Editor’s Note: This article is the second of a two-part series. In Part 1 , we explored whether a digital-led health system using clinical talent and a technology chassis can deliver high-quality clinical care and an integrated patient experience while owning the patient relationship and foregoing physical assets. In Part 2 below, we will transition from describing this vision to looking into the feasibility for such an entity to emerge. We will do this by reviewing the required building blocks to create such a health system, identify the different designs it may embody, and predict which players are perhaps best positioned to make everything come to life.

Consumers realize the value in experiencing integrated and coordinated care delivery and building strong relationships with a consistent set of care providers – including primary care, specialists, nurses, and others. They can address most of their care needs from wherever they happen to be – all the while keeping their costs lower.

As we conclude below, health systems may be best positioned now to establish a digital-led system. However, their edge is likely temporary — other players, including payers and technology companies, have unique capabilities of their own that can be leveraged for such a proposition.

Five Requirements to Build A Digital-Only Health System

To deliver on this vision, there are several critical assets a digital-led system will require. Organizations will need all these building blocks no matter how they create their digital system, but they will make different choices within each building block, and emphasize certain ones over others, as they determine the market positioning of their digital offering.

1. Clinical resources. A digital-led health system will require breadth and depth of clinicians to provide comprehensive care across specialties and sub-specialties. These clinicians will act as the focal point for developing patient relationships, and together with technology will serve as the key differentiator for the system. For specialists whose practice is physical in nature (like orthopedic surgeons), the system can choose to contract or to employ local talent. (More on that in the “Challenges” section below.)

2. Technology-enabled experiences. This capability means the ability to deliver the broadest set of virtual services possible in an integrated and seamless fashion. “Integrated,” in this case, does not just mean the vertical stack of technological components can “talk” to one another. It also means the user experience is tightly coordinated with seamless handoffs. For example, it’s not enough that the specialist can see the visit notes from the primary care provider (PCP) – as is already common today. Instead, the digital solution should proactively suggest the next steps for the patient post-visit and support navigation and follow-up on the patient’s care plan. As another example, it’s not enough that Bluetooth devices in the home are relaying patient information to a provider – which can already happen today. But the technology supports a response that is coordinated across the clinical team with nurses, physicians, and care managers all working together to address the issue.

3. Brand. This must center around a trusted relationship. This trust can take several forms depending on the entity. Current or prior relationships with medical providers breed trust, even if these are not strong brand names in the market. Trust can also come from familiarity with a regional or national medical brand, even if the patient has never received care from there (like for academic medical centers). Lastly, trust can come from extremely strong brand names in non-medical industries (for example, with Big Tech), and by the entity making it obvious what parts of the user experience they are directly responsible for (for example, technology) and what parts are outsourced through partnerships and ownership (for example, clinical care).

4. Commercialization. A digital entity will likely go to market in a similar fashion to other health systems – through payers’ insurance products. Traditionally, a health system will become a part of multiple payers’ provider networks alongside other providers, with consumers given different levels of provider choice based on their product configuration (for example, a Preferred Provider Organization (PPO) or Health Maintenance Organization (HMO)). However, to deliver on its integrated experience value proposition, a digital-led entity will want to avoid being part of a network and instead be the network – for example, have an insurance product wrapped around it. This is where the ability to engage, guide, and steer consumers will become critical, to avoid the impression that the supply of care is constrained. Instead, the digital entity will work to influence and guide demand to its owned set of providers. This approach also lends itself for assuming the risk for the total cost of care, as the system can now manage and prevent utilization. Ultimately, we expect such a digital-led product to be offered alongside conventional ones for consumers to choose from, whether for an employee population or to seniors through a Medicare Advantage offering and will likely need to be initially offered at a lower price point to be attractive enough.

5. Access to physical care. Despite digital care investments and re-imagined processes to deliver care virtually, there will be times when in-person care or clinical expertise is necessary. On these occasions, the digital system will need to ensure its patients have access to high-quality and timely physical care.

The (Digital) Health System of Tomorrow

In Part 1 of this series, we concluded that the physical care not requiring in-person interaction with a physician (for example, a Magnetic resonance imaging (MRI) scan or infusion therapy) can be subcontracted to local operators with the digital entity maintaining control over the patient relationship. However, what happens when a patient needs to undergo surgery? Who will be the surgeon and what is its affiliation with the digital system? Let’s explore answers to these questions below.

