The Centers for Medicare and Medicaid Services (CMS) recently released two rules (one final, one proposed) to advance the Trump administration’s agenda to create a transparent healthcare marketplace. The rules are designed to spur competition that will benefit consumers by making hospital prices and out-of-pocket costs much clearer and to remove the secrecy surrounding contracted prices. If this is enacted in a way that’s consistent with the current proposals (which is a big if), the impact to consumers could be wide ranging, but will heavily depend on how payers and providers respond. Here is a summary of these regulations and what they are likely to mean for the industry:

Five Immediate Considerations for the Industry

1. Some prices should compress if transparency is achieved. But only some.

Healthcare’s limited examples of transparency suggest prices should decline overall in the medium term, but will most likely be concentrated in higher-volume “shoppable” services that are more comparable across providers and plans. For example, Kentucky’s price transparency tool for public employees saved $13.2 million, while paying employees over $1.9 million in cash benefits over three years. New Hampshire’s price transparency efforts had positive, though lackluster overall results, partly driven by low consumer adoption of tools. Professors from University of Chicago Booth School of Business found state price transparency regulations resulted in reduced prices charged for elective, uncomplicated hip replacements by an average of about seven percent. Additional supporting evidence has been reported in Health Affairs, The New York Post, and JAMA.

It is worth noting that in the short-term, there could be unanticipated increases in some cases. Payer-provider contracting dynamics should prevent the healthcare industry from becoming another exception case where transparency leads to increased costs. However, there may be markets where providers with lower rates are able to successfully negotiate harder once they realize exactly what others are getting paid. In select markets, prices could rise in the short-term. Still, the overall net effect is expected to be a dampening of price levels and narrowing of the price band – to the benefit of most consumers.

2. Consumer behavior may not change as much as we’d like.

Context and ease of use will determine how impactful the information is for consumers. As long as price information is not partnered with useful quality, appropriateness, access, and experience data, consumers will still need to search across multiple sources to cobble together a perspective on relative value, to the extent that they do so at all. Especially outside of simple “shoppable” services, there will still be barriers to changing consumer behavior.

There is also the complexity that hospital contracts take various forms and aren’t standard across service types or payers in the same market. For example, some hospitals contract for inpatient services on a diagnosis-related group basis with one payer and per-diem with another. Transparency of rates by itself may not make apples-to-apples cost comparisons simple.

Moreover, consumers are most interested in their own out-of-pocket expenses, not negotiated rates that far exceed their deductibles or out-of-pocket maximums. In the cases of major diagnoses, factors related to quality, brand reputation, access, and safety quickly outweigh price in how patients select providers, and for some higher cost is even seen as an indicator of higher quality.

