between Risk

Data, and Technology

Dear Reader

This is the 24th instalment of our State of Financial Services research, and as always, it presents us with an opportunity to take stock of the development of the industry as a whole.

Sound financial risk-intermediation — and the risk management that supports it — is crucial for industry and economic growth. We report today on an industry that is in reasonable shape — growing, more resilient, serving well as an economic shock absorber, providing the financial stability that is critical to fostering innovation, and mobilizing around climate change. And with a long period of cheap money and leverage building coming to an end, bigger tests of risk management may be coming.

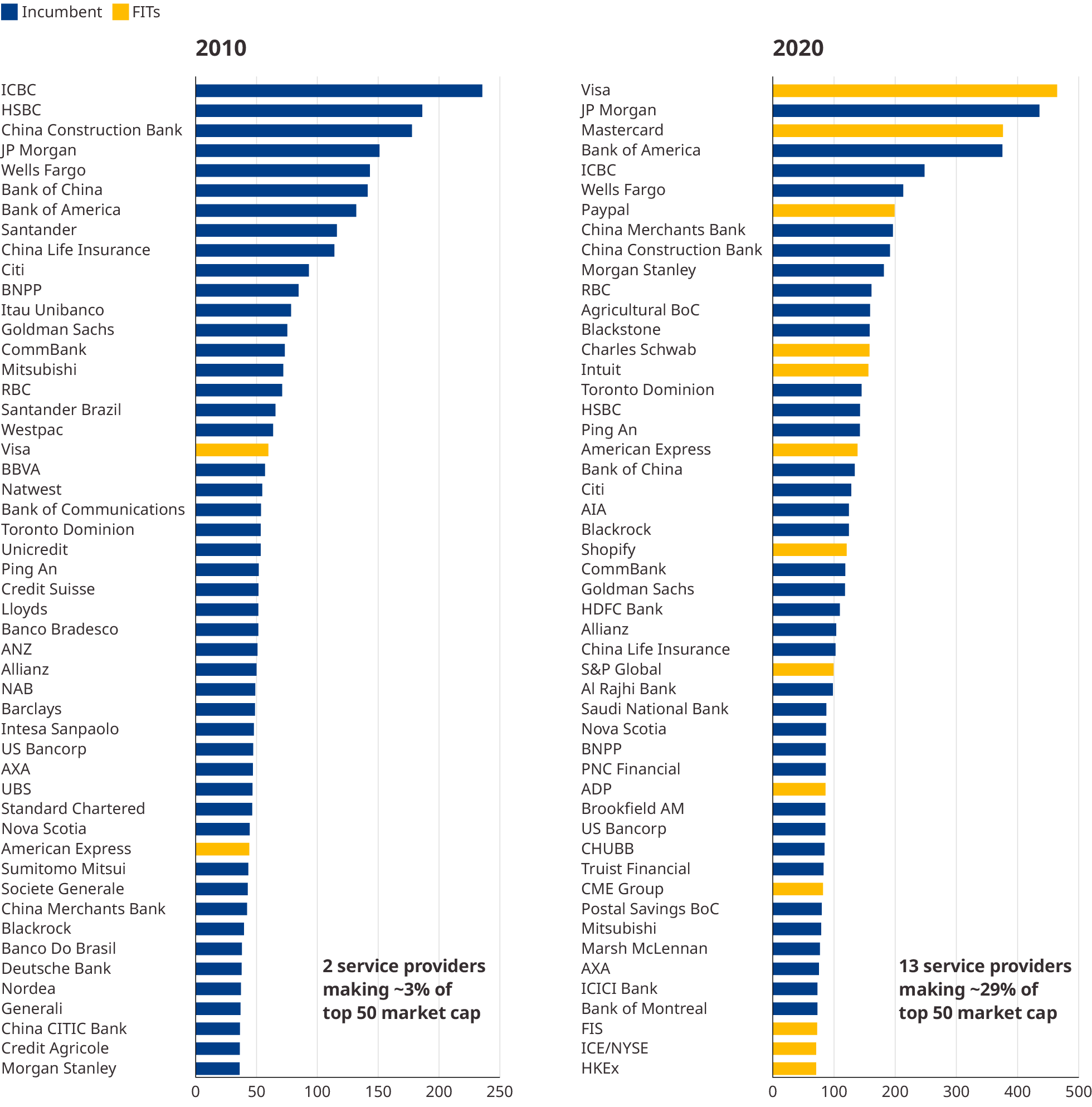

At the same time, we see a significant shift taking place as data and technology drive faster growth in new capital-light services, with a different set of winners to date. And this shows up in the structure of the industry — nearly a third of the top 50 financial institutions are now data and technology firms rather than regulated balance sheet firms, up from just two a decade ago.

With climate data, digital wallets, embedded finance, digital identity, digital assets, central bank digital currencies (CBDCs), and the Metaverse all taking root, the scope for growth in capital-light financial services is huge. We see many avenues of attractive growth for big tech, data, technology, and infrastructure firms in financial services.

The response from the incumbents in financial services — banks, insurers, and asset managers — will be fascinating to watch in the coming years. This challenge of how to manage mature, asset-intensive businesses while trying to grasp opportunities in high-growth technology and data services is prevalent in many industries such as autos, energy, healthcare, and telecoms — and in most the answer, increasingly, is a more decisive structural pivot of the organization to drive greater focus on the new areas.

How the landscape evolves next is far from certain. With rising interest rates, shifting customer trust, and market skepticism on tech valuations, the next 10 years could be very different from the last 10. The steps China has taken over the last year to rebalance its financial landscape show just how influential policy decisions can be. Watch this space.

We hope you enjoy the read.

Yours sincerely,

Ted Moynihan

Managing Partner, Oliver Wyman Financial Services

A period of stability and increasing resilience for financial services

The tagline in financial services over most of the past decade would be stability. Due in large part to steps taken in the years after the global financial crisis in 2008, the financial system has proved resilient, without the regular drumbeat of crises we experienced in the prior two decades.

As a result, the financial system is far better positioned now to play the economic shock absorption and policy transmission role for which it is at least partially underwritten by governments — as we have seen in the responses to COVID-19, in the war in Ukraine, and on climate. And when considering the big picture, the outlook is not bad, with rising interest rates in many parts of the world likely to expand net interest margins on balance sheet businesses.

This resilience is important; with economic concerns rising after a decade of very cheap money, the combination of leverage and possible stagflation is a worrying prospect and not one that many central bankers or leaders of financial institutions have had to manage through before.

Beneath the surface, dramatic shifts in value are taking place

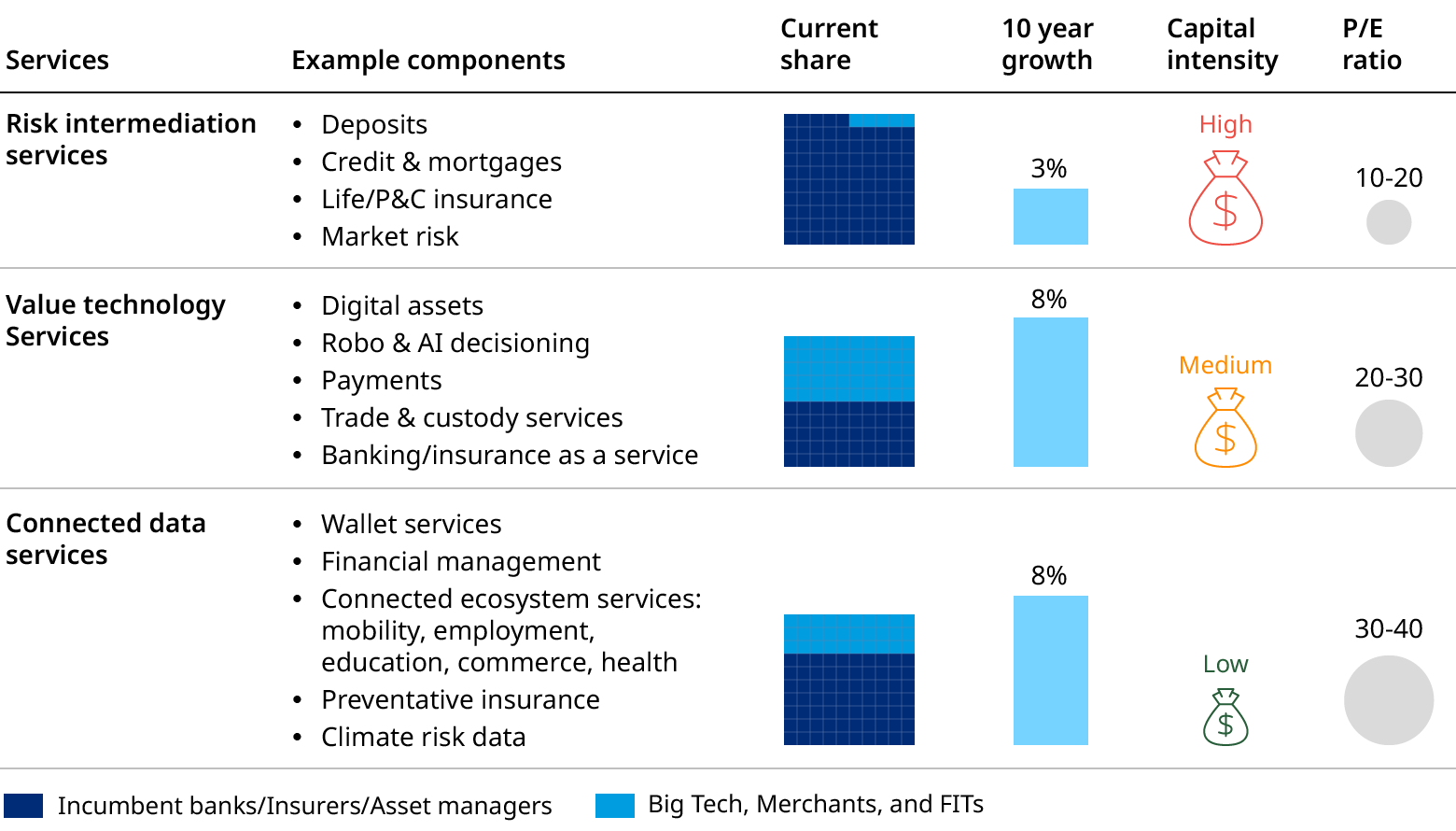

However, what this picture of increased stability and resilience obscures is that the financial services industry is undergoing a dramatic shift in value across the landscape. The driver of this value shift: the slowing growth of more capital-intensive risk intermediation services relative to the faster growth of more capital-light services linked to connected data and value technology services.

