collaboration with these FIs is imperative for AI fintechs to achieve innovation and success. However, apprehensions related to regulations, security, compliance, and reliability create hesitancy and friction in FIs when collaborating with AI fintechs. It is vital to mitigate the following challenges: lack of understanding of use case, concerns regarding risk and regulatory compliance, and data scarcity for model training.

In addition, the size of the AI fintech pool plays a pivotal role in determining the overall quality of the AI fintechs operating within it. When the quality of local AI fintechs is subpar, larger numbers within the pool increases the probability of discovering high-quality ventures to some extent.

For smaller nations, overcoming the challenges associated with a limited pool of local AI fintechs is imperative. The solution lies in attracting them from overseas to bolster the local ecosystem, thus creating a more extensive and investable landscape. Many countries actively position themselves as prime destinations to lure successful global AI fintech firms. Some cultivate an environment that fosters growth, while others sweeten the deal with financial incentives to entice AI fintechs to establish a presence.

How regulators and ecosystem stakeholders can drive AI talent and investments

1. Enable robust collaboration and innovation

By fostering collaboration among diverse stakeholders within the financial sector, the complementary strengths of each ecosystem player can be leveraged to address complex challenges and collectively drive economic and societal impact through AI. In turn, the increased vibrancy of the ecosystem from greater opportunities for collaboration will attract top-tier talents and AI fintechs, leading to higher prospects of getting investable AI fintechs within the ecosystem.

2. Attract and nurture AI fintechs

Attracting and nurturing AI fintechs would require three key factors. Firstly, grants and financial support play a crucial role in the decision-making process for AI fintechs and FIs seeking to establish their presence in a new jurisdiction. However, to improve the effectiveness and efficacy of such grants, regulators should address any shortcomings on existing grants related to rigid assessment criteria and long disbursement periods.

Secondly, incubators and accelerators provide invaluable mentorship, exposure to potential investors, strategic partnerships, and a conducive growth environment for emerging companies to flourish. Encouraging and supporting such initiatives will strengthen the allure of global entrepreneurs and technology talents, fostering an environment conducive to rapid ideation, the execution of POCs, and expansion opportunities into adjacent markets.

Thirdly, boosting the confidence of FIs in AI fintech solutions is important in fostering deeper levels of collaboration. One viable approach to tackle this challenge involves implementing a comprehensive, government-endorsed accreditation framework tailored specifically for AI fintechs. This accreditation should align seamlessly with globally recognized standards, ensuring that accredited AI Fintechs not only gain credibility within domestic markets for collaboration with local FIs, but also possess the credibility to expand into international markets.

3. Enhance AI talent quality and accessibility

The shortage of experienced AI professionals necessitates the implementation of structured programs designed to expedite the growth of AI practitioners with expertise relevant to the financial industry. Concurrently, FIs should equip their senior leadership with comprehensive AI knowledge and actively offer specialized courses to acquaint them with the potential of advanced technologies, including an understanding of their capabilities and limitations.

Additionally, establishing a globally interconnected network of AI expertise and knowledge is crucial for smaller countries to compete with larger AI hubs in terms of local talents and firms. Our research underscores the importance of forging robust research partnerships that bridge academic institutions, industry players, and AI firms.

The imperative of attracting talent and investment to establish a city as a global AI in Finance hub is unmistakable. Across the globe, key industry leaders recognize similar challenges, and exhibit a keen interest in bolstering efforts aimed at fortifying AI in Finance ecosystems. This marks a promising beginning because what lies ahead demands the collective commitment of all ecosystem participants, spanning both emerging and established AI in finance hubs. Together, AI in finance ecosystem players must forge a unified vision to elevate the vibrancy of the AI ecosystem and collaboratively pave the path forward.