One of the biggest challenges of our time is how we will respond to the demand for sustainability and the need to decarbonise production. While the public at large is focused on industry’s responses – increasingly so, with every misstep at home and abroad being highlighted and punished – B2B customers are looking to industrial equipment manufacturers to create breakthrough solutions in sustainability and de-carbonization.

Equipment manufacturers are impelled to act quickly

Equipment manufacturers are well aware that it is not only what happens within their business that determines whether or not they succeed in meeting their climate goals – a large proportion of all their emissions happen outside the company confines – both upstream and downstream. Such Scope 3 emissions are increasingly coming under scrutiny. This is here where equipment suppliers hold the trump card, as they will play an absolutely central role in helping energy producers, discrete manufacturing industries as well as process industries achieve their environmental, social, governmental (ESG) goals, or not.

The good news from our research is that a number of emerging ESG Champions are already starting to support this transformation through a wide range of innovations.

Where machinery and equipment manufacturers stand today

We wanted to better understand how equipment manufacturers are responding to what’s being demanded of them. To this end, we analysed the top 100 European machinery and equipment manufacturers leveraging our Oliver Wyman Carbon Database. The results show that the industry still has a long way to go to meet expectations. While many appear to be doing their best to meet regulatory demands, it is clear that a few are still dragging their feet and doing as little as possible. More encouragingly, a number are moving forward at speed, seeing ESG for the opportunity that it is.

Our research shows high ESG awareness, with over 70% of European equipment manufacturers now issuing some sort of sustainability report, either separately or integrated into their annual report. More than half of companies also issue CO2 targets in Scope 1 and 2 emissions. On average, they managed to reduce those types of emissions by 9% p.a. in the last years.

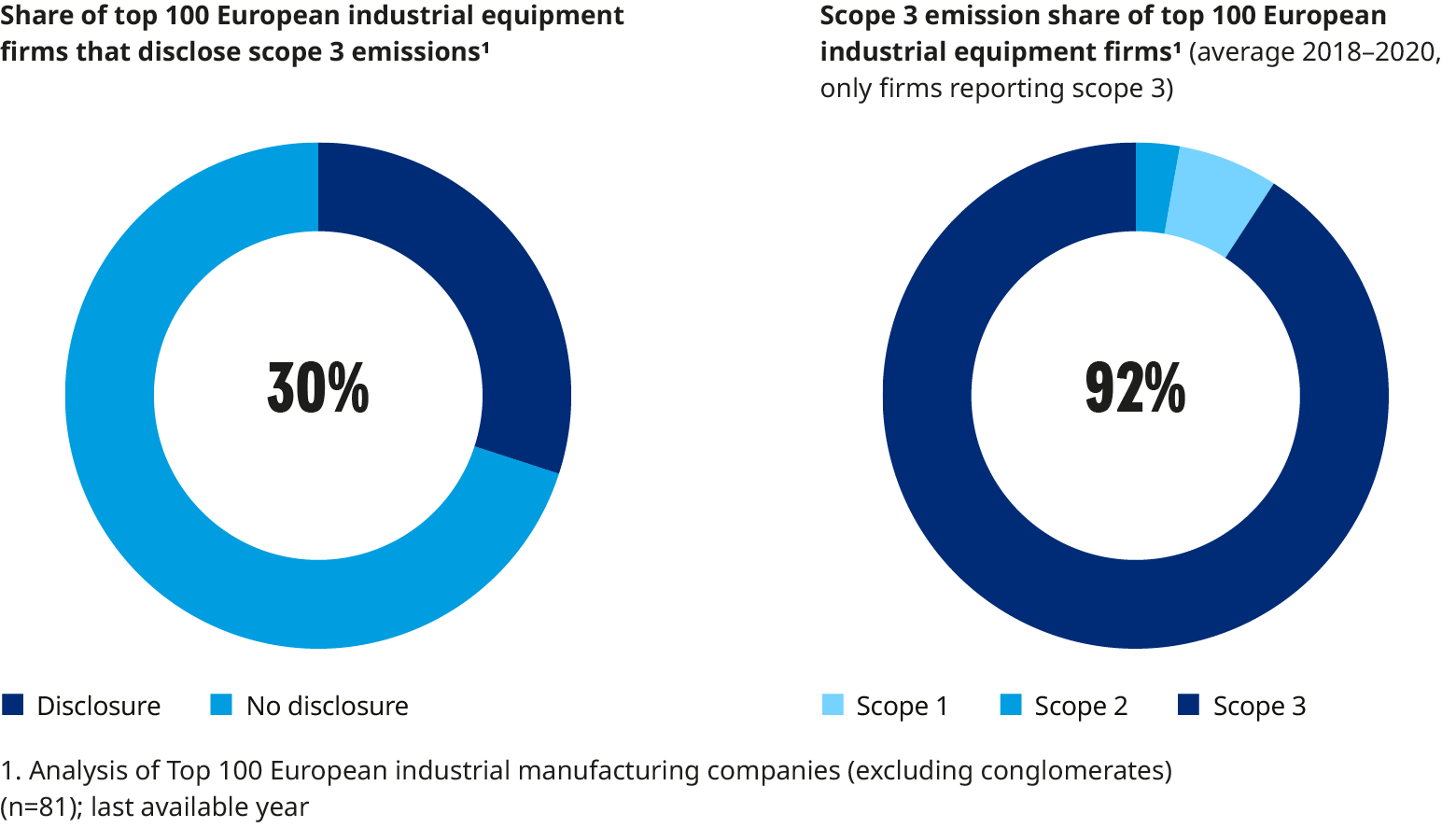

The more troublesome aspect is in regard to Scope 3 emissions. Currently, only 30% report such emissions at all. Such reporting is vital, as has already been highlighted, as what happens upstream and downstream is even more important for equipment manufacturers than what happens within their own four walls. Though varying somewhat by sub-sector, Scope 3 emissions on average account for around 90% of machinery and equipment manufacturers’ carbon footprint.

Nor do the current projections square with ambitions. Our research shows that fewer than 10% of the top 100 machinery and equipment manufacturers have targets and plans that are sufficiently ambitious in terms of their goals and timeframes to meet the Paris target of limiting global warming to 1.5 degrees. Though this is disappointing, the same is also true of other sectors.

Find out what strategic choices and opportunities equipment manufacturers have and how to become an ESG champion.

.jpg/_jcr_content/renditions/cq5dam.thumbnail.319.319.png)