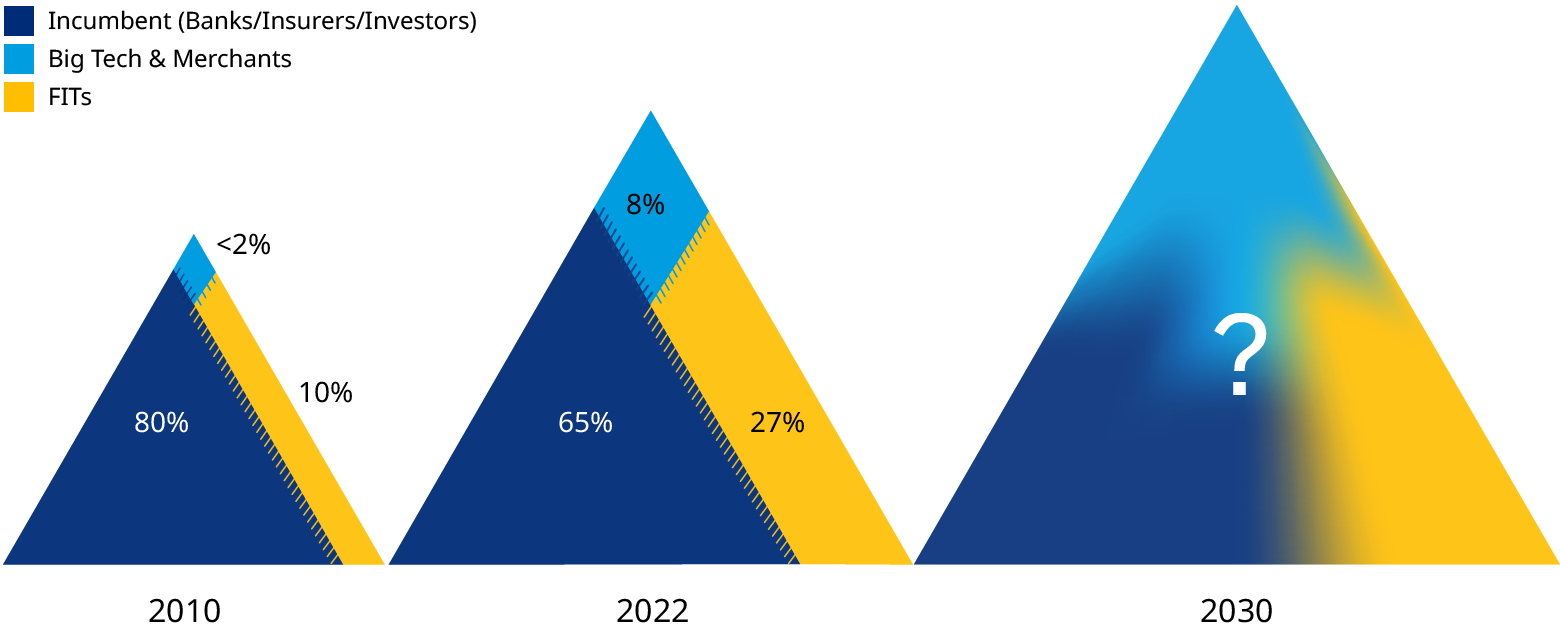

As a result, a new, wider financial services industry has emerged, in which incumbent players such as banks, insurance companies, and asset managers have shrunk as a proportion of the total from 90% of the industry value 10 years ago to about 65% of the industry value today. Big tech and other merchants active in financial services, as well as a wide group we refer to as FITs firms — financial infrastructure and technology companies — now account for 35% of the aggregate financial services industry value. The main driver of this shift has been slower growth of more capital-intensive risk intermediation services — which have grown globally at about 3% per year over the last decade, relative to the faster growth of more capital-light services linked to connected data services and value technology services which have been growing at about 10% per year. This shift shows up in winners and losers — nearly one third of the largest financial institutions are now FITs firms, up from only two a decade ago.

Another wave of change is building. Most incumbents are still struggling to find a decisive way to reorganize around the changing sources of value and growth in the industry. As big tech business models converge, their wallets and their moves into embedded finance, including in the Metaverse, will become more prominent. The extraordinary growth in “digital asset” native firms — in a two-year period they were collectively valued at a peak of $400 billion — is now undergoing a serious shakeout. However, valuable, defensible business models are emerging among the new players, anchored in compelling use cases for customers around efficiency and inclusion.

While the rapid expansion of the value and nature of financial services is set to continue, the shape of the future landscape is far from certain. As of today, we have yet to see a decisive pivot from many of the incumbents toward providing existing or new customers with new services. Yet rising interest rates and volatile share prices in technology markets could change the dynamics of the past few years. There will be consolidation in fintech, presenting opportunities for stronger firms, including incumbents, to roll-up. The nature of customer trust is changing. And as we have seen in China, big policy and regulatory shifts can materially change both the economics and the balance of power in the system.

What should happen next

Supervisors have much to think through over the coming years. This dramatic shift in value, and the potential misalignment of cost and risk management with value, could pose risks. Supervisors are all too aware that actually disintermediating the incumbent industry would result in a dangerous loss of supervisory oversight of the traditional risks in the system; future regulation of crypto and stablecoins, and the future design of CBDCs are likely to be settled to prevent this. Building trust in the financial system is paramount, but at the same time there is limited appetite from supervisors to shore up incumbent businesses that are not able to adjust to the value shifts.

The large incumbent banks, insurance companies, and asset managers have spent nearly a decade digitally transforming their business activities and improving their customer experience. While they have largely protected their existing customer base and risk intermediation franchise, there has not been enough success in capturing the new, growing sources of value. It is very difficult to simultaneously manage a mature, asset-intensive business with a high-growth, asset-light set of businesses, as many industries are finding. It can require a decisive pivot of management and investment focus toward new value sources, including different organization structures, different investment mechanisms, and even different capital structures. The incumbents that thrive in the next decade will make a bigger pivot now — and if they can do so, the opportunities will be huge. Rising interest rates might provide an earnings boost that will allow headroom to invest more in new value growth.

The big tech players — which need new sources of revenue growth — have a huge opportunity arising from these trends. In a more decentralized financial services industry structure, they can address much of the new value potential in the industry without taking on the onerous capital and supervisory costs of risk intermediation. There is a queue of smaller incumbents looking to partner with them and happy to take their terms. Co-opetition with incumbents and FITs players alike and the rise of the Metaverse look most likely to benefit big tech. As big tech companies move more decisively into commerce across the board, embedded finance, digital identity, digital wallets, and digital currencies will sit at the center of their business models.

FITs players and private capital providers face a dilema. Some giant scale players have emerged in data and in payments, but as a whole the sector remains highly fragmented and susceptible to shocks or simply valuation cycles. Gaining strategic scale is going to be vital. However, as consolidation, already well-underway, gathers pace, the consolidators will have to avoid becoming unfocused financial technology conglomerates.

While publicly traded incumbents generally fetch 10 to 20 times earnings, publicly traded data providers and big tech firms and privately held fintech companies are investing consistently at 20 to 40 times earnings. Understandably, public equity investors in the incumbent industry largely see financial services as value stocks and want most capital returned through dividends or buybacks — and as a consequence most incumbents struggle with the investment needed to tap longer-term growth opportunities. We expect more structures that allow private capital to invest in the myriad opportunities facing incumbents.

A bit of fun — possible game changers

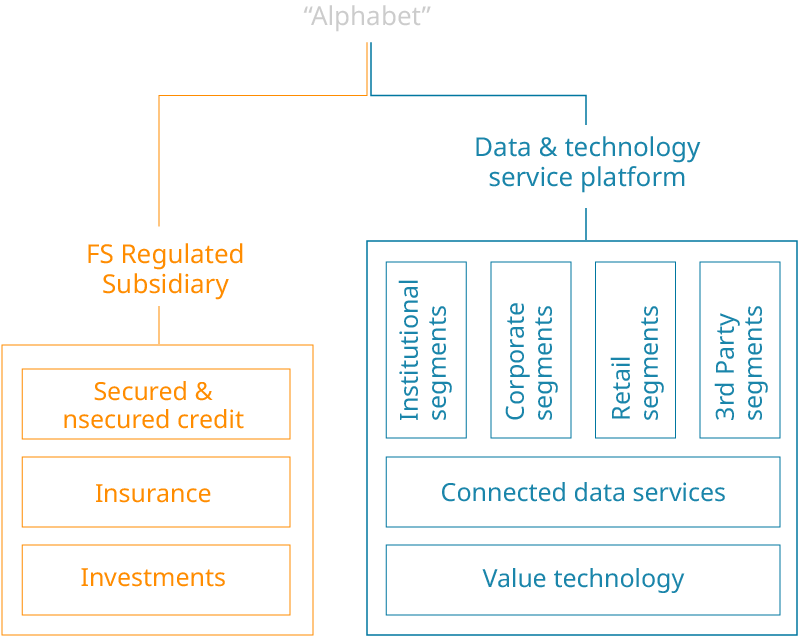

With so much change afoot in the industry, it is possible to conceive of strategic moves that could accelerate these value shifts. We tease out a few examples: a big tech company served by a utility bank that gathers a $1 trillion balance sheet; a big tech in strategic combination with one of the GSIB international network banks to build banking dominance in all of its non-domestic markets; the combination of a financial data provider and a cloud provider to build a climate data services world-beater; an Alphabet-like structure for a major bank or insurance company that allows private equity growth of its data and technology platforms; a combined cross-border logistics and financial transaction category killer anchored in distributed ledger.

The financial services industry is, at one level, a story of stability over the last decade

First and foremost, there hasn’t been a major financial crisis since 2008. This is a far cry from the experience of the previous 20 years, when a crisis of reasonable scale hit the financial system every four to five years.

This greater level of resilience has allowed the financial system to play the shock absorption and policy transmission roles for which it is at least partially underwritten by governments and societies in three major ways:

COVID-19 turned out to create far lower credit losses than planned for. The financial system played an important role of economic shock absorber, with excess capital able to absorb a high projected level of economic losses that did not come to pass, allowing financial services companies to write back up much of what they had written down.

In the war in Ukraine, the financial system has acted as the primary instrument of economic sanctions policies, shutting off Russia from most cross-border and international financial interaction with the West, and absorbing or managing actual losses in the financial system without any major signs of contagion risk so far.

On climate, financial services firms are playing a leading role, making ambitious net zero commitments and beginning to pour huge investment into helping corporate and retail customers to achieve their own net zero transition plans over the coming years.

Exhibit 1: Total financial services shareholder value

Based on market cap, USD TN, Jan 2000-Jan 2022

Source: Refinitiv Datastream, Oliver Wyman analysis

Incumbent financial institutions believe they have at least sufficiently caught up on digital transformation. Many have significantly increased the quality of services through mobile apps to close the gaps in customer service and retain their customers, and have digitized some internal processes to make operations more efficient.

The economics in the industry are improving: Profit levels are up in banking in many parts of the world, heavily challenged capital markets businesses have had a good couple of years, and strong asset values have generally continued to power wealth management and insurance. Looking ahead, rising interest rates will have beneficial effects on net interest margins.

By no means are we calling the end of financial crises. The build-up of leverage in the economy after a decade of cheap money is concerning, and as most banks look at the future scenarios, stagflation — low economic growth combined with underlying inflation — is a very challenging possibility for economies and could spark credit deterioration. Yet the evidence is that the financial system is in better shape than at any time in recent memory to manage and continue to support economic growth.