3. A lot can still happen before these rules take effect.

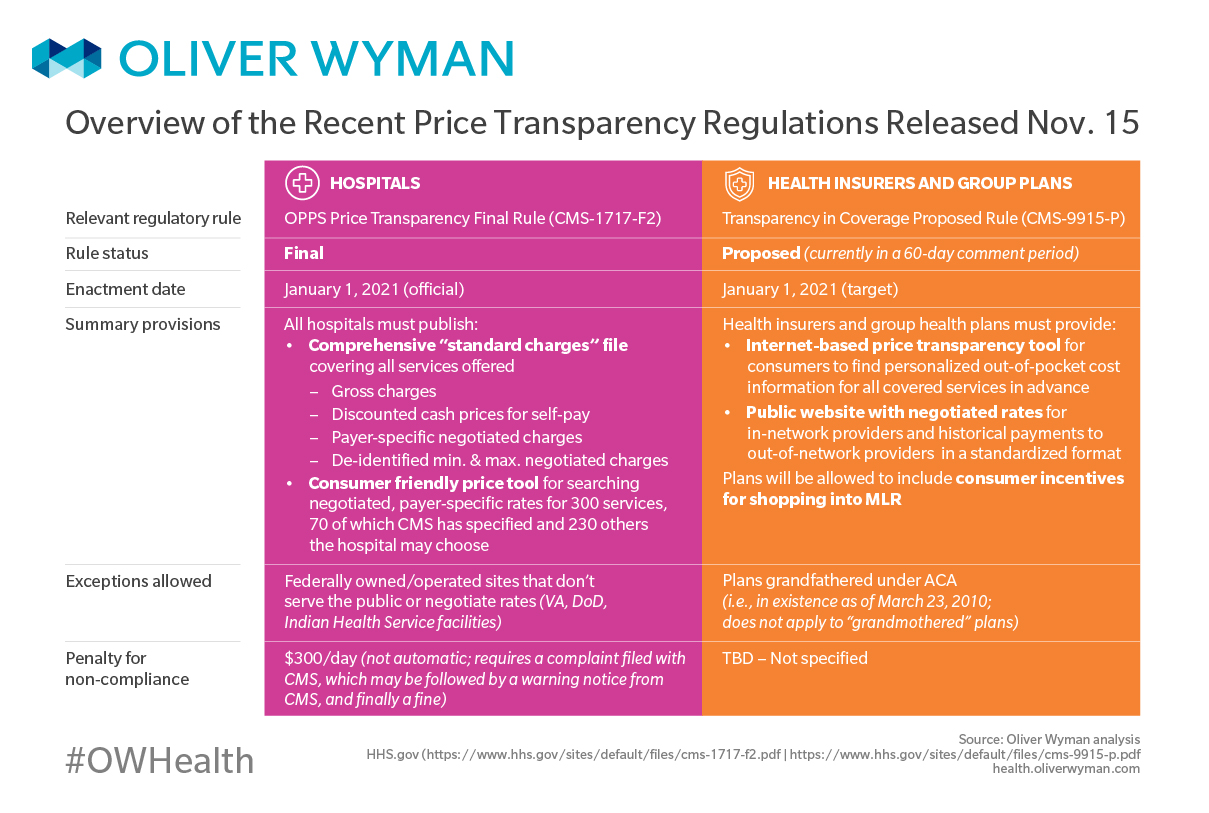

A variety of factors (like the upcoming US elections, pending and prospective litigation, and comments received during the comment period) will influence how these regulations end up unfolding. Consider, for instance, that America’s Health Insurance Plans (AHIP) joined a lawsuit from several hospital organizations claiming CMS is overstepping regulators’ authority. More such filings will surely follow, as will appeals to initial decisions. With the implementation timelines set for after the new election, voter and media reactions and lobbying will have ample time to influence the future administration, regardless of who that becomes. In short, the above chart is very much subject to change before it is scheduled to take effect.

4. Enforcement has no teeth. This makes it unclear who will and won’t comply.

Daily penalties per facility for non-compliant hospitals are only $300, or about $110,000 a year. This amount is far smaller than the margin at risk for most providers if consumers act on this information and shift where they receive care. The game theory here suggests few will participate since the market leaders on both the plan and hospital side typically have the most to lose, and lower share players risk facing market scrutiny with little upside in going at it alone.

5. Industry innovation should accelerate.

As with any change, we anticipate payers, providers, and other innovators and start-ups will try to seize the opportunity to engage consumers and differentiate with the new data that becomes available. The proposed rule allowing consumer shopping incentives to be included in Medical Loss Ratio certainly creates that opportunity. While there is no dearth of players with transparency tools, member guidance solutions, health benefits administration, custom networks, and other offerings today, these changes might enable additional innovations and further investments in these types of models.

The Anticipated Aftermath of CMS’ Price Transparency Rules for Payers and Providers

Payer Considerations

1. Total cost and quality (versus unit cost) becomes more important.

If, as expected, unit cost compression occurs across providers and payers for a large portion of healthcare costs, the traditional payer advantage of unit cost / discount rate will decrease, benefitting some payers over others. This will cause total cost of care and quality to become important differentiators, with outcomes that are measurable and provable to employers and consumers. Investing in value-based provider partnerships, stronger clinical programs, better care management, and consumer engagement becomes increasingly important, as do performance guarantees associated with these approaches.

2. Anticipate more competition from disruptors.

We also expect the playing field to get more crowded as innovators and new entrants bring new solutions to market. While this innovation may give incumbents access to a host of new tools and solutions, they will likely continue to also face carve-out threats as innovators bring better solutions directly to employers. Partnership strategies and internal capabilities that deliver similar outcomes become important priorities to avoid being “on defense.”

3. Prepare for more sophisticated provider contracting.

Providers may respond to transparency with more sophisticated contracting approaches (see our second chart above), and payers should be prepared to do the same. For example, increasing focus on contracting strategies for targeted high-spend categories becomes critical as rates on shoppable services commoditize. Additionally, some providers who are uniquely positioned as market leaders in complex services may try to negotiate higher rates that better reflect the value they deliver. Finally, deeper total cost understanding of which providers best manage cost and use, and partnerships that more effectively steer members toward provider centers of excellence, utilize alternative payment models, and create payer / provider collaboration become even more important.

4. Product differentiation opportunities increase.

The door is widening to engage consumers in a new way with products that start to align consumer incentives with actual cost on a broader range of services. These require going well beyond today’s basic reference-based benefits and assessing very different network, payment, and consumer accountability models, but transparency on price potentially sets the foundation for doing so much more quickly.

Payer No-Regret Moves

1. Understand your exposure and opportunities.

Use existing market intelligence and benchmarks on your unit cost advantage to assess where you may be a winner and loser, and how transparency may impact upcoming provider negotiations and your competitive position in the market.

