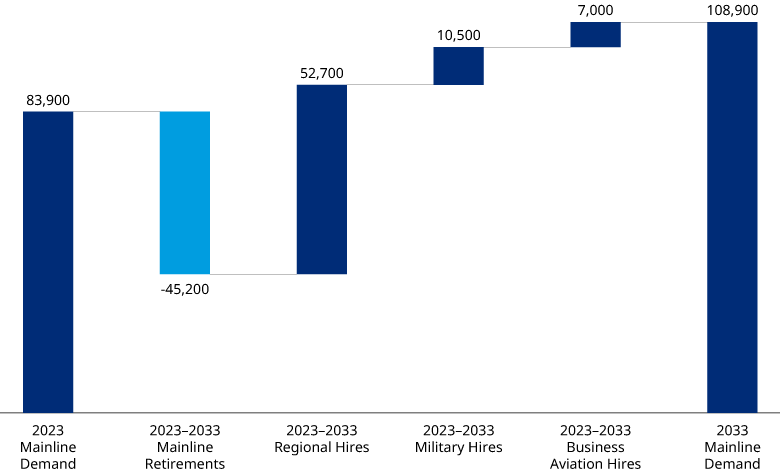

The outlook for the North American pilot shortage looks better than it did a year ago, thanks to both a healthier supply of pilots and constrained demand. Oliver Wyman’s latest figures now project the gap between pilot supply and demand in 2032 to shrink to around 13,300 from just short of 17,300 — 23% smaller than last year’s projection. Both the shortage and the narrowing of the gap have been largely determined by the market in the United States, where the problem has been most acute.

Driving the larger supply: new pilot contracts that pushed pilot compensation to record levels at both major and regional airlines, substantially more airline transport pilot (ATP) certificates and licenses being issued, and improved career security and advancement for pilots. For instance, captains’ pay at US mainline carriers has increased 46% since 2020, while those flying for US regional airlines saw their wages rise 86%.

In fact, post-pandemic ATP license issuances have been robust across North America. In the United States, a higher-than-normal percentage of ATP certificate recipients have also been pursuing scheduled commercial airline work. Maintaining robust certification numbers will be critical if the gap is to continue to narrow.

Regional airline challenges

The improved supply-demand outlook is also the result of artificially constrained demand. In the wake of the COVID-19 pandemic, airlines reduced or eliminated many regional flights and routes in response to the lack of pilots and the evolving economics of flying smaller aircraft, given higher fuel and labor costs.

US regional traffic, using block hours, is still only about two-thirds of what it was before COVID, and regional flights using aircraft with 50 seats or fewer are at only about one-third of pre-COVID levels. In contrast, narrowbodies with 100 seats or more are hitting close to 95% of their pre-pandemic traffic levels.

The decline in the number of regional pilots is directly tied to recruitment practices of larger airlines that hire heavily from regional airlines. If regional flying were to return to pre-pandemic levels, based on block hours, an additional 6,000 pilots would be required to meet demand — once again enlarging the gap.

Canada versus the United States

While the pilot shortage has caused delays and disrupted schedules in the US, the tight supply has proved to be less dire in Canada. Based on current figures, we expect to see a mild pilot shortage this year, with pilot supply and demand converging in 2024. This could result in a surplus through the early 2030s.

Part of this trend is driven by strong issuance of Canadian air transport pilot certificates. In 2022, ATP license issuance rose 65% over the prior year, according to data from Transport Canada. Another factor bolstering supply is the absence of the US rule that requires pilots to earn a minimum of 1,500 flight hours before being allowed to work for an airline. While some airlines in Canada require an ATP or higher flying experience levels, others do not. That reduces the time and cost of becoming a commercial pilot in Canada.

What might change the outlook for the Canadian pilot supply is the widening gap between US and Canadian pilot salaries. Recently ratified and generous pilot contracts in the US may lead to more Canadian pilots being lured across the border to work for US airlines.

This may be a trend we’ll see globally as pilots seek out better compensation. We expect to see more pilots from one region flying in another, similar to what the industry experienced a decade ago when high-paying Middle Eastern airlines were able to recruit globally.