Yet where growth and value creation are taking place is anything but stable

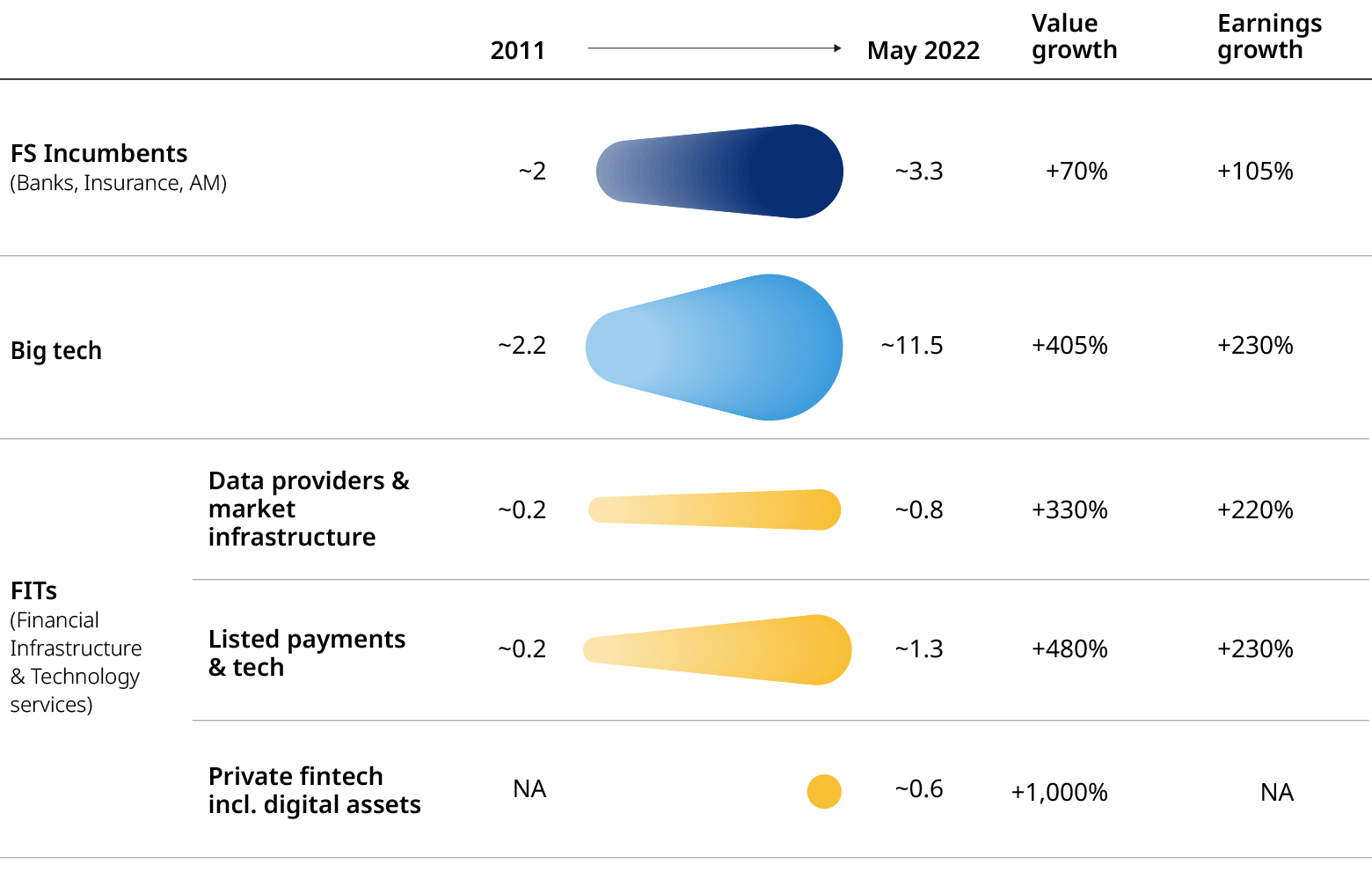

The shifts in valuation for participants in the industry point either to significant misallocation of capital or to a much more significant shift in underlying value taking place. Our analysis of value is conducted in late May 2022, already after the significant sell-off in some big tech and fintech stocks and valuations over the course of early 2022.

Exhibit 2: Financial services valuation change

Top 20 firms, 2011 vs. May 2022, US$ TN

Source: Refinitiv Datastream, Oliver Wyman analysis

The three categories of firms we think of today in Financial Services are:

While the top incumbent firms in the industry have delivered about $1.3 trillion in new value in the last 10 years, the listed FITs firms alone have delivered $1.7 trillion of value growth, added to which is the value created in private capital and in big tech and the merchants’ activities in financial services. In total we estimate even after the technology shakeout in 2022, the top firms outside the incumbents have delivered more than $3 trillion of new value in financial services.

IHS Markit and S&P Financial are both firms that grew from aggregating data from financial firms, financial markets, and financial transactions. They are service providers and supplies to the largest financial services firms in the world. In 2020, when S&P agreed to pay $44 billion for IHS MarkIT, a combined company was created that was worth $140 billion, more than most of the largest banks in the world. And the combined company has branched decisively into providing information services that affect asset valuation — such as climate related data — to corporates, effectively disintermediating the financial system to provide data and information services to the end customers of the financial system.

In November 2019 Nasdaq announced it was acquiring Verafin Analytics for $2.75 billion. Verafin is a leader in providing anti-financial-crime and compliance analytics services to financial services firms and to corporates. The move signalled two important themes. The first was an acceleration of the path of turning the group from an intermediary of financial transactions into a data and analytics powerhouse. The second was the widening of the set of services for both financial institutions and, importantly, for corporates.

Not many banks have the financial power or customer reach of JPMorgan. So when it acquired a strategic stake in Volkswagen’s auto payments platform, many took note. Of course, JPMorgan’s transaction bank can serve Volkswagen as a corporate client, but the power of the data that will come directly through the vehicle itself will also support a far wider set of opportunities in mobile payments — be that for fuel or electricity purchases or, eventually, for convenience purchasing in local stores, drive-through meal purchases, road haulage servicing, and so on.

Verisk arguably is the most important data provider to insurance companies and their tied agents in the United States. Verisk’s ISO product dates back to the 1970s and was originally designed as an industry utility for carriers to pool historical claims and ratings data. Most of the carriers sold their stake in the business in 2009 when Verisk went public. Since then the company has built on its unique data asset and added a suite of analytics, workflow, and third-party data re-selling services across key insurance lines and processes, and has grown to a market value of more than $25 billion, bigger than many large insurance companies.

While smaller in size, Unqork is a business model worth watching in insurance. Founded in 2017 in New York, Unqork has been revolutionizing the way large corporates tackle workflow development and analytics across insurance, healthcare, financial services, and government. The technology allows companies to quickly change business rules and reporting on their systems without additional development efforts. In insurance, Unqork poses an important alternative to traditional providers of distribution, core, and claims systems, and in a short space of time has accumulated 500 clients on its platform.

As a multitude of firms scramble around the growing market for banking as a service, it is notable that something akin to this has been growing quickly in asset management over the past decade. Blackrock’s Aladdin platform, which provides risk and portfolio management solutions to third-party asset managers, now manages more than $20 trillion of assets.

The top incumbents in financial services have grown in value by $1.3 trillion over the last decade, while we estimate that more than $3 trillion of value has been delivered by the top firms in financial services across FITs, big tech, and merchants.

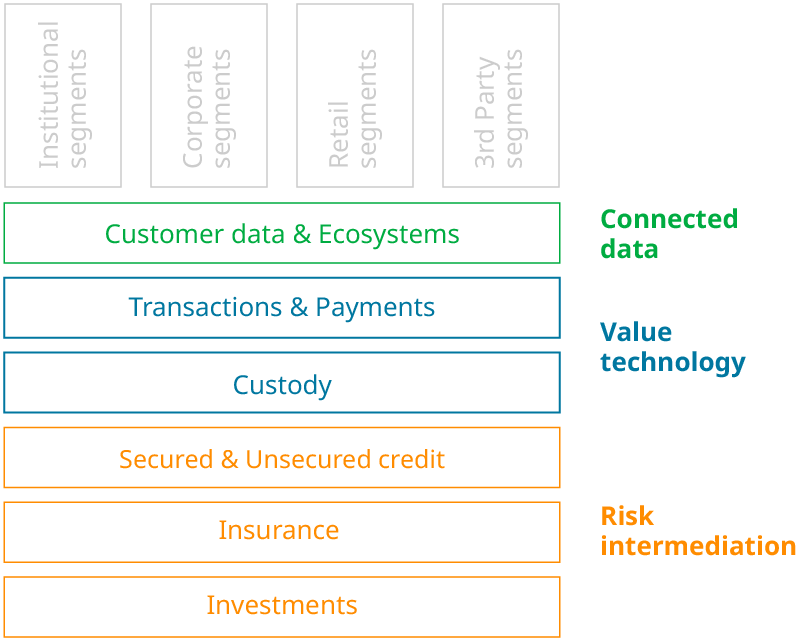

The underlying driver is the shift in value from lower growth/high-capital risk intermediation services to higher growth/lower-capital data and technology services

Capital is piling into financial services and has been earning rich rewards, but only in certain parts of the system and with certain types of firms, causing significant shifts in value. To better understand the value shifts, one must look further back in history to what was a golden age for financial services from the 1970s through the 1990s. Over this period the industry grew two to three times faster than GDP, as people and businesses bought more financial risk intermediation services. Governments sold off assets and borrowed and encouraged homeownership; industries like pensions, savings, mortgages, and insurance took root, first in developed and then in emerging economies; and consumers and businesses took on more financial leverage — all structural drivers of outsized growth in financial intermediation.

Exhibit 3: Top 50 global financial services focused (excludes big tech and merchants)

By market capitalization, US$ BN, Jan 2010-2020

Source: Refinitiv Datastream

Note: This is public companies only and does not include privately owned firms such as Ant Financial or Bloomberg

Financial institutions built extremely lucrative business models to serve these needs. Risk pools were created and value was extracted through risk management over time and via diversification. In fact, managing and holding pools of risk were so lucrative that ancillary services like custody of money and reporting through bank accounts were provided for free, and others, such as payments, were essentially positioned as a low-cost add-on or “part of the service.”

Exhibit 4: Growth of banking revenue and balance sheets

2010-2021 Compound annual growth rate (CAGR)

Source: Oxford Economics, S&P Capital IQ Pro

Over the last 15 years, we estimate, the customer penetration of new products and services anchored in creating and managing pools of diversifiable risk has slowed in most of the world, with the main exception being some emerging markets and parts of Asia. More dramatically, the cost of this balance sheet-intensive business in terms of capital and infrastructure costs, compliance costs, and regulatory costs has rocketed — largely in reaction to a series of crises, most notably the global financial crisis.

Just as the relative value and speed of growth momentum of risk intermediation services has waned, the value of technology and data services is rapidly increasing, in myriad ways. Some of these services involve the evolution of risk intermediation toward services that help customers better understand their own risk profile and reduce it. For example, instead of providing a general price on car insurance, companies can use far more accurate data to help customers reduce the chances of having a car crash and therefore the amount and cost of insurance required. Or a bank can use analysis of customers’ spending behavior to help them avoid credit charges or even default. In some instances banks, particularly in Asia, are starting to use social media data to improve underwriting and offer better terms to good credit customers.

Many of the potential new services are very different from traditional financial offerings. Instead of providing an account balance, for example, a bank can advise customers on whether they are overpaying for energy services, or whether their spending patterns will create a problem when it comes to their kids’ education costs in 10 years. Instead of just processing their payment, a payment provider can inform them where they might have accessed a cheaper product, or refer them to a physical location nearby where they can go to look at future alternatives. The list goes on.

Incumbent banks and insurance companies have been building these offerings for years now — just not at all quickly enough relative to the range of other new entrants taking market share in the most lucrative parts of the value chains.

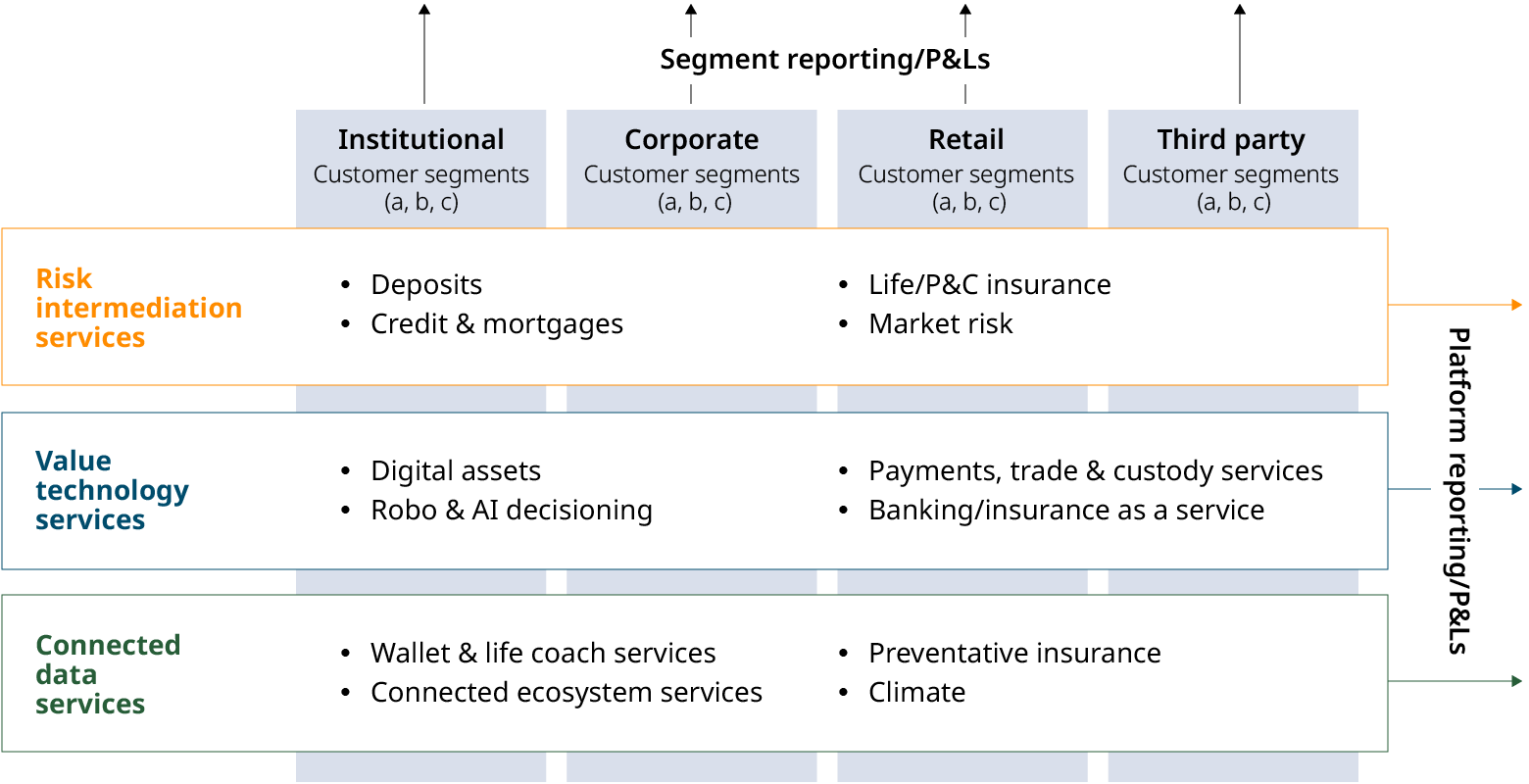

The new financial services industry emerging

So financial services is expanding and growing in all sorts of ways, attracting capital from many sources and garnering more and more involvement from big tech. There are opportunities galore, but the nature of these opportunities has changed. We break out the emerging industry into the following service segments:

Exhibit 5: A wider set of financial services now, with very different economic profile

Note: This picture excludes pure advisory services like M&A, and excludes software solutions for financial institutions

Source: Oliver Wyman analysis, Refinitiv eikon, S&P Capital IQ

It is important to note that we believe the expansion in the nature of financial services is based on new data and technology and evolving customer needs and expectations, and as such will continue. Likewise, the faster growth in new capital-light businesses driving greater potential for value-accretion to the winners in providing these services will continue. What is far less certain is precisely who will win in delivering these services.

Compelling customer service and customer trust — where value and valuation meet

Services take root only when customers find them compelling. The high growth in value technology and connected data-related services are driven by providers offering customers something they find valuable, that improves their business effectiveness or their lives, and that they are willing to pay for. In B2B financial markets the high growth in market data services is largely because the providers have integrated data into desktop and workflow in ways that make financial analysis, trading, and investing far more efficient. In B2C markets the extraordinary expansion in new payments accounts, as shown in Exhibit 6, is because providers are integrating payments into frictionless and mobile services at the point of purchase that provide real-time information back to customers through much more accessible apps.

Exhibit 6: Growth in traditional US bank accounts vs. payment provider accounts US$ MN

* Includes all US accounts and PayPal global accounts

Source: S&P Global, company filings, eMarketer, Oliver Wyman analysis

Customer trust is hard to value, but there is little doubt it is playing a core role in how the financial services industry is evolving, and where value and valuation emerge. Some of the shift we have seen over the past decade has roots in the global financial crisis, when the incumbent financial system took a significant trust hit. At this point in time, trust in big tech is under significant pressure, and volatility in instruments like digital assets is posing trust questions. These dynamics could prove central to how the landscape evolves in the coming years.

Exhibit 7: Revenue and revenue growth from leading listed FITs firms

Source: Datastream, Oliver Wyman analysis

Valuations will oscillate, particularly in unproven business models, and we have seen a lot of this already in 2022. But underlying customer value is being created in both connected data and value technology services, and where compelling services and customer trust combine, winners will emerge.

Change in services, change in landscape

As the value in technology and data related services has increased, this shift has resulted in many new competitors thriving. As we show in Exhibit 3, the list of the top 50 firms in financial services in 2010 included only two that were not incumbent banks, insurers, or asset managers. Today that is getting close to a third by number and market cap. This list also excludes big tech and other large merchants, such as Walmart and Walgreens, that are now extremely active in financial services.

Likewise, in 2010 the industry largely looked like a set of banks, insurers, and asset managers with a set of technology and service suppliers. Today this is a far more complex picture. Ecosystem co-opetition is the new landscape, where firms sit in each others’ value chains in simultaneous partnership and competition. It’s worth noting that this not just about the relationship of incumbents with big tech and with FITs firms. There are equally fascinating dynamics in the relationship between big tech and FITs; witness the much commented-on shifts in the relationship between Amazon and Visa in recent years.

The result is a very different financial services industry from just a decade ago. At that point our most relevant segmentation would have been between global banks, regional and local banks, insurance companies, and asset managers. But Exhibit 8 shows what is arguably a more telling segmentation today.

Exhibit 8: Reframing the financial services industry

Source: Datastream, CB Insights, Oliver Wyman analysis

The fascinating question is how this plays out over the next decade, and this is far from certain because it depends both on market conditions and on how policy and regulation evolve. We lay out four possible scenarios:

1. Continued expansion with incumbents becoming utilities

Continuing the path of the last decade, where more of the capital-light technology and data services get picked up by

FITs, big tech, and merchants — likely with consolidation of the fintech industry into a smaller number of bigger

winners, with the incumbent banks/insurers/asset managers significantly limited, utility like, to provision of

risk intermediation services.

2. Market-driven rebalancing

A shift in market conditions drives a rebalancing of the system, for example prolonged high interest rates,

combined with a severe market correction in technology valuations as we saw in the dot-com crash — all of

which would likely drive consolidation of incumbents with small-to medium-sized FITs firms and support

incumbents regaining ground in connected data and value technology services.

3. Policy-driven rebalancing

Policy and regulation are designed to put greater constraints on more of the firms growing quickly in

data and technology services, including in digital assets. China is certainly an important case study

in this regard, where the explosive growth in fintech and big tech in financial services has been

curtailed over the last two years, rebalancing the system, at least to some extent, back

toward the incumbents.

4. Trust-busting crisis

Dramatic loss of trust tends to come out of significant crises, and in the past most of these

have been financial crises, where leverage bubbles burst. However, as financial resilience has improved

and privacy concerns increase, the likelihood grows that cyber or privacy breaches could be the next big trust crisis,

with a lot of possible new weak points in the system now.

As things stand, most incumbents are not well positioned to reverse the shift in relative value in the industry

There has been an enormous amount of work over the last decade in banking, insurance, and asset management to digitally transform, and much progress made by the most ambitious. Yet much of this effort has been defensive — closing the gap in digital customer experience, digitizing processes to streamline operations, launching some new digital businesses, few of which have achieved scale.

The reaction of incumbent firms has therefore been more gradual so far, preserving what made them successful, layering on new capabilities via innovation while upgrading customer experience, and creating partnerships that move them in the direction of data and technology platforms. However, the evidence is overwhelming that this is not moving far enough or fast enough

To give four important examples:

Connected data and ecosystem services. You will find very few incumbent financial services firms that have an organized business unit around customer data and ecosystems; at most firms there are some form of data utilities and partnership management functions. Meanwhile, the extraction of value of many forms of data is being consolidated out of the incumbents into scale data providers that are themselves set up now as intermediary platforms connecting different contributors and users of data. This process gathered pace over two decades in banking but is happening today much faster in insurance markets.

Payments services. The power relationship between banks, merchants, and non-bank payment providers has shifted even as the importance of payments has increased, and most banks have been aghast at the scale and speed of loss of value share and lack of market recognition of the value of the payments businesses they have. Yet you will find very few incumbent financial services firms that have really consolidated their payments assets together into a customer service platform that is visible to the outside world. They are still often embedded in other businesses, set up as a horizontal non-P&L utility, or positioned as a product. This has helped open the door for entirely new firms such as Ant Financial, Paypal, Square, and others to create much of the new value in payments.

Third party value technology services. Large incumbents have been undergoing a massive program of technology investment, including modularizing through APIs and moving to the cloud — creating huge opportunities for value creation as those suppliers build economies of scale that individual financial firms could not have. Yet many incumbents are starting to realize they are building, through this process, extremely valuable technology capable of delivering services well beyond their own distribution channels. Banking-as-a-service and insurance-as-a-service are taking off, but it is far from clear whether any incumbents will win in this or if the winners will be digital-native or technology firms that are far more focused on it.

