A recent Oliver Wyman survey explored UK consumers’ perceptions of the internet and technology. The results show that sharing personal information online remains a top concern, and sharing personal information with hospitals is especially worrisome. Here, Oliver Wyman’s Chris McMillan provides an overview of the research findings and offers insights into how organizations might use the results to better interact with consumers in this digital age.

When we surveyed 1,500 adults about their hopes and fears living in a digital Britain, some of the results were expected. For example, it came as no real surprise that 84 percent of internet users like or love spending time online. And it was not unexpected that more people over age 65 feel left behind by new technology, compared with younger generations.

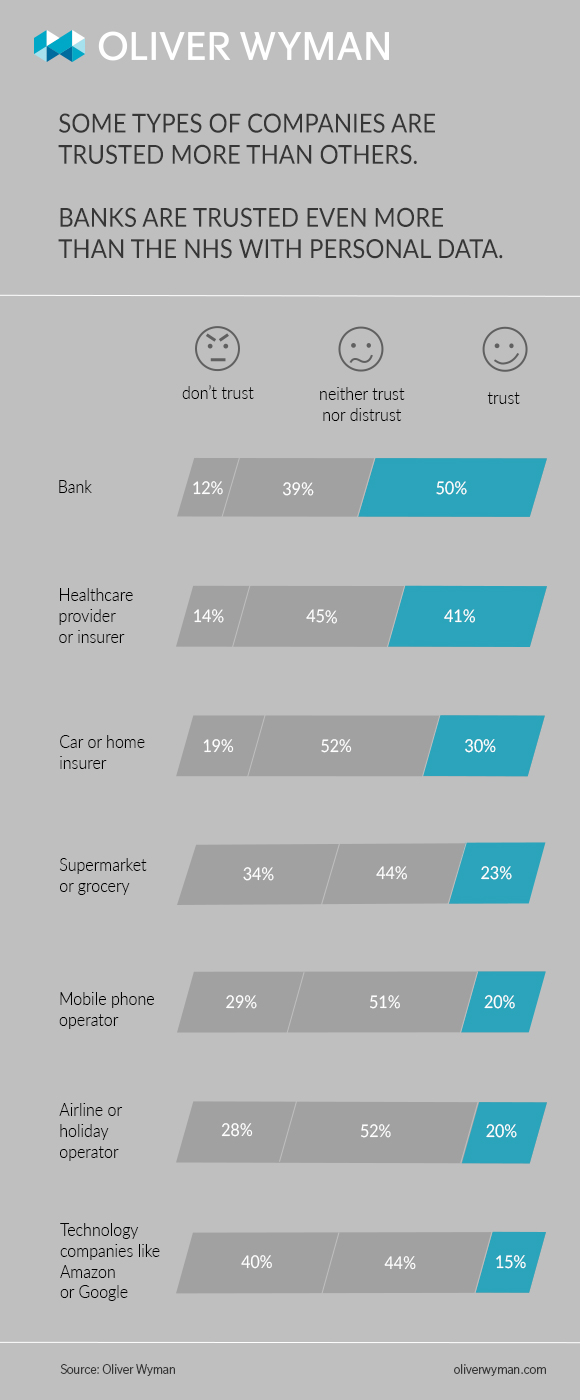

We also weren’t particularly shocked that protection of personal information is consumers’ number one online fear. But what did catch our research team off guard is that banks are most likely to be trusted with personal data, over and above any other kind of business, including healthcare providers like the National Health Service (NHS) and health insurers.

The difference is marked: 50 percent of people in the UK trust banks with their data, compared with 41 percent trusting healthcare providers, and 20 percent trusting their mobile phone operators. We also found that 68 percent of respondents didn’t trust the UK government to protect the privacy.

How banks are gaining consumer trust

So what are banks doing that, despite a recent global financial crisis, is winning more trust than hospitals and NHS bodies, who save lives every day?

Banks put a lot of investment into educating customers about the security measures they take to protect them, assuaging the worry many of us feel when handing over our personal information. Healthcare providers can learn from this by working harder to keep patient data safe, and being more vocal in assuring the public what these protections are and why they work. They should also be clear about explaining what personal data is being collected, and what it’s being used for.

How banks are gaining the trust of seniors

Our research also found that older people, who place a large burden on healthcare systems, feel the most left behind by new technology: 41 percent of those 65 and older feel they can’t keep up with changing technology, compared to around 27 percent of younger generations. As technology and digital innovations open up better and more cost-effective ways of managing health, it will be critical for the NHS and insurers to ensure that older people and are comfortable taking advantage of these solutions to manage their declining health.

Again, there is something to be learned from banks in this space. For example, programmes like Barclay’s Digital Eagles help get older people online and comfortable not just with banking services but also applications like video calls and email that reduce social isolation and improve well-being. For the bank, it helps moves more of their customer base online, allowing them to reduce costs in high-street branches and invest elsewhere.

In healthcare provision, providing similar training for the elderly and their caregivers might enable video calls instead of expensive home visits for non-urgent appointments in remote rural locations. Asthma sufferers could confidently use smart inhalers that monitor and electronically report back on usage to a medical team, who can then intervene before an episode requires hospitalization. In addition, apps are already available to help with medication management and fun cognitive exercises can be done on a tablet to help slow the onset of dementia.

These are just the tip of the iceberg of the benefits technology can bring to keeping the elderly healthier and reducing healthcare spending on tertiary care. But our research clearly shows that in order to realize these benefits, healthcare providers like the NHS need to de-mystify technology for the older generations.

Overall, our new research suggests that data protection and technology enablement are two key areas where UK healthcare providers can improve. By taking lessons from consumer financial services, they can not only gain the trust of their service users, but also benefit from substantial cost savings that could be invested elsewhere in the healthcare system.