This report was written in collaboration with Celent and the American Bankers Association. The external authors of this piece include Zilvinas Bareisis (Celent), John Carlson (American Bankers Association) and Brooke Ybarra (American Bankers Association).

Strengthening digital identities is critical for reducing fraud, complying with regulatory requirements and establishing trusted relationships with customers. Further, customers expect the identity proofing process to be frictionless and failure to meet this expectation could lead to lost market share to companies with an easier user experience.

However, for a Financial Services institution looking to invest in its customer identity capabilities, it can feel as though there are many moving pieces. This report seeks to demystify the topic of digital identity by outlining the three customer-facing processes that rely most on trusted customers’ identities, explores the cost for Financial Services institutions of not investing in these capabilities, and maps the vendor market and the forces that are shaping this ecosystem. Finally, we close with a set of actions that Financial Services institutions across the U.S. can take today.

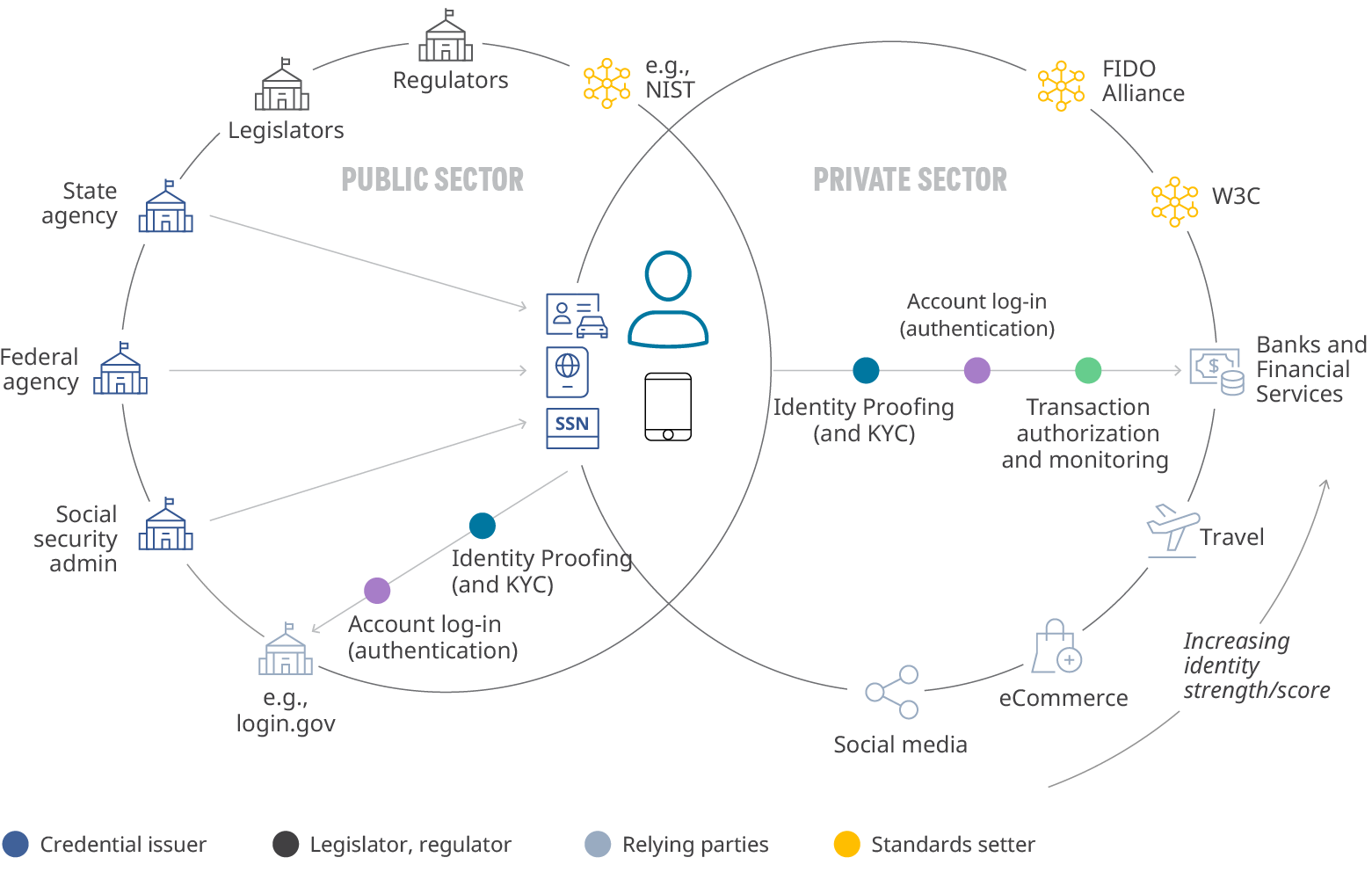

The three customer-facing processes where weakness in identity causes the most significant problems — and where better digital identity solutions can have the biggest impact — are identity proofing and KYC (which occurs at the point of onboarding a new customer), authentication (for example, a customer logging in to their online bank account), and transaction authorization and monitoring (see Note 1).

The Federal Reserve Bank of Boston has developed a “Fraud Classifier” model that shows clearly how bad actors can inject themselves into the financial system through each of these processes to commit fraud. Depending on the type and channel of fraud, dollar losses may be borne by the financial institution, the consumer, or a merchant. Even when the bank does not take the loss, its reputation may be damaged. To mitigate fraud losses, Financial Services institutions are already sustaining significant operating expenses.

The digital identity landscape is evolving fast; Financial Services institutions need to understand the ecosystem to reap its benefits

The digital identity landscape is evolving fast; Financial Services institutions need to understand the ecosystem to reap its benefits

Today, many Financial Services institutions are taking steps to improve their digital identity capabilities, typically seeking to upgrade historically manual and in-person verification processes to digitally enabled ones by moving to stronger verification and authentication methods. They have also been enhancing their authentication methods and transaction fraud monitoring processes. This market need has fostered a vibrant and competitive landscape of vendors with rapidly improving solutions across all three areas mentioned above.

