This article was first published on March 19, 2021.

After mixed success in the late 1990s and early 2000s, digital banking has finally arrived. Buoyed by changes in customer behavior and maturing technology, digital banks are now leveraging a superior client experience and structural cost advantage to rapidly gain customers and deposits. Disruption does not always equal success, however. Without a compelling customer value proposition, sound monetization model and sharp execution, digital banks are more likely to destroy value than make profits at scale.

In this paper, we explore why the conditions are now right for digital banking, review current market plays and share key lessons for successfully building a digital bank.

Below is an excerpt from the report, for the full PDF version of Digital Banking, please click here.

Why now is the right time for digital banking

Many firms have long held interest in digital banking; however, the first wave of digital banks that entered the market in the late 1990s and early 2000s mostly disappeared within a decade, either merging with more established players or shutting down altogether.

A winning business strategy requires three critical components: (1) customers, (2) a compelling value proposition and (3) a strong monetization model. Early entrants struggled with all of them (except possibly ING Direct, though it ended up being acquired by Capital One). While many factors contributed to the demise of the early internet banks, arguably a combination of limited customer adoption and nascent technology impacted their success most greatly.

The world has changed significantly in the past nearly two decades (See note 1)

- Digital-only banks now represent ~7 percent of US consumer liquid deposits

- Digital lenders account for ~40 percent of all unsecured personal loans

- Non-bank (including digital) lenders originate over 35 percent of mortgages (and Quicken Loans became the largest originator in 2020)

Banking is ripe for further disruption—from favorable changes in consumer preferences and market dynamics—to a supportive regulatory environment, and advances in banking technology and enabling infrastructure.

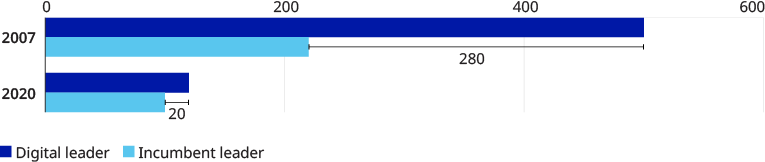

These changes have resulted in erosion of economics for incumbents. For example, the 280 bps all-in cost of deposits advantage of incumbents vs. digital players in 2007 has eroded to only 20 bps in 2020.

The time is ripe for digital banking, don’t spoil the opportunity. Players that execute well have the potential to enjoy superior economics and structural cost advantages over many incumbents, while firms that delay or fail to develop a sound monetization model may ultimately share the same fate as the first wave disruptors.

How can we help

We help organizations bring differentiated digitally enabled financial services propositions to market quickly through our integrated approach to strategy and business model design; client experience and value proposition development; brand design & marketing; governance, financial and risk management; technology and operating model set-up (including vendor selection, architecture blueprinting); bank chartering and regulatory guidance; and build/launch support including building bespoke components.

NOTES

1. Federal Reserve Bank of St. Louis; Inside Mortgage Finance; Nilson Report; Call reports (via SNL); Oliver Wyman analysis