2. Invest in member enablement.

Ensure your investment roadmap embraces technology and tools that will empower members with actionable information and reward and incentivize them to make smarter care purchasing choices.

3. Improve analytics and contracting capabilities.

Increasing transparency will force you to go beyond unit cost and total cost as the two metrics that matter. Invest in health analytics capabilities that enable you to understand provider performance on total cost of key episodes, bundles, and sub-populations and develop the contracting and negotiations strategy that allows you to partner in a more nuanced way.

Provider Considerations

1. Multiple opportunities to differentiate on value and outcomes.

Providers with low-cost, high value positions in the market will naturally benefit from drawing cost-conscious consumers, but prices can also be used to communicate value proposition. While cost and quality have a low correlation in healthcare, a portion of consumers do associate the two. Providers with a demonstrable position as the higher quality provider in a complex service area will be able to sustain higher prices and margins.

Similar opportunities will exist around value-based care as payers increasingly look to differentiate on value over unit cost. Providers with low operating costs in the market may have the opportunity to secure preferred network positions and differentiate with “focused factory” type care models for higher volume and more routine and transactional services. Providers with differentiated capabilities in high complexity service lines or conditions may gain share by driving total cost and quality outcomes in those areas.

2. Pressure will accelerate on services that can be delivered outside the hospital.

Pricing transparency will create a new level of cost pressure for hospital systems to deliver “shoppable” services cheaper to win consumers, especially around ancillaries, procedures, and services that are also delivered in community ambulatory settings. The challenge will be steep for many hospitals, as these services, which can be obtained at lower cost ambulatory settings, are traditionally big profit / surplus drivers. As demand decreases on these services, hospital systems must adapt to reduce their cost structure and / or operate on a potentially narrower scope of services. Conversely, those who lead in shifting services to the community may find higher payoff than in the past as consumers are expected to shift more quickly in a more transparent environment.

Providers may take the opportunity to rebalance prices, reducing them on more shoppable services such as ancillaries and lower complexity procedures. But they’ll also potentially raise prices for complex services.

3. More sophisticated managed care contracting is a critical imperative.

Providers may protect margins by taking the opportunity to rebalance prices, reducing them on more shoppable services such as ancillaries and lower complexity procedures but also raising them for complex services with a material quality differential or urgency dynamic. Optimizing prices across services and sites of delivery will be the new normal to compete successfully.

There is also opportunity in realigning underlying economics, given prices are no longer closely tied to underlying cost of delivery for many hospitals. Consider if substantial effort is made to rebalance prices so they’re market competitive. This effort can be readily extended to better match variable revenue to cost, resulting in lower profit risk from volume variability and cost per case variability.

4. Leadership models may be challenged.

Accountability for delivery cost on any given service can be diffuse, given patients engage with multiple departments in their journey through a care episode. Adaptation of the operating model and decision rights will be needed to drive a different focus of accountability to win in a price-transparent market.

5. Patient expectations and satisfaction both may increase.

Patients will more often expect physicians to make cost-conscious referrals and will increasingly bring this front-and-center to their physician conversations. This is supported by Oliver Wyman’s 2018 Consumer Survey of US Healthcare, where more than half of consumers said they want cost taken into account for their care decisions. It’s easy to envision the frustrated patient, struggling to pay high bills, bringing price comparisons post-facto to his or her physician and demanding justification for where they were referred. Conversely, more transparent pricing should reduce consumer frustrations around billing.

Provider No-Regret Moves

1. Use price as a new strategic lever.

Clarify your strategy, know where you have a differentiated position (such as quality in select complex services, downstream efficiency, or experience) and negotiate accordingly. Imbed pricing and margin goals in service line planning to create productive pressure and accountability for performance.

2. Develop improved clinical and operational analytics.

Build a stronger understanding of true cost-to-serve, clinical performance, and outcomes. Payers will increasingly be looking beyond unit cost to understand where you can deliver superior performance. Hospital systems should use these insights to redesign clinical and non-clinical end-to-end processes to achieve lean, high reliability operations.

3. Invest to benefit from market shifts.

Rebalance capacity and assets to shift revenue towards areas of future growth and differentiation across both shoppable and more complex services. Incorporate value-based care, payer partnerships, and employer strategies to maximize value you receive from areas of differentiation. Lastly, take this opportunity to catalyze internal change, productively disrupt the status quo, and cast an agenda for higher efficiency and agility for your organization.

In the Meantime…

As we await what comes next, expect efforts from all sectors to try and shape transparency rules. Incumbents will look to play a mix of offense and defense. Innovators will be ready to pounce. And while consumers may become better decision-makers in shoppable areas, they will continue to be in need of actionable insights and guidance to receive the right care at the right place and time. Transparency (or the sticker shock that accompanies it) is only the first step in helping consumers make informed choices.