Published, March 2022: The following report, "Financial Home" was created in collaboration with Oliver Wyman and InsurTech Hub Munich. InsurTech Hub Munich (ITHM) is a non-profit innovation platform uniting international insurance and cross industry partners, startups, investors, academia and governmental entities in their quest to make the industry future-proof. Our report provides market trends and a selection of FIN:SURE Insights, gathered from an ecosystem of insurers, tech leaders, financial players and innovative startups.

The time seems opportune to elevate digital financial relationships to the next level — from a digital version of an in-person financial advice interaction to a truly holistic and personalized offering, a Financial Home.

The time seems opportune to elevate digital financial relationships to the next level — from a digital version of an in-person financial advice interaction to a truly holistic and personalized offering, a Financial Home.

Financial planning, the need for innovation

For many decades, life and pension insurance products were the preferred choice when it came to providing peace of mind for long-term financial planning. Yet the game has changed for both the insurers and customers. The ongoing environment of low interest rates in most industrialized countries has been weighing heavily on Life insurers’ profitability, especially for those with products offering guarantees.

On the customersʼ side, volatility of global markets and the incisive effect of the global pandemic has raised attention for long-term financial stability, driving demand for products and services offering safe and transparent solutions. However, it is not insurers, traditionally trusted providers of security who are serving this trend. Customers are increasingly turning to new entrants for simple and convenient personal finance and investment solutions.

In this environment, insurers are increasingly asking themselves: “What role can we play in providing solutions for customers looking to secure their financial future?” The following whitepaper, “Financial Home,” was created in collaboration with Oliver Wyman and InsurTech Hub Munich (ITHM). It provides an overview of market trends, a mapping of strategic challenges that insurers may face, and a detailed description of real-life customer personas, with distinguished profiles to determine different needs towards a financial home offering.

Overall, the market for financial home solutions is still open to be defined: key players, target groups, market volume and scope, as well as strategic milestones and success factors are continuously being developed. All of this results in untapped business development potential and opportunities for insurers and Insurtechs. Below is an excerpt of our report, for the full "Financial Home" PDF version, please click here.

A Financial Home should be a trusted platform, combining customer journeys in one holistic view — to create an entry portal to the customer’s personal financial world, that is accessible, transparent, comprehensive, and in-line with customer value.

A Financial Home should be a trusted platform, combining customer journeys in one holistic view — to create an entry portal to the customer’s personal financial world, that is accessible, transparent, comprehensive, and in-line with customer value.

Financial Home — A digital portal to the financial world

People are creatures of habit. When we think about looking for information, shopping or traveling, most of us have our favorite websites in mind. Our portals to the internet, to e-commerce or to digital travel.

But what is the portal to our financial world? For many of us, there is no one answer to this question. We often use many different digital tools for initiating payments, banking, borrowing, investments, or safeguarding our future. Our digital financial world is often fragmented, and also influenced by our everyday lives: our earnings and (planned) spending and sudden surprises, such as accidents. It’s no wonder that we often make financial decisions based on partial information, gut feelings, and at times this even can be influenced by questionable advice. It’s fair to say, that the ways we make good financial decisions can be improved.

For the wealthiest, a solution exists — private banking. A very labor intensive, expensive solution that is out of reach for the larger population. Wouldn’t it be beneficial to have accessible digital private banking services on our smartphones? Essentially, having the ability to access services through one centralized portal, or a Financial Home. The obvious answer is “yes,” but the task is so complex that it’s not easy to accomplish. So, while the digital private banker is the holy grail for a Financial Home, it will not be achieved in a single bold step. It needs to be designed and built in a way that provides customer value. This, at the core, is a business model problem. Technology is only the enabler. So how we can make progress and get there?

A Financial Home should be the portal to a customer’s financial world. This means, it must encompass all relevant activities and features needed to manage finances.

On one hand it provides what’s needed to manage cashflow — managing earnings, enabling transfers, and tracking spending. Concretely, it should provide access to bank accounts, payment providers and possibly cryptocurrency wallets.

On the other hand, it should help manage wealth — enabling borrowing, and helping clients to grow and protect wealth. To do that, built-in features like financial planning will enable clients to get a grip on their financial future. Insurers are well positioned to help grow and safeguard wealth. This clearly is the sweet spot.

Customers want financial home solutions

There is significant interest in developing a Financial Home proposition! Prior to COVID-19, Oliver Wyman conducted a broad consumer survey across five European countries. Among the 5,000 consumers surveyed in Germany, France, Spain, Italy and the UK we found that 33% were interested or very interested in using a Financial Home solution.