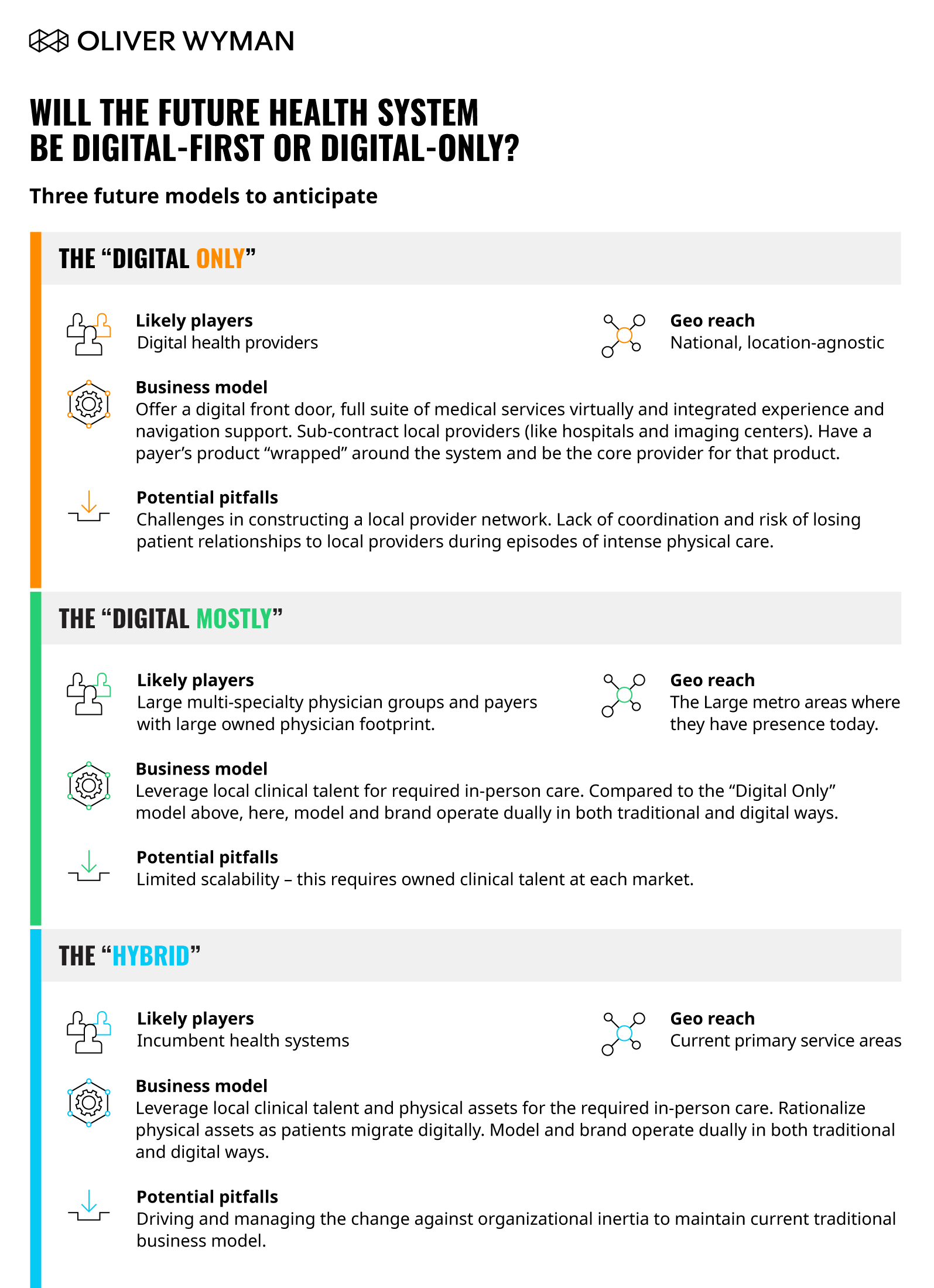

Two Real Challenges to “Digital-Only” (And as a Result, Two New Archetypes)

Challenge #1: The Need for In-Person Physician Talent

Resulting Archetype: “Digital Mostly”

When care needs shift to physical sites for procedures or acute episodes, a digital-only system will have to rely on sub-contracted suppliers to deliver. However, this approach runs the risks of losing control over the care experience and quality during a major care episode and weakening the doctor-patient relationship (which can push patients to shift wallet share to local physicians). To mitigate these risks, some players may choose a “Digital Mostly” approach wherein they employ a set of physicians in the markets they operate in and use them to deliver necessary in-person care. The ownership and operation of the site of care itself, whether an ambulatory or acute facility, can still be sub-contracted to a local operator, as many independent physician groups already do today.

