This post is the second in a series of three this week based on a new Oliver Wyman report that explores in-depth how “partnered products”—health insurance products built around a single provider system, multi-specialty group, accountable care organization (ACO), or clinically integrated network(CIN)—are transforming US health insurance:

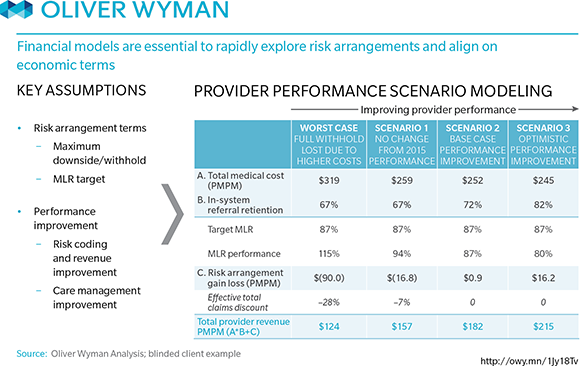

The basic concept of a partnered product is simple but execution can be tricky. Product partnerships represent significant win-win opportunities, especially for early movers. But for there to be full buy-in, both sides need to be able to quantify how the deal creates value for them. And that means that both sides need access to an integrated model that gives them visibility into key assumptions on financial drivers and allows both partners to review them and model scenarios in concrete terms related to how they think about their business.

Payers, for instance, need to quantify membership opportunity and impacts on premiums and margins; providers need the ability to translate metrics of lives at risk and attributed membership into patient volumes and market share. Each party has data and insights that can be critical in informing the other’s evaluation of the financial value of a product partnership; without this way of reviewing the deal, neither side is going to be comfortable pulling the trigger on the partnered product, no matter how strategically interesting it is in principle.

The case study below illustrates how financial models are essential to rapidly exploring risk arrangements and aligning on economic terms: