A comprehensive approach to managing payments is more critical than ever for merchants. Merchants experimented with a host of new payment approaches during the COVID-19 pandemic and now they are looking for ways to ensure those levers help drive and sustain growth, according to the 2024 Voice of the Merchant study, which was jointly conducted by Oliver Wyman and the Merchant Advisory Group (MAG).

The survey included executives from various industries, including specialty retail, gas/c-stores, digital goods, grocery/pharmacy, and travel, among others, to understand key trends in consumer payments and their implications for business. It builds on the findings from our 2023 and 2022 Voice of the Merchant studies.

Merchants seek to boost revenues with clear payment strategies, APMs, and global growth

Merchants spend about a third of their time on strategic topics, of which defining a comprehensive payments strategy takes the most time. Similarly, updating their payments strategy is cited as one of the top challenges by 31% of merchants. In other words, merchants rank strategic topics as a top challenge and spend a significant portion of their time trying to solve these strategic issues.

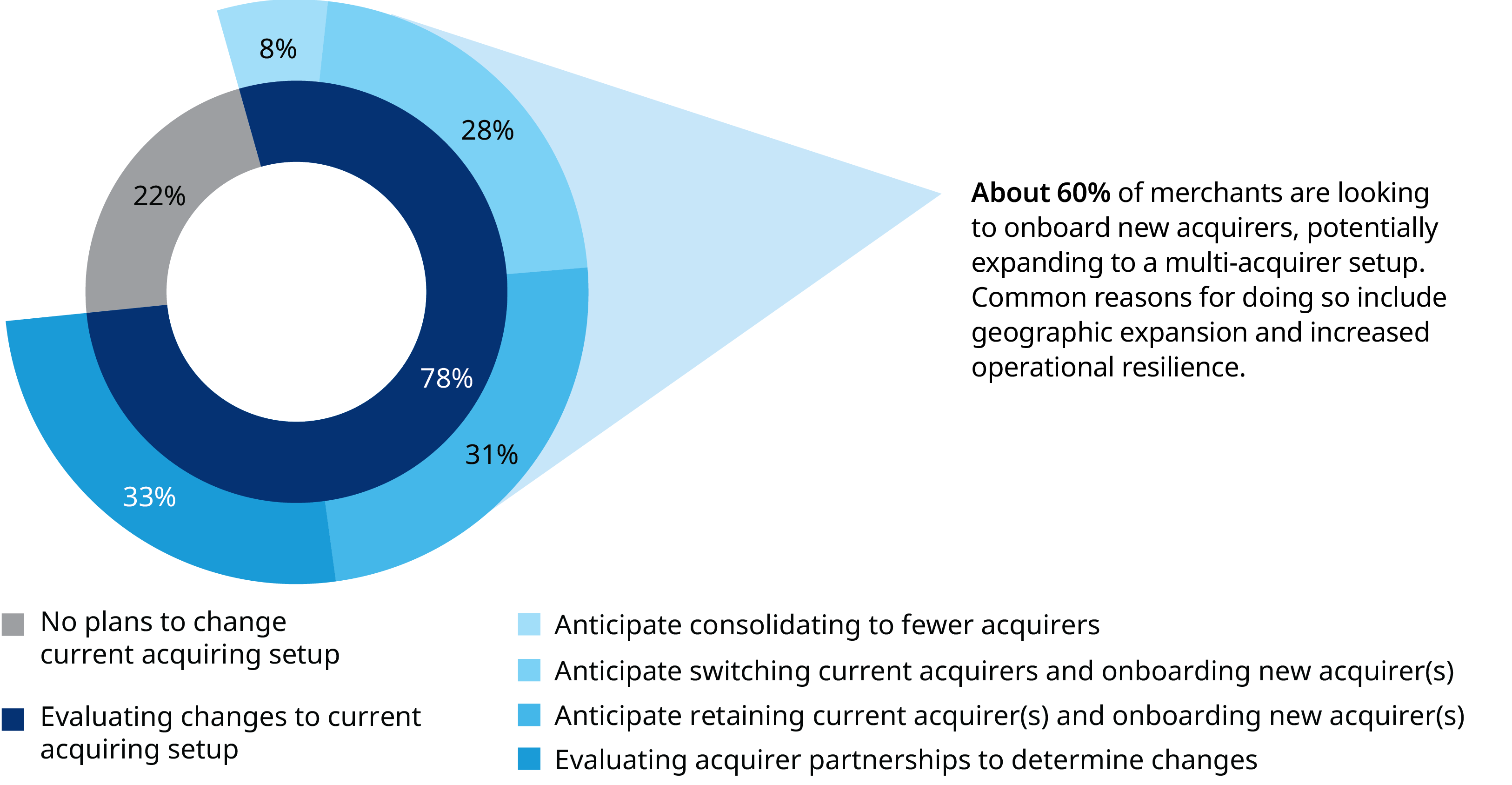

Relatedly, merchants are looking for increased value. As a result, nearly 80% of merchants are open to reviewing their acquiring partnerships, with about 60% seeking to add new acquirers (and only 8% aiming to consolidate their partners).

Merchants are also increasingly accepting alternative payment methods (APMs), with near-ubiquitous acceptance for Apple Pay/Google Pay wallets (90%) expected by 2025. Additionally, with a focus on sustained growth, over 50% of merchants have enabled international payments, typically adopting local acquiring.

