In partnership with Aircraft Leasing Ireland (ALI) and the University of Limerick, Oliver Wyman has developed “Aviation Sustainability: Our Future,” an in-depth report that analyzes the latest improvements in aviation sustainability and outlines the possible options and pathways for the industry to achieve net-zero greenhouse gas (GHG) emissions by 2050. ALI’s 31 members include 18 of the world’s top 20 aircraft lessors and the majority of the global lessor-owned fleet.

Respondents to the World Economic Forum’s 2021 Global Risks Report ranked environmental risks as four of the top five global risks in terms of likelihood. Investors are now viewing risk and sustainability as integral to financial risk assessment; they may soon price aviation investments as higher risk if sector decarbonization is not addressed effectively.

This report provides an analysis of aviation’s potential pathways to achieve net zero by 2050 through aircraft design changes, operational improvements, sustainable aviation fuels, electrical/hydrogen propulsion, and aircraft recycling. In addition, it considers how the aircraft leasing sector can help drive aviation toward a sustainable future through tangible actions, including the immediate development of a sustainability charter for aircraft leasing.

Many actions are already underway to address aviation emissions through improvements in aircraft design and operational efficiency. Emerging technologies such as sustainable aviation fuel (SAF) are beyond the pilot stage and beginning to scale. Step changes in technologies such as electric or hydrogen propulsion are underway but are a long way from realization, due to complex technical challenges.

