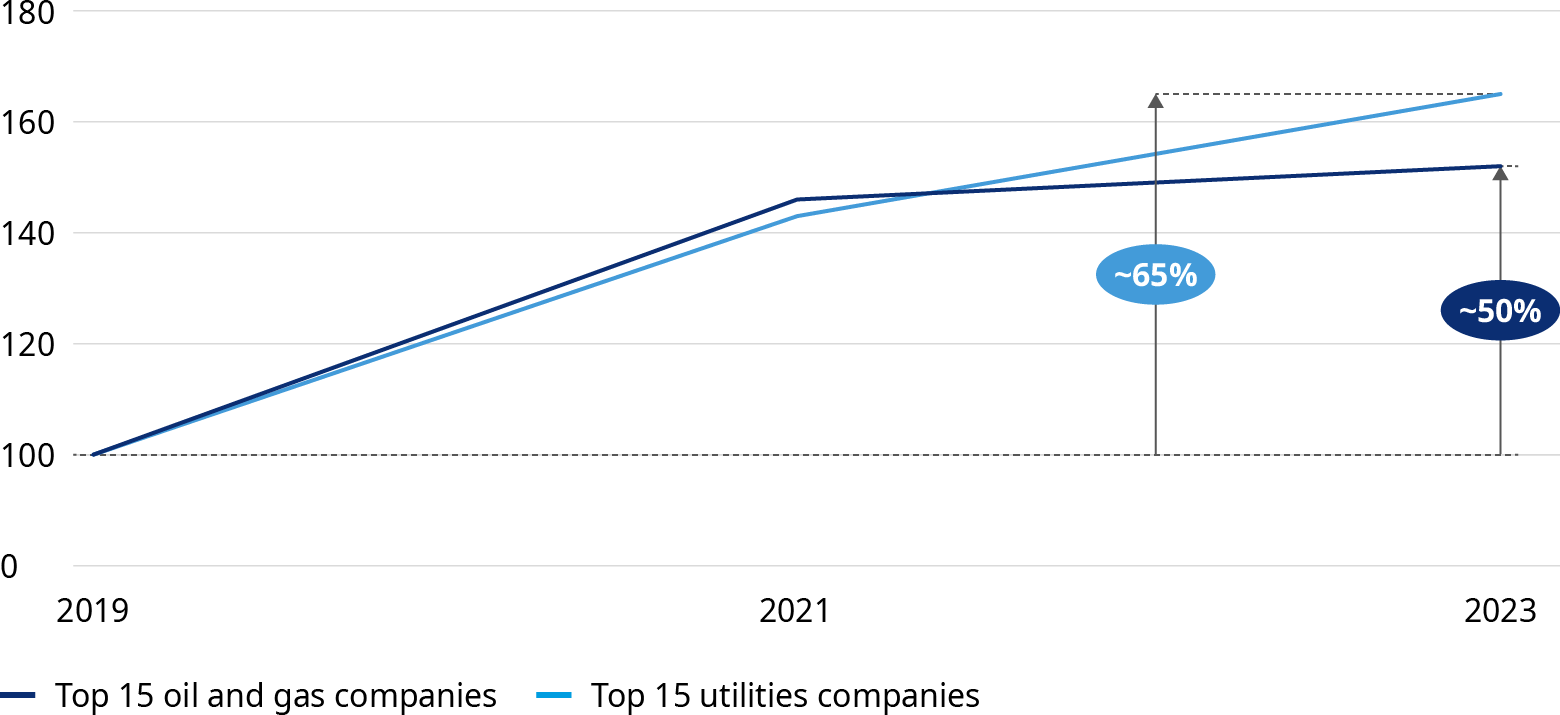

Market volatility, supply chains, and economic growth stabilized in 2023, but major energy businesses have continued to generate impressive profits. These companies are now holding cash and cash equivalent reserves of more than $250 billion. Our analysis suggests the top 15 listed oil and gas companies saw a 50% increase in cash and cash equivalents from 2019 to 2023. Similarly, the top 15 utilities companies experienced a 65% increase in cash holdings (Exhibit 1).

Decision-makers now face the challenge of wisely allocating these available funds while protecting value in the midst of the energy and portfolio transition. Making these spending decisions at a group level requires management to have a clear view of which investments and existing business segments drive real, risk-adjusted returns without overstretching risk appetite. Energy companies can only achieve this by creating a common dimension to optimize capital allocation – something they should make a priority now.

