The US insurance market has seen a prolonged period of growth driven by supportive macroeconomic conditions and an increasingly complex set of risks that are actively managed by corporates, small to medium-sized businesses (SMBs), and individuals alike. Insurance brokers have been central in helping end-insureds navigate this evolving risk landscape — ranging from an increased rise of climate-linked catastrophic events to more sophisticated and frequent cybersecurity and data privacy incidents. As a result of the COVID-19 pandemic, insurance brokers have needed to take actions and incorporate new ways of working.

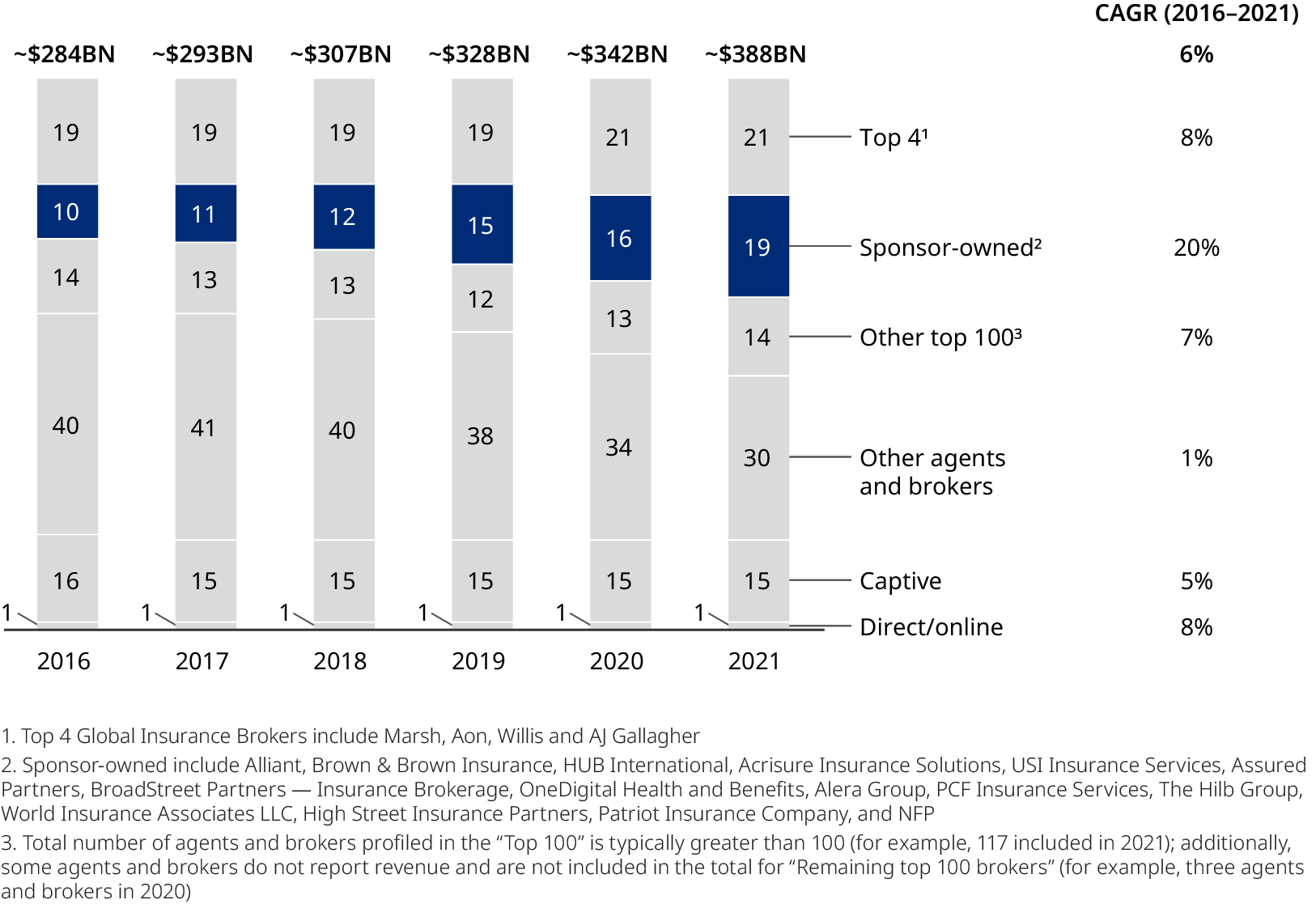

Our analysis suggests that a handful of insurance brokers — such as the Top 4 Global Insurance Brokers (Marsh, Aon plc, Willis Towers Watson and Arthur J Gallagher & Co.) and, highly acquisitive sponsor-backed insurance brokers (for example, Hub, USI, Acrisure) — have experienced significantly higher premium and revenue growth, while many others in the long-tail struggle to remain competitive without the same scale benefits.