Aviation emissions and decarbonization pathways

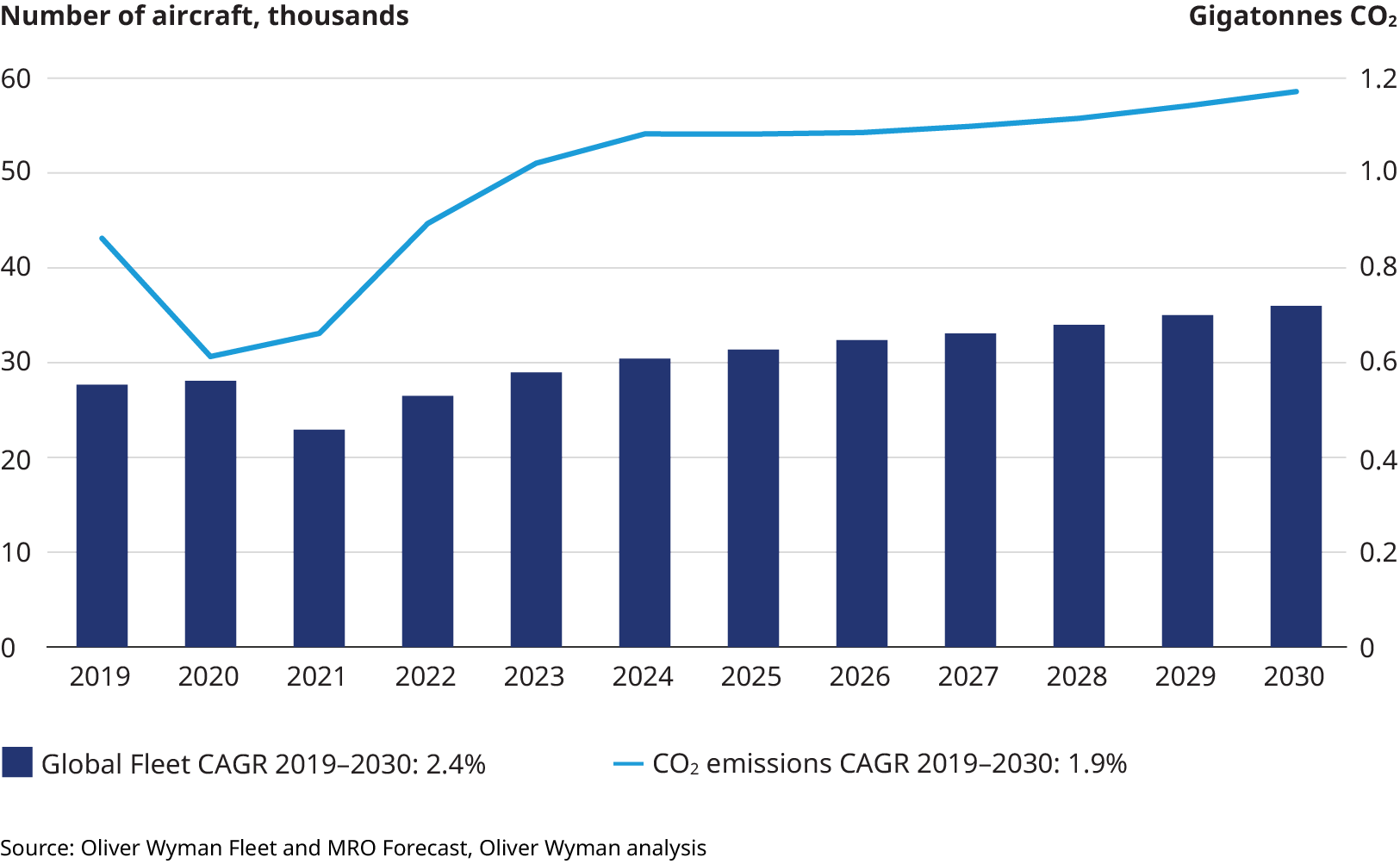

In 2019, aviation accounted for about 2.3% of global GHG emissions. On a seat-per-kilometer basis, aviation has cut emissions in half since 1990 through improvements in aircraft design, aerodynamics, materials, and operating efficiencies. But the industry’s absolute CO2 emissions are continuing to rise, in line with the expansion of air travel demand and the growth of the global fleet.

To entirely decarbonize aviation and reach net zero will be extremely challenging. The industry is highly regulated, which means that the technological leaps required to address climate change must be measured in decades, not years. Stabilizing emissions and then reaching net zero by 2050 is critically dependent on the actions the industry takes right now.

A combination of decarbonization pathways will be required, taking into account the entire life cycle of aircraft. The priority of course is fuel and propulsion, since most GHG emissions take place during flight. SAF is expected to be the main driver of emissions reduction through 2050. Electric and hydrogen propulsion are likely to have limited impacts until post-2040. In addition, aggressive operational and design improvements can play an important role in holding down the net increase in aviation’s GHG emissions.

Sustainable Aviation Fuel (SAF)

SAF refers to aviation fuel derived from non-fossil fuel sources. A variety of sources for SAF and production pathways have been approved; SAF is in production and in use by commercial aircraft on a limited scale. How fast and how much the industry can scale over the next few decades will largely drive the pace of aviation decarbonization.

Today, 17 sites produce SAF, but more than 80 additional production facilities are planned worldwide. Running at full capacity, this scale would be enough to meet aviation’s needs by 2050. But the raw materials used to make SAF are in demand to make other biofuels as well, such as renewable diesel – which is cheaper to produce. That said, the pressure on feedstocks may wane as electric cars and trucks become more common and as SAF technology matures.

Electric propulsion

While several options exist for electrifying aircraft propulsion systems, these technologies are in the early stages of development for large commercial aircraft. An immediate problem is that batteries are heavy; aircraft need a lot of them to replace the energy in liquid fuel. In addition, aircraft get lighter as they burn fuel, but don’t if carrying batteries. This creates a Catch-22: the heavier the plane, the more batteries it needs.

Over time, battery energy density is expected to improve, but all-electric propulsion is likely to be restricted to short-haul aircraft for some time to come. Hybrid systems seem more likely for large planes, but even these come with many engineering challenges that are yet to be solved. A nearer-term option may be electrically assisted propulsion systems (EAPS), which can help reduce fuel burn during specific flight phases, such as take-off and climbing.

Penetration of electric-powered aircraft into the market

Hydrogren propulsion

Hydrogen is an appealing fuel source, as it is not a source of CO2 emissions. In aviation, hydrogen-electric hybrids could be a good option for commuter and short-haul aircraft. But these aircraft and flight types only account for about a quarter of GHG emissions: Medium- and long-haul aircraft are the real prize. Challenges must be solved around how to store hydrogen aboard aircraft, which in liquid form must be kept very cold and would need larger fuel storage tanks than planes have now. The tradeoff: liquid hydrogen only weighs a third as much as jet fuel.

Improvements in aircraft efficiency, flight, and ground operations

We believe that the steady pace of aircraft efficiency improvements since the 1960s will continue through at least 2040, as ongoing technology advances continue to make engines more efficient and planes lighter and more aerodynamic. Finally, optimizing flight, ground operations, and air traffic management (ATM) is another area of focus expected to drive small but material GHG emissions reductions.

ESG and the role of aircraft lessors

Other environmental topics covered in the report include aircraft recycling and a wider view of aviation’s non-CO2 emissions. We also delve into the social and governance considerations that make up the other points of the ESG triangle and which will impact how the aviation industry approaches decarbonization. Finally, we review the actions that the aircraft leasing sector could take to drive sustainability in the industry. Most importantly, as buyers of more than half the world’s aircraft, lessors could demand the acceleration in technology development from OEMs that will be vital for aviation to achieve net-zero by 2050.

Download the report for the full discussion of the topics highlighted above and more: