Retailers and suppliers must choose whether to initiate a new type of collaboration or remain stalled in a standoff benefiting no one.

Several grocery retailers and suppliers across Europe have yet to close their annual agreements. Out-of-stock situations highlight the gravity of the standoff, with the two sides taking disruptive action to make it clear that they mean business. At the same time, the mutual term structures could not be more complex, combining dozens of terms on the national and international level linked to a broad set of counterparts ranging from in-store displays, to promotions, supply-chain conditions or access to sales data. Many retailers report hundreds of individual term agreements across their supplier base, while suppliers oftentimes quarrel with retailers’ operationalization and the effectiveness of the counterparts. In summary, it’s a case of the prisoner’s dilemma, a paradoxical situation in game theory in which two individuals acting in their own self-interests fail to produce the optimal outcome — and as a result, both participants find themselves in a worse state than if they had cooperated with each other in the decision-making process.

Both retailers and suppliers are confronted with a challenging market environment characterized by saturation and slow growth, rising cost to serve, very low price inflation, and an increasingly active role of regulators. The time has come for the two sides to simplify their term agreements and devote more time and energy to focusing on customers and joint value creation — or ultimately having government regulations imposed on them.

Observers have long wondered how long such a highly inefficient collaboration could prevail in an industry that often praises itself for its efficiency and speed. We think the system is finally about to break under this tremendous pressure, paving the way for a fundamental reset of the retailer-supplier negotiations:

