Grocery retailers across Europe are facing the highest margin pressure they’ve experienced in the last 20 years. Supermarket and hypermarket operators have seen hefty declines in commercial margin as consumers trade down their baskets (see here for more)—or, worse, switch their shopping destination to discount formats. Given the largely domestic nature of their business, most retailers are not diversified enough to balance shortfalls in their core business.

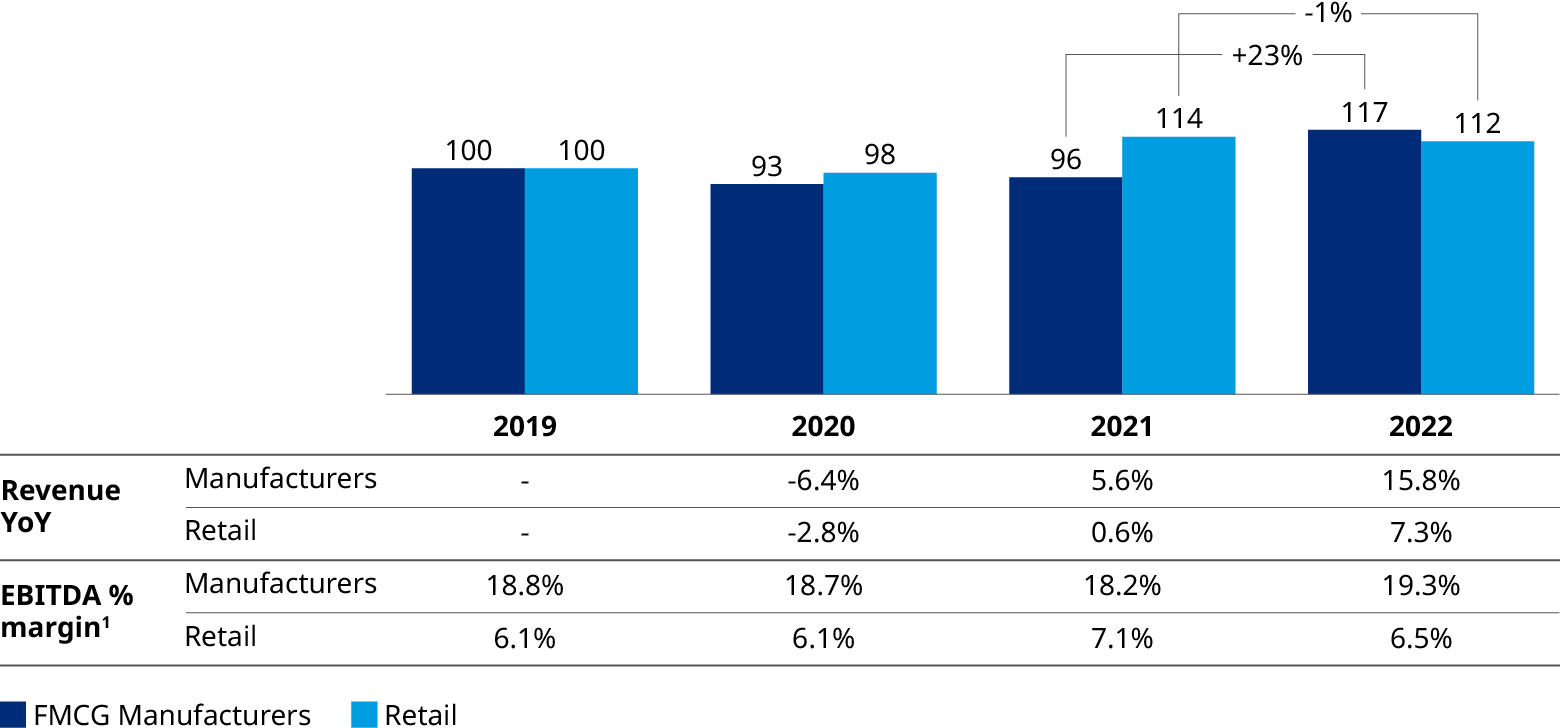

This stands in contrast to large fast-moving consumer goods (FMCG) suppliers, many of which are benefiting from a global footprint and presence in a wide variety of channels. While grocery retailer profits strongly benefited from out-of-home restrictions in 2021, the following year brought a strong swing back from large retailers to large manufacturers [Exhibit 1]. And signs are that this trend will only accelerate in 2023.