Climate financial disclosures. Climate change is the biggest physical and economic shift in generations. The economic profile of every activity and asset has to be recalculated and transitioned, impacting the value of all debt and equity and every other financial instrument. The Taskforce on Climate-related Financial Disclosures (TCFD) has firmly put the onus on firms to make financial disclosures of their greenhouse gas emissions concurrently with other financial disclosures, and the Securities and Exchange Commission has now mandated firms follow the TCFD requirements by end of 2023. Armies of data firms, market infrastructure firms, and technology firms are lining up to facilitate this process, with the expectation that this will generate new markets for information as big again as today’s financial markets. And yet almost no incumbent financial institution is organized effectively to compete in this market, despite the many starting advantages of both banks and insurance companies.

Exhibit 9: Listed financial services by sub-sector

Companies with market cap >$25 BN

In the face of such change in value, why hasn’t there been a more decisive response from incumbents that have all the advantages of customers, trust, regulatory experience, and decades of risk management and technology management experience?

There remains some denial in parts of the industry, but for many it is accepted that this is a major shift that could be existential to tackle, they feel constrained by complexity and regulation, and they hope rising interest rates floating up the balance sheet and risk intermediation businesses will offer a reprieve.

Above all, they are understandably concerned about the disruption risks involved with making any changes that are significant enough to really pivot to new value. Why? The simple answer is that it’s incredibly hard to do, for a number of reasons. Redesigning complex organizations is fraught with risks. The industry is built around risk management for important reasons — there are large and highly leveraged risks — and beyond the institutions themselves, supervisors want to be sure that a primary focus of the organization is on managing those risks. Equity analysts understand the economics of these institutions as they are currently organized, which is largely around product, and will rarely congratulate firms for shifting to a less well understood organization or reporting structure.

Incumbents have tremendous advantages, but as things stand today they bear a significant risk of being recast as highly regulated risk management utilities, delivering relatively stable if low earnings with an equity story firmly anchored in cash-out. Repositioning themselves requires more significant steps than are currently on the table. Before we explore that, significant further change is coming that is likely to amplify these value opportunities and value shifts and therefore set the stage for the moves different actors should be planning to make.

There is a shrinking window of time for incumbents to change the future from “I am the utility” to “I have the utility”

Even technology has its incumbents. In 2014 Microsoft was becoming seen as an old world technology and software company. Its market value was languishing, it had overtaken in value terms by Apple, and was in danger of being left behind by Amazon, Google, Facebook, and others.

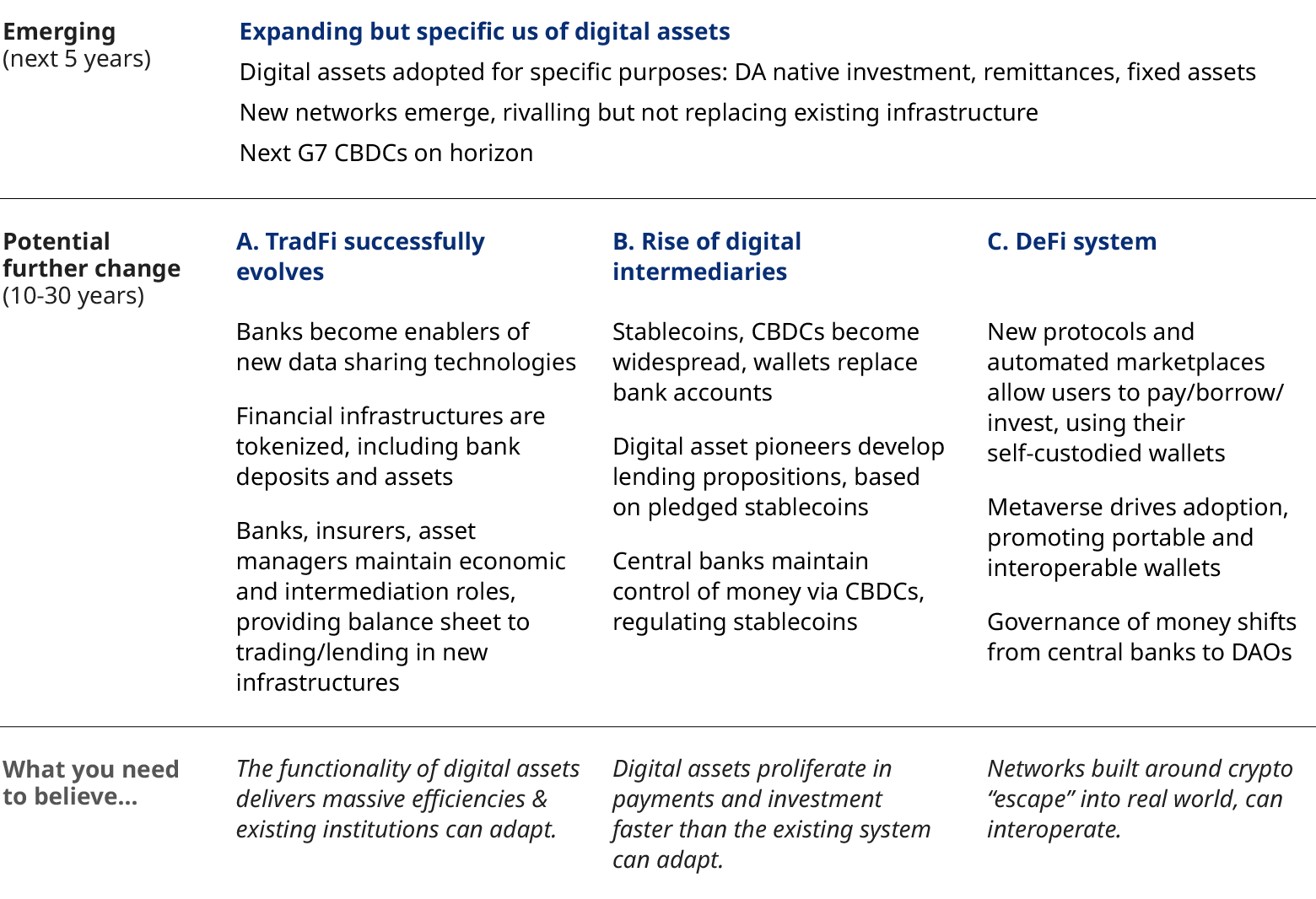

Digital assets, centralized finance firms for digital assets, decentralized finance (DeFi), and decentralized autonomous organizations (DAOs) are likely to amplify and accelerate the value shifts, but it is important to separate the signal from the noise

Behind all the hype and accompanying criticism, a new financial system is being developed from the ground up. Digital asset developers are creating new types of money, crypto-assets, new means of exchanging value, new networks, and new types of institutions. Digital assets, financial services of such assets, DeFi and DAOs are likely to drive profound changes to the structure of financial services, and on the current path will amplify the shift in value from risk intermediation toward connected data and value technology.

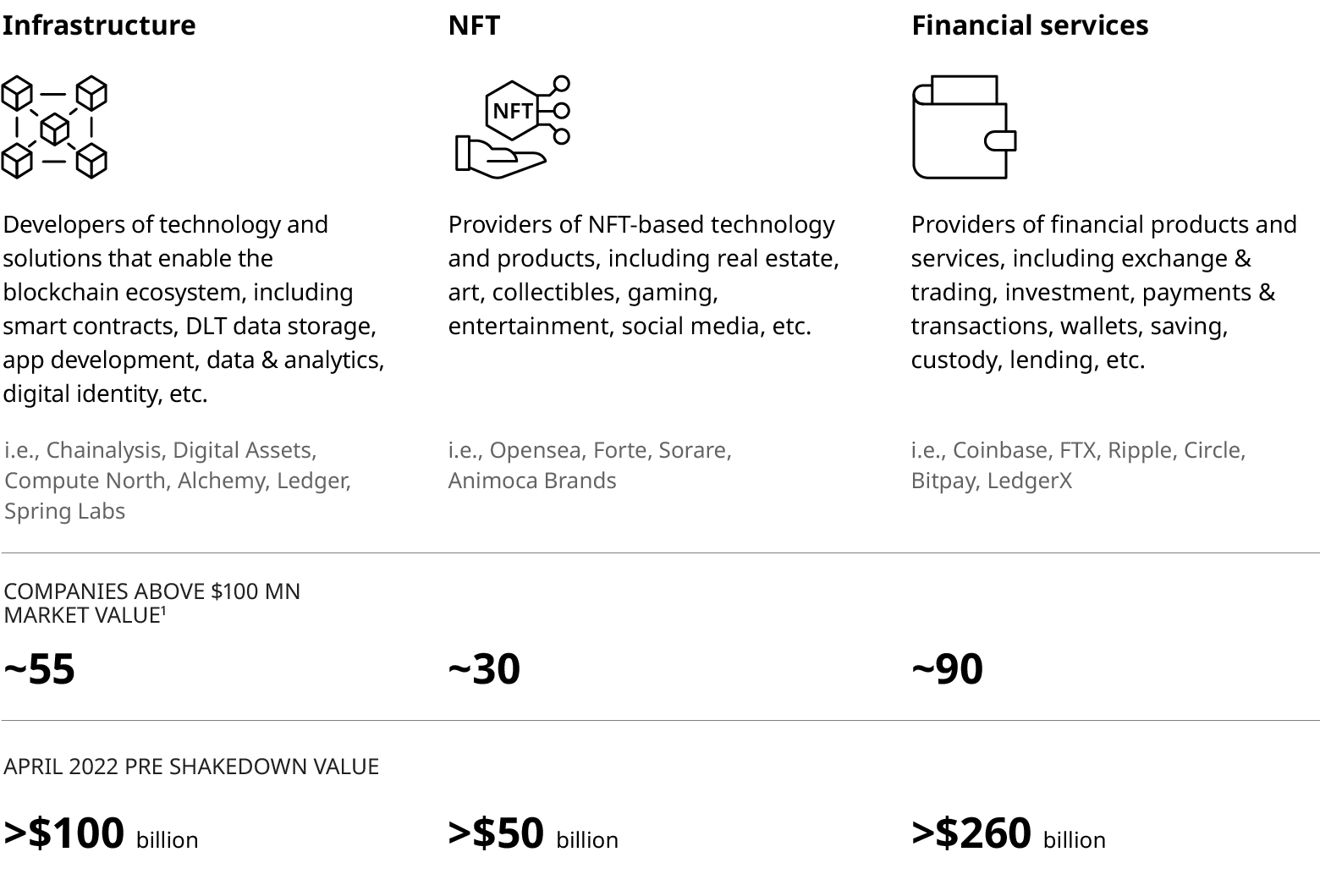

The primary use case so far for this technology has been the creation of cryptocurrencies and their use for speculative investment and store of value in the long run. In a period of just a few years, digital asset native companies have emerged to provide financial services for this market, reaching nearly $400 billion in market value in the first quarter of 2022 before some big falls. These firms range from exchanges to lenders to intermediaries to investors to firms providing wallet services to insurance, or even staking services. One segmentation we show in Exhibit 10 is between infrastructure solutions, tokens/nonfungible tokens (NFTs), and asset management and intermediation services.

