Home electrification is a key element of Australia’s path to net zero — one that is supported by policy, household economics, and public demand tailwinds. For players in the energy industry, it also presents a series of challenges. The declining role of gas and increase in electricity self-generation will reduce household energy bills and reshape industry value pools. To survive and thrive, energy players have to adapt their businesses and product offerings to meet evolving customer demands.

Home electrification has historically centred around solar energy adoption. However, in recent years, it has expanded to include batteries, electric vehicles (EVs) and residential charging infrastructure, heating, ventilation, and air conditioning (HVAC).

Three categories across six key energy assets in the electrification of Australian households

Solar panels and home batteries

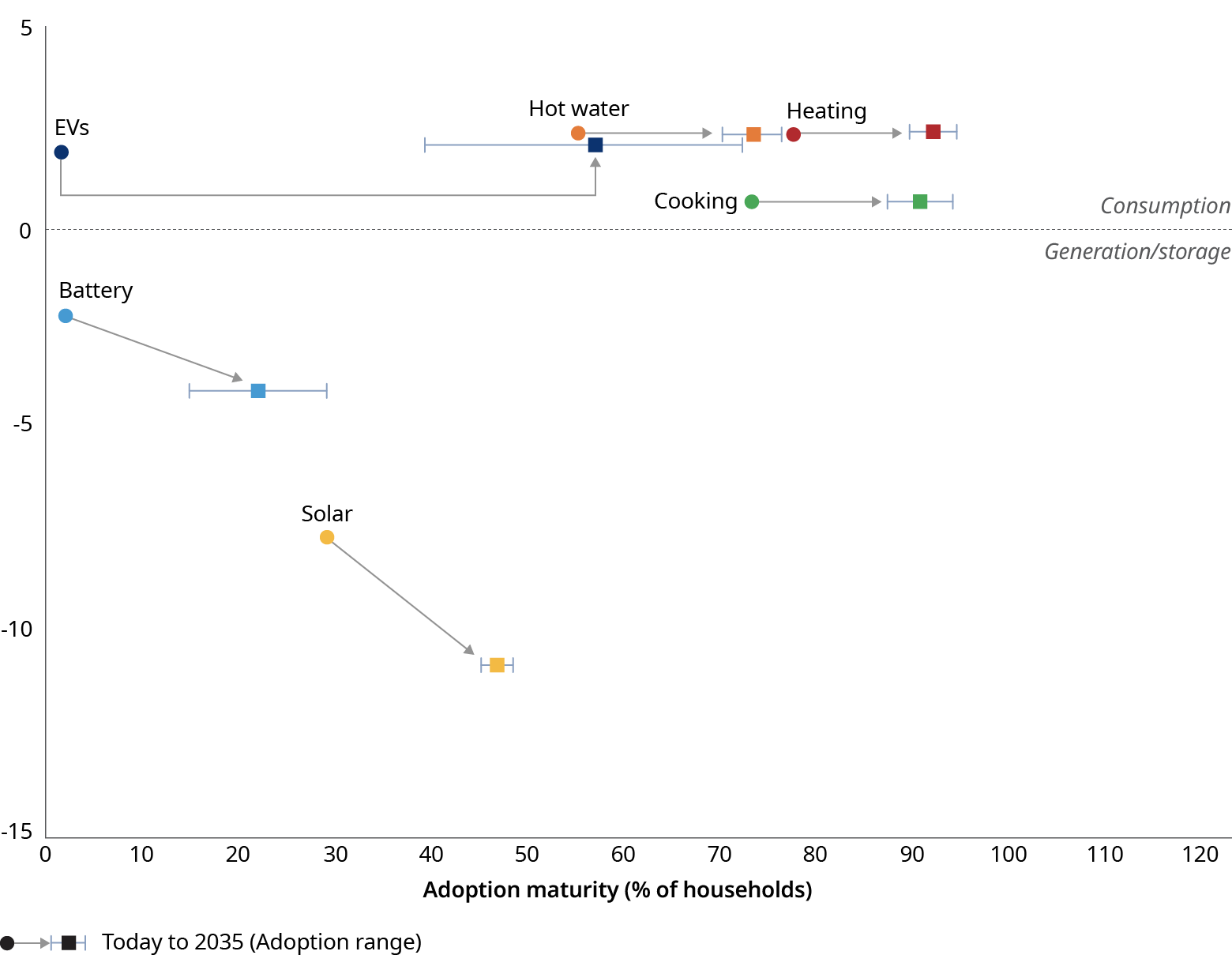

Solar and battery are gateway assets that generate and store clean energy, thus lowering household energy costs and emissions. Australia has world-leading rooftop solar penetration rates, with approximately 30% of detached homes in the National Electricity Market (NEM) having already installed home solar systems. Residential system sizes have grown as system costs decline and retail tariffs rise. Uptake is expected to reach as many as 150,000 installs annually by 2035.

