Editor’s Note: The following article is part of an ongoing series offering our strategic advice and expertise on what healthcare industry stakeholders should do immediately in response to the rapidly evolving novel coronavirus (COVID-19) pandemic. This perspective, originally published on OliverWyman.com by our Financial Services practice, begins with a note from our Health & Life Sciences Partner, Ashley Smith.

Identifying Certainty

Health systems that successfully navigated COVID-19’s first wave of negative financial impacts took swift action. They secured lines of credit, restructured debt, accessed CARES Act funds, delayed or eliminated capital expenditures, and used furloughs to keep liquidity at acceptable levels. Elective procedure backlogs are now clearing, further closing some of the financial gap left by initial COVID-19 closures. These actions weren’t easy or simple, but traditional levers supported liquidity for many.

Rising caseloads across the US are again causing intensive care units to reach capacity, leaving many providers contemplating a second wave of impacts to volume, jobs, and financials. Traditional levers pulled between March and May likely don’t have enough runway to stretch across several cycles of virus resurgence, shut-downs, and suppression. This pattern of uncertainty could continue for some time.

What is more certain is continued COVID-19 financial impacts will be compounded by secondary effects: An increase in expenses (such as an over 59 percent year-over-year increase in expense per adjusted discharge last April) a hit to revenue from mix shift (such as a -6.5 to 14 percent revenue hit if current unemployment hits), debt service that still needs to be repaid, plus health systems’ dependence on investment income isn’t sustainable during a recession. (Half of the largest US hospital systems rely on investment returns for 50 percent or more of their total annual profit).

Provider Chief Financial Officers (CFOs) and Treasurers have more (and harder) work ahead to support their organizations through continuing uncertainty, and in planning for the coming other financial headwinds.

Supporting liquidity and profitability in uncertain times requires different competencies and skillsets. Capital planning periods that span multiple decades aren’t going away, but they do need to be supplemented by activities that bring more near-term resilience to financials and cost structure: Rapid cycle scenario-based planning, a strong understanding of leadership’s risk appetite and its implications for decision making, and a more structured governance plan to enable swift responses to frequent changes. Health system CFOs and Treasurers can support their organizations now by upgrading these practices and creating the resiliency needed to succeed amidst future financial uncertainty.

-- Ashley Smith, Health & Life Sciences Partner, Oliver Wyman

Making Good Decisions in Bad Times

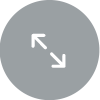

Managing liquidity during COVID-19 has become both challenging and critical for businesses. The pandemic has exposed important gaps in the frameworks, analytic tools, and processes by which companies make decisions in crisis regarding liquidity.

Decisions that are rapidly made today frequently suffer from a lack of robust underlying information, insufficient consideration of trade-offs and implications for the broader ecosystem (for example, suppliers), and lack of clear oversight. This challenge is exacerbated in times of crisis, where decision making needs to be well-informed and quick to avert financial distress and unintended consequences.

Closing critical gaps — especially for urgent needs like cash visibility — should be a priority considering the likelihood of multiple waves of the pandemic and a prolonged economic crisis.

This perspective helps companies to look forward, and build well-defined liquidity management capabilities to bolster resilience and profitability during the immediate COVID-19 crisis and for years to come.

Critical Capabilities for Liquidity Management

The liquidity management challenge is often compounded by the lack of a cohesive decision-making framework and legacy enterprise resource planning solutions that are slow, inflexible, and do not provide relevant information as well as a lack of clear delineation of governance and accountability.

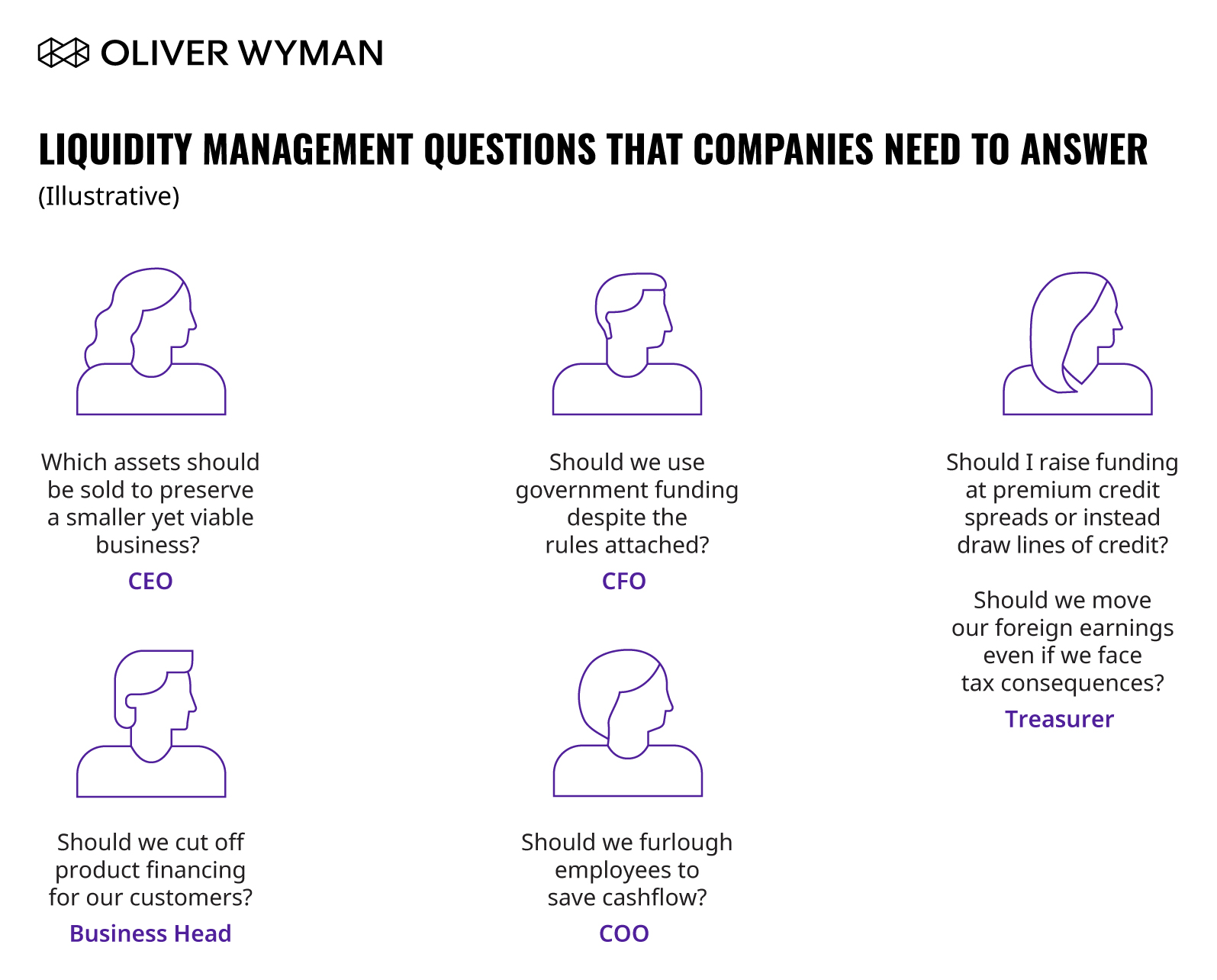

In order to make good decisions consistently over time and in the face of uncertainty, companies need to effectively develop their capabilities to answer four central questions (see below).

Addressing Blind Spots in the time of COVID-19

For many companies, fully developing the capabilities for crisis decision making will be a journey rather than a “leap.” In the face of competing priorities, companies can use the following approach to prioritize this journey to ensure consistent and tangible progress

Immediate-term:

Address any “blind spots” in cash visibility and forecasting approaches. These capabilities are critical for day-to-day liquidity management and enhancements and will immediately provide benefits such as additional headroom or the ability to better anticipate shortfalls.

Short-term (3-6 months)

Engage senior leadership and the board in a discussion to align on liquidity thresholds, discuss and define scenarios, and the relative costs and benefits of levers. This will enable a more informed and rapid response to a liquidity stress (such as a second wave of the pandemic).

Medium-term (next 16-18 months)

Formalize capabilities within a governance playbook and define a prioritized plan to address longer-term gaps to build out the foundational capabilities (for example, data collection, MIS upgrades, etc.) to ensure that improvements are incorporated into the company’s modus operandi and can serve in future crises when needed the most vs. being a one-time build.

The Path Forward

Having liquidity decision-making and management capabilities in place prior to the advent of COVID-19 would have served many companies well. Companies need to develop and upgrade management information systems to be able to source data (often from multiple systems), conduct analysis, and generate reports in a manner that can be refreshed quickly (ideally at the press of a button). While most companies are significantly far from achieving this level of functionality — advancements in process and data transformation tools can be effectively leveraged to help companies make rapid progress.

Read the entire perspective, Making Good Decisions in Bad Times.