Shifting toward a nature-positive economy is not only an environmental imperative. It also presents a significant economic opportunity, potentially yielding an estimated $10.1 trillion in annual benefits globally, according to The Future Of Nature And Business report by the World Economic Forum. Among the key driving sectors are agriculture, mining and energy, construction, and manufacturing.

Financial institutions have a crucial role to play through the unlocking of required funding for these nature-related opportunities and improving the access and cost of financing for nature-positive projects. An array of innovative nature solutions is surfacing, including nature-linked financing, nature credit markets, such as Australia’s recently announced Nature Repair Market, and nature insurance products. These will all provide additional revenue opportunities for financial institutions, while helping the planet.

The key is to start now because the clock is clicking down on environmental disasters that could threaten the global economy. Over half of the world’s total gross domestic product, equivalent to $44 trillion in economic value generation, is moderately or highly dependent on various elements of nature, according to the World Economic Forum. For Australia, the stakes are equally high, with nature underpinning around 50% of its GDP (or AU$900 billion) and over 80% of the nation’s exports, made up principally of natural resources and agricultural goods.

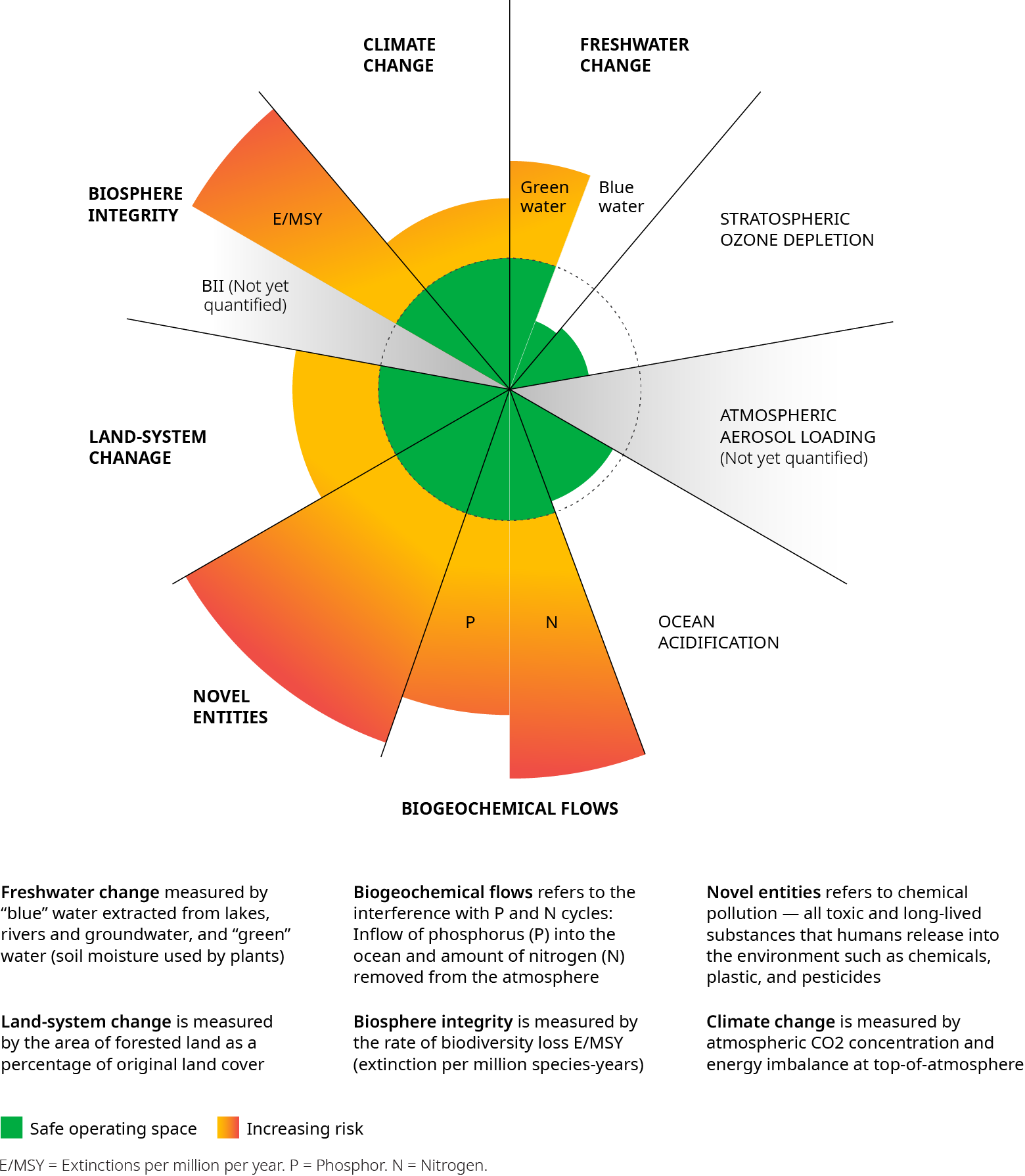

While global focus has been on increasingly destructive effects of the planet’s accelerating climate change, research by the Stockholm Resilience Centre indicates that the warming of the planet may not even be our most advanced threat. Based on a 2022 Centre analysis, human activity has pushed six of the nine planetary boundaries — thresholds, if exceeded, threaten human existence — beyond their safe zones. Besides climate change, these include a substantial loss of biodiversity, detrimental phosphorus and nitrogen pollution linked principally to fertilizer use, and disconcerting alterations to land and freshwater ecosystems. Australia's own 2021 State Of The Environment Report casts an equally alarming spotlight on these trends, reminding us of the devastating consequences of unchecked economic expansion on the land and its traditional custodians.

Why nature must be part of the solution

Reports like these are beginning to make it clear to policymakers, regulators, investors, and businesses that cutting emissions alone is no longer the complete answer. In order to reduce the threat to humanity, a holistic approach to restoring and preserving nature is required and net-zero targets won’t be achieved without it.

Providing guidance on how to attack the problem are efforts, such as the Taskforce on Nature-related Financial Disclosures (TNFD) beta framework, which was the product of work by multiple global financial institutions that Oliver Wyman was privileged to support. This provides a useful blueprint for financial institutions on how they can help their corporate customers begin tackling the enormous task ahead of protecting the planet.

