Part 1 in a series

In the first of a series of articles, we summarize inflationary factors that may result in a sharp increase in interest rates and implications for life insurer convexity risk exposure, most notably to dynamic policyholder lapsation. We further provide insights into potential ALM strategies to mitigate this convexity risk.

Key highlights:

Rising interest rate environment — what is unique this time?

Tail risk — convexity and embedded options

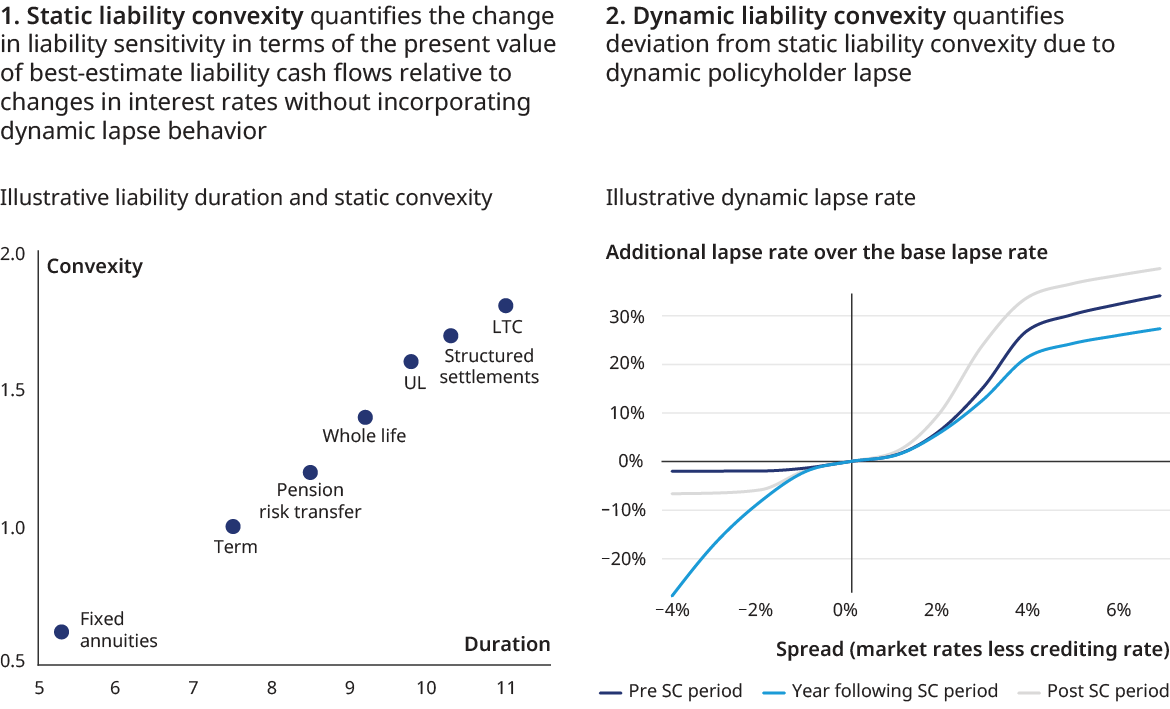

Due to the prolonged low-interest rate environment and low minimum interest rate guarantees offered to policyholders, liability convexity is higher than prior historical periods, which results in life insurers’ ALM positions being extremely vulnerable to short-term interest rate spikes.

Measuring liability convexity

Liability convexity can be attributed to the following two metrics:

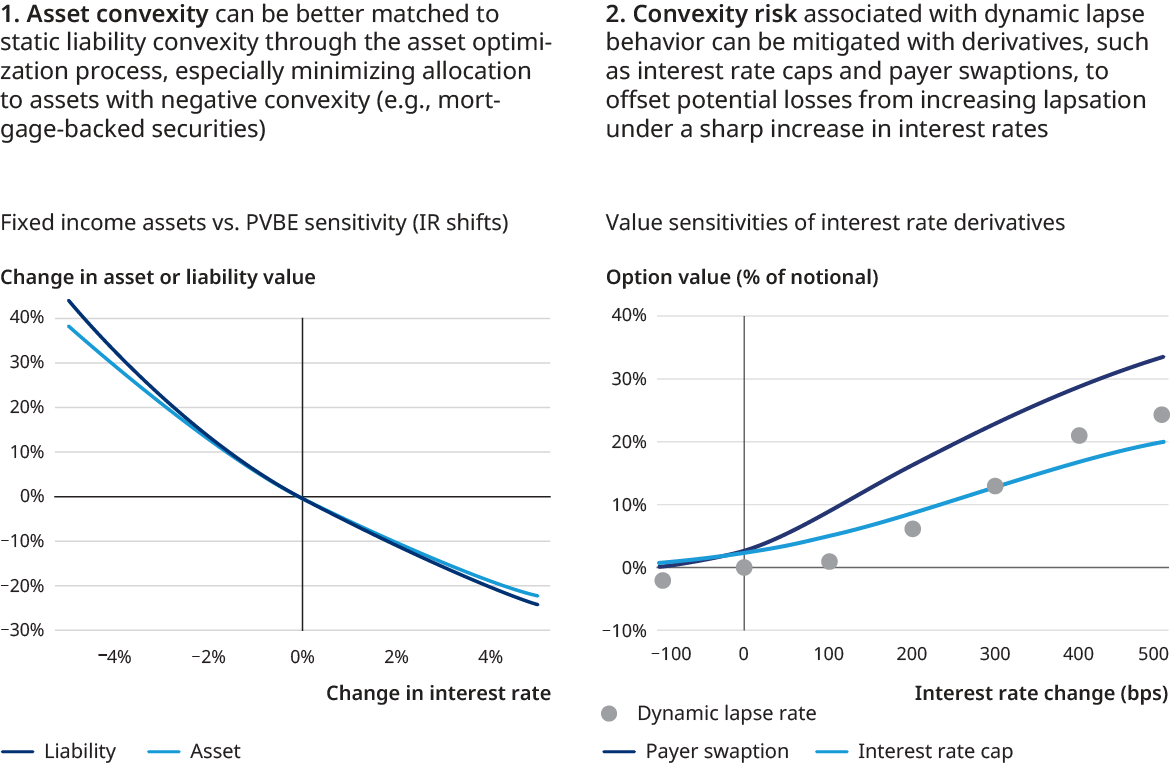

Implication for asset allocation and hedging

Convexity mismatches cause issues for life insurers under both rising and declining interest rate scenarios. This means that life insurers are not compensated for taking convexity risk and, therefore, convexity matching should always be considered in the asset optimization process.