It is also critical for firms that are facing market or operational vulnerabilities or that are under pressure to turn around financial performance. The value of a risk appetite statement is more than just as a set of benchmarks, it is also a means of communication. By bringing together the performance of the corporation and its commercial operations in a single framework, it triggers discussion about the key financial drivers and associated risks.

Consisting of only a few pages that should include a crisp statement with clear tolerance thresholds, and a financial model that supports the analysis of risk-bearing capacity, the statement assists senior management teams to reach a consensus with respect to their tolerance for variance and acceptable levels of risk taking. Equally important, it helps management engage with the board of directors—focusing attention on high-level, meaningful targets at the intersection of risk, strategy, and performance.

Developing a Holistic View of Company Tolerances

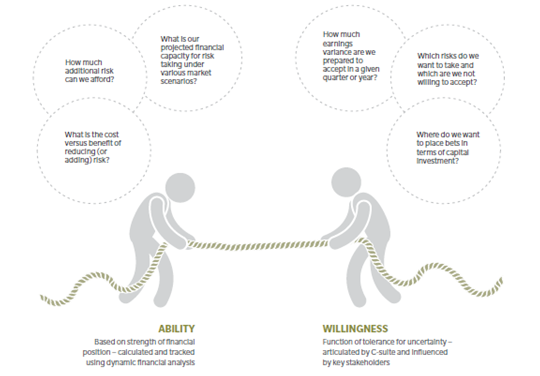

Effectively prepared and stated, the risk appetite framework helps a company determine, communicate and track is ability and willingness to take risks. This article, a collaboration between the Association for Financial Professionals and Oliver Wyman's Global Risk Center, sets out why companies should make defining their risk appetite a priority. We then suggest strategies for how the framework can be developed and used.

This is the third in a series of papers addressing critical issues for finance professionals being developed by Oliver Wyman and the Association for Financial Professionals. The first article in this series, "The New Weakest Link in Your Supply Chain," examined how companies can protect themselves against the deteriorating financial strength of supplier and the second, " Vulnerability, Not Volatility" provides an in-depth review of the role of analytics in a new systematic approach to managing commodity risk.

The value of a risk appetite statement is more than just as a set of benchmarks, it is also a means of communication.