With numerous COVID-19 lockdowns and restrictions in China dampening consumer confidence and spending, 2022 has been a real rollercoaster for consumer companies and retailers in the country. After averaging 124.9, 119.5, and 121.2 in 2019, 2020, and 2021, respectively, China’s consumer confidence hit an all-time low of 86.7 points in April 2022 and has yet to recover. At the same time, new household savings deposits ballooned to RMB13 trillion in the first nine months of the year, up from RMB10 trillion in 2020. Overall, retail spending has been flat so far in 2022, with a decrease in discretionary spending and a double-digit decline year-over-year in Shanghai.

While the Chinese government has focused on driving domestic consumption since 2008, achieving moderate success, China remains an investment/infrastructure driven economy (investment represented 43% of China’s GDP in 2021 versus 22% in the US). With the massive slowdown in economic growth in 2022 and fewer real estate and infrastructure opportunities to drive growth, it has become even more important for the Chinese government to make domestic consumption a key engine for future growth.

However, will Chinese consumers increase their spending in 2023? And will we see a strong recovery that resembles what happened in 2021? To understand current and future sentiment, we surveyed 4,000 consumers in China in October 2022 right after the country’s 20th Party Congress.

A brighter outlook for 2023

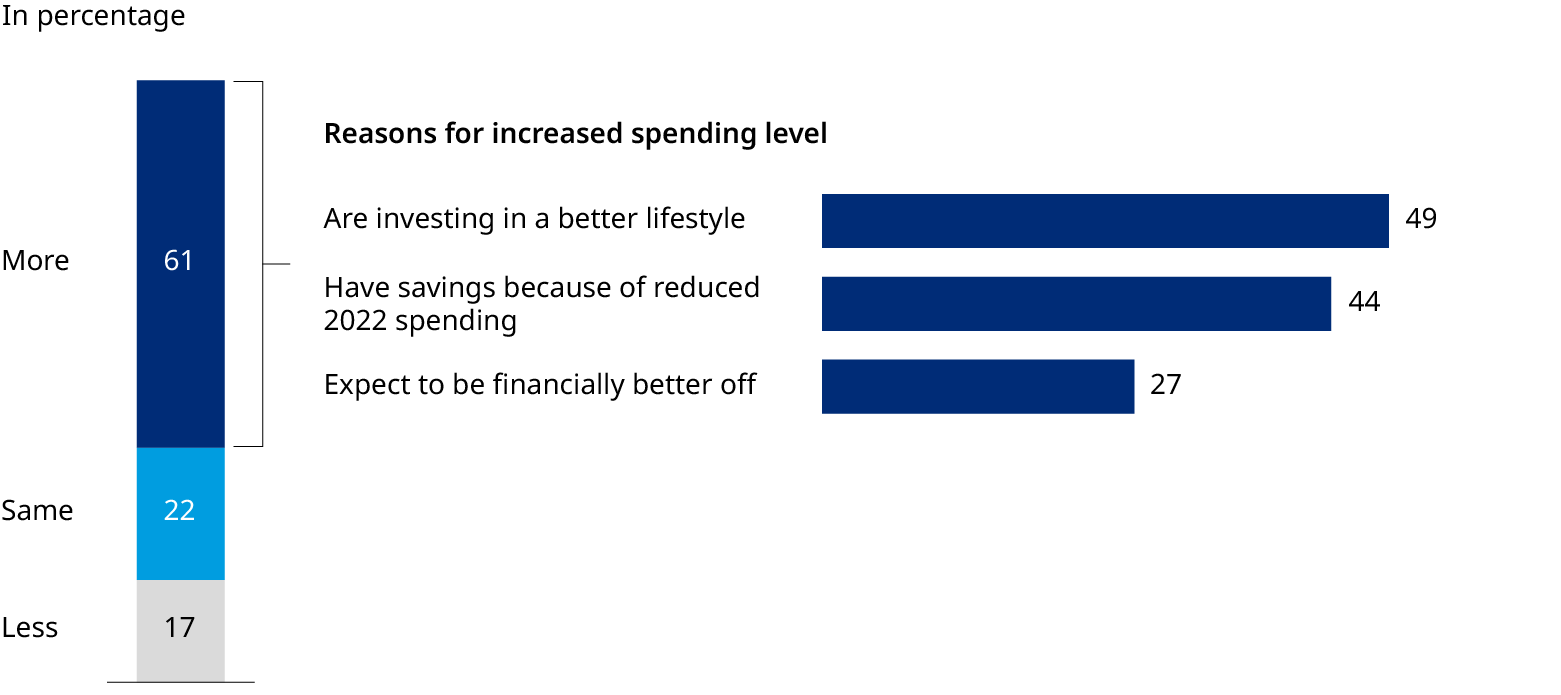

While current consumer sentiment is negative across the board, all Chinese income and age groups are much more positive about 2023 and eager to spend more again. Presently, the lowest income groups (with monthly household incomes below RMB20,000) are most negative, according to our consumer sentiment index. They are particularly concerned about job security and their ability to both cover their rent or mortgage and pay off their debts. Consumers in lower tier cities are also more worried than those in China’s major cities. This brings into question the continuation of lower tier cities as an economic growth engine, as it would require more cautious expansion efforts. Nevertheless, 61% of the respondents surveyed said they would increase their spending in 2023, mainly desiring to invest in a better lifestyle in 2023 and planning to use their accumulated savings to do so.

This tells us that Chinese consumers are resilient. While the current COVID-19 lockdowns and restrictions pose many challenges and uncertainties, Chinese consumers still believe 2023 will be much better than the present.

Investing in the future versus living in the moment

We see a clear divergence between Gen Z and all the other age groups on where they want to spend their money in 2023. While Gen Z wishes to live in the moment, the other generations desire investing in their overall wellbeing and having a healthy future. As we shared in our 2021 luxury research (please read our 2021 Gen Z luxury shopper research paper for more information), this generation was the key driver of the huge growth in the domestic luxury market in 2021, as they like to spend and reward themselves whenever they can. While we do not expect the same domestic luxury boom this time around, we see Gen Z again being a key driving force for discretionary categories related to looking good, such as fashion and skincare.