Boost loyalty growth with payment integration and personalization

More than three in five merchants have a loyalty program, with 70% of those housing loyalty within a single function (with marketing being the most common). Of the 30% of merchants who have adopted a more decentralized reporting for loyalty, marketing is again the most common; however, payments, digital/IT and other functions also have distributed ownership of loyalty in such cases. Payments and loyalty programs are expected to become more interconnected, with only 10% of merchants expected to keep them decoupled in the future (down from the current 27%).

Currently, loyalty programs primarily rely on proprietary methods, but this is expected to change as the inclusion of general-purpose payment methods such as debit cards and automated clearing house (ACH) is projected to increase by approximately 20%. It is anticipated that around 70% of merchants will adopt personalized loyalty programs in the future, allowing them to differentiate themselves by offering a more seamless payments and checkout experience.

Optimizing payment costs remains key for merchants' value growth

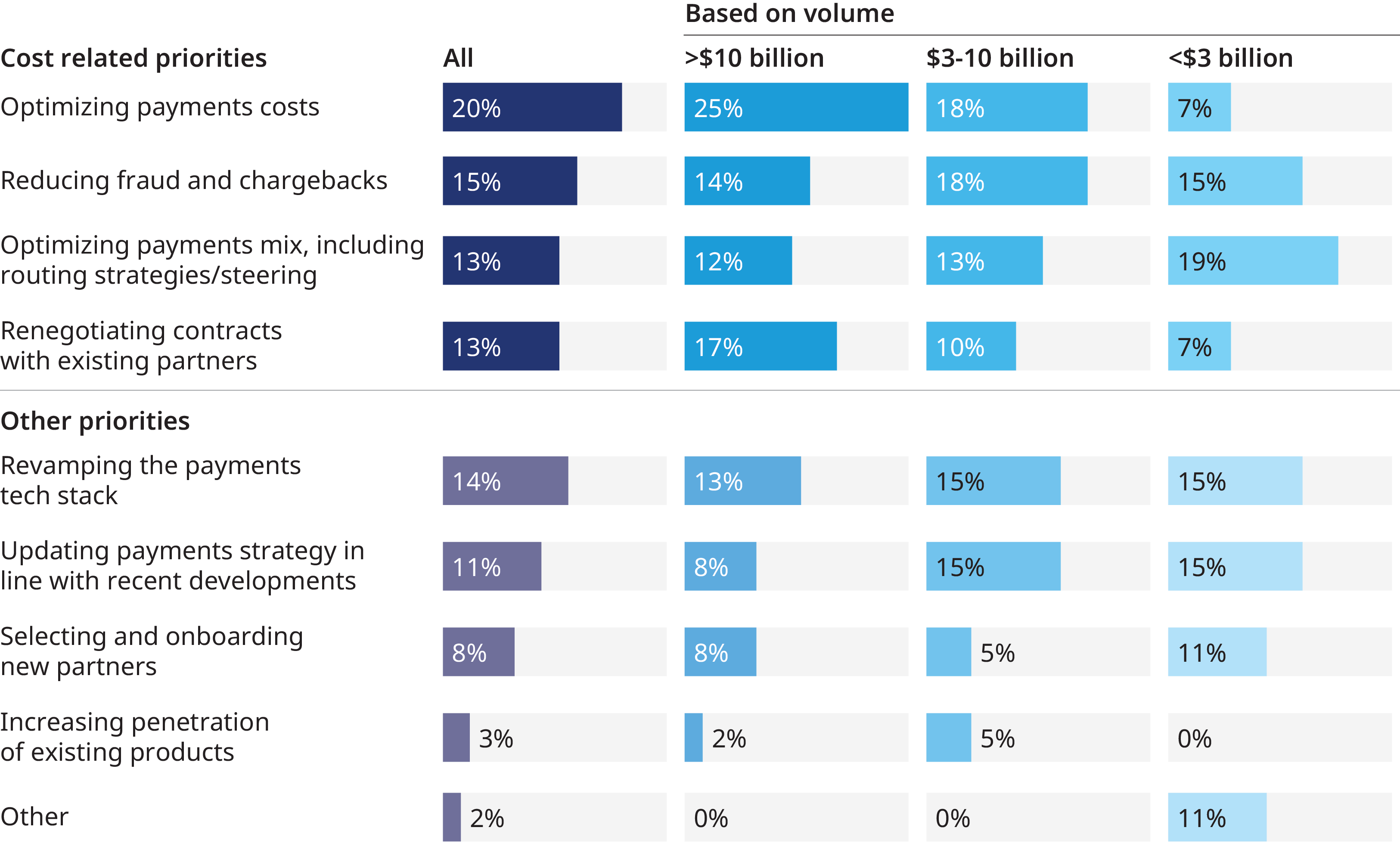

A significant portion – over 50% – of merchants ranked cost of payments as their top challenge. Merchants dedicate approximately 70% of their time to cost-related topics.

Despite a growing need for dedicated payments specialists within organizations, cost-conscious merchants have kept payment team sizes stable – over 95% of survey respondents remained in the same team size tier (which is notable after consistent growth reported over the last two years). The key focus areas for the payments teams varies by team size, with smaller merchants more focused on optimizing acceptance costs, whereas larger teams are challenged by the increasing complexity brought on by engaging multiple providers across channels, as well as geographies.

Major regulatory updates such as proposed changes to interchange fees and updates to CNP routing may lower costs for merchants in the future.