Navigating through the maze of available taxonomies, frameworks, and standards can seem daunting. Simplicity is key. Selecting straightforward, intuitive metrics and easy to explain methodologies can significantly streamline the process and reduce greenwashing or greenhushing on reductions, they have failed to set goals aimed at preserving freshwater and biodiversity and preventing deforestation. We recommend the following priority actions for financial institutions as they chart a course to a nature-positive future:

- Engage leadership and mobilize team

Shifting to a nature-positive economy demands a holistic mindset shift, starting at the top. Raising awareness among board members and senior executives is essential, while simultaneously strengthening the team's capacity to address challenges posed by the transition. - Initiate pilot studies to reveal complexities

Commence with a portfolio heatmap to identify where the most significant risks, impacts, and dependencies lie in relation to nature at the sub-sector level. Once hotspots have been identified, conduct a scenario analysis of financial implications involved with various strategies and targets to lay the groundwork for informed decision-making and effort prioritization. Starting this analysis now will help education the institution on the significant complexities and help to clarify the path forward. - Bridge the data gap

Currently, nature-related data is less developed compared with climate-related data. Notable deficits exist in geolocation, customer/supplier, and supply chain data. Institutions should utilize existing tools, such as ENCORE and IBAT for geospatial data on natural capital assets, 3D carbon accounting for supply chain emissions data, and satellite sensors and geospatial analytics. Financial institutions should also work with clients to improve data availability and supply chain traceability. - Integrate with climate efforts

Climate and nature are inextricably linked. Leaning into the progress made on climate transition planning and building a roadmap for integrating nature can harness synergies and yield win-wins. - Capitalize on opportunities

Adopting a nature-positive approach will mitigate risks and create commercial opportunities. Companies should actively explore these avenues, preparing to harness them to create value for both their businesses and nature.

An early start will allow businesses to take a phased approach to developing a nature-positive agenda that dovetails with their overarching corporate strategy and ESG goals. This proactive approach will help safeguard against nature-related risks, enable institutions to capitalize on new opportunities, and set the stage for longer-term success.

WATCH: Australia needs these critical levers to achieve net zero by 2050