Artificial intelligence (AI) has become a top priority throughout organizations, driven largely by the exciting opportunities unlocked by generative AI and the large language models (LLMs) underpinning it. Anti-Financial Crime (AFC) Compliance is an area of priority, and with good reason; at their core these models are pattern recognition engines, and pattern recognition has been at the foundation of much of AFC analytics for years.

Beyond generative AI, institutions and regulators are getting more comfortable adopting a broader suite of AI models that allow sharper risk differentiation, sophisticated anomaly detection, and more advanced solutions to augment investigations. While AFC teams must proceed carefully to manage the risks that new AI solutions pose, they should be excited by the potential of AI to automate many of the everyday AFC tasks that are often highly manual and inefficient.

Banks that have undertaken the journey to adopt AI-based solutions in areas like watchlist screening, Know-Your-Customer (KYC), and transaction monitoring are seeing significant improvements in their programs.

With these types of advancements, it comes as no surprise that many AFC teams are intensifying their efforts to develop AI solutions. As cited in Celent’s 2023 Technology Transformation in Financial Crime Compliance Report, 73% of organizations identify their current technology as insufficient and 86% assert that they plan to increase investment in AI solutions over the next two years.

Moreover, public sector interest in AI’s role in financial crime risk management is evolving. Regulators globally, exemplified by Anti-Money Laundering 2020 in the US and the Europe AI Act, are fostering innovation through policies, establishing guidelines for AI development, and emphasizing the use of advanced technologies like AI and machine learning for financial crimes.

Although AI solutions come with inherent risks and require careful governance and planning, AFC teams should be encouraged and excited by the potential of AI to transform their programs. By taking a careful, well-planned, and collaborative approach, we believe firms can successfully navigate the integration of AI into the AFC function, and AFC professionals will have freed up capacity to focus on more strategic decision‑making and risk assessment.

Future state AI-enabled anti-financial crime program

We anticipate that future state anti-financial crime programs will make use of AI in multiple areas, automating or reducing many labor-intensive and inefficient activities. However, AI should not be expected to replace the expertise of AFC professionals who possess extensive knowledge in risk management; rules-based solutions and manual processes will still be necessary parts of an effective program, and AFC leadership must understand the inherent strengths and weaknesses of the different forms of AI to find that balance.

An approach for AI implementation in anti-financial crime compliance

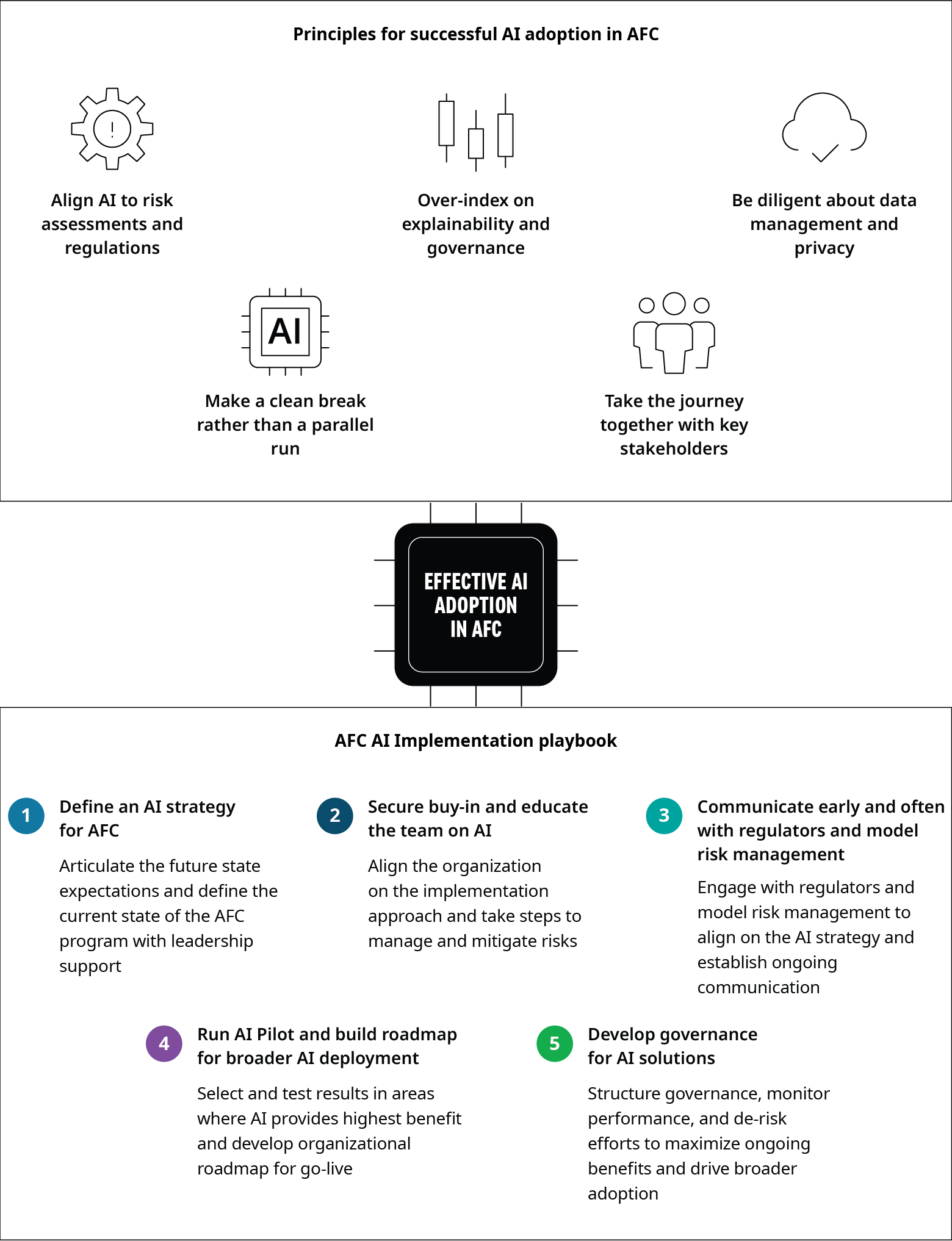

Transitioning to an AI-based AFC function requires more than simply replacing existing solutions with an AI-based solution. Anti-financial crime leaders should recognize that this is a transformation of the processes, governance, people, and operating structures. We believe firms must follow a strategic playbook and prioritize key principles to mitigate risks and ensure successful execution throughout the change management lifecycle from pre- to post-implementation.

Next steps for embracing AI in anti-financial crime compliance

AI solutions like generative AI pose new risks that require careful planning, testing, and governance, and teams should be prepared to undertake the journey collaboratively with regulators, business, technology partners, and model risk management teams. We have outlined this playbook to help anti-financial crime leaders identify use cases and structure a high-level implementation plan as they manage the transition to an AI-based function.

As a next step, anti-financial crime leaders should begin reviewing their programs and prioritize use cases based upon technical enablers and limitations, appetite for innovation, and existing program process strengths and weaknesses. They should engage with internal and external stakeholders throughout the potential transition to new AI-driven technology to ensure that there is clear alignment on objectives and a clear path forward from piloting solutions to implementation. For organizations that are prepared to make the leap into AI integration, the journey may be arduous but represents the future of anti-financial crime compliance.