Separating the signal from the noise is hard in this fast-moving part of the industry. At a minimum, we expect the underlying value-add of infrastructures such as distributed ledger technology and smart contracts will be exploited at scale, given the efficiencies on offer. Cheaper, faster, and smarter services will be developed to support asset issuance, asset holdings, transaction clearing, international transactions, and movement of money. These potential efficiencies are driving the likely launch of CBDCs across the world, with most governments deep into launching, planning, or contingency planning.

Exhibit 10: Segmentation of digital asset native start-ups

1. Estimation based on publicly announced valuation information

Source: Oliver Wyman analysis, Pitchbook, S&P Capital

The value from digital assets, DeFi, and DAOs is up for grabs. With the primary use case to-date being crypto speculation, banks so far have been unable or unwilling to drive this market. In the background, though, many banks have been investing, building out a parallel digital asset operating model, experimenting with use cases across markets and transaction banking, and are starting to offer customers services. Similarly, traditional financial infrastructures have been developing offerings for digital assets. Tokenization is a potential gamechanger in assets that were previously illiquid, allowing rapid issuance, data standardization, and fractionalization. Major projects are also underway to adopt DLTs in mainstream financial infrastructure.

The emergence of digital assets, financial service providers for such digital assets, DeFi, and DAOs are likely to accelerate the value shifts in the industry

With the banks absent from crypto, the field has been clear for new intermediaries to emerge. These companies are highly profitable and have built huge retail customer bases, particularly in emerging markets. They are now coming under high levels of regulatory scrutiny and being required to adopt the same KYC/AML (know your customer/anti-money-laundering), risk management, and compliance rules as incumbent parts of the financial system. Nonetheless, if wallets over time replace the current account with interoperable, highly trusted stablecoins or CBDCs, then they are well-placed to emerge as key intermediaries.

That is not the vision of many of the pioneers of digital assets, who envisaged a truly user-centric, decentralized financial system with self-custodial wallets. DeFi lending and DAOs are at the cutting edge of this kind of innovation. Their path to breaking out from experiment to mainstream use would most likely be via integration into other networks and require easier access and use.

Exhibit 11: Future digital assets and conceptual decentralization paradigms

Source: Oliver Wyman analysis

The companies that are able to generate value from digital assets will in large part be driven by policy, including regulation of the crypto ecosystem, the design of CBDCs, and the extent to which policy decisions avoid or encourage partial disintermediation of banks and insurance companies. For instance, in the Bank of England’s assessment of CBDCs, one scenario sees 10% to 20% leakage of deposits from commercial banks. Unintended consequences could be significant and tools to control the use of CDBCs may be weaker than thought.

Today there is limited specific regulation of digital assets, but this is poised to change, with new regulatory frameworks in the pipeline in major financial centers. We anticipate ultimately that for supervisors to have the best shot of maintaining systemic stability, policy will create some advantage to incumbents conferred in exchange for very high capitalization and liquidity.

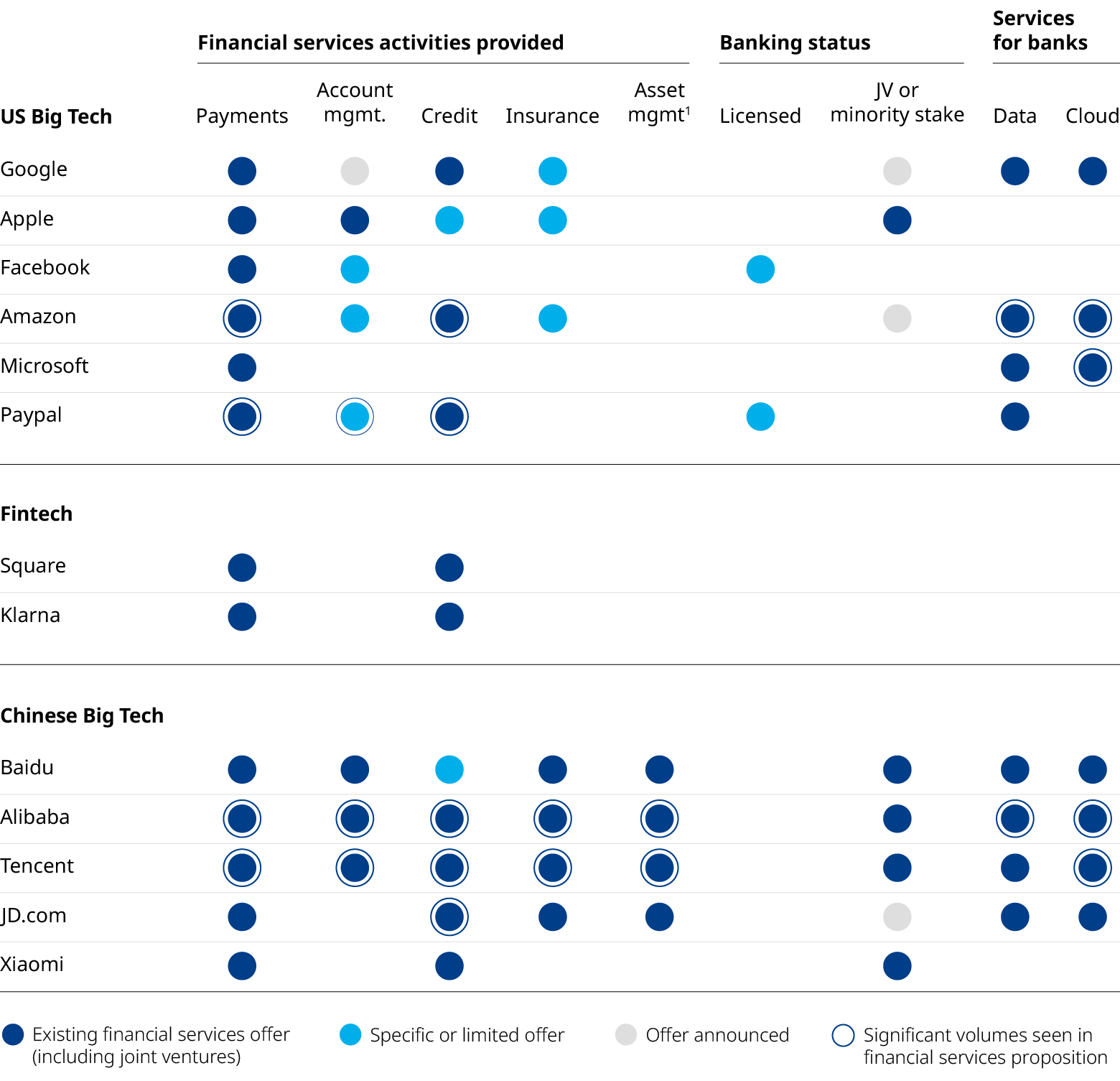

Big tech competition in financial services is going to accelerate with the launch of powerful wallets and the growth of embedded finance

The convulsions in tech stock valuations this year have further reinforced the need for big tech to find new valuable earnings pools to disrupt and access, as the advertising business matures.

In our recent report Big Banks, Bigger Techs, we analyzed in some detail how quickly big tech companies are integrating financial services into their end-to-end customer experiences. What started out as a focus on payments has shifted into various forms of both retail and wholesale credit tied to commerce, secured and unsecured.

Exhibit 12: Emerging presence of big tech in financial services

1. Includes fund distribution businesses

Sources: Company websites, press and research articles, Oliver Wyman analysis

Big tech companies are customer platforms organized entirely around connected customer data and value technology. In some cases (such as Facebook and Google) the end purpose was originally to monetize customer attention and data to sell advertising. In other cases (Ebay, Amazon) the end purpose was commerce. These business models are converging as evidenced by firms like Facebook/Meta shifting more decisively into commerce in general. In China this convergence has already happened, as firms like Alibaba and Baidu run social media, social networks, search, and commerce products and transactions off their customer data platforms.

What jumps out from most of these moves is how little interest big tech companies are showing in the core risk intermediation value pools in financial services. There is little evidence of a desire to manage balance sheets or conduct tenure transformation. The focus is on further embedding a company at the center of the lives of the customer, and bringing commerce, advertising, and other services to the customer through greater accumulation of connected data and delivery of valuable technology.

However, as the business models in big tech are converging, we anticipate that a far greater penetration into financial services will be one of the consequences. We outline three of the big shifts in this convergence:

Moves into commerce with wallets at the core. Meta/Facebook has been vocal about the importance of its launch of the Novi wallet to support its move into commerce, allowing it to facilitate commercial transactions of individual and ultimately corporate customers through tying together analysis of needs, marketing of options, transaction logistics, payments, credit of one form or another, cashflow management, and settlement. It’s likely that other big techs will follow suit, and it’s not hard to imagine that once all big tech firms offer customers a wallet and have access to a deeper understanding of spending and earning trends that a move into wider lifetime financial management for individuals and transaction services and treasury management for companies will follow.

Connected data ecosystems with embedded finance. Big tech companies are moving heavily into the internet of things and are looking to own connected data ecosystems that will increasingly need to have embedded finance built from the ground up, be that mobility data solutions built around cars, wearables for health management, management of climate footprint and energy costs through active energy usage tracking, and many other examples.

The race to build the Metaverse. Most big tech firms are betting the Metaverse is the next big thing, and value from the Metaverse will be based on what people actually do there, rather than bringing people there to advertise to them. So the route to monetizing all the investment in virtual technology and the Metaverse is much more likely to have embedded financial services built ground up from the start. You don’t need to be a Metaverse-missionary to see the huge potential here. For example there are an estimated 2.9 billion active gamers in the world, and most of this population are already engaging with the Metaverse. Whoever has brought them there or controls their surroundings has their attention, and with the blink of an eye, literally, those users will be able to buy products and services via seamlessly embedded financial services.

There are 2.9 billion active gamers in the world, who are arriving first into the metaverse. Once there, with the blink of an eye — literally — they are paying whoever controls the environment around them for goods and services

In short, as digital advertising becomes a more saturated business, big tech companies are looking for new value pools to go after, and as more people spend more hours in the Metaverse and as a consequence require innovative mechanisms for value exchange, there are tremendous opportunities for tech players to extend into financial services. While there clearly is going to be more regulation of big tech in the future, we believe big tech still has the scope to use partnerships and embedded finance to take or create significant additional value in financial services without the full weight of onerous capital and regulation incurred by the large incumbents.

These changes underway and coming soon are likely to have profound implications for all the actors in the financial system:

What public sector actors should do

It is hard to recall a point in time when there was greater change underway in the provision of financial services and the structure of the industry. Governments, financial system supervisors, and regulators are concerned with protecting customers and ensuring financial stability, and in some cases with the competitiveness of their financial systems. The choices public sector leaders make on key looming issues in the next five years will have far reaching consequences for the structure of the financial system we will have, its stability, and where and by whom value is created.

With policy and regulation, the devil is in the details. And progress is already moving, and will continue to move, at different paces in different jurisdictions.

Nevertheless, we outline below the shortlist of critically important issues on which the public sector needs to take a stance in the next couple of years that will have far reaching consequences.

We note that China is a fascinating case study in financial system evolution. Highly supportive of the growth of big tech over most of the last decade, China became a case study for the integration of big tech and financial services. And while that willingness to push experimentation has continued with China’s launch of its retail CBDC, the policy pendulum has swung materially in the direction of regulation of the technology sector and policies that put more protection around the incumbent banking and insurance sectors in particular.

