This post is the final in a series of three this week based on a new Oliver Wyman report that explores in-depth how “partnered products”—health insurance products built around a single provider system, multi-specialty group, accountable care organization (ACO), or clinically integrated network (CIN)—are transforming US health insurance:

Don’t just contract – partner. It’s tempting to approach a partnered product with the habits and perspectives that have fueled negotiations for decades: unit cost reimbursement rates, steerage, administrative cost load, etc. But a partnered product is very different from a traditional insurance product, and it needs to be created by a different kind of process—one that leads to true partnership and a strong ongoing relationship. Team members outside of the traditional contracting teams, including the C-suite, should be involved from the outset to enable a much more strategic conversation.

Remember that you’re not replacing network building—you’re engaging in a different kind of network building. Instead of taking an outside-in approach—developing the network by excluding the provider partner’s competitors, design the network inside out. Begin with the core ACO or CIN. Assess current referral patterns to identify key independent providers, ancillary providers, and others that need to be included. Quantify likely levels of out-of-network care—a key input for product pricing. (A typical population will generate at least 10 to 15 percent of out-of-system care just from ER visits and associated inpatient stays.) Ensure that the product meets state network adequacy requirements—which include factors such as specific driving distance and quota requirements for each physician specialty.

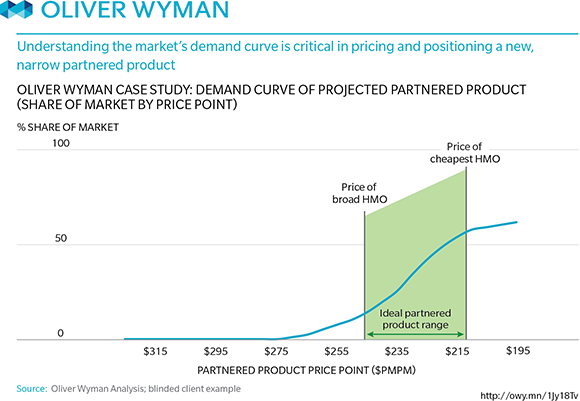

Test market demand for the resulting network. In some markets, you will discover that you can substantially improve uptake by including specific highly recognized providers and brands. In some markets, we’ve seen this sort of research lead to the creation of multi-partner joint ventures bringing together key provider systems—and generating strong early enrollment numbers. See graphic: