Insurers will be tested in 2023. They face several pain points and uncertainties: fears of recession; growing cost pressure — both medical cost increases and operating cost structure; and talent attraction and retention in the face of growing business complexity and shifting consumer preferences. On top of all that, there’s intense competition from traditional and non-traditional actors.

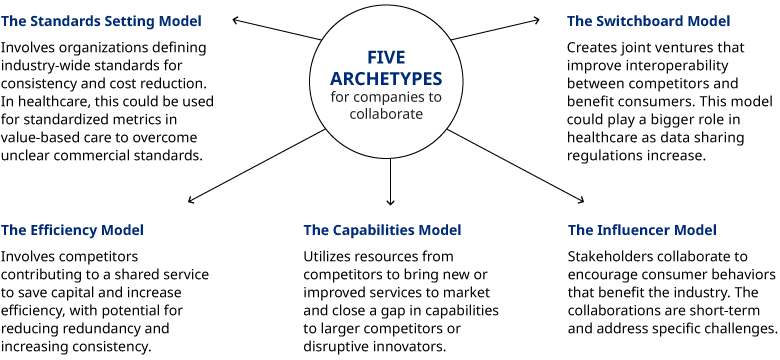

One novel approach to thrive in such an environment is to take a cue from other industries: partner with competitors to capture mutually beneficial opportunities. There are numerous examples of collaboration between competitors across industries, the majority of which can be classified into five archetypes. Correctly identifying and implementing the most appropriate collaboration style will enable insurers to better serve patients and advance their strategic priorities. Let’s take a closer look at the five archetypes:

The Standards Setting Model: Organizations come together to define industry-wide standards that enable consistency for consumers and reduce unnecessary investments for enterprises. There are a couple of prime examples of this in the technology space. Intel, Samsung, Qualcomm, Verizon, and others in 2015 developed the 5G Technology Forum to set 5G speed specifications, bandwidth, and security expectations. Looking at social media, many companies developed security standards and agreements enabling users to provide password information from one site to access another. For example, Pinterest allows users to log in with their Apple, Facebook, or Google credentials.

How might this model play out in healthcare? One area is value-based care where payers could come together around standardized metrics. The hope is that this would accelerate the transition to VBC as providers wouldn’t have to contend with myriad measurement programs from different payers. We’ve seen this occur in Medicare Advantage where the Centers for Medicare and Medicaid Services set clear incentives for Stars performance and member risk scoring, which has driven rapid and sustained innovation of programs and value-based payment models. The lack of clear standards in the commercial market has been one of the primary barriers to further VBC adoption.

The Switchboard Model: A joint venture is formed to establish systems for interoperability between competitors and to create more seamless interactions for consumers. Like the Standards Setting model, this archetype involves creating a new organization to operate as a bridge between organizations. Solutions emanating from this archetype tend to be permanent, or at least long-term, and benefit consumers as much as the companies involved.

Early iterations of this model include Visa, which was founded in 1958 by Bank of America, and then transformed into a consortium of banks that contributed to a system for processing credit card transactions between financial institutions and eventually became an independent company. There’s also the Options Clearing Corporation. Founded in 1973 by large investment houses, the OCC is a single services entity that today settles every listed options trade in the US. A more recent example is Zelle, a payments platform jointly owned by several large banks, that allows consumers to easily transfer funds to one another. In each example, the new entities reduced friction in the system, increased efficiency, and drove usage, ultimately benefiting all market players and customers.

The archetype has examples in healthcare, too. SureScripts, formed by a consortium of pharmacy benefit management companies, enable e-prescribing and pharmacy script fulfillment via the electronic transmission of prescriptions between healthcare organizations and pharmacies. Then there’s the massive data exchange company Availity, a joint venture between Florida Blue and Humana, that now serves more than two million providers, health plans, and technology companies.

The Switchboard Model could play an even larger role in healthcare as price transparency and data-sharing regulations take hold.

The Efficiency Model: This model occurs when competitors or players in the same industry contribute to a shared service that is inefficient or ineffective for each to develop alone, saving all parties capital when done together. One of the best examples is in the food industry where players of all sizes rely on co-manufacturing and co-packaging to trim costs. Leveraging a shared investment in machinery, space, labor, and compliance the third-party company manufacturers and packages products for multiple clients, creating efficiency of scale for the food companies and keeping prices down for consumers.

Financial institutions utilize this model as well. CB Shared Services is a collaboration between several Minnesota community-based banks. It was created to allow local banks to scale efficiencies for core transaction and support services, enabling them to remain independent while remaining cost-competitive with larger banks. We are also seeing this model play out in the highly competitive automobile space. Ford Motor Co. and Volkswagen AG have a partnership to jointly build pickup trucks and electric vehicles.

The most visible example in healthcare is the use by hospitals of group purchasing organizations to leverage purchasing power and achieve better pricing for all participating organizations but we see significant potential for payers to reduce market redundancy and inefficiency by finding places to centralize capabilities where consistency and scale benefits exist.

The Capabilities Model: This archetype utilizes resources from competitors to bring new or improved services to market, often to close a gap in capabilities to larger competitors or disruptive innovators. Lockheed Martin and Boeing, for instance, partnered in 2006 to form United Launch Alliance. It was a response to the threat of losing government business to SpaceX. Another example comes from media: A year after Netflix launched its streaming platform, a collection of entertainment companies, including NBC Universal and News Corp., founded Hulu streaming service, which was eventually sold to Walt Disney Company, NBC Universal, and Comcast.

A couple of healthcare examples have come to the forefront over the past few years. Frustrated by ongoing drug shortages, several health systems in 2018 founded generic drug manufacturer CivicaRX. The company is not only working to improve the supply of generic drugs but doing so at a lower cost. It is also entering the retail space with CivicaScript, aiming to bring lower-cost generics directly to consumers.

At the outset of the COVID-19 pandemic, Pfizer and BioNTech jointly developed their vaccine which enabled them to leverage development and manufacturing capabilities. This not only increased the resources they each could contribute towards vaccine development but put the credibility of both their names behind bids to supply vaccines to governments around the world.

Look for continued Capabilities Model partnerships and joint ventures in healthcare, particularly in the areas of drug development and purchasing and payer technology-enabled services like member advocacy, next-generation care management, and program impact measurement.

The Influencer Model: Under this archetype, stakeholders join forces to encourage consumer behavior that is also a benefit to the industry. These generally have a short-term in focus, targeting a specific challenge facing the industry. Once consumers adjust their behavior and the issue improves, these collaborations fade into the background. Taking advantage of one of the biggest stages in the world, the American Beverage Association, Coca-Cola Co., Keurig Dr Pepper, and PepsiCo teamed with environmental groups to announce its “Every Bottle Back” campaign during Super Bowl LIV. The TV commercial spot reminded consumers about the value of recycling plastic bottles and caps.

Payers, potentially in collaboration with providers, may benefit from campaigns to encourage consumer behavior surrounding vaccinations, notifications for screenings based on various demographic needs, or encouraging members to become more active shoppers based on quality and price transparency.

As insurers continue to look for ways to better serve members and become more efficient, aligning with a competitor, and other industry stakeholders, may be an attractive option to achieve breakthrough results. Naturally, joint ventures come with their own set of risks and challenges. Any initiative must be undertaken with clear objectives and shared outcomes. We fully expect even more partnerships between competitors in the coming years as healthcare players recognize the need for stepwise change to address a growing set of challenges.

To learn more contact Matthew Weinstock, Senior Editor, Health and Life Sciences.