This article was first published on May 17, 2021.

While change is the only constant in life, there are certainly periods where change is more amplified. We currently find ourselves in one of those periods. The world and our key industries are not immune to the ripple effects of the global pandemic. As an example, for the financial services industry, there are many drivers of change: in the short term, retail banks are facing downward pressures on net income due to record-low interest rates and increasing delinquency rates, and the need to trim costs quickly; in the medium term, new remote working routines are further accelerating digitization, automation, and disintermediation. As a result, business and operating models are trying to adapt to the “new normal.”

The firms able to effectively deliver change will thrive and are more likely to emerge stronger from these changes. However, as recent social science research has shown, delivering change is no easy task: humans have a natural bias against change. Failing to drive change is a challenge to the competitiveness and sustainability of any firm, creating monetary costs, eroding trust with customers and investors, and weighing on culture and employee engagement. On the flip side, firms that successfully deliver change set off a self-reinforcing feedback loop that increases profitability and productivity, builds trust with stakeholders, and attracts top talent.

An often forgotten institutional ‘muscle’ for firms is the ability to effectively manage change risk—the risk that a change program fails to deliver the desired goals. We believe that most firms do not proactively manage change risk in a way that commensurate with the benefits of success and the costs of failure. Effectively managing change risk is a necessary ‘muscle’ to reduce, preempt, mitigate, and manage the challenges that come with (intents of) transformation, without bringing decision paralysis or stifling innovation in the organization. We refer to change risk as a ‘silent risk’ because this ‘muscle’ is often neglected and, too often, that neglect is one of the root causes behind the inability to drive to the desired outcomes.

In our paper, we present an approach to proactively manage change risk, including:

- How to manage change across the end-to-end change lifecycle, to ensure firms develop fit for purpose mechanisms

- How change risk management is a key component of the journey, and the best ways to understand drivers of successful change

- Recommendation for four key change management capabilities, a change risk management framework, change delivery igniters, workforce change capacity management, and a process for initiative prioritization; and actions to help leaders make change management a priority

Below is an excerpt from the report, for the full PDF version, please click here.

Our views on successful change

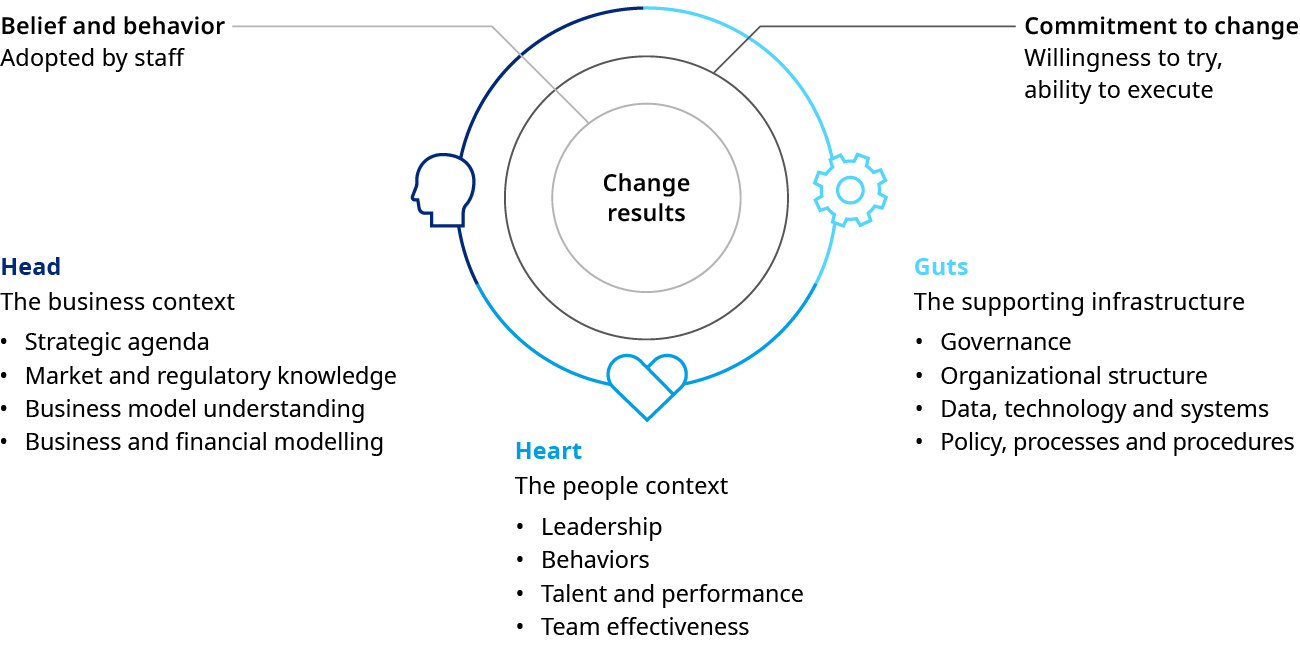

Effective change boils down to directing energy and aligning efforts toward three key elements:

- The strategy and thinking

- The people and behaviors

- The underlying infrastructure

We call these elements the Head, the Heart, and the Guts of an organization. Successful change should have risk management embedded into these key elements.

