The last several years have been tumultuous for the global chemical sector. Supply chains were disrupted by COVID-19. Demand fluctuated unpredictably and wildly. Inflation skyrocketed as economies reopened. As we enter 2024, however, is there a new dawn on the horizon? On the surface, it seems so – the Q3 2023 World Uncertainty Index shows a lower level of uncertainty compared to the index's 10-year average.

Yet, while measures of uncertainty may create a sense of security, they do not tell the whole story. The chemical sector remains highly dynamic given the acceleration of technological innovation, a global (albeit uneven) commitment to transition to sustainable energy and continued unpredictable geopolitical conflicts. These factors point to a new, higher baseline of uncertainty that the chemical sector must navigate. And importantly, while not a new theme for the chemical sector, structural shifts across regions this past year are more real than ever and make clear the complex trade-offs global executives will need to balance going forward.

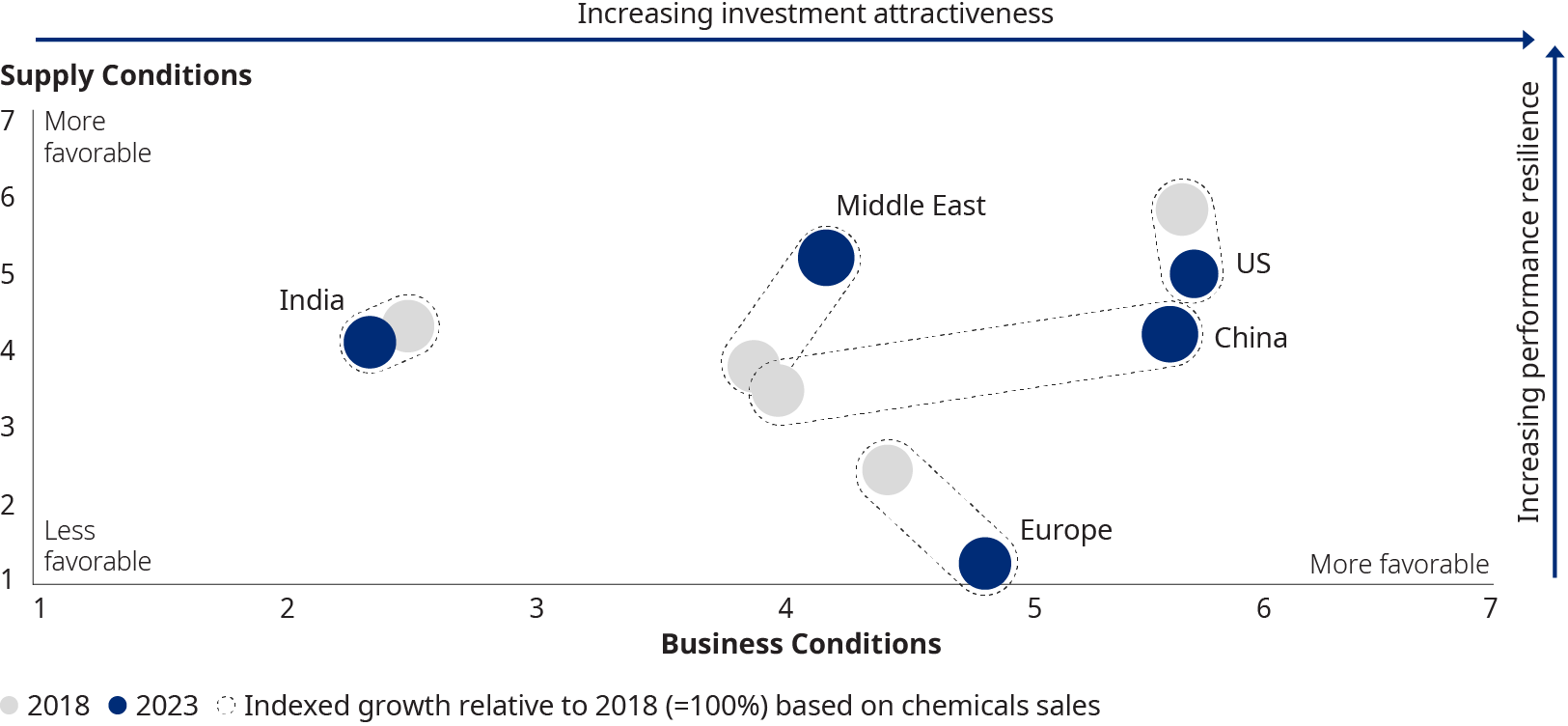

Headwinds in 2023, such as feedstock and energy price increases, played out differently on a regional level, further widening the gaps in competitiveness between regions. Some US specialty players, for example, experienced margin expansion in the second half of the year. On the other hand, the disadvantaged supply cost structures for European players resulted in capacity reductions, including the permanent shutdown of assets where value chains were not expected to return to profitable operations. Similarly, with ethane as key feedstock, the United States and Middle East benefitted from cost advantages over naphtha despite yielding a lower volume of co-products such as propylene. Despite growing concerns over geopolitical tensions, expansion of chemical production capacities in China continued and is expected to account for 50% of the global chemical sales by 2030.

To thrive and grow in this evolving landscape, chemical companies must adapt and build greater resiliency. Here are three imperatives for chemical companies in 2024 and beyond.

Focus on value to manage cost and cash-generation pressures

In the face of challenging growth environment, coupled with sustained cost and cash generation pressure, executives are turning towards well-known programs for cost efficiency, operational and functional excellence, and operating model and portfolio reviews.

Yet toolboxes will have to be elevated to enable more specific actions at a regional level and agile decision-making that reflects the rapidly evolving market and customer requirements. Pure-play competitive environments require businesses to develop a deep understanding of their own position within end-to-end value chains. Companies must engage in further portfolio sharpening and partnerships. They will need to cultivate more entrepreneurial operating models that allow for a differentiated, industry-specific steering of businesses. This also means lean corporate setups with a more nuanced view on the balance of value-adding services versus transactional efficiencies. To manage input-related volatility, global players need to advance their instruments for risk management, such as longer-term feedstock and energy purchasing agreements and financial hedging.