In strong bancassurance markets, such as France, Spain, Italy, the interest was even higher, in Germany with 26%, a little lower. It makes sense given the fact that customers in strong bancassurance markets have learned to get all their finance and insurance problems solved at one place — the banks. We are still a long way from initial interest to the regular daily use of a Financial Home offering. Customers will need to be convinced and approached in a low barrier way to leverage the full potential.

Consumers want holistic financial advice

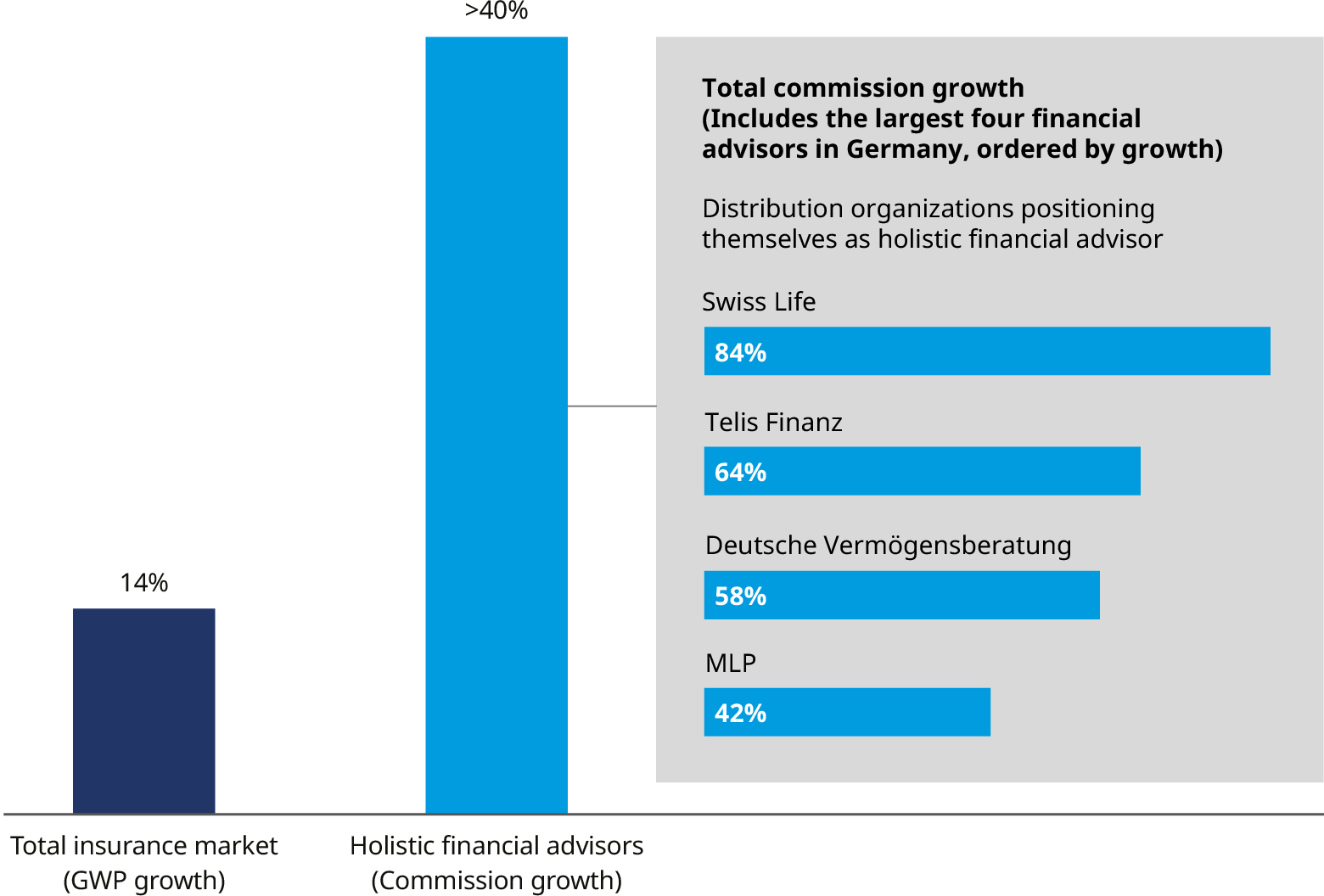

There is also clear evidence and demand in today’s analog world to incorporate holistic financial advice as part of a Financial Home. In Germany, banks are only partially perceived as the go-to-place for managing all of your finances compared to consumers in bancassurance markets. Consequently, an industry of distributors promising holistic financial advice has developed in Germany. Their value proposition is even broader than that of the well-known independent financial advisers (IFAs). They not only cover investment and banking products, but also access to insurance products, mortgages, and sometimes even real estate. Financed through commissions, this solution is also accessible to many people.