Battery adoption, however, is still nascent in Australia today, but uptake is accelerating, with a 55% increase in installs in 2022 compared with 2021. With declining battery prices, increasing energy price volatility, and reduced feed-in tariffs, an estimated 2.2 million households could adopt batteries between now and 2035.

EVs and home charger infastructure

Households are now able to electrify domestic transport which will drive increasing emissions benefits as the grid decarbonizes. EV adoption continues to accelerate, with 87,000 electric vehicles sold in 2023, an increase of 160% from 2022. Market penetration is however still low (less than 2% of homes in 2023), though adoption is anticipated to continue accelerating, driven by cost parity between internal combustion engines (ICE) and EVs, and policy support. EVs will increase a household’s demand for electricity, and are expected to drive the largest increase in home electricity consumption across the six assets for the typical home.

Home appliances (space heating, water heating, cooking)

Upgrading from gas to more efficient electric equivalents can help lower household bills. Australian households consume around 170 petajoule of gas annually, predominantly for space and water heating. Heat pumps, which largely move rather than create heat, can be three-to-five times more energy efficient than gas appliances and provide a clear savings opportunity for the average customer. While electric appliances are more efficient, upfront capital costs are typically higher versus gas equivalents, potentially impeding a homeowner’s decision to switch. Electric appliance uptake would see a cumulative 2.8 million hot water, 2.8 million space heating, and 3.1 million cooking installs through to 2035 in the NEM.

As a guiding principle, electrification will not happen unless a consumer is better off economically, or legacy carbon-intensive options are penalized or removed. Considering these factors, across all six asset categories, about 1.6 million assets per annum or some 19 million new electric assets in total are estimated to be installed between now and 2035. As households progressively “electrify”, the average household’s energy production and consumption patterns will change.

How electrification reshapes gross margin pools for industry players

The NEM’s collective electrification will see significant impact on the gross margin pools available to players in the space. The adoption of solar and batteries drive substantial cost benefits to the household from self-generation and enable further savings from EVs and electric appliances to be achieved as less grid electricity is consumed.

For traditional electricity retailers however, this means a decline in typical electricity demand and retail gross margin pool. Likewise, a switch from gas heating to heat pumps will see long-term structural changes in gas margin pools. However, the installation and ongoing management of these new assets presents new opportunities for players, and new margin pools will emerge. These new gross margin pools created are expected to more than offset the decline in traditional retail (electricity and gas), prompting industry participants to adapt business models to protect profits.

By 2035, the orchestration of batteries, EV chargers, and hot water assets present a $350 million opportunity for market participants and will be a vital part of managing Australia’s grid in the transition away from coal and gas. Here is where scale and sophistication can provide an advantage, as the more assets under management, the more of this margin pool is accessible. This, however, does not mean incumbents have a guaranteed role. There is still every chance of digital first challengers emerging here.

How industry players can navigate the transition to electrification

monitoring value changes in business

Businesses need to keep a close eye on the dynamics of these shifting value pools and monitor the opportunities as they emerge. Customers behavior, government policies, and technology developments can all cause these pools to grow and/or shrink faster or slower than anticipated.

Identifying exposure for business shifts in energy markets

Businesses need to understand at a granular level how their business is impacted by these shifted value pools. For traditional energy retailers, this may mean an honest reflection internally, recognizing some parts of the business may shrink, while other parts row in importance. For others, this might mean recognizing a strength that allows entrance into a new segment or sector.

Developing a clear strategy on how to play in the game

Players need to identify which areas of the home electrification opportunity they want to compete in and develop new business models to ensure successful market participation. In many cases, this may require collaboration with other partners, who can provide the access, capabilities, or capital required to execute a winning strategy.

crafting agile strategies for the ever-changing energy landscape

Businesses must be aware they are operating in a highly uncertain environment constantly being shaped by technological advancement and changing regulations. Players need to be agile with their strategy and execution. Such uncertainty requires continuous review and assessment of the market, internal readiness, and strategy performance to avoid either over committing or missing out.

Ultimately, shifting value pools in energy is not a new concept, and industry players have withstood this before. Energy remains a non-negotiable element of our modern lives, even if how we purchase and consume it changes. The electrification of Australian households, along with progressive decarbonization of the grid, will bring both emissions under check and economic benefits to all. It is now up to energy players to determine what their roles will be in this journey.