This post is the first in a series of three this week based on a new Oliver Wyman report that explores in-depth how “partnered products”—health insurance products built around a single provider system, multi-specialty group, accountable care organization (ACO), or clinically integrated network(CIN)—are transforming US health insurance:

The movement in recent years from fee-for-service toward a value-based approach in US healthcare has led to a huge increase in numbers of ACOs and CINs. Based on Oliver Wyman’s most recent update, almost 70 percent of the US population now live in localities served by ACOs, and 44 percent live in areas served by two or more. However, value for consumers, especially in terms of health insurance product pricing, has been elusive. Below are three questions for report author Tomas Mikuckis on how this newly developed value-based care infrastructure can serve as the foundational chassis for payer-provider partnered products:

- How different is a partnered product from a narrow network?

Very. The traditional narrow network is constructed of provider organizations that are willing to accept lower fees. There’s typically little attention paid to how well they work together or enhance value. The partnered product uses an existing clinical organization to provide structure and coordinated care. When it works well, patients have an incentive to stay in network, and the provider organization can be more effective at managing care, improving outcomes, and reducing underlying costs. - What do payers and providers get out of the partnered product?

To us, the most important benefit is that it helps both sides move more quickly to a value-based model. If the health plan knows that the provider can actually reduce costs, it can afford to reduce its own prices to gain market share. And if the provider knows the payer will be funneling new patients its way, it can adopt new clinical models, knowing that the new patients will make up for lost per-patient volume. - What’s the biggest mistake payers and providers can make in creating a partnered product?

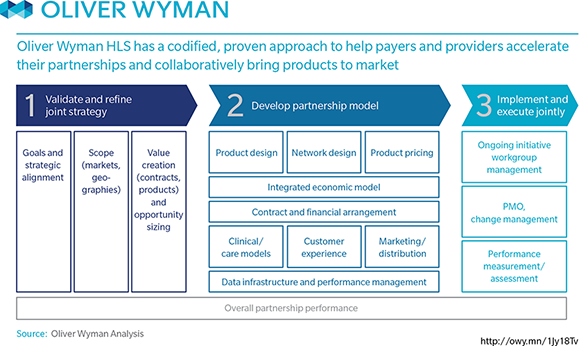

Leaving the process in the hands of the contracting department. A partnered product has to be more than a contract—it has to be a true ongoing partnership between the two organizations. You need to involve an expanded team, usually including the C-suite, and the conversation has to be much wider ranging and more strategic than the typical contract negotiation. You’re building a path to sustainable competitive advantage for both sides. That’s worth the extra effort.