Digital payment offerings and their adoption rates vary widely across Asia. Banks face significant challenges trying to keep up with the changing payments method landscape and consumer demands. To meet their customers’ needs, banks are transitioning to fully modern and flexible payments technology stacks. These typically consist of an open architecture user interface, an application and orchestration layer, and a cloud-based infrastructure foundation. In this article, we explore these three elements in detail and discuss considerations that banks should consider when modernizing their payments architecture.

Overview of payments in Asia

Digital payments have become the standard expectation for consumers in today's fast-paced world. Asia, with its vast and diverse markets, offers a wide range of digital payment options. The availability and adoption rate of digital payments vary significantly across different Asian markets.

While the availability of digital payments in each market is affected by regulations and infrastructure, the adoption rate is influenced by cultural and customer preferences. Our analysis shows that mainland China and South Korea are the frontrunners. In 2021, about 70% of each country’s population were digital payment users. In that year, mainland China and South Korea recorded digital payment transaction values of US$3.1 trillion and US$189 billion, respectively. At the other end of the scale, Vietnam’s online and mobile banking penetration rates were below 20% in 2021, equating to a digital payment transaction value of only about US$17 billion.

The finance industry is also increasingly focusing on cross-border payments, which are expected to exceed US$150 trillion by 2026. New entrants and non-bank players continue to disrupt the industry. They have captured more than 10% of cross-border payment volumes in recent years. According to the World Trade Statistical Review 2021 published by the World Trade Organization, the ASEAN region contributed to approximately 7% of global cross-border trade.

Digital payment themes across Asia

Each market in Asia has its own unique characteristics that affect the adoption of digital payments. Exhibit 1 highlights the major variances and key themes of each market in the digital payments landscape.

Digital payments in Asia are entering a new phase, driven by regulators' efforts at the cross-country and subregional levels, and advancements in individual markets. In Southeast Asia (SEA), the central banks of Singapore, Indonesia, Malaysia, and Thailand have signed a memorandum of understanding to cooperate in regional payment connectivity.

Key elements for modernizing the payments architecture

The evolution of payment use cases, regulations, and the resulting creation of new payment options have made it challenging for banks to efficiently adapt and support the changing landscape and consumer demands. The payment service design employed by banks is often inflexible, and the systems on top of it are typically batch-processed, siloed, monolithic, and difficult to integrate with external data sources and vendors. Banks need to adopt modern technologies to provide agile, scalable, and flexible payment solutions that can adapt to the rapidly changing digital payments landscape.