Accordingly, one option for Financial Services institutions today is to explore the currently available solutions for each of these three processes, invite bids from vendors, and select based on price, performance, and ability to integrate with their existing systems. However, doing so would not fully take into account the potential effects of forces that are putting the U.S. digital identity ecosystem in a state of flux. Here, Financial Services trends in faster payments, the different roles played by both the U.S. government and private sector, evolution in underlying technologies, and competitive dynamics in the vendor landscape are all impacting the ecosystem. Regulators are also increasingly pushing for innovation in this space; the recent FDIC Tech Sprint on measuring the effectiveness of digital identity proofing in Financial Services is a prime example of this. Therefore, any bank seeking to upgrade its digital identity processes and controls first needs to understand these broader trends and how they might reshape the ecosystem and vendors; and then seek solutions that will have long-term relevance.

Below is a brief excerpt from the report.

Forces that are shaping the U.S. digital identity landscape

In the U.S., as in many other developed economies, the digital identity ecosystem is in a state of flux. Given this, Financial Services institutions need to keep an eye on what’s happening in the wider landscape as they contemplate investments in their digital identity solutions and capabilities.

The exhibit below, provides a view of the U.S. digital identity ecosystem from the perspective of the consumer. On the left side is the government, in the various roles that it can play. We explore these different roles and their potential impacts on the U.S. digital identity ecosystem in more detail in an Appendix, but it is important to acknowledge government’s central role as an issuer of identity credentials that are used to proof customers’ identities. On the right side is the private sector — principally comprising organizations acting as relying parties (everyone from social media, ecommerce, and travel companies to Financial Services institutions themselves), solution who support one of more of the key identity processes as outlined in Section 2 above, attribute and credential verifiers, as well as the key standardsetters such as the FIDO Alliance and World Wide Web Consortium (W3C) (see Note 2).

You can download the complete version of the report below.

About The American Bankers Association

The American Bankers Association is the voice of the nation's $23.7 trillion banking industry, which is composed of small, regional and large banks that together employ more than 2 million people, safeguard $19.6 trillion in deposits and extend $11.8 trillion in loans.

NoteS

1. This report employs numerous specific terms of art, which can be found in the Glossary.

2. W3C is the World Wide Web Consortium, founded and led by Sir Tim Berners-Lee, often referred to as “the father of the web.”