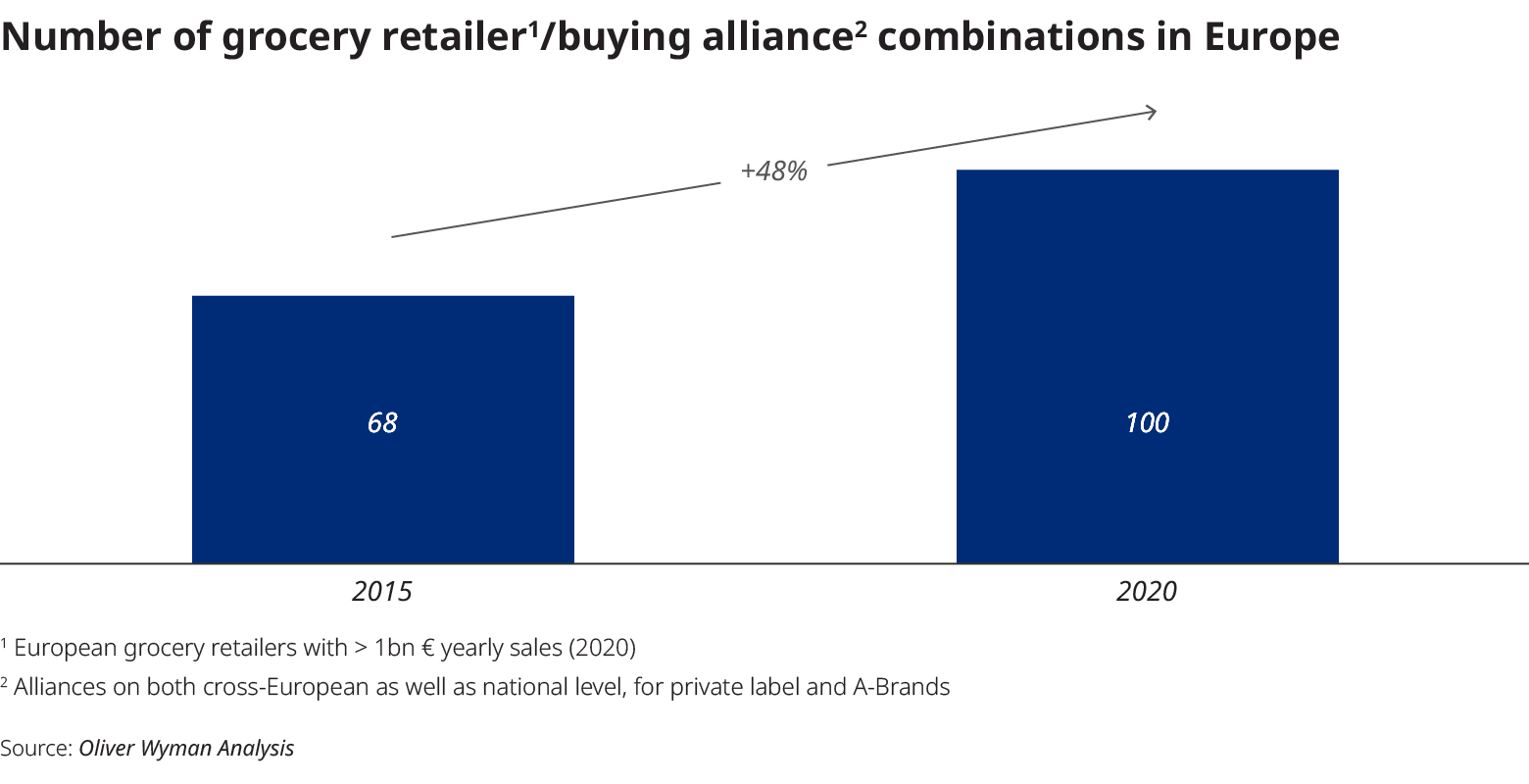

- Convergence and internationalization of competition: Hard discounters are becoming more like supermarkets, Amazon has become a serious fast-moving consumer goods(FMCG) player, and new multinational e-food players are entering the market. In response, traditional retailers increasingly are becoming part of international buying alliances — in Europe we have seen almost 50 percent more such participation in 2020 compared to 2015. (See Exhibit 1.) Yet the incremental return of volume bundling alone is diminishing. All these elements are pushing toward a real redesign and simplification of (international) term structures and doing so from an increasingly powerful position in the market.

- Tighter regulation: French regulators — together with official watchdogs in several key markets in Eastern Europe — are limiting back margin elements while demanding more transparent counterpart measurement. Retailers are starting to use these dynamics to simplify their term structures not only from a domestic legal perspective, but also as a trigger for a more comprehensive redesign across markets.

- Coming to senses: Despite all drawbacks, today’s complexity of terms is often interpreted as a unilateral advantage by both sides, but in reality, it involves unnecessary use of resources and reduced net-net-margin transparency for everyone. If “omnichannel customer-centricity” is to become a real paradigm, then it can only be supported by simpler term and agreement structures.

In our view, now is the right time for retailers and suppliers to drive changes before losing the customer out of sight and the appearance of additional regulatory impediments. This will allow for a simplification of the collaboration and more time and energy for (jointly) focusing on customers. Some European retailers have already begun this transformation and are starting to reap the benefits. Others who have yet to begin the process should not lose time and consider the following recommendations:

- Create net-net transparency on SKU level first: Knowledge is power, and leading the change is better than reacting to the proposals of others. Economic control over term simplification first requires deep transparency on the true net-net profitability on a product level. Retailers and suppliers should prepare now for the dynamics to come or risk losing control over the total P&L impact.

- Dramatically simplify term and agreement structures: Reduce funding agreements with suppliers, trimming them to fewer than 20 from the hundreds that currently exist, and get as close as possible to net-net-margin basis on SKU level, so as to allow for a more effective steering of the business and a P&L forecast in real time.

- Move from highly specific counterparts to strategic guardrails: Detailed definitions of counterparts may signal control for suppliers, but it often prevents a more holistic optimization of the value proposition to the end customers — let alone secondary effects like supply chain efficiency or food waste further down the chain.

- Start a new era of transparent, data-driven, customer-centric collaboration: Jointly focusing on the customers across channels should also mean working off the same data and KPIs. This will require more openness on both sides to share data, KPIs, and objectives.

Dramatic change will come to the industry within the next two to three years. It is up to retailers and suppliers if they want to get ahead of the curve and initiate a new type of collaboration now — or continue to devote their energy on complex negotiations until the sum of regulatory requirements demands action.