Note: Copyright 2024, S&P Global Market Intelligence. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. S&P and their content providers are not responsible for any errors obtained as a result of usage of such Content and will not be liable for any damages in connection with the use of this content.

The rise of global interest rates has made debt financing more expensive, resulting in fewer long-term investments and greater scrutiny applied to investment decisions (Exhibit 2). While rates may decline again in the future, access to cash will likely remain more restricted than in the ultra-low-rate environment of the past decade. For energy companies, this can have critical impact on their long-term decarbonization aims. With the development of a single offshore wind farm potentially taking more than a decade, for example, the future carbon footprint of energy consumption depends in large part on the decisions that companies now make with their available resources.

Creating a common currency for risk

To make wise spending choices, management must know which investments and existing business segments drive real, risk-adjusted returns without overstretching risk appetite. Recent experiences have shown how important the risk perspective can be in evaluating green investments. One major European player, for example, tripled its investment in green power purchase agreements after introducing a common currency framework that brings risk into the evaluation process. It was an investment that would not have been possible if evaluated on strict economic return.

According to our analysis, green trading activity of major energy players is expected to more than double in the coming years. This growth can be partially attributed to the adoption of new investment metrics rather than using traditional risk-adjusted business plans. At present, energy companies typically use a variety of metrics to measure investments or segment performance, and in many cases do not assess risk-adjusted returns. In this setup, asset-related risks, trading risks, and downstream risks are all managed separately, creating a wide spread of bespoke methodologies across the business. In addition, traditional metrics for investments — such as internal rate of return (IRR) — fall short of capturing risk profiles. As a result, management decisions lack a common understanding of both risk and return and must be course-corrected to avoid investment decisions that are misaligned with corporate risk appetite and can lead to underinvestment in trading and green activities.

Assessing business decisions with currency risk considerations

For leaders to make informed decisions, it is imperative to establish a common currency for risk to assess all ongoing activities and future investments across an entire business in a single risk metric (Exhibit 3). This common currency allows management to accurately determine the risk intensity of any activity or decision, which makes past, present, and future choices commensurable.

To fully understand the impact of past choices on performance, it is crucial to evaluate all returns, taking an appropriate risk-adjustment into account. Similarly, when making present capital steering and allocation decisions, it is essential to have a shared calibration point for assessing risk-bearing capacity. Looking ahead, future investment decisions need to be based on an integrated risk perspective to capture impact on risk profile and longer-term, risk-adjusted returns. By adopting these perspectives, a comprehensive understanding of the relationship between decisions, performance, and risk can be achieved, enabling more informed decision-making and ultimately enhancing overall outcomes.

This idea of optimizing around a single metric is not a new one. The financial services sector already started measuring economic capital — a way to consolidate all risks into a common currency — prior to the 2008 financial crisis. This approach drastically increased the number of questions at board level on resource utilization and is a major key performance indicator benchmark for today’s banks in their overarching capitalization. Consequently, management teams in financial services have changed how they view and compare different business units — a change that only a few advanced energy companies have yet established.

Why energy companies should adopt the debtor perspective

While the economic capital metric used in the financial sector aims to maximize capital returns on given capital using traditional risk capital quotas, energy firms find themselves optimizing against a different objective. The asset-intensive and diversified nature of energy and trading companies means the main concern is not just economic return. The focus is also on the maintenance of their refinancing capability. Sustainable refinancing is critical for business continuity and the biggest constraint for energy and trading companies, with potentially catastrophic consequences if compromised. A high interest rate environment further exacerbates this risk.

As a result, many energy peers are increasingly opting for a debtor perspective rather than a shareholder perspective to unify risk metrics for investment decisions. Credit rating agencies deliver an observable, objective calibration point against this constraint. Each investment decision to be made can be evaluated with respect to its impact on the rating and refinancing covenant.

Four success factors for sustainable common currency implementation

With increasing pressure from shareholders to make well-informed investment decisions, energy companies can follow these four steps to build a robust risk-adjusted currency for investments:

- Pick the right debtholder metric by identifying the metrics that rating agencies apply to assess your organization, which may differ between sub-sectors

- Consider your entire business when creating methodologies that translate existing metrics into the common currency, making sure that unique aspects of the risk profile are well understood and taken into account

- Assess all major risks including market risk, liquidity risk, credit risk, and non-financial risks, when translating metrics to the common currency

- Socialize the framework by integrating the common currency into strategic planning across the business, continuously measuring and elevating it above other segment metrics when considering capital steering.