Getting the basics right has never been more important. In The Next Phase Of Growth For Insurance Brokers, we dive into the macroeconomic environment and the impacts to the brokerage ecosystem. We share perspectives on how to win in the long-term — through integrated business models, greater standardization, and by driving cross-organizational effectiveness. And we offer four key drivers for successful business integration. Below is an excerpt of our report, for the full version, please click the PDF below.

Sponsor-backed insurance brokers now account for more than half of the top 30 brokers in the US across commercial, personal, and employee benefits (EB) lines

Sponsor-backed insurance brokers now account for more than half of the top 30 brokers in the US across commercial, personal, and employee benefits (EB) lines

Impacts to the brokerage ecosystem

Sponsor-backed brokers now account for more than half of the top 30 brokers in the US across commercial, personal and employee benefits (EB) lines. While a plurality of integration approaches has worked until now, financial sponsors and the management teams they support will have to work harder to integrate businesses and drive cross-organizational effectiveness to realize continued growth, especially considering the turning economic environment.

Expectations are that the economy will likely face a ‘hard landing’ in coming months as the Federal Reserve approved an interest rate increased to 5.25% in May 2023, which is the 10th increase in a little more than a year. This may dampen borrowing and result in fewer new property, vehicle, and inventory purchases, but we do not expect the impact of less insurable risks on the associated brokerage to be outsized for the following reasons:

- End clients will continue to require risk management advice to address growing exposures: As risks continue to percolate and magnify across different industries within the economy (such as cyber and climate), we believe end clients will seek more comprehensive and ‘fit-for-purpose’ insurance solutions even in a more bearish market.

- Insurance brokers have historically been a resilient category: The ‘must have,’ often mandated nature of insurance means it is not an expense that is cut in times of cost rationalization, and instead primarily impacted by asset value related declines (for example, contract risk exposures) that may be observed disproportionately at the beginning of a turning economic cycle.

- Brokers remain highly relevant — despite the continued growing relevance of direct-to-customer models: We expect that many end-insureds (especially larger corporates) will continue to require a broker’s support to evaluate risk management strategy and determine the appropriate insurance markets.

- While brokers have made progress in ‘running a tighter ship,’ there remains a lot of opportunity for operational value creation: We anticipate a changing macro environment will nudge executives to re-focus on margin management and help support continued profit pool expansion even in a period of more muted top-line growth.