What should incumbents do?

This does not have to continue to be a story of relative value loss for incumbents. The industry is growing and expanding in many ways, and incumbent banks, insurers, and investors have tremendous advantages. None of the opportunities outlined in this report will be new to most incumbents; however, the evidence of the last decade is that the response has not been decisive enough.

The core risk intermediation services of incumbents will likely also prove more lucrative in the coming years as interest rates rise, and this should present an opportunity for incumbents to fight back. Investor skepticism of unproven tech and fintech business models is growing, and the rising premium on customer trust could all provide tailwinds. The question, however, is what the incumbents do with the additional earnings — return most of them to shareholders and employees while investing further to defend the core, or pivot their organizations to invest to scale new services and strengthen their customer relationships.

We would characterize what is needed now for most incumbents in two steps. First, they should pivot the focus of the organization more decisively toward the big future sources of value growth. Second, they should use the rising rate environment to go on offense.

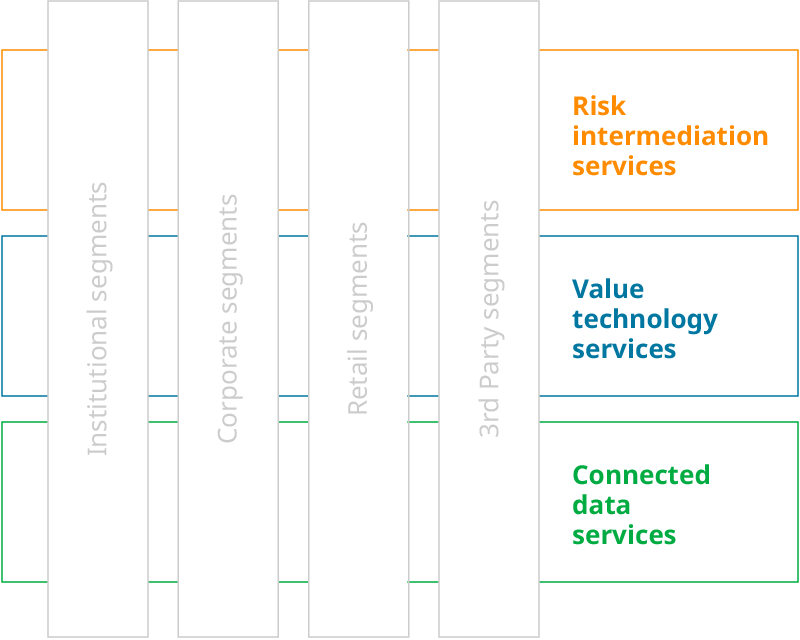

Pivot the focus of the organization more decisively toward the big future sources of value growth

The structure of an organization matters — it defines how customers are served, which mandates leaders focus on, and how investment in growth is channelled. The majority of regulated incumbent financial services firms have organized themselves around the management of large risk pools in one way or another. Within each division, most financial services firms are essentially organized by product, and the P&L sits with the product. There are good reasons for this, because the underlying risk aligns reasonably well with product, and the industry has spent decades understanding economics at the product level so companies feel more comfortable managing economics along those lines. Equity analysts all review incumbents through the same lens.

The consequence of this is that few incumbents are truly organized around creating value for customers, or structured to focus leadership and investment on the big value drivers. Typically most management attention, and most investment, is focused on defending the mature risk-intermediation services, including regulatory requirements. New customer service builds related to connected data and value technology are either managed in an innovation portfolio (good at incubating many ideas but poor at scaling anything to be meaningful enough to drive enterprise value), or managed by leaders who have a full-time job on their hands leading risk-intermediation businesses.

The core question for incumbent leaders is, if structural change is needed to grow their connected-data and value-technology platforms, how far are they prepared to go?

There are a number of ways to solve this, and many ways to sequence the change. But all will ultimately involve a significant reorientation of the group structure to achieve two things. First, organizing around the notion of customer first, where customer type and need define the services provided, partners worked with, and infrastructure needed — and those responsible for solving customer needs are not incentivized by sitting on balance sheets. And second, creating distinct service platforms that expand the service breadth of the group and put greater internal and external focus on growth and investment.

Exhibit 13: The financial services firm of the future

A highly simplified view

Source Oliver Wyman

Example option 1 (least radical)

Expanded service platforms

P&L ownership remains with the core product lines within divisions of the group.

However, products are regrouped into service platforms, some of which span divisions, and the platform view around areas like payments and connected data services is shown to the public market.

Example option 2 (mid-radical)

Customer-first platform

P&L ownership is balanced between product lines and customer segments.

Products are regrouped into service platforms and new publicly visible platforms are created.

Customer segment heads are measured and rewarded on the basis of a P&L reflecting customer value from the front book.

Utility inside platform

In this model the regulated financial services unit is actually a part of a wider platform conglomerate, like an Alphabet structure.

This could even allow different investors in the customer platform including private capital or strategic partners.

May seem radical but the ringfencing solution that the United Kingdom put in place already points toward this solution.

While there are many routes to and versions of the financial services firm of the future, any reorganization has to achieve the following four goals:

First, it must reframe internally and to the external market what the sources and drivers of value are. We believe that if a typical incumbent banking or insurance group re-organized in this way and presented its service platforms to the market today, there would be significant valuation upside. The market simply has no way today to value the customer services assets around payments, technology, and data.

Second, it should define what mandates the most talented leaders focus on. The most talented leaders of incumbents are largely tasked with defending and evolving the product and divisional businesses they inherited and balance sheet returns. This change will involve different incentive structures oriented around growing new customer value, and scaling new customer service platforms.

Third, it should define how investment in growth is channelled. Investment is somewhat broken today in large incumbent banks and insurance companies. A large investment pot is generally salami-sliced across many doubtless important initiatives, which largely defend or remediate the core business. The change in orientation needs to channel more consolidated investment, at scale, into the growth customer service platforms that matter.

Fourth, it should define how to think about M&A. Does it make sense for an organization to spend several years consolidating more risk services assets, for example by merging two 20th century banks together? Far more sensible would be to create a 21st century bank and then define the M&A strategy around that vision. As the volatility in tech markets kicks off opportunities to consolidate fintech assets, it would be sensible to have a structure that allows integration of these kinds of businesses.

This is the direction of thinking of a lot of more thoughtful incumbents, yet where to start and how to go about it are difficult questions. There have been some notable steps taken in this direction by firms like Santander, JPMorgan, Fifth Third, Siam Commercial, ANZ, and Progressive Insurance, and we outline some of these steps in Exhibit 14.

Exhibit 14: Examples of financial institutions organizing around service platforms

Source: Oliver Wyman analysis

Use the rising rate environment to go on offense

Rising interest rates should mean the risk intermediation businesses kick off earnings in the coming years. Volatility in tech valuations points to investor concern over path to scale and returns for some businesses. Policymakers will be putting more emphasis on regulatory capture and bringing digital assets into the core financial system. All of this can create a context in which incumbents can go on offense. But it will be critical to channel investment well. With net interest margins boosted by higher interest rates while volumes may be languishing, incumbents will face choices on what to do with earnings, and to what extent to pay them out in shareholder return or to raise reinvestment levels

With the right focus and well-channelled investment, this could be the period when incumbents start to reverse the decline in share of value created in the industry. They can do so in the following five ways:

Fighting back before it’s too late on core assets such as payments;

Getting on the crest of the wave with some of the biggest new opportunities coming such as digital assets and climate financials

Positioning at the center of a powerful set of partnerships to mine the opportunities in connected data services to avoid disintermediation by big tech wallets and transaction services; and

Learning how to monetize the significant investments made in technology, compliance, and risk management in selling third-party services like BaaS and IaaS; and

Looking to consolidate some business that can accelerate their pivot to value technology and connected data, as opportunities to roll-up struggling fintechs emerge

What should big tech do?

Big tech companies need to find new sources of growth and have an enormous opportunity to do so in financial services. The pools of value are large and attractive already, but more importantly by embedding finance in every other interaction with their customers, big tech can strengthen their relationships and the stickiness and value of their customer activity.

Let’s take a look through the lens of the services we have outlined in this report:

Risk intermediation services: The commonly accepted consensus is that big tech companies are steering clear in general of these pools of value for fear of greater regulation and scrutiny, and this may in part continue to be the case. Yet powerful distributors can still access much of the margin through partnerships or through providing alternative forms of credit, for example. And several big tech players are flush with cash — they could opt to start to rent out their balance sheets even without taking deposits, which would be far less concerning to regulators.

Value technology services: Payments is already a huge area of focus for big tech, and with the arrival of powerful financial wallets, this will be a battleground to watch in the next few years. The push into logistics linked to transaction finance, including cross border, corporate treasury management, and using blockchain technology to reduce frictional costs are all natural extensions.

Connected data services: In fulfilling almost every objective for an individual or company, from health and beneFITs to pay and real estate to mobility, there is a financial transaction embedded at the heart of the workflow. Like liquidity, data begets data, so the beneFITs of data in winning the race to anchor these ecosystems are there for big tech to lose.

In embedding more and more financial services it remains likely that most big tech companies will continue to source most of the highly capitalized and highly regulated risk services from third parties. This is already well underway, with a rapid pace at which partnerships of one sort or another are being negotiated.

As big tech business models converge, and wallets and Metaverse wallets grow, there will be a host of new strategic partnership options to consider

There are a range of options here, summarized in Exhibit 15 below:

Exhibit 15: Range of options for big techs integrating more financial products

Neutral to service provider buying on

Big tech firm sources products on best-cost basis at point of transaction, no strategic relationship

Many

Partnership with handful of larger domestic

Big tech firm has fewer than 10 partnerships with large incumbent financial services providers

Google + AxisBank

Intel inside partnership

Big tech firm picks a challenger happy to embed its product on a white-labelled basis in return for margin and data

Alibaba + Zhong An

Partnership with a focused challenger

Big tech firm picks a focused challenger in a segment/ country that has little to lose in customer ownership vs. what is to gain in distribution scale

Apple & Goldman Sachs

Regulated back-end provider of financial products

Big tech strikes a large strategic partnership with one regulated entity, such as in banking and in insurance, which provide KYC/AML and regulator management at scale

SolarisBank & Samsung

Own the underlying financial services-regulated provider

Big tech firms build or buy a regulated entity to have full ownership

Tencent & WeBank

Source: Oliver Wyman analysis

Macro- and micro-prudential risks are not the only concern of financial supervisors. Consumer protection is increasing in focus and there is concern about how to maintain and build trust in the financial system, and how privacy and cyber concerns are affecting trust. Supervisors are working hard on the frameworks they will use to oversee the activities of big tech. The supervision is going to get more serious in the future, and in deciding how far down this route big tech companies want to go, and how they want to participate, they will face the question of how much oversight from financial supervisors they want to incur. Ultimately this, we think, could be one of the most important factors in how the landscape shifts over the coming five years.

What FITs and private capital providers should do

We combined FITs companies and private capital simply because most of the private capital in financial services today is in FITs, and because more than 25% of total FITs equity is owned by private capital, so the two are intrinsically interlinked.

