In recent years, headwinds have been observed in China’s life insurance industry, with Gross Written Premium (GWP) growth slowing to single-digit levels and the First Year Premium (FYP) dropping for an unprecedented three years in a row. This has given rise to questions of whether China’s life insurance market is saturated, and if not, what prerequisites it will take for the industry to regain its momentum. This report addresses the above questions by analyzing the industry’s long-term potential, and demystifying the misperceptions of the market and the industry’s short-term challenges. The report concludes with a set of proposed reform initiatives that the industry could undertake to realize its long-term potential.

Long-term potential

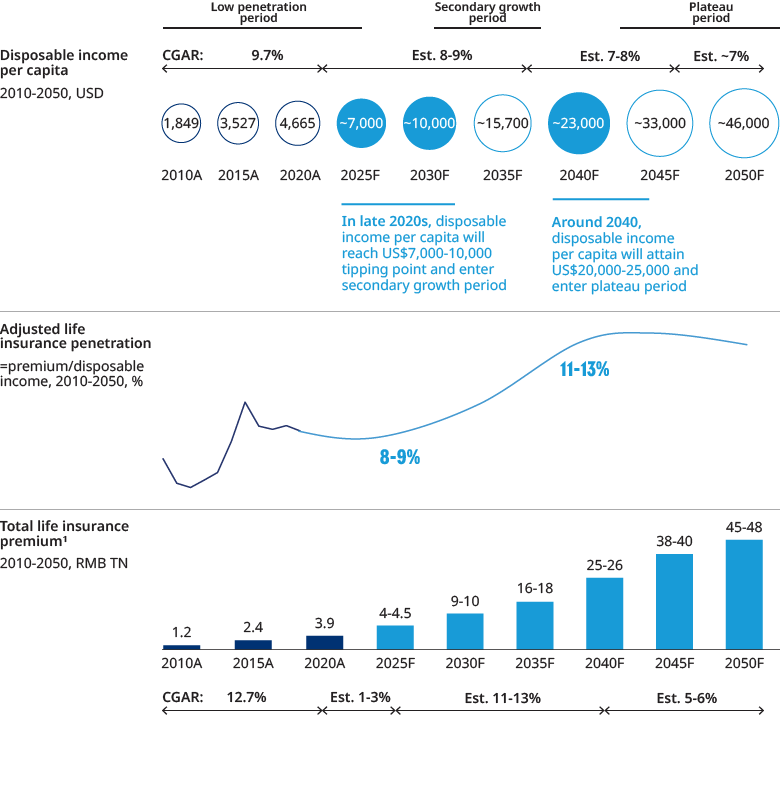

Based on a set of peer comparisons across Asian markets, at a mature stage, China’s life insurance market can be expected to reach an 11-13% penetration rate, expressed via the formula premium/disposable income; drawing from the experience in other mature markets, one can expect that China’s life insurance market will enter into an accelerated growth stage when disposable income per capita reaches the US$7,000-10,000 range. The anticipated growth rate will reach up to 13% per annum, making the market the largest in the world by 2030 and triple the size of the US market by the early 2040s. Medical insurance, pension and annuities, and term/whole life products present the most significant opportunity set for life insurers to support this expected growth, and these sectors will likely become the backbone of the industry in the future.

1. Includes the gross written premium (GWP) and deposit components for universal and investment-linked life products.

Market misperceptions and short-term challenges

With technology disrupting and transforming many consumer sectors, many believe digital enablement can be the silver bullet for the life insurance industry. The traditional headcount-based agency model would thus no longer work. To understand the issues more thoroughly, Oliver Wyman conducted primary research covering 12,000 individual life policyholders and agents from 12 firms. The results of the study point towards a different yet nuanced direction. Digital channels and tools are only the means, and the more critical and urgently-needed initiative is agent empowerment and reform. Life insurance will remain a ‘people business.’ At the same time, the original ‘mass-in-mass-out’ tied agency model is no longer sustainable, as it is unsuitable for serving the target segment of the middle class and above in China. High-quality agents are called for, and the roll-out of digital tools is only the first step in the reform process. What is more urgent is the enablement impact that such tools can create and the subsequent behavioral changes.

Reform initiatives

To address the aforementioned short-term challenges and seize the long-term opportunities, a customer-centric model which links customer profiles and needs, product sales and service delivery channels, and insurance ecosystem offerings together should be adopted. At the model’s heart is a mindset change from focusing on product sales to fulfilling customer lifecycle needs. Adopting such a model means gradually building trust with customers in three layers: trust in sales, products, and insurers. To create such trust, insurers will require a customer-centric ecosystem to bring together all kinds of financial and healthcare needs. A well-planned and incentivized agency reform initiative should be designed to support the ecosystem. We need the future generation of agents to be more adept in serving the needs of the middle class and above segments. The industry should also leverage the 2B2C channels, including a more robust and prudent development plan for the bancassurance channel, and the uptake of the opportunities arising in the group insurance channel. Lastly, digital channels will still have their advantage for more standardized products and should be leveraged to supplement the ecosystem.

In conclusion, Oliver Wyman is fully confident in China’s life insurance market. However, patience is required for the industry to get over the bumpy transformation period that lies ahead. To set the industry back on the right track for growth, both management and shareholders should show faith in the market, commit to the right initiatives, and continuously devote resources, even when there may not be immediate results.