Focusing on the bottom-line

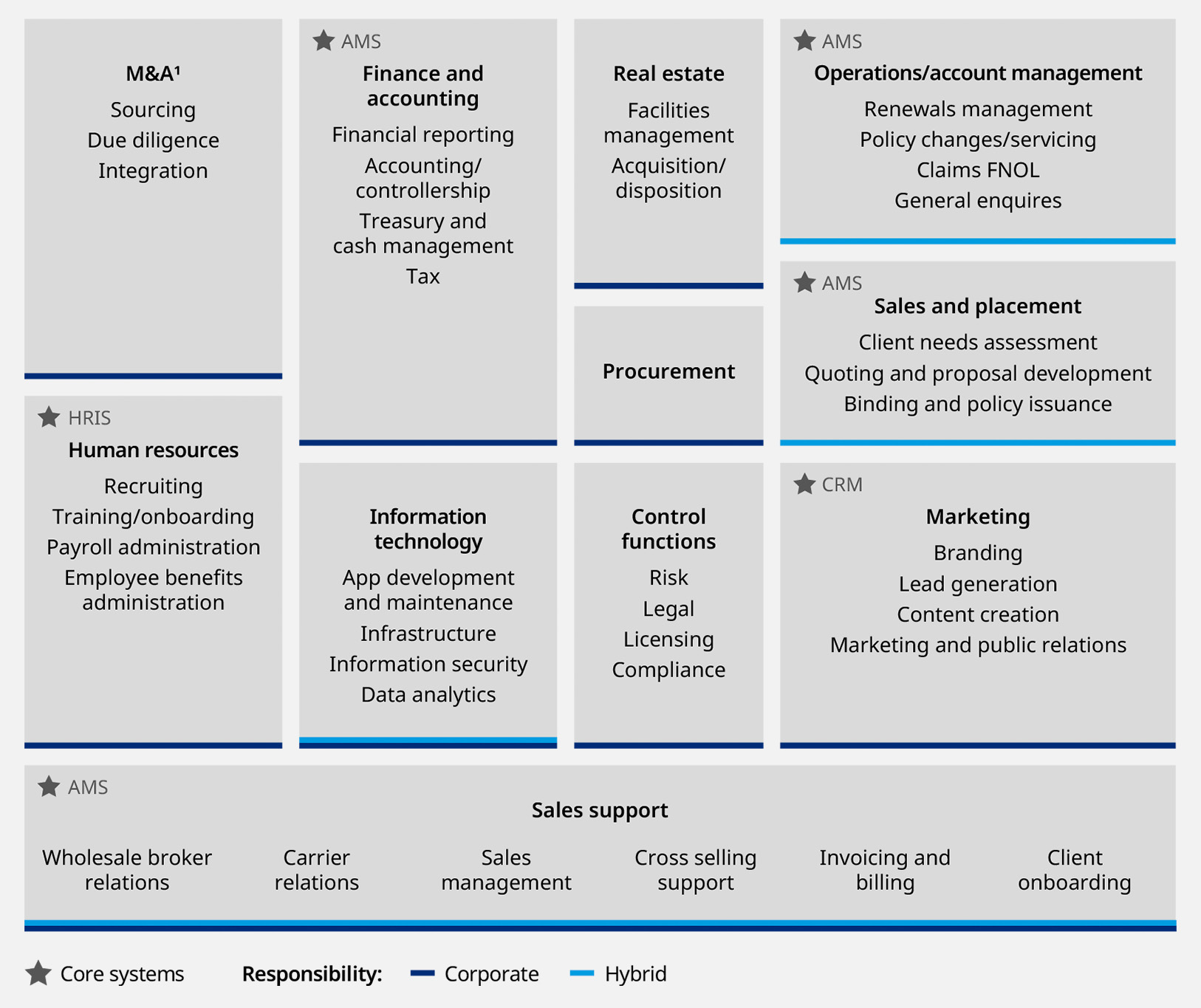

Sponsors used favorable conditions during the long bull market run to craft highly accretive inorganic roll-up plays where local and regional brokers were consolidated into national broker platforms. Through our work with a significant number of sponsors and management teams, we observed that acquisition philosophy was largely consistent, but there were greater divergences in integration strategies. Integrating a group of (often highly entrepreneurial) insurance brokers with pre-established ways of working into a platform is non-trivial and must be managed carefully, so as not to stifle productivity and drive unwanted attrition. On the flipside, adopting a more ‘light-touch’ approach runs the risk of creating a franchise with an inefficient and varied operating model, and possibly weak controls. Sponsors and management teams have generally adopted one of these three strategies:

- Hands-off acquirers: Minimize change at the agency level with integration focused on control functions and HR administration.

- Hybrid acquirers: Extend integration beyond control and human resources administration functions into finance, IT, real estate, brand, and aspects of sales support.

- Integrated acquirers: Rationalize brand identity, finance, and control functions shortly after close, and over time align front office practices and functions.

While all these models saw notable success in the bull market years, we expect some bifurcation in the relative success of these strategies in a more muted market, with flat to contracting deal multiples. We anticipate that high-quality broker platforms will continue to benefit from healthy multiples, whilst businesses with “work required” are likely to be disproportionately impacted in a dislocated market.

Financial sponsors and the management teams they support will have to work harder to integrate businesses and drive cross-organizational effectiveness to realize continued growth, especially considering the turning economic environment

Financial sponsors and the management teams they support will have to work harder to integrate businesses and drive cross-organizational effectiveness to realize continued growth, especially considering the turning economic environment

Four key drivers for successful business model integration

We increasingly see significant integration and an institutional focus on the bottom-line as a requisite for a high-quality insurance brokerage platform of the future. Through our work with a broad spectrum of brokers and their third-party software and service providers in the insurance ecosystem, we have identified the following four key drivers of tangible results from greater integration.

- Tech and operational model optimization: Focus should be placed on establishing an integrated technology stack, standardization and centralization of corporate services, process re-engineering to expand automation and self-service, and organizational streamlining.

- Effective use of third-party vendors: Optimizing procurement and vendor management can help extract savings in third-party expenses.

- Pricing effectiveness: Focus should be placed on ensuring commission alignment and driving yield optimization via standardizing commissions, optimizing performance commissions, and reducing commissions leakage.

- Salesforce effectiveness: Key focus areas include optimizing the front-office organization, implementing productivity management (for example, aligning incentives to metrics, centralizing support teams), analyzing customer profitability, and ensuring a structured coverage model.

The right combination of the drivers listed above (amongst others) will vary broker-to-broker. Nonetheless, we see universal value for brokers investing in these areas in lockstep with ongoing acquisition strategies. We see universal value for brokers investing in these areas and generally recommend a staged approach, starting with levers that have the broadest level of organizational buy-in and are expected to deliver the greatest upside.

Building a well-integrated and operationally efficient insurance brokerage

Insurance brokers remain a very attractive category for private equity investment, the changing market conditions have necessitated a refresh in the playbooks for success. We believe that the market will disproportionately reward consolidators that deliver well-integrated and operationally efficient insurance brokerages. Brokerages that combine scale with a level of uniformity allow them to be nimbler and react to change as end insured demands and needs evolve.

Get started with Oliver Wyman Insurance and Private Equity

Oliver Wyman’s work for private equity investors is informed by the wide-ranging strategy, operations, risk and capital management, and actuarial work we do for industry incumbents and challengers — across the property and casualty, life and annuity, and accident and health industry segments. We offer unparalleled depth and breadth of experience to insurance sector investors in value creation, integration, post-investment service offerings and due diligence. Please reach out to learn more.