Part 3 in a series

This article examines the implications of rising interest rates on life insurance products, focusing on in-force retention, new business strategy, and third-party transactions. The past year has seen interest rates rise materially from 2020 lows. The article provides key considerations as well as action items for insurers seeking to maximize competitive advantage in a rising-rate environment.

Key highlights:

IN-FORCE RETENTION

Traditional products such as term life or whole life offer few levers for insurers to control policyholder behavior. While the impact of rising rates on term life is unlikely to cause policyholders to submit to re-underwriting, whole life policyholders may surrender at increased rates due to competitors offering richer benefits. An active retention program targeting profitable policyholders most likely to surrender may be the best solution.

Insurers have more leverage with interest sensitive products, where they can respond to rising rates by increasing credited interest in order to retain policyholders. The key challenge is that the yield on existing portfolios will lag relative to the interest rate environment, making it difficult to offer crediting rates that will compete with new money products. Insurers will need to find a point of balance between the benefits of preventing lapse and the drawback of increasing credited interest.

NEW BUSINESS PROFITABILITY AND PRODUCT DESIGN

Rising interest rates could provide opportunity to insurers to realize increased profitability in the short term. The challenge insurers will face is finding the balance between retaining additional earnings and increasing competitiveness of products. In the long term, competition will reduce insurer’s ability to retain the additional yield; those insurers who act quickly will be poised to realize the largest additional profits but will also bear the greatest risk.

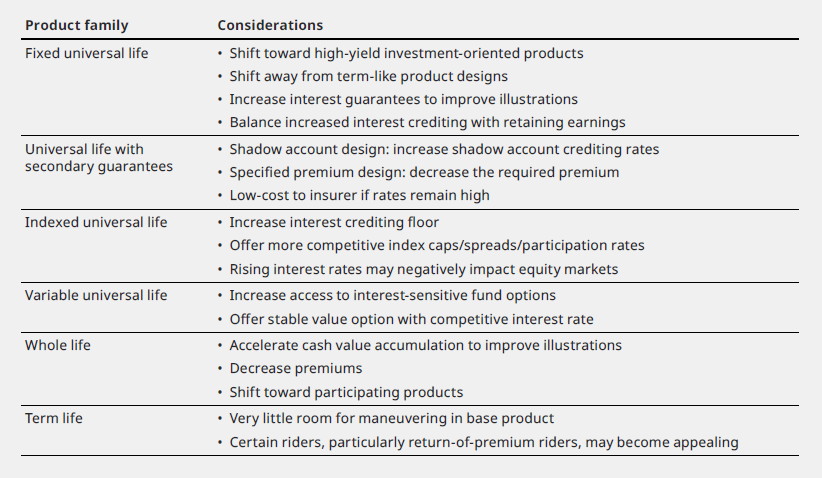

Alterations to product design and business mix may allow insurers to increase the appeal of products:

REINSURANCE AND M&A

Low interest rates have driven a significant portion of reinsurance and M&A activity over the past decade, as insurers sought external relief for products not designed to perform well in a low rate environment. An increasing rate environment may lower the appetite for transactions of this nature; however, insurers may still seek to leverage offshore reinsurance arrangements to allow for more competitive pricing. M&A transactions may shift toward riskier business, as the impact of the risk-free component on the risk discount rate is small relative to transactions on low risk business.

Download our paper to read more.

This report was also authored by Jeff Raven, Consultant at Oliver Wyman.