Heightened worries for Gen Z in the longer term

Even though Chinese consumers are overly optimistic about 2023, all age groups are less optimistic about the economic situation five years from now, according to our consumer sentiment index. This is especially the case for Gen Z, which is the most optimistic about 2023 but the least optimistic among all age groups about China’s economic outlook in the longer term. With a current unemployment rate in China of 20% for people aged 16 to 24, they are more worried than the broader population about job security. Additionally, with economic growth slowing down, they are more worried about upward mobility. In Tier 2 cities, almost 70% of Gen Z are worried about job security, and close to 60% are worried about a weak outlook for a better lifestyle.

Therefore, while 2023 is likely to be a much better year for consumer and retail companies in China, concerns about the Chinese consumer remain for the longer term. The Chinese government will need to do much more to bring back long-term confidence and successfully use domestic consumption as a key engine for future growth.

Traveling still low on the agenda

Nobody knows when mainland China will resume traveling without any quarantine. Even when that happens, it will take time before we see the number of mainland Chinese tourists return to pre-COVID-19 levels (155 million travelers in 2019).

Compared with 18 months ago, Chinese travelers have become more cautious about resuming international travel. According to our survey, 55% of the respondents are worried about getting COVID-19 while traveling, and 50% are worried about dealing with potential changes in re-entry policies.

However, if they resume international travel, Hong Kong continues to be the top destination of choice to visit. Overall, the desire for short-haul travel has also gained popularity over long-haul travel. With the current situation in mind, it may still take a few more years before we again see over a hundred million Chinese tourists annually.

Domestic travel has also taken a very hard hit this year, with the number of domestic travelers down 22% and 54% from last year and 2019, respectively. However, if conditions allow, Hainan will continue to be the top domestic destination to visit.

After a rollercoaster year, resilient Chinese consumers are heading into 2023 amid continuing uncertainties. We believe consumer spending will improve in 2023, driven by accumulated savings and a desire for lifestyle upgrades. These will clearly benefit relevant categories and brands. The younger generation is more cautious though, as the outlook of the economy for the longer term remains cloudy. Moreover, the outbound travel market likely will not rebound completely in the near term even if the Chinese border reopens properly and quarantine restrictions are canceled.