Actuarial insights: Life insurance impacts under a rising interest rate environment

Welcome to our article series that addresses how life insurers should prepare for what lies ahead under a rising interest rate environment.

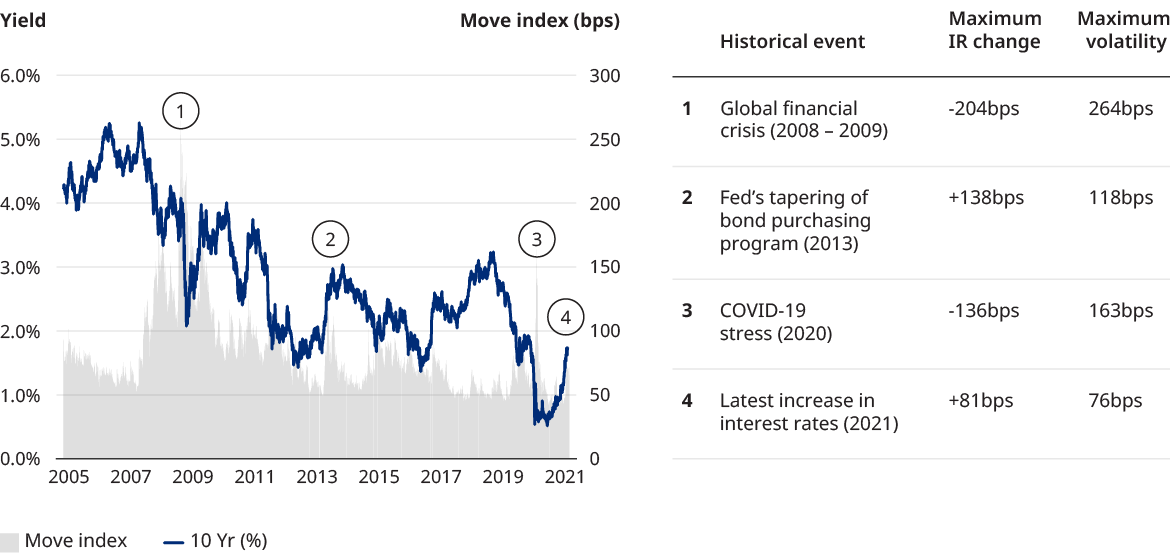

The 10-year U.S. Treasury rate increased 81bps during the first quarter of this year. While a modest increase in inflation and interest rates is generally thought to be beneficial to the life insurance industry, a sharp increase in rates and the resulting tail risk could be quite the opposite.

Over the coming months, we will be sharing a series of articles highlighting impacts to the life insurance industry from a potential rising interest rate environment. The topics include: 1) ALM strategies under a potential spike in interest rates, 2) Implications for financial reporting, 3) Market trends, product development and design considerations, and 4) Implications for individual product lines such as life insurance, annuities, disability income, and long-term care.