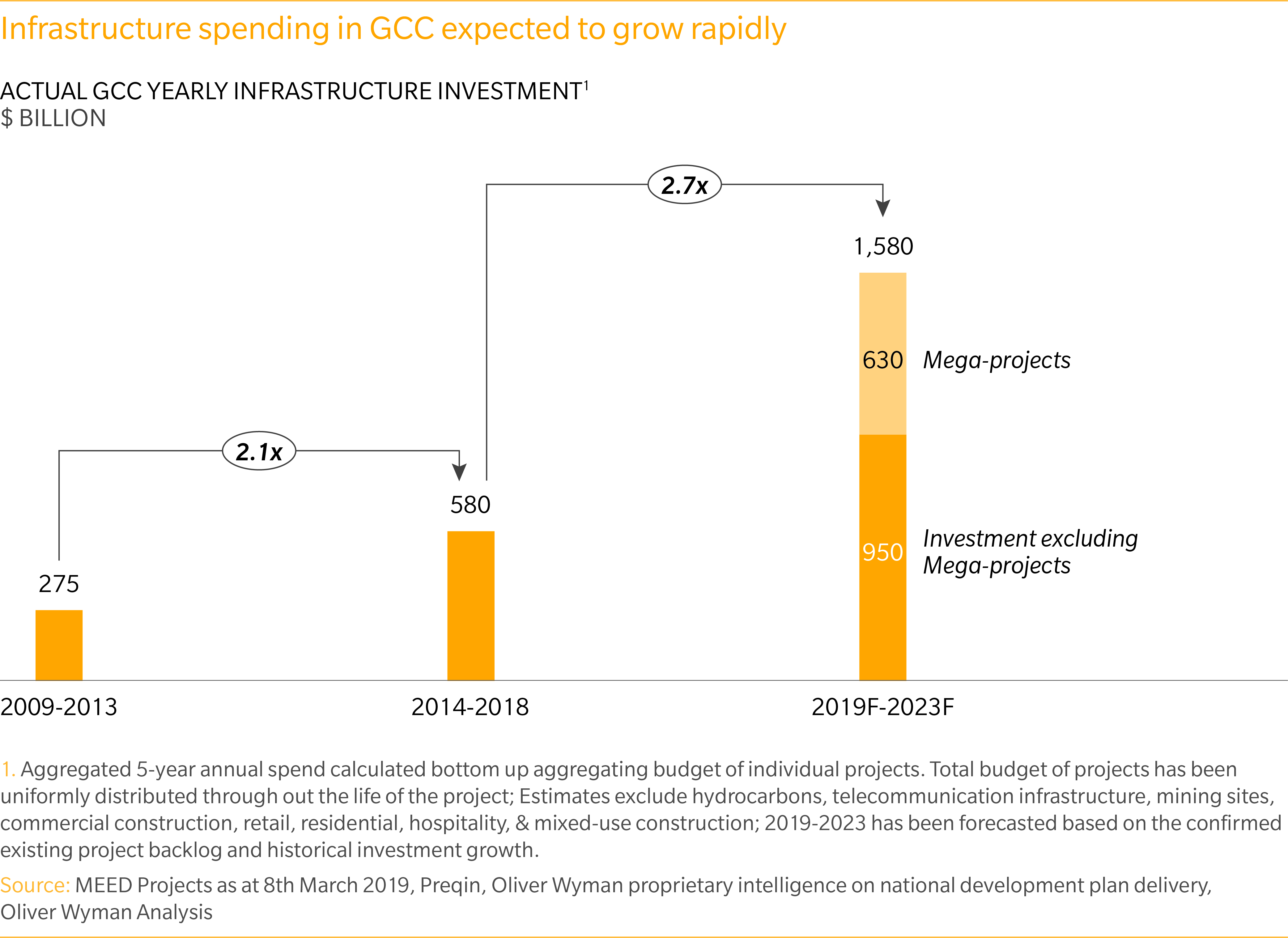

Governments however are constrained by funding limitations. A whopping sum of $1.6 trillion needs to be spent on upgrading and building infrastructure in the next five years in the Gulf, and national governments cannot meet this expenditure by themselves. This means that private investment on a scale hitherto not seen in the region is required to bridge the gap, without which the region’s economic and social development could be stifled.

Public Private partnerships (PPPs) are now emerging as the preferred path to bring private investment projects that are part of the various national development plans for GCC governments. National governments must step up efforts to attract investors to a region that still presents tangible impediments to private participation in infrastructure provision and delivery, and one in which the (PPP) frameworks are still in their nascency.

The need of the hour is for Governments to:

- ensure regulations and PPP laws are in place and are clear

- ensure that the project pipeline is robust and feasible

- ensure acceptable risk-sharing

- accept that investors need to make money and 5) build capabilities to engage with investors

National governments must step up efforts to attract investors to a region that still presents tangible impediments to private participation in infrastructure provision and delivery, and one in which the (PPP) frameworks are still in their nascency.