Challenge #2: Loss of Income Sources from Physical Assets

Resulting Archetype: “Hybrid”

Health systems have made tremendous capital investments in physical assets, many of which are highly margin accretive. The proposition of switching to a “Digital Only” model and foregoing these productive assets won’t make sense. For these incumbent health systems, a more realistic option may be two concurrent operating models. Under this “Hybrid” approach, systems establish a digital-first entity alongside their conventional one. They rely on existing talent and assets to deliver only the necessary physical care. As their patient mix skews digital, they rationalize their physical assets accordingly. This approach allows an incumbent health system to earn income both from the upstream (likely more digital) and the downstream care (likely more physical).

Market Players and the Archetypes that Suit Them

Who may be best-positioned to embark on a digital-led care delivery approach? Are these the incumbent health systems? Payers? Or maybe Digital Health and Big Tech companies? We explore these questions below.

Providers and Health Systems’ Archetype of Choice: “Hybrid”

Health systems will perhaps want to keep their physical footprints and execute a digital-first approach with existing assets delivering needed physical care. Their biggest gap is often technological know-how, agility, and an understanding of the modern consumer’s relationship with digital tools. Therefore, at first, it may be difficult to build consumer trust.

Non-Hospital Providers’ Archetype of Choice: “Digital Mostly”

Like large health systems, clinical talent is a strength for non-hospital providers such as multi-specialty physician groups, and their brands are known and trusted locally. These players may not have the balance sheet of some systems to invest – making them more likely to wade up favor a “Digital Mostly” approach.

Payers’ Archetype of Choice: “Digital Only” or “Digital Mostly”

The key attribute that will impact how payers approach a digital solution is ownership of clinical talent. Payers with little or no clinical talent on their roster, “Digital Only” is more likely. They will still need to amass clinical talent by partnering with the right providers or through provider group acquisitions. Payers who do own some clinical talent and/or have a care delivery footprint will find this approach more appealing.

Technology Players’ and Digital Health Companies’ Archetype of Choice: “Digital Only”

Few consumers who use these companies may be familiar with their brands. However, these companies have years of data on what digital features consumers value and have knowledge crafting effective user experiences. Perhaps the largest hurdle for these players is the need to expand out from the typical niche they are operating in and develop a comprehensive suite of clinical services to treat most people in most situations, including having the required clinical talent.

Big Tech’s Archetype of Choice: “Digital Only”

Big Tech is ubiquitously used and trusted, whether for online shopping, internet searches, or hardware. Their being household names, coupled with healthcare’s historically low consumer satisfaction scores, gives these companies a wedge to enter a space in which they have no clinical talent nor healthcare commercialization experience. With no care delivery talent, these organizations would likely stick to “simpler” care delivery to begin with (for example, primary care). Their deep bench of engineering talent and deep pockets allow them to move swiftly and solve highly complex, problems, including by using artificial intelligence and machine learning techniques.

Rising to the Challenge

The Digital-X Health System is an inevitable future. As described above, these models are viable strategies for many types of players. But for health systems, the stakes are really existential – they have the most to lose and the best set of puzzle pieces from which to build. Hospitals and health systems have had many of the building blocks necessary for success in place for years. The clinical assets, delivery networks, investments in electronic medical records (EMRs) and technology systems, and the general shift of care outside of acute facilities created an incentive to transition to digital – be it “Only,” “Mostly,” or “Hybrid.” Now, they will need to adapt quickly and experiment, historically skills that are not always their strong suit. If they don’t, they are providing an opening for new market entrants.

Commercializing and making these digital solutions “mainstream” will take time – which is why organizations must start now. As we begin to emerge from the initial fog of adapting to COVID-19, the race is already on to test and deploy digital models. There are many first-mover advantages to be had from committing to a digital strategy, as consumer adoption and willingness to try digital solutions has dramatically increased.

The stage is set for healthcare’s largest inflection point in many years. Now is the time for health systems to rise to the challenge and find the archetype and strategy that best suits them.