The Reserve Bank of Australia’s (RBA) current cycle of interest rate tightening is designed to cool consumer confidence, reduce pressure on prices, and lower inflation. For this to be effective, retail activity needs to fall, and while ABS data shows some early evidence that retail activity has slowed since October 2022 (for example, retail sales fell by 4% in December), there is no real consensus around how soon sufficient adjustment can be achieved. Unfortunately, consumers must experience stress to trigger the required behavioral change in retail spending.

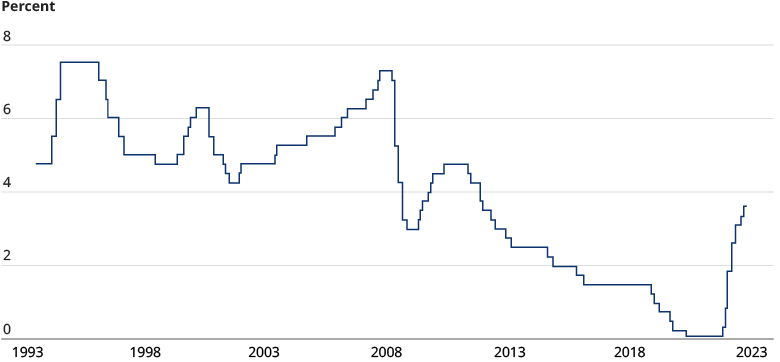

The RBA’s primary tool for achieving this objective is the cash rate target, now forecast to peak near to 4% — up from its historic low of 0.1% which persisted from December 2020 to April 2022. The pause in increases announced by the RBA in April 2023 will slow but may not stop the journey towards this peak. Correspondingly, home loan interest rates are expected to peak around 7% in 2024. Crucially, for a meaningful cohort of mortgage customers, this circa 4% increase in the cash rate target is greater than the 3% stress loading used to test affordability (those that borrowed prior to October 2021 were subject only to a 250 bps stress). These customers will face potentially unaffordable repayments and will bear the brunt of pressure required to bring down economic activity and ease inflation.

Whilst banks’ strong levels of capital, healthy loan-to-value ratios (LVRs), and lenders mortgage insurance (LMI) coverage will largely protect the banks from material credit losses, this is not the only factor that impacts how banks will emerge from this crisis. They will be judged on how they support customers during this period: customers and society may (rightly or wrongly) blame banks for financial stress incurred. Post crisis, examples of customers struggling to repay debt could drown out the many stories of those for whom banks will have worked hard to provide protection.

Three actions banks should take to protect consumers and chart a positive course through current uncertainty

- Prioritizing reputation over near-term profit: bring reputation even more actively into strategic decision making by executives, actively balancing near-term pressure on solvency and profit with longer-term reputation and associated market share

- Educating customers about financial wellness: take a stand on financial wellbeing, informing customers and providing tools to help them economize

- Smart scaling of collections and hardship teams: plan to be able to help customers experiencing hardship as volumes in distress increase. Build capability (especially data insights) to support team efficiencies to improve agility and team capacity required

Supporting customers now to lessen future financial pain

Substantial pain in the mortgage market is highly likely, and many borrowers will experience significant stretch for most of 2024-2025 if they are not already. Australian banks and mortgage lenders must act now to position themselves to support customers. This includes educating customers on financial wellness so that the chances of falling into a more extreme scenario is minimized, readying collections teams so that appropriate support and assessment can be provided depending on customers’ circumstances, and taking strategic decisions that take account of the longer term ramifications of actions now.

There is clearly an element of moral hazard associated with the support of customers who are behind with debt payments, and this cannot be ignored. Banks will need to tread a careful path which combines upfront education of customers to avoid overextension, and support of customers who really need help through no fault of their own, whilst taking stronger positions with customers who may have not taken their commitments as a borrower seriously.

Many questions need to be urgently addressed for lenders to best position themselves during these tough times for borrowers. Interventions may be required at different levels: by individual consumers, banks, and the industry overall. Prior crises provide a helpful guide to what interventions may or may not work.

This is a critical time for banking in Australia as well as for consumers. Banks will be judged by their response to this crisis, and their future reputation depends on it.

Download the PDF below to read our full report.