Build deeper commercial insight and take lots of small steps quickly

Traditional approaches to growth come with substantial downsides such as multiyear project timelines, large investments, or unproven innovations. In a volatile market, however, it is essential to offset these risks by taking smaller, agile steps and being prepared to adapt when new surprises inevitably arise.

The ability to adapt will require chemical companies to build stronger, more dynamic commercial capabilities, including consumer and market intelligence, pricing and value selling, and strategic planning and execution. Building deeper insight into a rapidly changing market is critical to staying a step ahead of competitors and addressing new market conditions.

As one example, with raw material prices coming down, companies need to justify the differentiated value of their offering, such as technical service, reliability, or the customer relationship. This “price defense” effort is a challenge when an organization does not have strong, dynamic commercial capabilities in place.

Optimize green business models

While the business benefits of sustainability efforts are widely acknowledged, sustainability-driven business models that are commercially viable remain uncommon in the sector. This is due to challenges such as a lack of confidence in the business case, regulatory uncertainty, limited consumer willingness to pay green premiums, and an inability to price “green” products competitively.

Nevertheless, chemical players are confident that portfolios and operations aligned with sustainability will become the industry “norm”. As a result, leaders are committed to driving their environmental, social, and governance (ESG) agendas and taking advantage of incentives such as the Inflation Reduction Act in the United States.

The successful commercialization of sustainable and circular business models will build on customers’ specific needs. These arise from increasingly specific commitments and targets, such as minimum usage of recycled content or lower-footprint product quotas. To monetize green solutions, companies need to look beyond product pricing, considering also supply reliability and benefit sharing for cost avoidance from achieving decarbonization targets.

It is undeniable that we live in a dynamic world where uncertainty is pervasive, and pace of change is only likely to increase. Chemical companies need to establish differentiated and defensible sources of value in the market. Positioning for profitable growth means developing deeper commercial insights, adjusting operations more rapidly, meaningfully participating in the energy transition, and finding ways to balance structural differences across regions. The companies who do not act are at risk of focusing on what they cannot control – uncertainty – and in the process risk the decline of their business. While this may be unfamiliar ground for many chemical companies, focusing on value, building deeper commercial insight, and optimizing green business models are imperative for success in today's dynamic business environment.

Additional Contributor: Frank Roberts, principal in the Energy and Natural Resources Practice.