Our current forecast anticipates that MRO spend will approach $80 billion in 2022 and come close to matching 2019 (pre-COVID-19 levels) in 2023. Survey respondents overwhelmingly indicated that government policy regarding COVID-19 is the most important factor dictating the pace of travel recovery, with customer sentiment being second and the actual health situation (case counts and hospitalization rates) of less concern.

Unless there is a dramatic return of COVID-19 worldwide, we are optimistic for the recovery of all MRO sectors to 2019 levels in the near future. But in aggregate for 2020-2030, we anticipate the total MRO market will be $160 billion (13%) smaller than the pre-COVID-19 forecast.

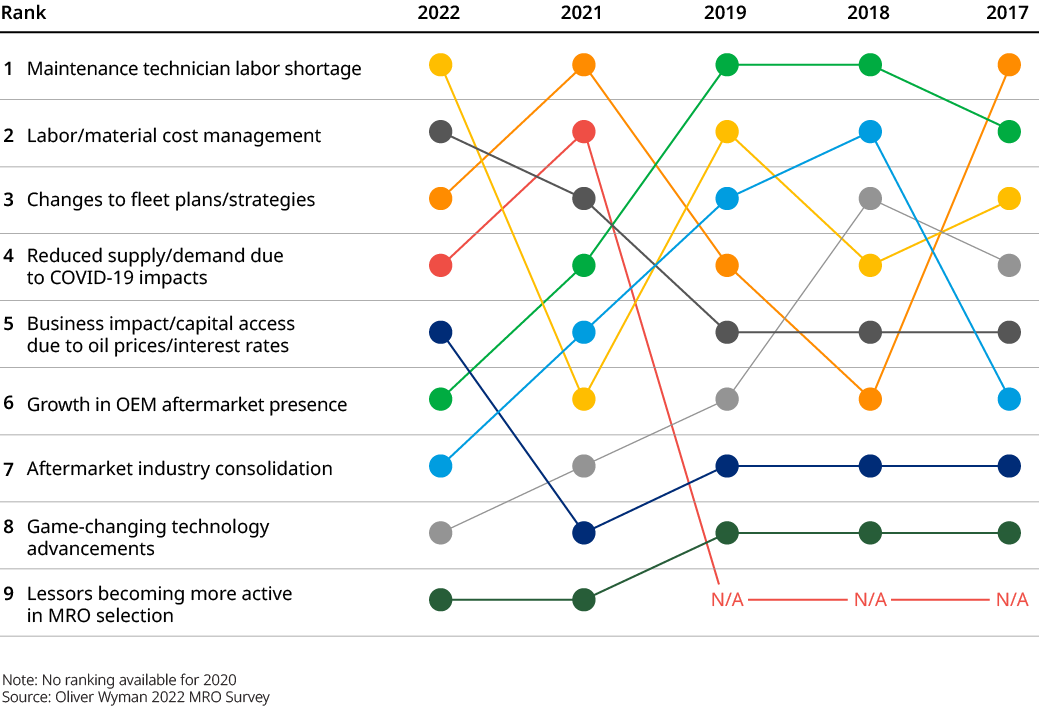

Top disruptors for the MRO industry

When asked about top disruptors for the MRO industry over the next five years, respondents cited a shortage of maintenance technicians as the top disruptor. After reducing workforces during the pandemic, the industry is now scrambling to secure labor to satisfy quickly recovering demand. And it is attempting to do so in a labor market that was tight even before the pandemic.

Respondents ranked labor/material cost management as second among top disruptors. MROs over the next few years will be looking for any operational efficiency gains they can make to offset increased material and labor costs. Changes to fleet plans and strategies also ranked highly, as the industry continues to evaluate longer-term impacts of the pandemic on demand and prepares for the influx of next generation narrowbodies (A320NEO, 737 MAX, etc.).

A tight labor market

Labor availability has been a concern for many years for MROs, but the COVID-19 pandemic, which brought about a wave of retirements, has accelerated the labor challenge. Fewer people are entering the industry, with work environments, questions about industry stability, and perceptions of aviation as a legacy industry all impacting the appeal of aviation jobs. Two-thirds of survey respondents in every region indicated that securing labor has become a challenge, with the problem most acute in North America.

More than half of survey respondents reported that the lack of labor is already beginning to constrain growth. This is notable, given that demand has yet to fully return to pre-pandemic levels. To attract talent, survey respondents pointed to apprentice programs and technical school partnerships as the most effective, but executives we interviewed are looking at a range of creative tactics to expand the talent pipeline.

Cost management crossroads

Survey respondents are anticipating significant inflation over the next two years. Some 60% of respondents anticipate that materials costs will increase by more than 5%. North American respondents expect the largest inflation in labor costs, with 59% expecting increases of 5% or more.

To contain costs, 80% of survey respondents plan to continue focusing on operational efficiency measures and renegotiating supplier agreements. For operators, 65-70% said that the use of greentime engines and alternative parts/repairs will be important cost levers going forward. Increased use of Used Serviceable Materials (USM) to manage costs did not materialize as expected in 2021; the market effectively “seized up” due to uncertainties around fleet needs and less need for materials overall. But two-thirds of respondents believe a substantial increase in USM is coming over the next 1-3 years.

The sustainability imperative

Nearly 90% of survey respondents indicated that sustainability is a priority for MRO-related activities. More than three-quarters expect sustainability to become an area of high focus within the next few years and report that their companies have put in place sustainability targets.

Although the industry appears enthusiastic, most levers to improve sustainability are still in the early stages of development. The most widely used is recycling, with nearly half of respondents indicating they are recycling now. About a third are measuring GHG emissions or taking steps to reduce direct resource input needs. Potential focus areas in the future for MRO could include the use of renewable energy and co-generation for facilities, electrification of vehicles, and better waste disposal processes. A majority expect sustainability to become a required cost of doing business rather than a pricing differentiator, but sustainability may play another key role: Several executives noted in interviews that sustainability and climate risk have become important to talent recruitment and retention efforts.

About the MRO survey

In its second decade, the annual Oliver Wyman MRO survey is an industry standard that samples the attitudes and strategies of executives from across the aviation industry, as they address key trends and emerging issues in the maintenance, repair, and overhaul sector. In this year’s survey, we focused on the continuing challenges of labor shortages, cost management, and sustainability. As always, we have leveraged the latest Oliver Wyman Global Fleet and MRO Forecast to provide additional color.

More than 150 global aviation professionals responded to this year’s survey. We also conducted hour-long interviews with more than 30 senior MRO leaders worldwide to provide additional insights. Survey and interview participants were drawn from a cross section of airline operators, airline and independent MROs, original equipment manufacturers (OEMs), and others. Approximately half of respondents were senior executives (C-suite or vice presidents) and 70% were director level or above. Over 60% of respondents’ companies are headquartered outside of North America.