Retailers are eagerly anticipating the annual negotiations for purchasing terms in 2024 to rebalance the margin distribution. However, most of the global FMCG brands see room for further price increases rather than any reason to cut back. We think that the only chance for retailers to win back an edge in negotiations is a step-change of their capabilities in how they approach suppliers.

Small assortment adjustment scenarios are no longer sufficient

Considering adjustments to the assortment has always been part of the retailer’s negotiation toolkit. This often meant that brand product variants “#5 or #6 —such as “cheesecake-flavored yogurt” or “curry sausage crisps with herbs”—are called into question, or the distribution of B- or C-brand portfolio products was to be limited to only the largest stores. Such considerations used to have a relevant influence over the negotiation dynamics. Now, however, in more and more categories, many retailers are barely making the commercial margin required to offset the total operating cost. As this situation requires a more radical improvement of purchasing cost, small assortment adjustment scenarios do not support the required negotiation power.

Instead, retailers now need to consider more significant assortment adjustments, such as a complete delisting of B- or C-brands, replaced by strengthened private label alternatives. The complete delisting of a brand can support a significant volume boost for the private label alternative, which in turn creates more scale in procurement and thus better margins. The better retailers prepare such replacement or shift scenarios, the more demand power they will have in the negotiation rounds. The well-known case of German supermarket corporation Edeka replacing iconic Heinz Tomato Ketchup with a private label look-alike is an example of such a bold move.