Investors in FITs, whether public or private, face some interesting choices. FITs have been an outstanding investment over a 10-year window, as we show in Exhibit 16. There is no doubt there are capital risks, with valuations to be tested by financial and economic cycles, and with significant regulatory risks to some business models.

Exhibit 16: Oliver Wyman FITs 100 index performance vs. peer indices

Index values, 100 = Jan 2012

Source: Oliver Wyman analysis, Refinitiv Datastream

FITs firms should scale carefully — aim to be strategically lean and mindful of bulk

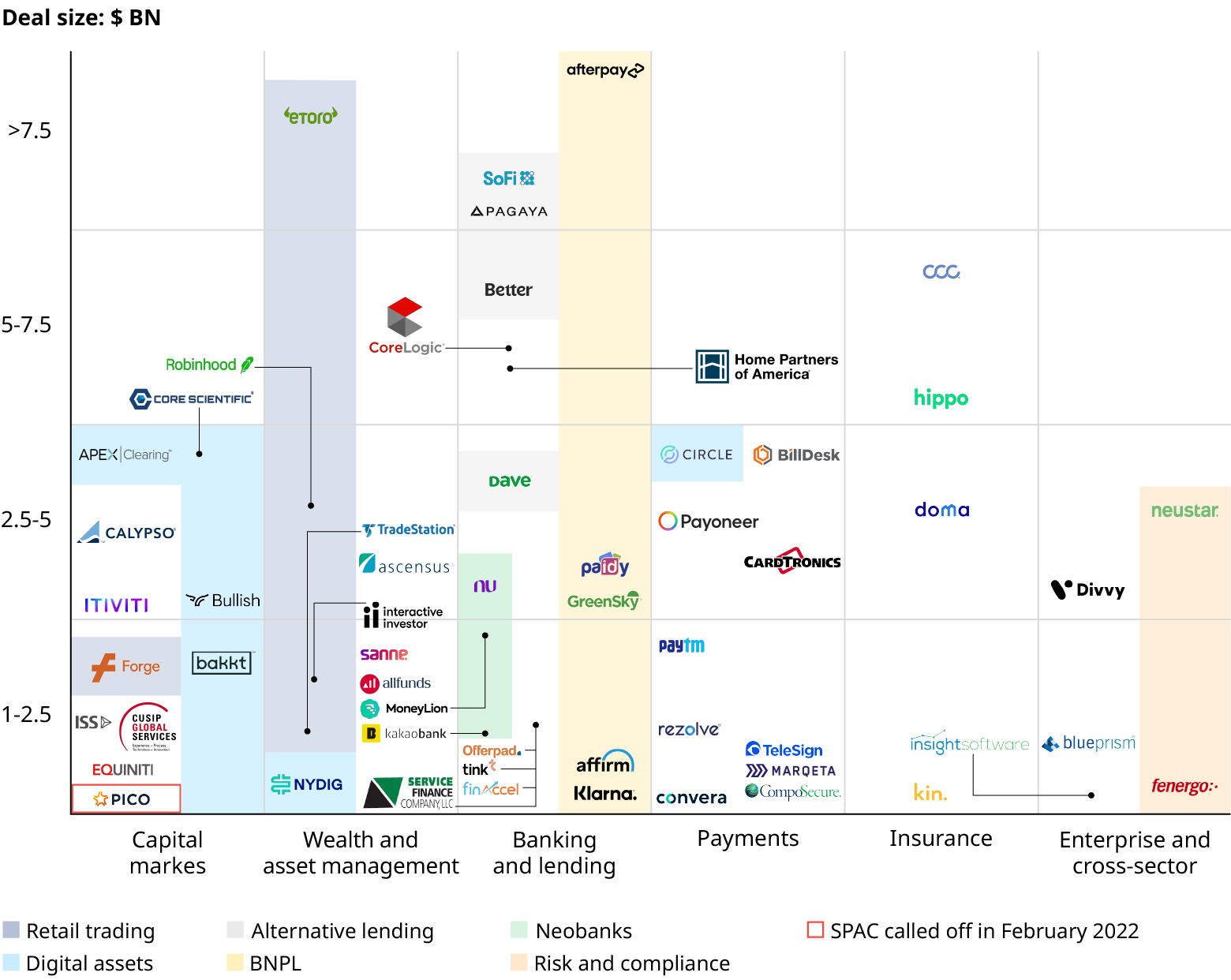

The underlying question for FITs companies is what the route to strategic scale is, or at least the exit velocity from sub-scale size. With this backdrop, the FITs industry has seen a flurry of M&A activity in recent years as FITs combine to release growth synergies and economies of scale and scope. In fact, there were more than 50 deals of more than $1 billion in 2021 alone, which we lay out in Exhibit 17. There are common themes across the deal landscape including digital assets, retail trading, alternative lending, neobanks, buy-now-pay-later (BNPL), and risk and compliance.

Exhibit 17: Largest FITs deals in 2021

There were more than 50 $1BN+ deals in FITs last year, with some common themes: digital assets, retail trading, alternative lending and neobanks, Buy Now Pay Later (BNPL), and risk & compliance

1. Includes M&A, Financing rounds and IPOs. Source: Mergermarket, Dealogic, CB Insights, FT Partners, Oliver Wyman analysis

Source: Oliver Wyman analysis

A careful balance needs to be struck as FITs players scale up. Scale presents new challenges as it risks diluting the dynamics that have enabled providers to gain traction and grow rapidly through their infancy (agility, focus, incentives for talent, and so on). And there have certainly been several cases in which the roll-up of FITs firms into financial conglomerates has created negative synergies that in some notable cases have had to be unwound through break-up.

For businesses that do pursue and achieve scale, there are a few hygiene factors to stay focused on to ensure they grow “strategically lean,” and limit the performance drag that “organizational bulk” threatens. They should:

Employ ruthless focus on driving home the competitive advantages that enterprise scale brings — distribution, diversity of capabilities, incumbency, investment capacity, brand, track record.

Critically review the portfolio of assets within the organization; divest and release assets that are strategically non-core, require transformation to fulfil the next wave of value creation, and might flourish elsewhere in the ecosystem.

Prioritize and pursue complex, multifaceted opportunities that can truly be unlocked only by the full enterprise.

Ensure the wider organization, which includes sales, technology, operations, and group management, are all 100% mission-focused on value creation and delivery.

These principles equally hold true for the largest FITs firms operating at scale, which we expect to continue to be consolidators — such as the information providers, exchanges, card and payments players — and which need to continually invest and evolve through a portfolio of new opportunities in order to maintain their advantage and growth. The largest FITs firms have some key advantages in scale and longevity in doing so, as they are able to weather tech cycles and invest in the medium term. And with valuations for smaller and less proven fintechs swinging, there may be a lot of shopping opportunities in the coming years.

Opportunity for the scale payments players to bridge the gap in embedded finance between incumbents and the new big tech and merchant providers

As value shifts and big tech and merchants play a stronger role, many will rely on different forms of embedded finance, and leveraging the services of the incumbent banks/insurers in particular.

For the scale payments firms, in particular, there is the opportunity to provide a new range of network services to facilitate and enable this transition — digital identity, digital assets, setting interoperable standards/protocols, utility services such as KYC, or risk scoring, compliance, and monitoring. Moving into these services could allow them to benefit enormously from the growth of embedded finance in new ecosystems.

The big payments players could also enormously capitalize on the shift to open banking, on the opportunity to offer efficient cross-border services, and perhaps the biggest of all, to position at the center of the race to establish digital identity.

Scope in future for more creative blending of value and growth capital

There are two reasonably distinct equity stories in financial services today. First, public equity investors in the incumbent industry, with P/E ratios of 10 to 20, largely see financial services as value stocks and want most capital returned through dividends or buybacks — and as a consequence most incumbents struggle with the investment needed to tap longer-term growth opportunities. Second, public and private capital investments in FITs or big tech, at P/E ratios of 20 to 40 times earnings, largely represent growth plays.

What this picture misses is that many incumbents are sitting on highly valuable technology and data assets, but don’t have the growth capital to invest in them to the level required to really scale them. Yes, a bank or an insurance company can put $50 million into a growth incubator, but the sort of capital that comes from a Series B or Series C investment round is far harder to muster. Are there ways to bridge this divide and have private capital invested into public companies? Full privatization of a significant balance sheet is unlikely, but some public companies are testing ways to bring private capital in at greater scale. The more traditional way to do this is to create ringfenced businesses and offer co-investment to private capital, but this is usually in relatively small and very distinct business opportunities held in a venture portfolio. But a strategic partner with a large part of a public company such as its entire payments business, connected data business, or insurance-as-a-service business? There is a lot of logic to it; watch this space.

Industry change is not always gradual. Nor is the emergence of new business models and competitors. We can chart the change in most industries with the periodic emergence of disruptive new players that ride underlying trends to scale quickly. With so much change afoot in the industry, it is possible to conceive of strategic moves that could accelerate these value shifts through step change. Here we tease out a few examples that are worth watching out for. These are not predictions, more like a bit of fun, but in each case we see a compelling potential.

Can a big tech build a $1 trillion banking or insurance balance sheet without being a bank or insurer? It’s very possible, by back-to-backing with a pure-play provider of banking/insurance-as-a-service that has licenses and will manage the regulatory relationships, and take responsibility for KYC and risk management. There are a growing number of digital native technology firms or neo-banks with regulatory approvals that could position themselves to be 100% dedicated, at least over the first few years, to one big tech relationship. Regulators would want a look-through on customer protection, but this is to a large extent already happening.

Big tech companies are largely forming relationships with challengers in markets where the challenger has more to gain than lose by putting the big tech brand in front of the customer relationships. But in retail banking, even the largest GSIBs are usually offering services in only one or two markets. For a GSIB with regulatory licensing in 20 or more countries, a joint build with a big tech in all markets except the home market could be a category killing way to enter many new markets with a retail banking offering, without the costs of customer acquisition/distribution.

Climate data is likely to be the next big data goldmine, and a plethora of data-related firms are lining up to play a role, from data specialists to enterprise resource planning (ERP) providers to accountancy firms. Which has the very best access to the data needed to derive greenhouse gas emissions estimates? Certainly the cloud providers increasingly managing all of the data — which would need an experienced partner to mine it, for example one of the large financial and energy data providers. The route to massive scale likely lies in then linking powerful data to a powerful user experience, such as “Fitbit for Carbon Footprint.”

The largest incumbent banks and insurers have exceptional assets in value technology and connected data, but lack the patient capital at scale to develop them, and incumbents cannot fully separate them. And few private equity firms want to own a large balance sheet business. But a bank, for example, in an Alphabet-like holding structure within which all the technology and data assets could be structured for private capital ownership, while maintaining all the valuable connectivity to the balance sheet, could work — which is a version of our model 3 in “Example Future Organizations for Banking Groups.”

It is largely agreed that the most compelling use-case for distributed ledger technology and a reliable stable-coin is to reduce the high costs of cross-border transactions, both financial and physical. A single firm with a powerful brand that facilitated businesses and individuals to seamlessly and at low cost send money and goods internationally would combine value pools that today are inefficiently split between banking, logistics, and ERP. This requires a logistics powerhouse, a multi-country distributed ledger technology (DLT) native, and the backing of a traditional bank.