In 2019, Chinese travelers made 155 million outbound trips, and spent a cumulative $245 billion on outbound tourism, an amount greater than the size of New Zealand’s total economy. After almost three years of border closure, Chinese travelers are finally coming back. Our survey of 3,495 affluent Chinese consumers, defined as those with a minimum monthly household income of ¥30,000, representing about 5% of China’s total population in 2022, sought to understand when and where we would see them again. Additionally, we aimed to determine whether their abundant international shopping habits, particularly for luxury products, would continue.

No full recovery yet as domestic travel remains a popular alternative

Although approximately 60% of experienced international travelers — those who traveled internationally before COVID-19 — have already traveled or are planning to travel in 2023, about 30% plan to wait more than two years before traveling internationally again. While we thought that after three years of border closure, everyone would be wishing to travel internationally again soon, for some the opposite has happened. In fact, 73% of the experienced travelers who have decided not to travel internationally in 2023 have made this choice because they prefer to travel domestically, having discovered the attractiveness of traveling at home during the last few years. Taking new international travelers into account, we expect a full recovery of Chinese outbound tourism in the second half of 2024 the earliest.

Chinese travelers return to familiar destinations

In 2023, the top destinations for Chinese travelers are expected to be familiar places, such as Hong Kong SAR, Western Europe, and Japan. These destinations are top of the list for experienced travelers, with almost 40% of those who have visited Western Europe planning to return this year. We expect an increase in the number of Chinese travelers visiting Europe later this year and expect Japan and South Korea will pick up in tourism significantly during the October holiday now that group tours are allowed.

Chinese travelers are also showing renewed interest in group tours. Contrary to the pre-pandemic sentiment where only 40% traveled in group tours, 52% of surveyed travelers plan to join these tours for their next trip in 2023. This upward trend is observed across all age groups and travel experience.

Shopping tops reasons for international travel, but luxury spending stays domestic

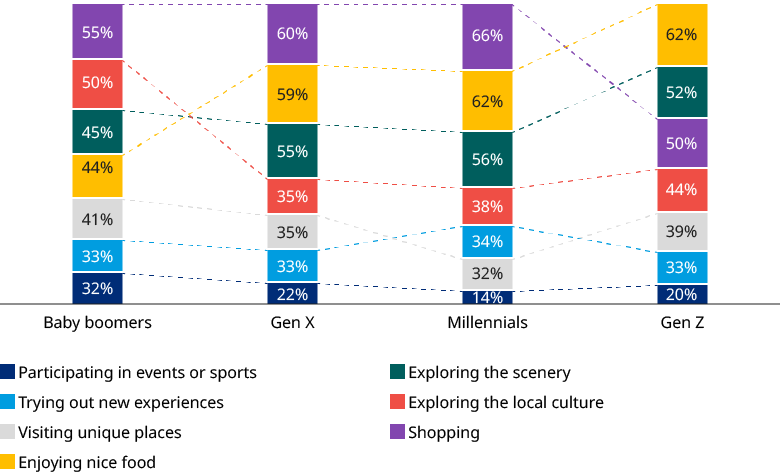

Before COVID-19, our surveys revealed the importance of shopping as a reason for international travel declining year-on-year, with exploring scenery becoming the primary motivation. However, shopping has regained its position as the top reason for international travel (Exhibit 3), followed by enjoying nice food. This trend is particularly popular among Gen Z travelers, with 62% of them inciting indulging in gastronomic experiences as their top reason for international travel.

While shopping is the main reason for international travel, the majority of luxury shopping is expected to remain domestic. Chinese luxury shoppers who travel internationally this year anticipate spending 20% of their luxury budget abroad and 80% domestically. Interestingly, we see a big difference between experienced and new luxury shoppers (those who only started buying luxury products during COVID-19 and so only have domestic luxury shopping experience). Approximately 85% of experienced luxury shoppers expect to revert to shopping overseas now that borders are open, only about a third of new luxury shoppers share this sentiment. These new luxury shoppers also have very high expectations on service levels internationally as they are accustomed to frequent and personal interactions with the sales associates of their core luxury brands domestically. With the luxury market booming in China in 2021, all luxury brands have invested in boosting their offerings in China. Given the wide domestic offerings, Chinese luxury shoppers see less of a need to shop internationally and are now also accustomed to buying luxury products when they want them, rather than waiting to travel. Gen Z represents a significant portion of these new luxury shoppers, and they are looking for new experiences and food rather than shopping.

Gen Z is the biggest group of new travelers

In the last four years, new types of Chinese travelers have emerged. Around 30% of the new travelers in 2023 are members of the Gen Z workforce, who now have a stable income and the means to travel internationally. They care less about shopping and prioritize new experiences they can share on social media. They typically have smaller budgets, so they favour destinations that are close with the aim to maximize the number of experiences they can enjoy in a short time. As they are accustomed to luxury shopping domestically they don't wish to waste their limited travel time on shopping.

Those who are anxiously waiting for the full return of Chinese travelers will have to wait a little longer and be prepared for a new type of Chinese traveler who has higher expectations, given the enhanced traveling and shopping experiences now available domestically.