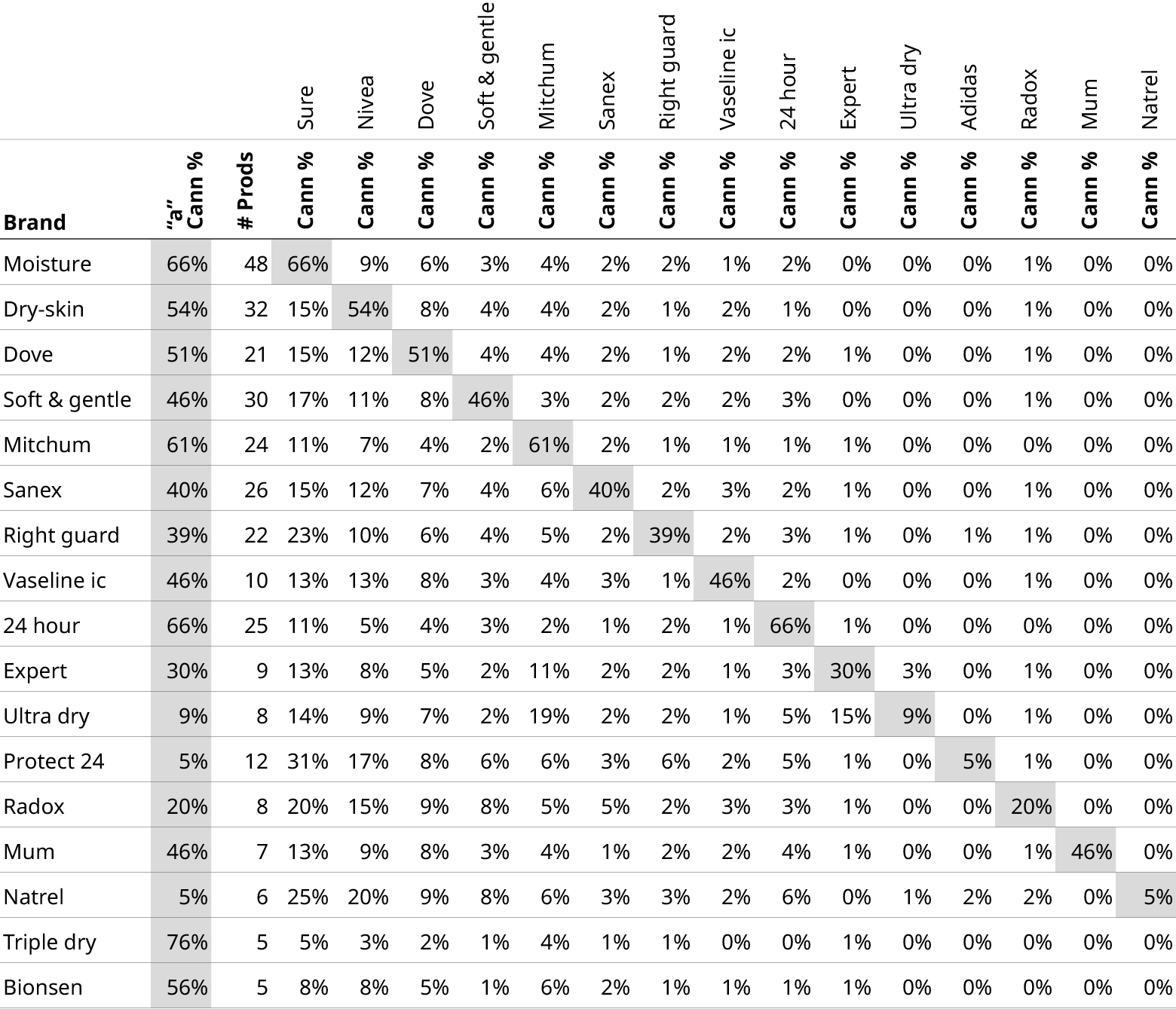

To master such scenarios at scale, retailers will have to step-change their demand and assortment analytics, combining point-of-sale (POS) and customer data insights into strong predictions on likely demand shifts resulting from assortment variations. We have found that indicating the expected percentage retention of revenues in case of forced brand switches is a powerful starting point for buyers to enter negotiations [Exhibit 2]. Such calculations need to be complemented by analyses on the private label sourcing side. Retailers need to ensure they are prepared for brand-to-private label switching scenarios like the one mentioned above for Edeka.

Should-cost modeling on a product level is no longer a “nice-to-have“

Aside from the assortment issues, the interpretation of commodity cost dynamics might be the dominant theme of this year’s negotiations. While retailers argue that most main commodity prices are past their peak, suppliers indicate that effective price adjustments are still well behind the cost curve and further price increases are warranted.