Financial Home solutions can bring together direct digital and holistic advice

Besides the clear market trend that sales organisations offering holistic advice across insurance, banking, and investment products are increasingly growing strong, there is another area of growth in the market — digital direct business models. It´s no secret that platforms such as online price comparison sites and well-positioned digital direct-to-consumer offerings are growing and step-by-step winning market share. This is driven by attractive pricing, but also because of easy access, transparency, flexibility, and simplicity of the offerings. Oliver Wymanʼs consumer survey across five European countries revealed that coverage flexibility (37%) was the top reason German consumers used neo-insurers with attractive prices coming in a close second place (34%).

Digital direct and holistic advice offerings are two significant growth drivers observed in the market. This is what a Financial Home needs to bring together. If well-designed, it can become a confluence of both success models.

1. Strengthening exclusive channels

Insurers that own an exclusive distribution channel will be driven by the need to protect and support this market access. This is, where Financial Homes can play a role, igniting growth and helping to defend the channel and secure market share. Going down that path needs to be more than a simple extension to an existing customer portal — a channel transformation is required. The inherent promise of a Financial Home is holistic financial advice. The channel needs to be enabled to live up to this promise — without that, it limits consumer value and creates a mismatch between the channel promise and the basics of a Financial Home. So, a simple technology investment deployed as another digital tool for an existing channel will not be sufficient.

2. B2C value proposition

Launching a Financial Home as a stand-alone B2C proposition means going head-to head with competitor offerings — whether the solutions of well-funded start-ups, or propositions of banks and large technology companies. In this archetype, the insurer builds a Financial Home to directly address (new) customers. This build is not intended to support existing sales channels. Hence, it needs a magnetic value proposition to find its customers with acceptable customer acquisition costs. And it needs the agility to out-compete others, which may be nimble in replicating successful ideas. In short: this is an “all-in” approach with significant funding and accepting failure as a prerequisite. The recent history of neo-banks launched by incumbent banks offers examples of successful ventures but also of failed attempts.

3. B2B2C value proposition

Insurers that have distribution partners with deep consumer relationships can leverage this access for launching a Financial Home. At the core, this means developing an offering that fits into the partner’s value proposition — and expands the digital insurance offering, that the partner will ask for anyway. Convincing the partner to go beyond insurance is the goal. For example, offering a technical solution and helping the partner create new efficiencies and save money could strengthen the overall partnership and open new revenue and profit streams for both parties. In today’s market, this is largely unchartered territory, but the potential is huge. It ranges from extending the value proposition of classical B2B2C insurance partners (such as retailers or telecommunication companies) to delivering a Financial Home as an extension to a digital employee benefit portal.

Strengthening exclusive channels with “Financial Home” is a transformation journey.

Strengthening exclusive channels with “Financial Home” is a transformation journey.

The time to act is now — for three reasons

Be first to get it right

Most customers will only use one Financial Home. Done right, it is their single portal to the financial world instead of one of many. We believe that while it is not necessary to be the first to market, the first to get it right will win and build many customer relationships.

Defending and leveraging existing assets

A Financial Home is more than only a digital tool. Success requires a repositioning in the mind of the consumer, and hence a transformation of the asset that has the trusted customer access. For example, if your asset is that your customers view you as the “go to place” for getting insurance, you need to transform this asset to be perceived as “the go to place not only for insurance.”

The COVID-19 catalyst

COVID-19 might, in hindsight, turn out to be the catalyst for Financial Homes. The pandemic has accelerated the digitization and with it the widespread use of digital financial propositions by consumers. Getting holistic financial advice is no longer a matter of an in-person meeting. Relationships between customers and companies have changed towards being more agile, remote, and digital. In short, the pandemic has created a window of opportunity. Use the momentum. The time is right to elevate digital financial relationships to the next level — from an in-person financial advice interaction to a truly digital offering, a Financial Home.

Act now. The timing and circumstances are opportune for a Financial Home. Don’t be left behind by the competition. But you have to get it right.

Act now. The timing and circumstances are opportune for a Financial Home. Don’t be left behind by the competition. But you have to get it right.