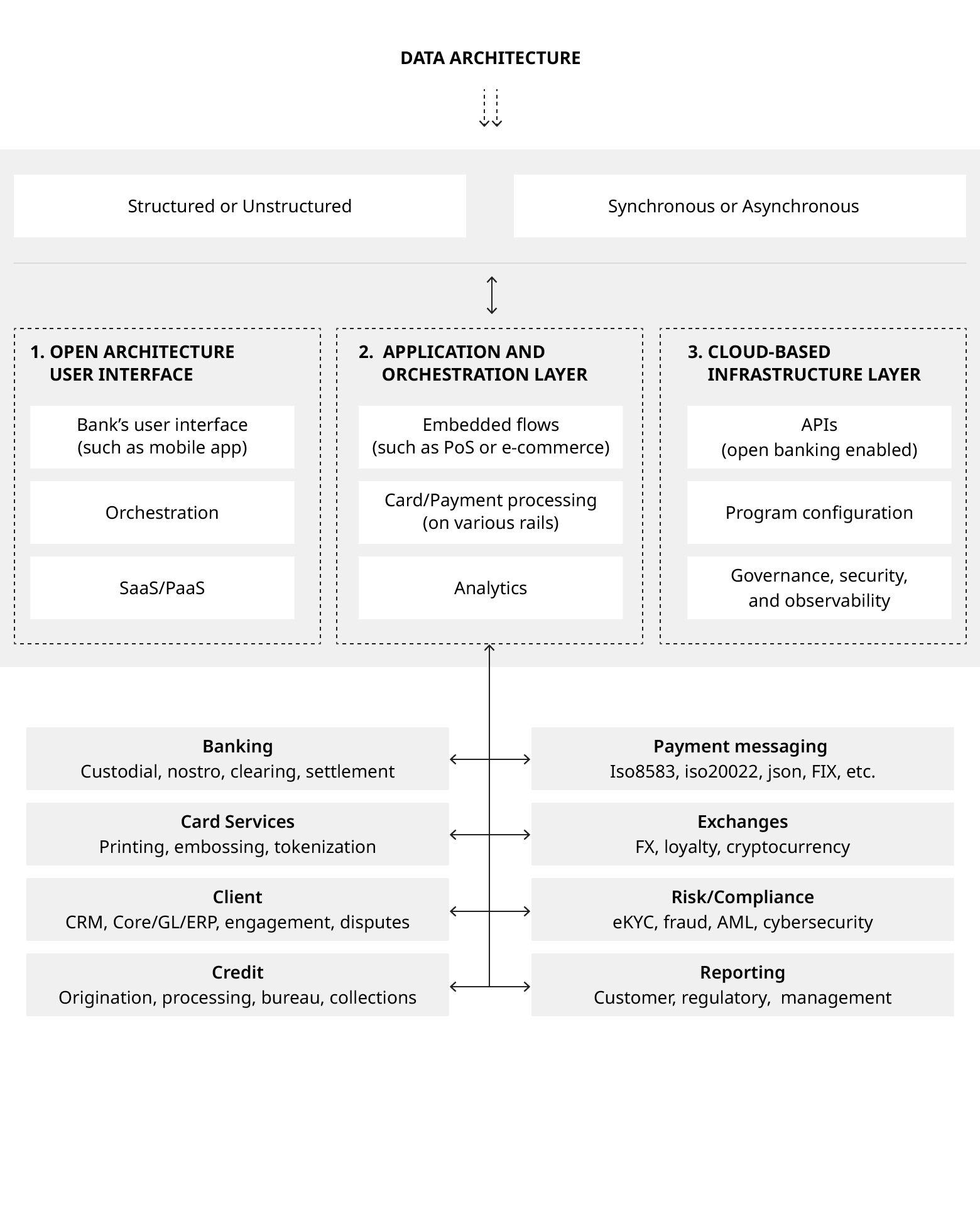

Modernizing to a fully flexible payments technology stack involves the following three key elements:

- An open architecture user interface layer that combines both self-owned payment channels and leverages APIs to enable scalable embedded payments solutions within third-party platforms.

A user-friendly payment channel that provides a seamless experience across channels and payment methods is essential. Payment channels need to be customer-centric, easy to understand, friendly to use, and a one-click solution. Banks need to have APIs that expose their payment systems and rails to the outside world. This will enable third parties to drive embedded payments, while also driving potential new revenue models for additional services, such as buy-now-pay-later. - An application and orchestration layer, where the application layer has a modern core payment system that supports multiple value-units and payment networks, and combines with an orchestration layer to manage communication with other systems across each payment lifecycle.

Modern flexible core payment systems allow for rapid product development and expansion to new markets. Replacing legacy systems will make it easier to handle expected large payment loads and support the broad range of payment needs from a single-service provider. Banks should also build an efficient and fast orchestration layer around the core payment systems that enriches payments with internal and external data sources, and interacts with shared services, such as fraud and anti-money laundering systems. - A cloud-based infrastructure foundation, with globally distributed processing capabilities and intelligent routing to improve the performance of transaction processing and meet residency requirements.

Running payments in the cloud ensures the availability and scalability needed to meet rapidly increasing payment volumes. Having all payment data on the cloud enables the ability to pull and post data in real-time with access to structured and unstructured data sets. Banks should also start using machine learning insights to enable new payment features or increase the processing capabilities of existing features. Moving payment systems to the cloud also allows banks to better manage future costs and optimize their total cost of ownership. An added benefit is that most of the external partners that banks will interact with are cloud-native, making interfacing with them easier.

Key considerations for banks

Improving these three elements typically involves a migration of some sort. Before embarking on a migration project, banks should consider factors such as their current architecture, business goals, customer needs, and regulatory requirements. They should also evaluate their migration options and select a vendor that can provide the necessary support they need throughout the migration process. Therefore, banks need to do the following:

- Ensure they fully understand, and have access to, legacy systems, data and processes before they start modernizing their core payment systems. This will allow a coherent and complete migration, as well as flag potential challenges from the start.

- Have clarity across senior leadership, the program, and external stakeholders with which they interact regarding any impact of migration and expected incremental benefits. A strong communication plan, which also involves the bank’s customers, will help.

- Solve for the security and compliance-perception issue, which includes fear of data loss and data residency challenges. Stakeholders need to understand that cloud providers are safe and compliant with regulators, and be convinced of the sensible trade-off of relinquishing control to a certain extent in return for the cost benefits and enhanced functionalities of cloud providers over on-premise infrastructure.

- Have strong migration program management that includes a clear and robust test plan. There are multiple approaches to consider, such as phased migration versus a big-bang approach, depending on scale and complexity.

- Create a robust commercial and business model to underpin the investments in these programs, since they are time and cost extensive.

Closing thoughts

Banks need to upgrade to fully modern and flexible payments technology stacks that consist of an open architecture user interface, an application and orchestration layer, and a cloud-based infrastructure foundation. Improving these elements would involve a migration process that requires a careful consideration of factors such as the current architecture in place, business goals, customer needs, and regulatory requirements. Selecting a vendor that can provide the necessary support throughout the migration process is also critical. By modernizing their payments architecture, banks can stay ahead of the rapidly evolving digital payments landscape and so properly meet the changing demands of their customers.

This article was jointly developed by Oliver Wyman and E6.