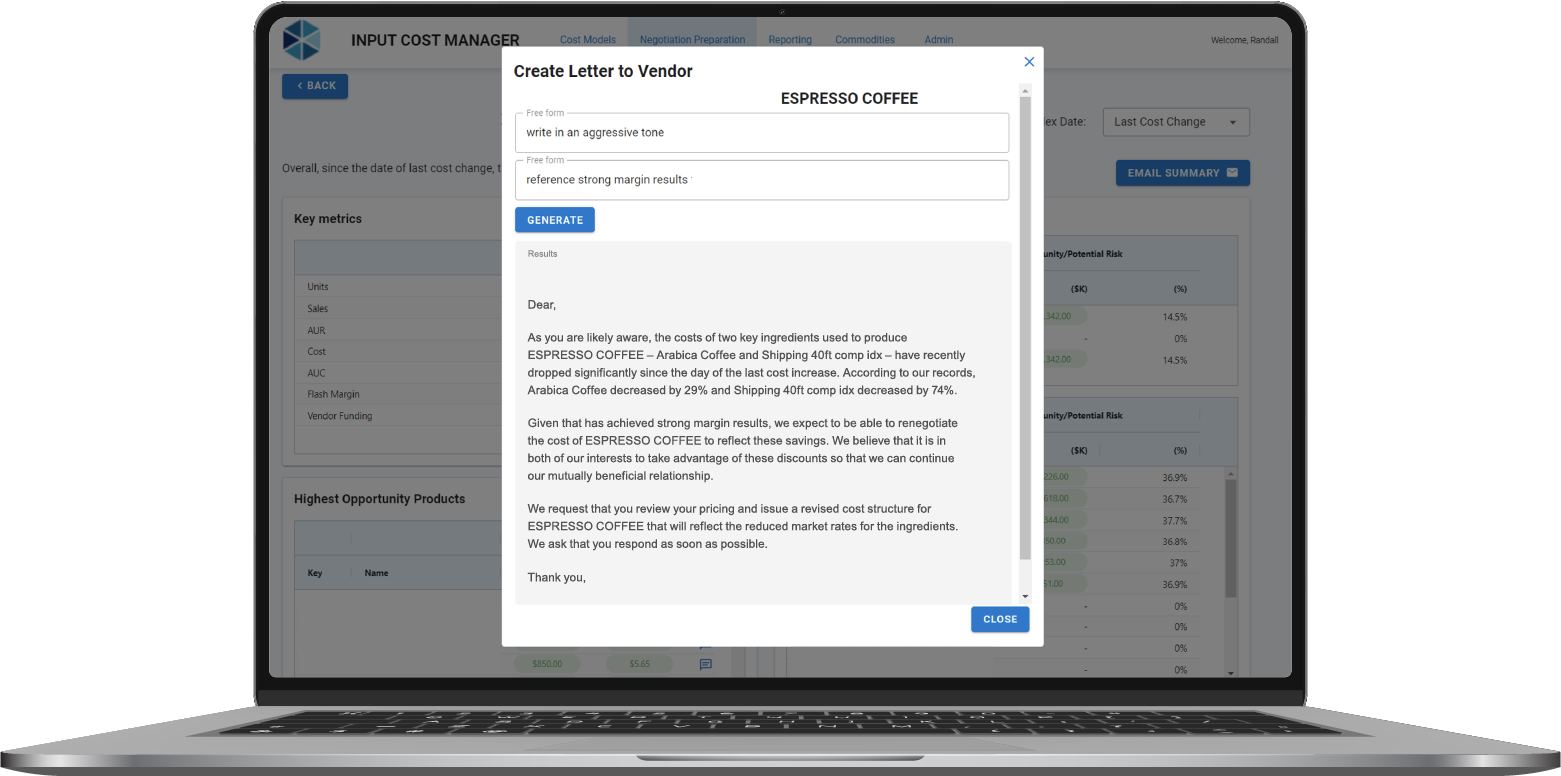

How can one tell which side is right? Generic statistics on global cost evolution will no longer do the trick for retailers. Rather, real should-cost analyses—which explain what a product should cost based on prices of underlying commodities—are required to make the case. For this the modeling needs to start with a proper breakdown of product specifications and ingredients, including packaging, as well as energy and labor costs for manufacturing and supply chain. These must then be linked to the “right” commodity cost codes and linked to respective real-time database providers. If done right, the result is a buyer-friendly cost control cockpit that allows for negotiation alerts and a sophisticated justification of any price reduction demand on the SKU level, such as the Oliver Wyman ICM Tool provides [Exhibit 3].

Generative AI already starts to play a role in supplier negotiations

Supplier negotiations are one of the generative artificial intelligence use cases being tested and validated in retail. In initial trials with clients, we have found that GenAI support can make a powerful difference in summarizing data, conclude supplier-specific arguments, draft letters to suppliers, and interpret supplier responses. When paired with other search models like retrieval augmented generative search (RAG), GenAI could also be leveraged to aggregate research on supplier data, such as annual reports and press statements. Due to the stock-listed nature of most big FMCG suppliers, automated GenAI web research can be especially effective for processing analyst presentations and creating transcripts of investor calls with top executives. Further, published reports can quickly put the key account manager in a defensive position when arguing for dearly needed price increases when the company CEO has just shared record profits and rosy outlooks with analysts.

Thinking further ahead to what GenAI might also change in supplier negotiations in the future, the data interpretation support may encompass all the category assortment analyses mentioned above, and enable a much more efficient (and rigid) negotiation with small suppliers for which buyers cannot dedicate the same amount of time as they have to do for major brands (assortment size, promotional effort, complexity of conditions, etc.) . At the same time, such leverage of GenAI potential requires a tight risk-management setup, including the sandboxing of proprietary data, restricted user interfaces, and mandatory manual checks before any outbound communication.