Successful change occurs when the Head, the Heart, and the Guts are fully aligned, resulting in an organization that has: (1) the willingness to change—through leadership, personal drive, and the identification of strategic value; and (2) the ability to execute—through an adequate workforce, the right infrastructure, and a clear roadmap.

Too often, firms facing change tend to focus on the Head at the expense of the Guts and, especially, the Heart. Such firms often struggle to achieve successful change because lasting change requires individuals to collectively change behaviors. For example, a firm does not become more customer-centric when rolling out a new top-down campaign or training module. Rather, the firm becomes customer-centric when the workforce begins adopting customer-centric behaviors—the way customer interactions play out; the way products are configured; and the way senior leadership communicates and makes decisions.

Change is the only constant in lifeHeraclitus, c. 535 BCE – 475 BCE.

Change is the only constant in lifeHeraclitus, c. 535 BCE – 475 BCE.

Experience and research indicate that, for change to occur, each level of the organization needs to understand the objectives and purpose of the change, as well as the new behaviors to adopt. Change experts across the globe call these “vital behaviors”—the smallest actions that, if consistently repeated, will lead to the intended outcomes.

In driving change, the ability to manage change risk needs to be developed in the Guts (through risk management capabilities); the Heart (through an understanding of the workforce stoppers and capacity in the firm); and the Head (through the incorporation of change risk into the firm strategy). Our research shows that, historically, neither risk managers nor front-line risk owners have paid enough attention to managing change risk. If firms believe—as we do—that a better managed change risk is a key success factor, firms must pay more attention to driving alignment between Heart, Head, and Guts in order to achieve successful change, and also appropriately embed risk management capabilities across these elements.

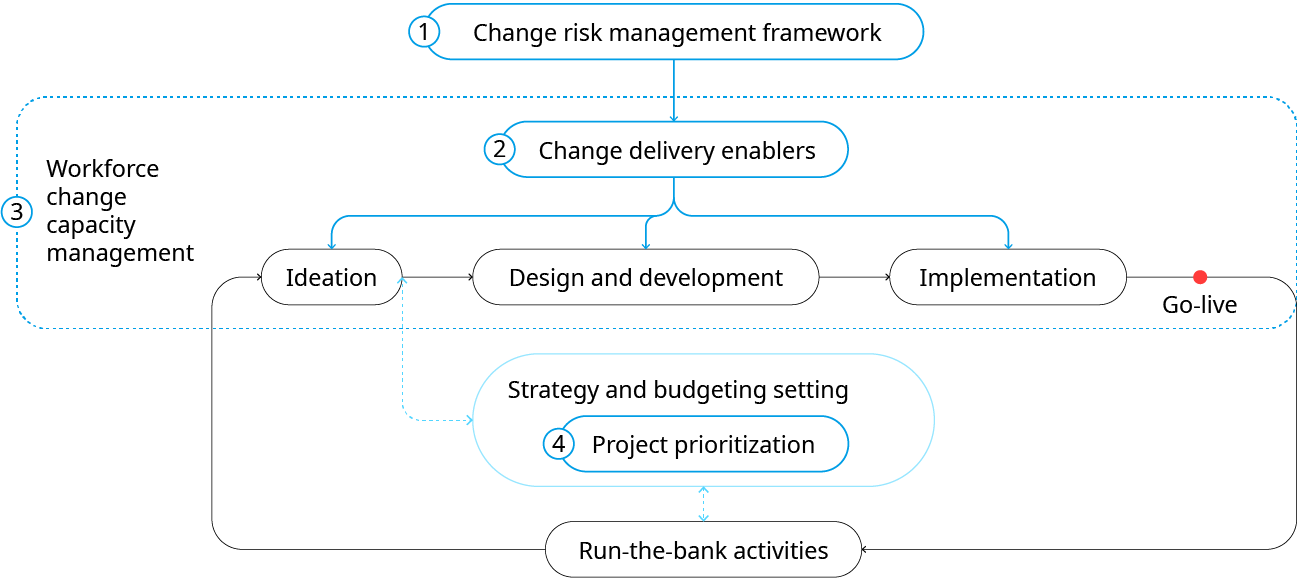

We have identified four capabilities for firms that can increase opportunities to drive effective change management:

1. Change risk management framework: Adapt the firm’s overall risk management framework to cover change risk across the lifecycle

2. Change igniters: Clear obstacles to build a change-oriented organization by diagnosing and addressing organizational weaknesses

3. Workforce change capacity management: Monitor change load and change fatigue, as well as improve organizational agility

4. Initiative prioritization: Develop a process for assessing change initiatives to maximize impact within change capacity

We believe firms that achieve these four capabilities will see an increased efficacy and decreased risk associated with the change programs. Returning to the change lifecycle in the exhibit below, we show how these capabilities can reinforce each stage and broaden the role risk management teams play well beyond the implementation and go-live steps.

Actions for effective change risk management

Given both, the necessity of achieving successful change in the current tumultuous world and the high cost of failure, organizations cannot afford to take a reactive or narrow approach to change risk management.

We recommend front-line and risk management leaders:

Overall, firms that succeed in incorporating change risk management into processes and culture will become more agile and more resilient, while firms that lag will run the risk of being caught flat-footed when the next disruption arrives. Firms that proactively manage change risk will be able to overcome the silent risk that hinders growth and emerge as winners.

The authors would like to acknowledge and thank Jonathan Lee and Rutger von Post for their contributions to this paper.