An entirely new level of negotiations is coming this winter

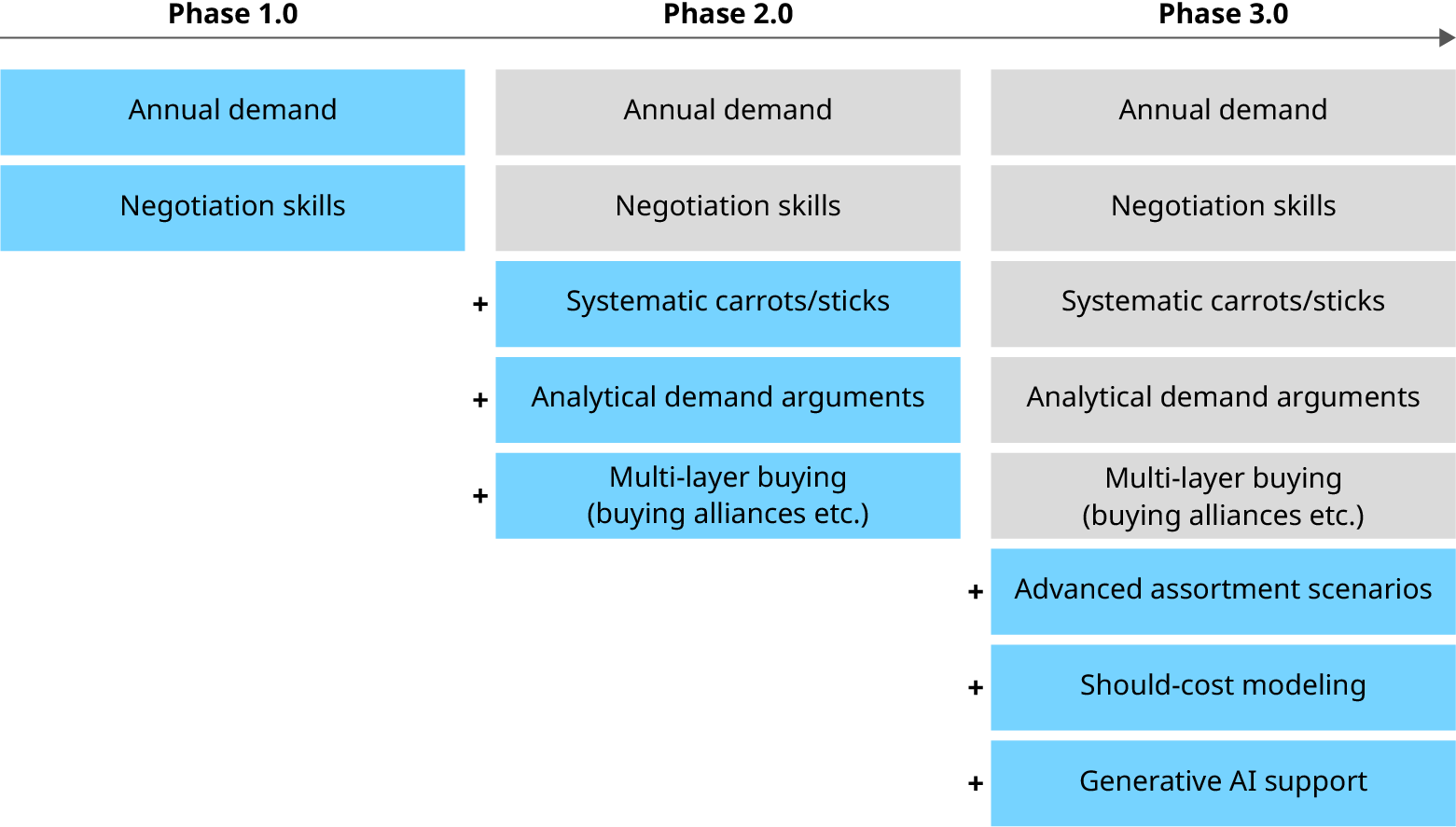

Putting all the above together, the supplier negotiations this winter may be different than the ones in the past. Reflecting on the last decades, there has been a long period of what we would call “Supplier Negotiations 1.0,” where there was an annual demand for price adjustment and then a power play in negotiations. In the late 2000s we saw retailers elevate to “2.0,” with much better analytics behind their price asks, more systematically prepared and orchestrated negotiations, and multilayer negotiations with international buying alliances and buying offices coming into play. While all these elements will remain, the elevation to “3.0” [Exhibit 4] may give a new edge to retailers and thus an opportunity to invert the profit loss to the big suppliers and regain momentum. In light of retailers’ economic dilemma, they can surely use it.